Marketing history is full of examples where even the most innovative companies misjudged consumer demand. Juicero attracted $120 million in funding for a Wi-Fi-connected juice press—only for the product to be scrapped within two years after consumers showed little interest. ESPN’s mobile phone service failed to take off due to a high price point and limited handset options. And New Coke remains one of the most infamous examples of misjudged brand innovation.

Even Google Glass failed to achieve traction, arguably due to timing, pricing, and lack of consumer readiness.

These cautionary tales underscore why concept testing is so essential. By validating product ideas with your target audience before launch, brands can avoid costly mistakes and build offerings that genuinely connect with consumer needs.

One thing is clear: whatever you launch has to be right. The problem is, “right” isn’t something you get to decide.

Your customers do.

It doesn’t matter if your team loves the idea. It doesn’t matter how clever the name is or how polished the prototype looks. If your target audience doesn’t understand it, want it, or find value in it—it’s not going anywhere.

That’s why the smartest brands don’t leave it to chance. They ask the people who matter most—before it’s too late to change direction. This is where concept testing comes in, delivering early, actionable feedback from your target audience.

What is concept testing?

Concept testing is how brands evaluate and refine ideas before taking them to market. It’s a way to pressure-test new concepts—whether that’s an entirely new product, a rebrand, or a packaging refresh—before major investment.

The concept itself could be a never-before-seen innovation or simply a new twist on something familiar. Either way, it pays to ask the right questions early on:

- Does the concept meet real consumer needs? Do people understand it? Does it resonate?

- Is the price right? What are people willing to pay? Is the idea commercially viable?

- How should it be positioned? Does it fit the brand? How does it stand out from competitors?

- What needs to be improved? Are key features missing, confusing, or unnecessary?

Concept testing isn’t a single method. It’s a suite of research tools—from concept screening surveys to qualitative interviews—designed to uncover the strongest ideas and shape them into winning propositions. The approach depends on the challenge, the category, and the stage of development.

Why concept testing matters

Concept testing takes time, effort, and budget. But skipping it is far more expensive.

Launching without feedback risks wasting not only investment but reputation. Failed products don’t just disappear—they can damage brand equity and undermine trust. The cost isn’t always visible in quarterly reports, but it shows up in lost momentum, team morale, and market position.

Concept testing isn’t just risk mitigation—it’s market strategy made smarter.

The history of product innovation is filled with high-profile flops—even from some of the world’s biggest brands.

The Amazon Fire Phone failed to gain traction despite the tech giant’s backing. With a high price tag, confusing interface, and lack of compelling features, it launched into a market already dominated by better-established smartphones.

Google’s Stadia, its cloud gaming platform, shut down just three years after launch. Despite promising a new era of gaming without consoles, it lacked exclusive content, struggled with latency, and failed to capture a committed user base.

Crystal Pepsi, relaunched in the 2010s after a brief 1990s run, was again pulled from shelves when nostalgic appeal couldn’t make up for consumer confusion over the taste.

Concept testing helps brands avoid these pitfalls. It identifies what works, what doesn’t, and why—long before a launch is on the line.

More than just risk mitigation, concept testing is a way to move forward with clarity and confidence.

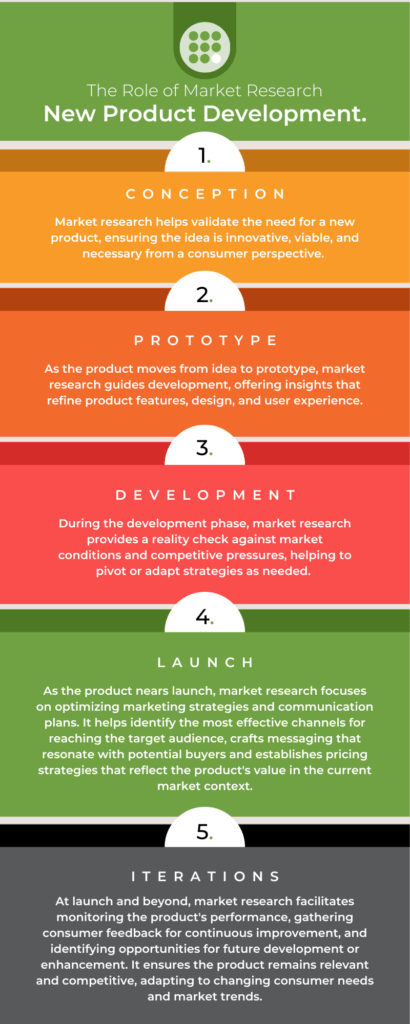

To better understand how to choose the right research tools for the job, it helps to explore the differences between concept testing and related approaches. While concept testing evaluates the appeal, clarity, and potential of early ideas, test marketing is a more advanced phase that focuses on launch readiness—often requiring prototypes, pilots, or small-scale rollouts.

The choice of concept testing method should reflect the stage of development you’re in. If you’re still refining the idea, early-stage concept screening or co-creation research may be more appropriate than fully structured surveys. On the other hand, if you’ve already narrowed your shortlist, tools like conjoint analysis or max diff can help compare features and pricing more precisely.

At Kadence, we support brands at every point on this journey—whether you’re seeking feedback on rough ideas or testing final-stage execution. Visit our concept testing services page to explore how we design studies that match your market, method, and moment.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

9 Use Cases for Concept Testing

1. Validate whether your idea will take off

Just because something feels like a good idea doesn’t mean it’s market-ready. Concept testing gives brands evidence—rather than gut instinct—on whether a new idea resonates with real consumers. It’s a chance to double down on the right concepts and walk away from the rest.

2. Cut through internal debate

Strong opinions can stall progress. Concept testing gives everyone—from product teams to stakeholders—objective data to work from. It brings clarity to creative discussions and helps unify decision-making around what the audience actually wants.

3. Compare competing concepts

Put multiple ideas in front of consumers and let them decide. Online concept testing lets you test head-to-head and identify clear winners before moving into development.

4. Prioritize the right features and benefits

Which features matter most? Which could be dropped without impact? Testing helps refine the value proposition by spotlighting what your audience really cares about.

5. Understand price sensitivity

A concept isn’t viable unless it can be sold profitably. Testing can uncover how much consumers are willing to pay and what pricing tier the concept fits.

6. Iterate before you launch

Concept testing isn’t just a greenlight mechanism. It’s a feedback loop. Test, tweak, retest—until the idea is tight.

7. Find your ideal audience

Early testing can reveal which segments respond best—whether that’s by age, income, lifestyle, or geography. That insight can shape both product development and marketing.

8. Fine-tune your messaging

The best idea still needs the right words. Use concept testing to explore different messages, formats, or taglines before you commit to a campaign.

9. Continue learning post-launch

Testing doesn’t stop at go-live. Keep tracking reactions to refine your offer, improve communication, or inform future versions.

Does concept testing really work?

Some brand leaders believe that true innovation comes from bold intuition—not research. There’s the often-quoted line about Henry Ford: “If I had asked people what they wanted, they would have said faster horses.”

But Ford wasn’t anti-feedback. He understood that innovation isn’t about asking people what they want—it’s about understanding what they value. That’s where concept testing proves its worth.

At Kadence, concept testing goes beyond asking respondents to pick a favorite. We design studies that uncover emotional triggers, hidden expectations, and real-world trade-offs—between product features, brand fit, and price.

It’s not about dumbing down ideas. It’s about making sure the best ones succeed.

The Kadence Approach to Concept Testing

Our approach blends both qualitative and quantitative methods, tailoring the study design to the market, objective, and stage of development. Below are a few examples of how concept testing delivers results:

Toiletries

A personal care brand wanted to create a new line of shower gels for teenagers. We began with an online concept screening survey to identify early-stage winners, then moved into co-creation sessions with the target audience. The result: a validated, compelling range of fragrance and packaging ideas ready for development.

Takeaway Coffee

To tap into the summer iced coffee market, a global beverage brand partnered with us to run a full concept development sprint. After an internal ideation workshop, we tested multiple drink concepts and price points using online quantitative methods. Follow-up focus groups fine-tuned the winning ideas. The brand launched with confidence, backed by clear consumer demand data.

Travel Advertising

For a national tourism board, we tested multiple ad concepts to see which creative route would drive the greatest increase in intent to visit. By establishing a baseline and tracking uplift across variations, we helped the client land on messaging and visuals that resonated most with high-value travelers.

Food (B2B)

A major food brand wanted to explore the viability of a direct-to-customer (D2C) model for its business buyers. Through in-depth interviews, we tested different fulfillment concepts and gathered feedback on brand perception, value, and pricing. Insights helped shape a more appealing offer with a clear route to market.

Research methods for concept testing

At Kadence, we use a range of concept testing methods—qualitative, quantitative, and hybrid—depending on the stage of development and the decisions a brand needs to make.

We don’t lead with methodology. We start by asking the right questions. What do you already know? Are you testing multiple concepts or refining one? Do you need high-level feedback or deep diagnostic insight? Should your focus be on emotional resonance, commercial potential, or both?

The answers shape our approach.

If you’re deciding which research technique to use, your approach should match the development phase you’re in. For example, exploratory qualitative research can help shape ideas during early-stage innovation, while online surveys are ideal when you’re comparing finalised concepts at scale. We break this down in our guide to how to conduct concept testing for different stages of product development, which outlines which tools to use—and when.

Online Surveys

Online concept testing is one of the most effective ways to gather structured feedback at scale. Surveys can reach thousands of carefully profiled respondents, producing data that can be analyzed, ranked, and compared across audiences. Our team builds surveys that simulate real-world decisions—allowing brands to test features, pricing, and positioning in controlled conditions. We then apply advanced statistical techniques to extract what matters most.

Qualifying the Right Audience

Before diving into the core of the concept test, we recommend using screener questions to ensure you’re speaking to the right respondents. These filter out participants who don’t meet your criteria, like frequency of use, category involvement, or geography.

Demographic questions—such as age, income bracket, and profession—are typically placed at the end. They allow for segmentation analysis without overwhelming the participant up front. When used thoughtfully, this profiling ensures your results reflect your true target market.

Focus Groups

Focus groups deliver the kind of texture and nuance you can’t get from numbers alone. Whether online or in-person, they create a space where consumers engage with your concept, react in real time, and build on each other’s thoughts. We use these sessions to uncover gut reactions, decode emotional cues, and surface new angles that spark further refinement.

Depth Interviews

When individual perspective matters more than group dynamics, depth interviews offer space to go deeper. We speak one-on-one with target users to explore motivations, hesitations, and behavioral drivers—often revealing insights that shape messaging, design, or product positioning.

Ethnography

Sometimes, the richest insights come from observation rather than direct questioning. Ethnographic research puts us in the everyday environments of your target audience. Through diaries, photo journals, and in-context observation, we gain a clearer picture of the unmet needs and behaviors that influence purchasing decisions.

Online Communities

Online concept testing communities allow brands to capture evolving feedback over time. These short-term, private digital spaces encourage participants to interact with your concepts through posts, videos, and tasks. Unlike traditional surveys, communities evolve as the research progresses—ideal for iterative concept development or creative refinement.

By matching the right method to the right stage, we help brands maximize insight while staying conscious of timing, scale, and cost.

Comparing Concept Testing Methods

| Method | Best For | Key Benefits |

|---|---|---|

| Online Surveys | Screening and prioritizing multiple concepts at scale | Fast turnaround, scalable, enables clear comparison across attributes like price and features |

| Focus Groups | Exploring emotional reactions and creative direction | Rich qualitative insight, visual feedback, discussion of messaging and positioning |

| Depth Interviews | Understanding motivations and reactions in detail | In-depth exploration of decision-making, barriers, and expectations |

| Ethnography | Observing how people interact with concepts in real life | High authenticity, uncovers unmet needs and real-world context |

| Online Communities | Iterative concept development and testing over time | Continuous feedback, co-creation, adaptable over several days or weeks |

Not sure whether concept testing or test marketing is the right approach for your stage? While both involve gathering real consumer feedback, they differ in purpose, timing, and scale. Explore our breakdown of concept testing vs. test marketing to understand which method best fits your innovation pipeline.

Choosing Between Monadic and Sequential Design

Two of the most common approaches in survey-based concept testing are monadic and sequential designs. In a monadic design, participants evaluate one concept in isolation, allowing for deep focus and reducing bias. This method delivers high-quality feedback but requires a larger sample size to compare concepts statistically.

A sequential design—where respondents review multiple concepts in one sitting—is faster and more cost-effective, especially in early screening stages. However, results can be influenced by order effects and fatigue, so it’s essential to randomize presentation order and monitor data quality carefully.

How Long Should a Concept Survey Be?

Length affects engagement. In our experience, surveys for concept testing perform best when kept under 25 minutes or 30 questions. Beyond that, respondent fatigue sets in, and data quality drops. Shorter, focused surveys tend to yield clearer insights—and make it more likely participants give considered feedback.

Making Sense of the Data

In survey-based concept testing, many responses are captured using Likert scales—asking how likely someone is to buy, how appealing a concept is, or how innovative it feels, rated on a 5- or 7-point scale.

One of the most actionable ways to interpret this data is by using Top 2 Box scoring: calculating the percentage of respondents who selected the top two positive responses (e.g., “very likely” or “likely”). This allows for fast comparison across multiple concepts and reveals which ideas stand out from the crowd.

Whether you’re running a product concept survey, testing pricing scenarios, or evaluating new messaging, these metrics can reveal what matters most to your audience.

The Role of Design

At Kadence, we bring creativity to every stage of concept testing, combining research expertise with in-house design capabilities to help brands move from idea to impact.

Often, the early concepts we receive are rough. They might start as a few words on a Post-it note or a collage of reference images. That’s where our design team steps in. We transform early-stage ideas into tangible stimuli that consumers can engage with—whether that’s a mock-up of an ad, a service visualisation, a website prototype, or test copy for a landing page.

We’re also exploring the use of augmented reality (AR) to elevate product concept testing. Using AR, we can generate digital 3D prototypes that participants can view through their smartphones in real environments. This approach enhances engagement and delivers more authentic feedback—especially when compared to static visuals—while remaining highly efficient and scalable.

Beyond visual execution, our work is shaped by the principles of design thinking, a framework that ensures ideas are developed with consumer needs at the center.

The five stages of design thinking include:

- Empathise: Understand your audience’s real-world context, needs, and pain points.

- Define: Frame the core problem or opportunity you want to solve with precision.

- Ideate: Brainstorm solutions based on what the research has revealed so far.

- Prototype: Build a working version—whether physical, digital, or visual—for feedback.

- Test: Put your concept in front of your audience, gather reactions, and refine as needed.

Many of our clients reach us during the ideation or prototype phase, but concept testing can also inform earlier and later stages. Our design-led, research-backed approach is part of what makes concept testing with Kadence more actionable and more commercially relevant.

10 Top tips for successful concept testing

- Set clear objectives

Start with a focused brief. What exactly do you want to learn—and how will you act on the findings? Whether you’re choosing between concepts or refining a single idea, clarity up front keeps the research sharp and the results meaningful. - Don’t fall too in love with your ideas

Concept testing isn’t about validating hunches. It’s about letting the customer response guide decisions. Stay open. If a promising product concept flops in testing, let it go. Great ideas are rarely one-offs—and the right research helps you spot what’s worth pursuing. - Find the right people

Your target audience matters more than volume. We’ve tested concepts with teenage gamers, healthcare professionals, rural farmers, and C-suite decision-makers. Whether you need broad reach or a niche segment, finding the right participants is half the battle. - Bring it to life

Early-stage ideas often need help becoming real for consumers. That’s why our in-house team turns sketches, mockups, and rough copy into visuals that spark real feedback. The stronger the stimulus, the sharper the insight. - Iterate quickly and often

Few concepts are perfect the first time. That’s why iterative testing—refining, retesting, refining again—gets better results. We use agile design and research cycles to sharpen ideas quickly, often in just days. - Stay flexible

Concept testing is not a fixed recipe. Sometimes you need a quick screen. Other times, deep qualitative work. Let your goals and the audience shape the approach—not the other way around. - Listen beyond the words

Good research isn’t just about what people say—it’s how they say it. Our researchers are trained to pick up on hesitations, contradictions, and patterns that reveal deeper insight into what people really think. - Context matters

A winning idea on paper might underperform in the real world. Test in context: how the idea compares to alternatives, fits with your brand, and lands emotionally with the audience. Concept scores are just one piece of the puzzle. - Protect your IP

Early concepts are sensitive. We’ve built secure systems to ensure designs, copy, and mockups stay confidential. Features like watermarked images and self-destructing videos help reduce leaks—and in over a decade, we haven’t seen one. - Keep testing after launch

Consumer needs shift fast. Great brands keep refining after launch. Concept testing isn’t a one-off event—it’s a habit. Keep listening, keep adjusting, and your product stays relevant.

Why It Pays to Get Concept Testing Right

Every great brand knows this: launching a new product isn’t just about creativity or gut feel. It’s about getting closer to your audience—understanding their reactions, their hesitations, their unmet needs—and building from there. That’s what concept testing delivers.

It’s not a barrier to innovation. It’s the mechanism that makes innovation work.

When done right, concept testing doesn’t just tell you which ideas are most appealing. It helps you craft better ones. It shows you where to focus investment, how to improve your offer, what to communicate, and—crucially—what not to pursue. It gives teams clarity, stakeholders confidence, and brands a stronger shot at real-world success.

Because the difference between a bold idea and a breakthrough product isn’t luck. It’s research-backed confidence.

To explore how concept testing services can support your product development process—whether you’re refining early ideas or validating go-to-market strategies—learn more about our concept testing solutions.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director