Move over Millennials; there’s a new kid in town – Gen Z. By 2026, this demographic will account for over a quarter of the world’s population and become the largest consumer group globally, with a purchasing power of over $44 billion. As a marketer, understanding the unique characteristics of this generation is crucial in creating impactful and effective marketing strategies. As the famous quote goes, ‘The future belongs to those who prepare for it today.’ So, let’s dive in and gain insights into the newest consumer market – Gen Z.

Gen Z Demographic Profile

Gen Z, also known as the iGeneration or Post-Millennials, includes individuals born between 1997 and 2012. As of 2023, the oldest members of this generation are 26 years old, and the youngest are just 11 years old.

Gen Z is a highly diverse generation with members from different cultural, social, and economic backgrounds. They are the first generation to be truly digital natives, growing up in a world that has always been connected by technology.

Gen Z is also a socially conscious generation with a strong emphasis on diversity, inclusion, and sustainability. In a global study by The Center for Generational Kinetics, 70% of Gen Z respondents said they believe in equal rights, regardless of race, gender, or sexual orientation. Furthermore, a survey found that 66% of Gen Z respondents in the United States prefer to buy products from companies that prioritise sustainability.

Gen Z Around the World

North America

In North America, the demographic profile of Gen Z varies significantly by country. According to a study by the US Census Bureau, the percentage of the population aged 15-24 in the United States is 13.6%, while in Canada, it is 12.9%. The ethnic composition of Gen Z in North America also varies, with the United States having a higher proportion of non-white populations compared to Canada. Gen Z in North America is highly diverse, with a growing number of individuals identifying as multiracial or belonging to minority groups.

Gen Z in North America is highly educated, with a more significant percentage pursuing higher education than any previous generation. According to a report by the National Center for Education Statistics, 59% of high school graduates in the United States enrolled in college in 2019, which is projected to continue to rise. A similar trend is seen in Canada, with 56% of high school graduates enrolling in college or university in 2018.

Overall, marketers targeting Gen Z in North America need to be aware of this generation’s demographic diversity and high levels of education. By understanding the unique characteristics of this generation, marketers can create impactful campaigns that resonate with Gen Z and build long-term brand loyalty.

UK

In the UK, Gen Z constitutes roughly 16% of the total population, with an estimated 11.2 million individuals in this age group. According to a report by Kantar, the ethnic diversity of Gen Z in the UK is higher than in any previous generation. Approximately 54% of Gen Z in the UK come from non-white backgrounds, with 18% identifying as Asian, 16% as Black, 11% as mixed, and 9% as other ethnic groups. Regarding gender, Gen Z in the UK is evenly split between males and females.

Europe

In Europe, the demographic profile of Gen Z varies significantly by country. According to the statistical office of the European Union, the percentage of the population aged 15-24 ranges from 8.8% in Italy to 18.9% in Cyprus. The ethnic composition of Gen Z in Europe also varies, with countries such as France, Germany, and the Netherlands having a higher proportion of non-white populations compared to countries such as Hungary, Poland, and Romania. Gen Z in Europe is generally highly educated, with a greater percentage pursuing higher education than any previous generation.

India

Gen Z represents the largest demographic group in India, with an estimated 472 million individuals aged 24 and below. The demographic profile of Gen Z in India is highly diverse, with a variety of languages, religions, and cultures represented. Gen Z in India are bilingual, with English and Hindi being the most commonly spoken languages. Regarding gender, there are slightly more males than females in this age group.

Southeast Asia

In Southeast Asian countries such as Indonesia, Malaysia, and the Philippines, Gen Z constitutes a significant portion of the population. According to the Asian Development Bank, the percentage of the population aged 15-24 in Southeast Asia ranges from 14% in Thailand to 22% in the Philippines. The ethnic composition of Gen Z in these countries is diverse, with a variety of ethnic groups and languages represented. Regarding gender, there are slightly more females than males in this age group in some countries, such as the Philippines.

Gen Z Behavioural Trends

Gen Z has grown up in a world where digital technology is ubiquitous. As a result, they have a strong preference for digital communication channels, such as social media, messaging apps, and video conferencing.

According to a report by Snapchat, Gen Z spends an average of 3.4 hours per day on social media, and 63% of this generation prefers to interact with businesses through social media channels. This trend presents an excellent opportunity for marketers to reach Gen Z effectively by creating engaging content for social media platforms.

Another major behavioural trend among Gen Z is their interest in social and environmental issues. Gen Z is more socially and environmentally conscious than any previous generation, and they expect businesses to take a stand on issues that are important to them. According to research, 62% of Gen Z respondents worldwide believe that companies have a responsibility to take a stand on social and environmental issues. This trend presents an opportunity for marketers to align their brands with causes that matter to Gen Z and to communicate their social and environmental impact effectively.

Gen Z also values personalisation and authenticity. They expect businesses to tailor their products and services to their individual needs and preferences, and they respond positively to authentic and transparent brands. A survey found that 53% of Gen Z respondents in the United States are more likely to buy from brands that provide personalised recommendations, and 72% are more likely to buy from brands that are transparent about their business practices.

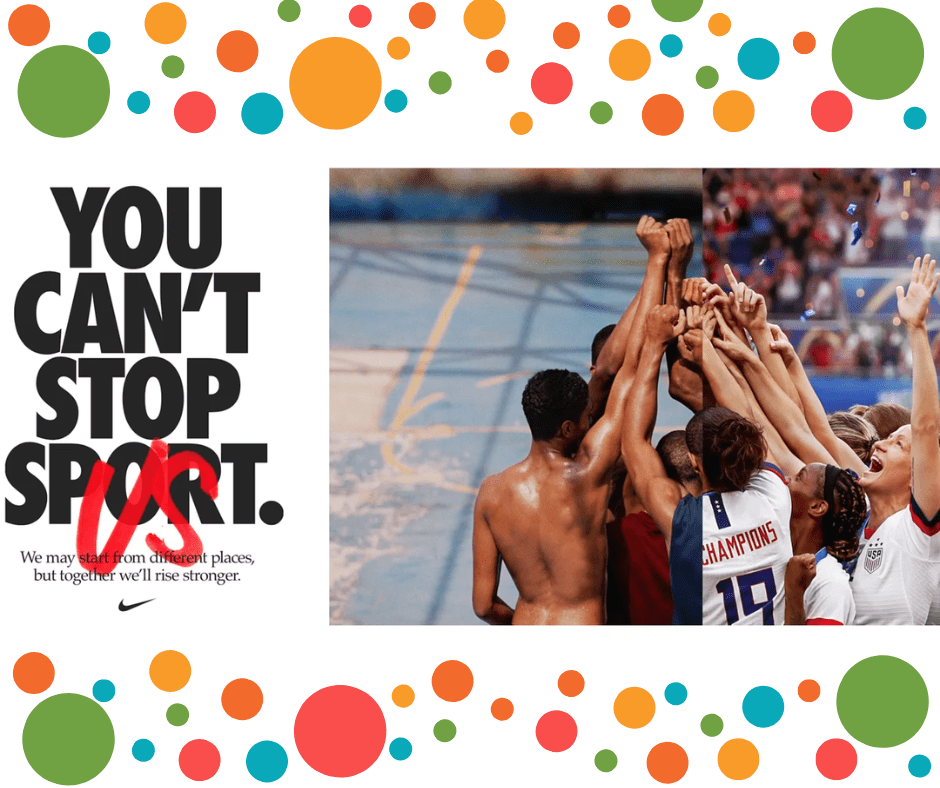

Case Study: Nike

Nike’s “You Can’t Stop Us” campaign is an excellent example of a marketing campaign that successfully targeted Gen Z by addressing their behavioural trends. The campaign highlighted Nike’s commitment to social issues, including racial justice and gender equality, while emphasizing personalisation and authenticity.

As demonstrated through split-screen video edits, the campaign’s message of resilience and determination resonated well with Gen Z, resulting in increased engagement and brand loyalty.

Case Study: Greggs

Greggs is a UK-based bakery chain that successfully targeted Gen Z by aligning its brand with social and environmental issues. In 2019, Greggs launched its vegan sausage roll, which became a viral sensation on social media, with the hashtag #vegansausageroll trending on Twitter. The launch of the vegan sausage roll was part of Greggs’ broader strategy to appeal to Gen Z, who are more likely to follow a plant-based diet than any previous generation. The vegan sausage roll’s success helped Greggs increase its sales and improve its brand perception among Gen Z, who saw the company as innovative and socially responsible.

Case Study: Grab

Grab is a ride-hailing and food delivery company that successfully targeted Gen Z in Southeast Asia by focusing on personalisation and authenticity. Grab’s “Personalise Your Journey” campaign aimed to show Gen Z that the company understands its individual needs and preferences. The campaign involved a series of short videos highlighting how Grab’s services can be tailored to each user’s preferences, such as music and temperature settings in the car. The campaign increased engagement and loyalty among Gen Z users, who saw Grab as a brand that values their unique identity and preferences.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Gen Z Consumption Habits

Gen Z has a unique set of consumption habits shaped by their digital upbringing, interest in social and environmental issues, and focus on personalisation and authenticity. Understanding these consumption habits is essential for marketers who want to engage effectively with this generation.

Preferred Shopping Channels

Gen Z prefers to shop online and is likelier to use their mobile devices than any other generation. According to a survey by Hootsuite, 54% of Gen Z respondents in the United States prefer to shop online, and 72% use their mobile devices to make purchases. This trend presents an opportunity for marketers to create mobile-optimised e-commerce websites and mobile apps that provide a seamless shopping experience for Gen Z.

In addition to online shopping, Gen Z also values physical stores that provide a unique and immersive experience. A survey found that 59% of Gen Z respondents in the United States prefer to shop in stores that offer an immersive experience, such as augmented reality or virtual reality. This trend allows marketers to create innovative, engaging in-store experiences that resonate with Gen Z.

Products They Buy

Gen Z has diverse interests and preferences regarding the products they buy. They are more likely to purchase products that align with their values and beliefs, such as social and environmental issues. A survey by NPD Group found that 83% of Gen Z respondents in the United States are more likely to buy products that support social and environmental causes. This trend allows marketers to create products and services that align with Gen Z’s values and beliefs.

Decision-Making Process

Social media and peer recommendations heavily influence Gen Z’s decision-making process. According to a survey by Common Sense Media, 43% of Gen Z respondents in the United States trust peer recommendations over advertising when making purchase decisions. This trend allows marketers to leverage influencer marketing and user-generated content to effectively reach and engage with Gen Z.

Case Study: Fabletics

Fabletics is a women’s activewear brand that has successfully targeted Gen Z in the US by aligning its brand with the consumption habits of this generation. Fabletics’ subscription model and personalised shopping experience have resonated well with Gen Z, who value convenience and personalisation.

Fabletics offers a monthly subscription service that provides members with personalised activewear outfits based on their style preferences, body shape, and fitness goals. The company also allows members to skip a month or cancel their subscription anytime, providing a flexible and convenient shopping experience that resonates well with Gen Z.

Fabletics’ focus on diversity and inclusivity has also resonated well with Gen Z. The company offers a wide range of sizes and styles, including a plus-size collection that promotes body positivity and inclusivity. Fabletics also partners with non-profit organisations that support women’s health and wellness, aligning the brand with social issues that matter to Gen Z.

Fabletics’ success with Gen Z is reflected in its highly engaged social media following, with over 2 million followers on Instagram and a highly active community of brand advocates. By aligning its brand with the consumption habits of this generation, Fabletics has become a popular choice for Gen Z women who value convenience, personalisation, and inclusivity.

Case Study: Zomato

Zomato is a food delivery and restaurant discovery platform that has successfully targeted Gen Z in India by aligning its brand with the consumption habits of this generation. Zomato’s user-friendly mobile app and website have resonated well with Gen Z, who value convenience and personalisation. In addition, Zomato’s focus on sustainability and ethical sourcing has appealed to Gen Z’s interest in social and environmental issues. Zomato’s success with Gen Z is reflected in its rapidly growing user base, with over 80 million monthly active users as of 2022.

Case Study: Depop

Depop is a fashion marketplace that has successfully targeted Gen Z in the UK by aligning its brand with the consumption habits of this generation. Depop’s mobile app allows users to buy and sell unique, vintage, and sustainable fashion items, which aligns with Gen Z’s interest in personalisation and sustainability. In addition, Depop’s focus on community building and peer-to-peer selling has appealed to Gen Z’s desire for authentic and transparent shopping experiences. Depop’s success with Gen Z is reflected in its rapidly growing user base, with over 30 million registered users as of 2022.

Understanding the consumption habits of Gen Z is crucial for marketers who want to engage this generation effectively. Gen Z prefers online shopping and values physical stores that provide an immersive experience. They are more likely to buy products that align with their values and beliefs, such as social and environmental issues. Social media and peer recommendations heavily influence their decision-making process. Marketers can create impactful campaigns that resonate with Gen Z by aligning their brands with these consumption habits.

Gen Z Marketing Strategies

Gen Z has a unique set of consumption habits, which requires marketers to use innovative and effective marketing strategies to reach and engage with this generation. Here are some of the most effective marketing strategies for targeting Gen Z:

Social Media Marketing

Social media marketing is one of the most effective strategies for reaching and engaging with Gen Z. This generation spends an average of 3.4 hours per day on social media, making it an excellent platform for marketers to reach them. To be successful, social media marketing needs to be personalised, engaging, and authentic. Marketers must create content that aligns with Gen Z’s interests and values, such as social and environmental issues, diversity, and inclusivity.

Influencer Marketing

Influencer marketing is another effective strategy for reaching and engaging with Gen Z. This generation trusts peer recommendations over advertising, making influencer marketing a powerful tool for marketers. Influencers are highly influential among Gen Z, and they can help brands reach this generation in an authentic and engaging way. However, working with influencers who align with the brand’s values and messaging is essential to avoid being inauthentic or disingenuous.

Experiential Marketing

Experiential marketing is a highly effective strategy for engaging with Gen Z, who value unique and immersive experiences. This strategy involves creating brand experiences that provide a tangible and memorable connection with the brand. For example, a pop-up store or event can create a powerful connection with Gen Z by delivering an immersive and engaging experience. This strategy can build brand awareness and loyalty among this generation.

Case Study: Taco Bell

Taco Bell is a fast-food chain that has successfully targeted Gen Z using innovative marketing strategies, including social media, influencer, and experiential marketing. Taco Bell’s highly engaged social media presence has helped it to connect with Gen Z, who value personalisation and authenticity.

The company has also leveraged influencer marketing to reach this generation in an authentic and engaging way. For example, in 2019, Taco Bell partnered with influencer David Dobrik to launch the “Belluminati” campaign, which generated over 3.4 billion impressions on social media.

Taco Bell has also used experiential marketing to create unique and immersive brand experiences that resonate with Gen Z. In 2019, the company opened a hotel in Palm Springs, California, which provided a highly immersive and engaging experience for fans of the brand. The hotel sold out in just two minutes, demonstrating the power of experiential marketing in engaging with this generation.

Marketers need to use innovative and effective marketing strategies to reach and engage with Gen Z. Social media marketing, influencer marketing, and experiential marketing are some of the most effective strategies for targeting this generation. By creating personalised, authentic, and engaging marketing campaigns, marketers can build brand awareness and loyalty among this highly influential generation.

Gen Z Campaigns from around the world

These examples demonstrate how successful marketing campaigns targeting Gen Z require creativity, authenticity, and a focus on emotions and experiences.

Using tactics such as social media challenges, short films, and humour, these brands engaged with Gen Z meaningfully and created strong connections with this generation. The outcomes achieved, such as increased sales and widespread media coverage, show the power of effective marketing in reaching and engaging with this highly influential generation.

India – Lays

Lays’ “Smile Deke Dekho” campaign targeted Gen Z in India by focusing on humour and creativity. The campaign involved a social media challenge that encouraged people to create and share their own funny videos using a Lays chip packet. The campaign was highly successful, with over 7 million views on YouTube and widespread social media engagement.

China – Pepsi

Pepsi’s “Bring Happiness Home” campaign targeted Gen Z in China by focusing on family and community. The campaign featured a short film that showed a young man using Pepsi to connect with his family and bring them together. The campaign also involved a social media challenge encouraging people to share their family stories and experiences. The campaign was highly successful, with over 10 million views on YouTube and widespread media coverage.

Japan – McDonald’s

McDonald’s “Fry Thief” campaign targeted Gen Z in Japan by focusing on humour and creativity. The campaign featured a series of short films that showed people stealing fries from each other in various settings, from a park to a beach. The campaign also involved a social media challenge encouraging people to share their “fry thief” moments. The campaign was highly successful, with over 3 million views on YouTube and widespread social media engagement.

Understanding Gen Z as a consumer market is essential for marketers who want to engage with this highly influential generation effectively. By aligning their brands with the consumption habits and marketing preferences of Gen Z, marketers can create impactful campaigns that resonate with this generation and build long-term brand loyalty.

Are you ready to take your marketing to the next level by understanding Gen Z as a consumer market? Download “The Definitive Guide to Gen Z” This guide is packed with valuable insights and data to help you create effective marketing campaigns that resonate with Gen Z.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director