Japan has one of the longest life expectancies in the world. Yet many of its citizens skip the dentist until something hurts, and the results are catching up with them.

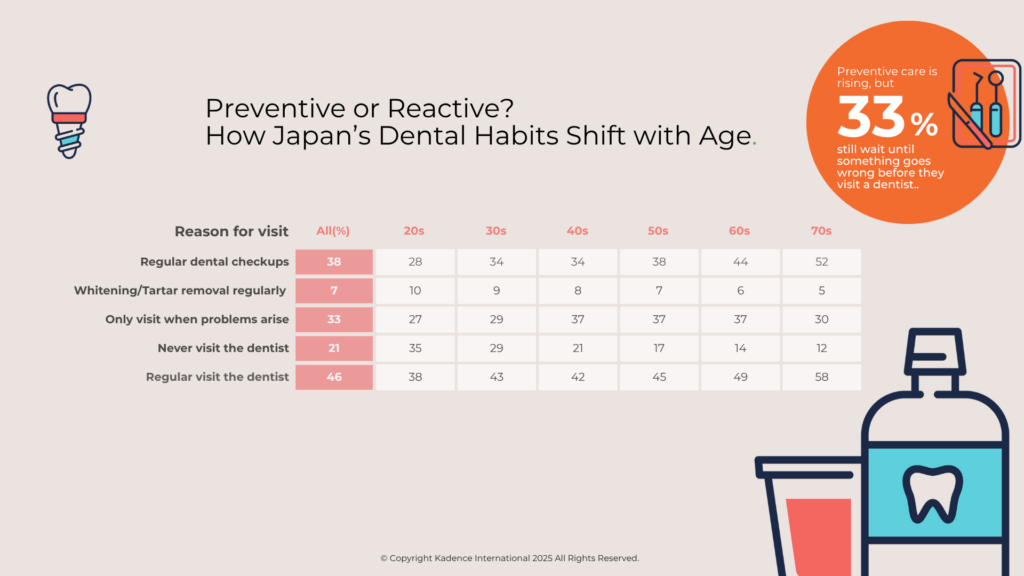

While the country’s universal health insurance system provides broad access to dental treatments, from fillings to oral surgery, preventive habits remain inconsistent. Japan’s universal health insurance covers dental treatment, but preventive habits lag behind. According to the Japan Dental Association, fewer than half of adults (46 percent) go for dental checkups, while more than a third seek care only when symptoms appear. These figures are echoed by a February 2025 nationwide survey conducted by our sister company, Cross Marketing Inc., which collected responses from 2,400 Japanese adults aged 20 to 79. The findings reveal a striking paradox: most people believe in daily care, but few follow through with checkups. Even fewer recognise how oral health connects to heart disease or dementia.

As Japan’s population ages, this disconnect between belief and behaviour has wide-reaching implications. Oral health is increasingly recognised as a key component of healthy ageing and quality of life. Yet, without deeper integration into public health planning and broader cultural shifts, preventive oral care risks remaining an afterthought in one of the world’s most advanced healthcare systems.

Japan’s Healthcare Landscape — A System Built on Access but Facing New Pressures

Japan’s healthcare system has long been regarded as one of the most efficient and equitable in the world. With universal coverage since 1961, residents enjoy broad access to medical care at relatively low cost. Life expectancy is approximately 84.5 years, and health outcomes such as infant mortality and preventable hospitalisations remain among the best globally.

Dental care is included within this system. Most restorative procedures, oral surgeries, and prosthetic treatments are covered under public insurance, requiring only modest co-payments. However, preventive dental care tells a different story. While schoolchildren must undergo routine checkups and some employees receive dental screenings through their workplaces, many working-age adults fall outside of regular preventive protocols. Those in their 20s and 30s are particularly affected, with no mandated checkups and limited incentives to seek early care.

Utilisation of dental services also varies by region. Rural areas and lower-income prefectures report lower access to periodontal treatment and fewer outreach initiatives. These inequalities are compounded by disparities in health literacy, particularly around the long-term benefits of preventive oral care.

The consequences of inconsistent dental habits are becoming more visible with Japan’s ageing population. In long-term care facilities, elderly patients often suffer from complications related to poor oral hygiene, including dry mouth, tooth loss, malnutrition, and aspiration pneumonia. Although Japan’s healthcare system is structurally equipped to support preventive dental care, it has yet to embed it into everyday health behaviour across all age groups and regions.

Top Concerns Reflect Cosmetic Anxiety and Age-Linked Decline

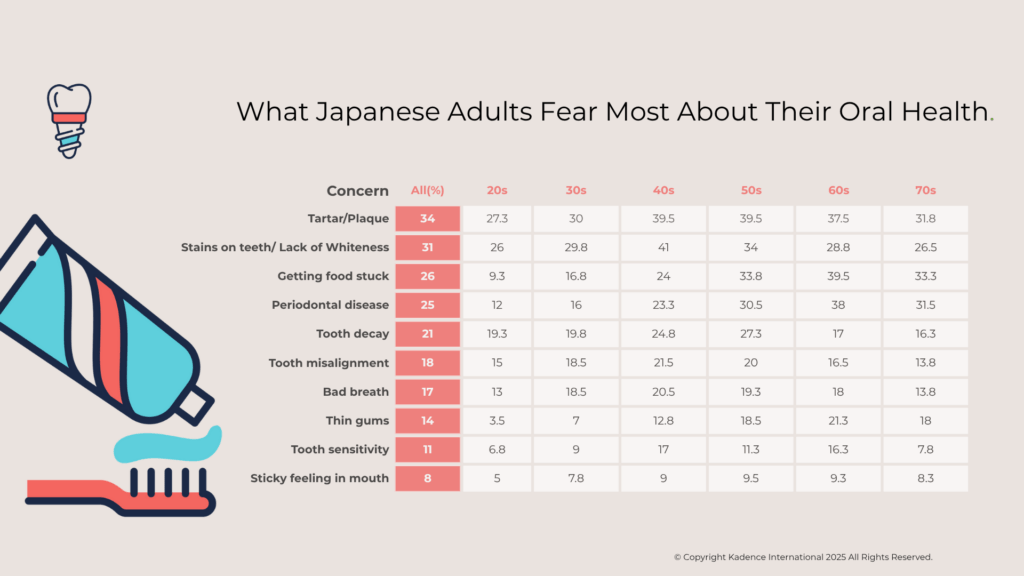

When asked about their primary concerns related to oral health, Japanese adults overwhelmingly pointed to issues with appearance and daily discomfort. Topping the list were tartar buildup, stained teeth, and the sensation of food getting stuck — issues that reflect cosmetic discomfort more than a serious health risk.

These are not necessarily signs of poor health but reflect a desire for cleanliness, freshness, and cosmetic upkeep.

Tartar and tooth stains top the list, while gum and periodontal issues dominate among older respondents.

The focus on appearance was especially pronounced among respondents in their 40s, where concerns about tooth colouration were highest. By contrast, ageing-associated issues — such as gum disease and thinning gums — were most common among people in their 50s, 60s, and 70s. Gum-related problems became far more common with age, especially among older adults, indicating a shift from cosmetic to functional and medical concerns with age.

Two in ten respondents cited tooth decay, another key indicator of oral health decline. While it appeared across all age groups, its frequency did not spike as sharply in older populations as gum-related conditions did. This suggests that while cavities remain a concern, gum health may be the more pressing issue as people age.

The data presents a clear divide. Younger adults appear most concerned with aesthetics and mild discomfort, while older adults are increasingly affected by chronic oral conditions. These patterns provide valuable insight for public health efforts to tailor messaging, education, and services by age group.

The Ritual of Brushing Is Not Enough

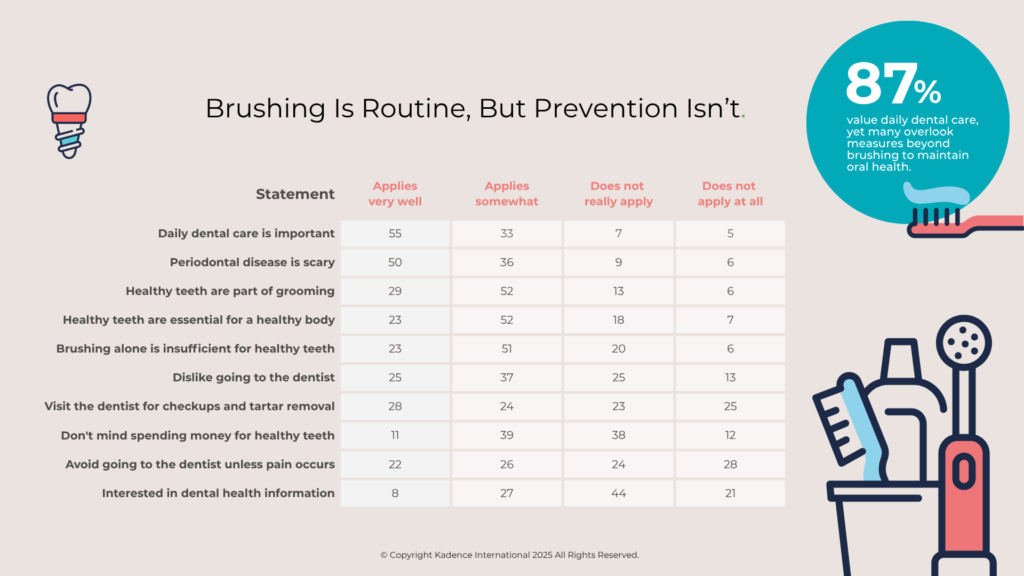

Most people consider daily dental care essential for health and as part of their grooming routine. These findings point to a population that understands the value of daily hygiene.

Yet despite a strong commitment to brushing, fewer people adopt more comprehensive preventive practices. Many acknowledge that brushing alone isn’t enough. And while gum disease is widely feared, it doesn’t always spur preventive action.

This mismatch between perception and practice highlights a key nuance in Japan’s oral health culture. Brushing is seen as a personal duty, but dental visits aren’t yet part of that norm. However, the idea of visiting a dentist for preventive care is still not ingrained in the same way. Many rely on brushing alone, underestimating the importance of professional cleanings, periodontal checkups, and non-invasive screenings.

The data also revealed a reluctance among some respondents to seek dental care. A quarter of respondents admitted they avoid going to the dentist unless in pain, and 13 percent said they dislike visiting dentists altogether. These numbers suggest that while oral health is valued, the path to maintaining it is still viewed through a narrow lens.

The Mouth-Body Disconnect

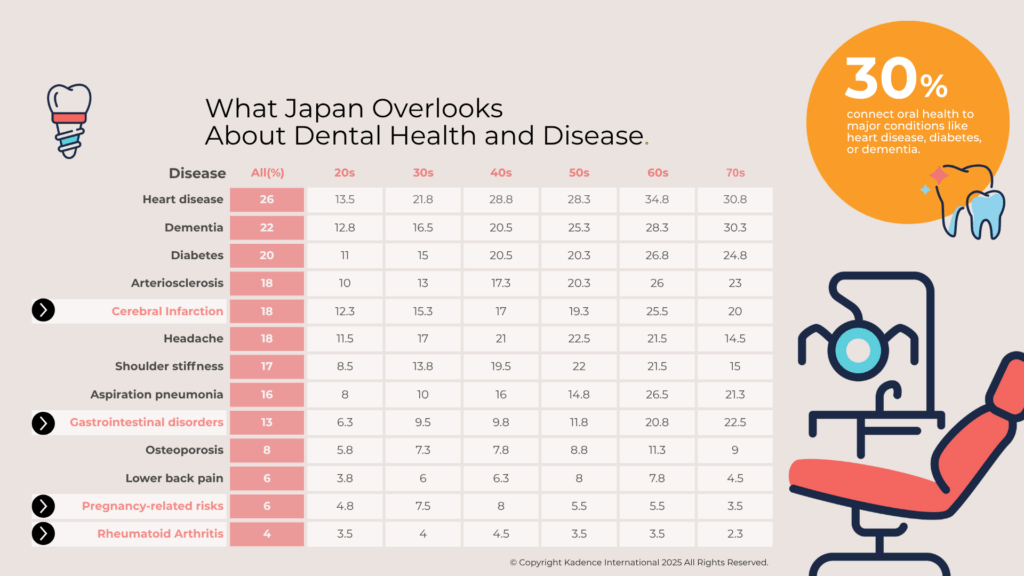

Despite growing global evidence linking oral health to systemic diseases, awareness of this connection remains limited among Japanese adults. The survey findings were clear: understanding of the mouth-body link—like oral inflammation’s ties to heart disease or dementia—remains low. These are conditions that public health officials worldwide now consider closely tied to oral inflammation and periodontal disease.

The data also showed that older adults were more aware of these links. People in their 60s and 70s demonstrated higher recognition of connections between oral health and conditions like arteriosclerosis, cerebral infarction, and aspiration pneumonia. Even so, awareness rarely exceeded 35 percent for any single disease across any age group.

This low recognition contrasts with decades of medical literature pointing to the systemic risks of untreated oral conditions. Periodontal disease, in particular, has been associated with elevated markers of inflammation that affect the heart and blood vessels. Poor oral hygiene has also been linked to the development of aspiration pneumonia in older adults, especially those in long-term care facilities.

One explanation may lie in how oral health has been framed historically. In Japan, as in many other countries, the mouth has often been treated as separate from the rest of the body in cultural and clinical settings. Dental care is viewed as important, but not necessarily medical. That perception is shifting slowly as experts call for integrating oral and general health services.

Closing the awareness gap will be essential as Japan confronts the dual challenges of an ageing population and rising rates of chronic disease. The data suggest that this will require better education and a shift in how oral health is positioned within the broader healthcare system.

The Ageing Divide in Dental Habits

As Japan’s population grows older, so does its dental behaviour. The survey revealed that regular dental visits increase significantly with age. Older adults are far more likely to go for regular checkups than their younger counterparts. Many in their 20s delay visits until there’s a problem — and a surprising number avoid the dentist altogether. In contrast, a third of young adults said they delay visits until problems appear.

This trend highlights a widening gap in preventive care between generations. Older adults appear to understand the importance of regular maintenance, likely due to direct experience with tooth loss, gum disease, and age-related oral complications. Younger adults, in contrast, often delay care until pain or visible problems emerge.

The implications extend beyond the dental chair. Poor oral health in older adults has been linked to malnutrition, frailty, and cognitive decline. In long-term care settings, conditions like aspiration pneumonia are now recognised as partly preventable through better oral hygiene. Integrating dental services into elder care has become a national priority, with some prefectures piloting programs that embed dental hygienists in aged care facilities.

Yet challenges remain. Even among older adults, routine visits are not universal. Mobility issues, regional disparities, or lack of family support can limit access. For younger people, the absence of mandatory screenings after adolescence creates a long stretch of disengagement during the early adult years, when lifelong habits take shape.

If Japan is to sustain its leadership in longevity and healthy ageing, oral health must be treated not as an optional service but as a core component of medical care across the lifespan.

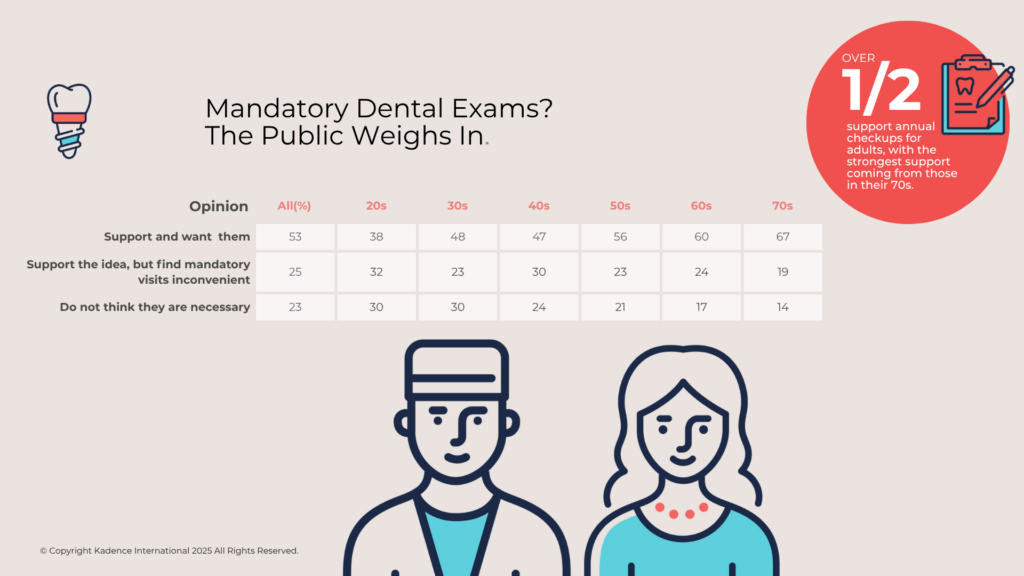

Support Grows for Annual Dental Checkups

As awareness of oral health grows, so does public support for stronger preventive measures. A majority of respondents support the idea of mandatory annual checkups, with only a small minority opposed.

Support for mandatory checkups increases sharply with age, with older adults more likely to see the long-term value of preventive care. This generational divide reflects both a difference in experience and in perceived risk. Older adults are more likely to have experienced tooth loss, gum recession, or oral discomfort, and understand the long-term benefits of early detection and maintenance.

The conversation around compulsory dental exams is not new in Japan. The 8020 Campaign, launched in 1989 by the Ministry of Health and the Japan Dental Association, has long encouraged citizens to retain at least 20 natural teeth by age 80. While the initiative has raised awareness, it relies on voluntary compliance. Policymakers are now weighing whether more formal mandates — similar to annual health checkups — could be applied to dental care for working-age adults.

Efforts are also underway to expand oral health screenings in schools, integrate dental visits into company-sponsored health programs, and increase outreach in underserved regions. However, implementation remains inconsistent, and not all employers or municipalities can scale these services.

Our survey results suggest the public may be more ready for reform than expected. Formalising annual dental checkups could advance Japan’s preventive care strategy and reinforce the message that oral health is inseparable from general well-being.

What Comes Next for Oral Health in Japan

Our Oral Health Survey offers a sharp diagnosis of how Japan approaches oral health. This isn’t a failure of access; it’s a gap in mindset. While many people brush daily, fear gum disease, and express support for annual checkups, their behavior often stops short of proper prevention. This pattern is most visible among younger adults, who remain disconnected from regular care during critical years for long-term dental health.

In contrast, older adults are beginning to close that gap. Preventive visits are rising among seniors, and there is growing recognition of how oral health affects everything from nutrition to chronic disease. As the population ages, oral healthcare quietly becomes a foundation of healthy longevity.

What comes next will require more than awareness. Expanding access to preventive services, embedding dental screenings into routine care, and reducing regional disparities are essential. Just as important is reshaping public understanding by positioning oral care as a personal habit and a core part of medical well-being.

The next breakthrough won’t be high-tech; it’ll be a shift in perception. Treating the mouth as part of the body, not apart from it, will support health and dignity across the lifespan. As Japan extends life, it faces a quieter challenge: keeping those years pain-free. The path may begin not in hospitals, but in the dental chair.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director