For years, brands have poured billions into social media, banking on its power to capture consumer attention. But many users are logging off, exhausted by algorithm-driven content, relentless ads, and digital fatigue. The rise of the social media detox movement presents an inconvenient truth for marketers: the platforms once considered indispensable may now push consumers away.

This shift isn’t anecdotal. Market research indicates a clear trend – users, especially Gen Z and millennials, are actively reducing screen time, muting notifications, and deactivating accounts in pursuit of mental clarity and reclaimed time. What was once an occasional break from digital noise is evolving into a broader consumer reset on social media engagement.

For brands, this poses a fundamental question: If audiences are stepping away from social platforms, how do businesses maintain visibility, connection, and influence?

The answer lies not in resisting the trend but in understanding the new rules of engagement.

Why are Consumers Logging Off?

Social media has dominated brand-consumer interactions for over a decade, but a growing segment of users is actively stepping back. The social media detox movement is no longer a fringe trend – it’s a behavioural shift with real marketing implications. Consumers, especially younger demographics, make intentional choices to reduce screen time, limit influencer engagement, and seek more authentic interactions.

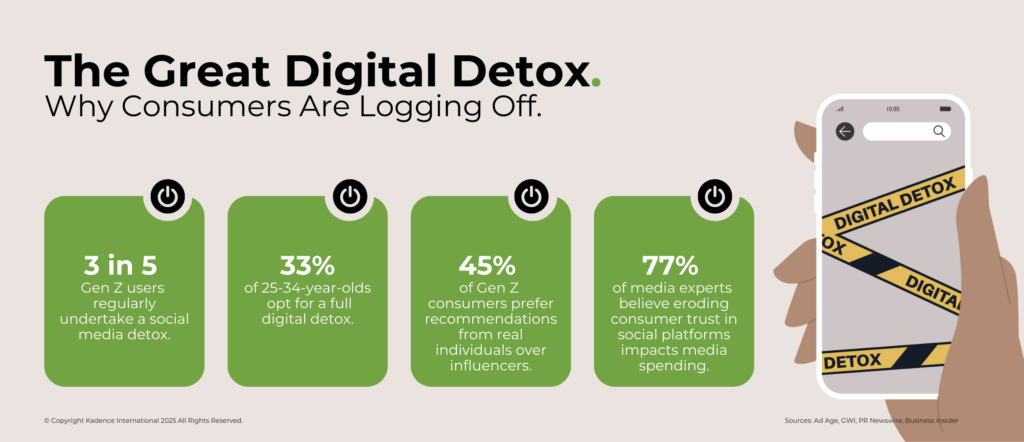

The Numbers Behind the Shift

The ‘why’ behind the great digital detox.

Digital detoxing isn’t just about reducing screen time; it’s rejecting the attention economy. Research indicates consumers are logging off due to:

- Mental wellness concerns: Young users cite anxiety, comparison culture, and doomscrolling as reasons to disengage.

- Algorithm fatigue: The push toward AI-driven content curation has left users feeling manipulated rather than engaged.

- Scepticism of influencer culture: With trust in influencers eroding, consumers are shifting toward community-based recommendations over celebrity endorsements.

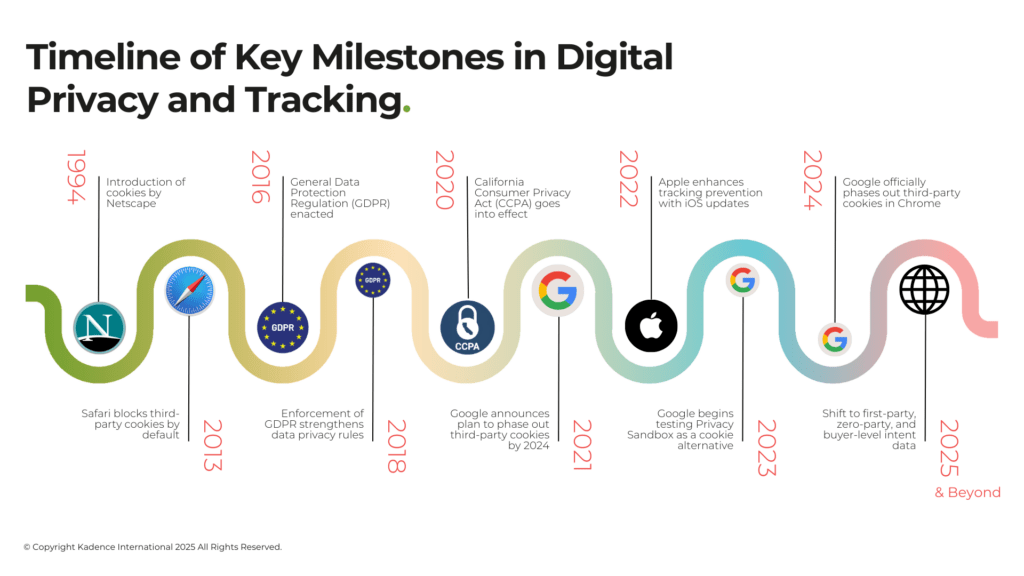

- Privacy concerns: Users are more aware of data collection practices and choose to interact in closed, private digital spaces.

While some consumers return to social media after temporary detox periods, others are making long-term behavioural changes, limiting their reliance on platforms indefinitely. Brands must prepare for a future where digital engagement is increasingly fragmented, requiring a more adaptable marketing strategy.

What the Social Media Detox Trend Means for Brand Marketing Strategies

Consumers aren’t just scrolling less – they’re re-evaluating their digital habits. Brands must rethink their engagement models if social media detoxing becomes a long-term shift rather than a temporary trend.

How do brands remain relevant when audiences deliberately tune out?

For years, brands have built marketing strategies around the assumption that social media is the primary touchpoint for consumer engagement. But with growing numbers of users stepping away, relying solely on platforms like Instagram, TikTok, and Facebook is becoming a risky proposition. The shift toward social media detoxing isn’t just about personal well-being—it’s altering how consumers interact with brands, discover products, and build trust.

The most immediate challenge is declining engagement. If consumers are reducing screen time, brands face shrinking opportunities to reach them through traditional social ads and influencer partnerships. This is particularly concerning for brands targeting Gen Z and Millennials, leading the movement toward digital detoxing. Ad fatigue is also accelerating the problem as consumers grow increasingly resistant to sponsored content and algorithm-driven recommendations.

Another major concern is the vulnerability of relying on rented platforms. With social media engagement declining, brands that have built their digital presence entirely on these platforms are now at the mercy of shifting algorithms and user behaviours. The lack of control over audience reach makes brands susceptible to sudden drops in visibility, forcing them to rethink their approach to audience building.

This shift is also reshaping digital advertising ROI. Brands that once saw high conversion rates from social media campaigns may now struggle as users actively disengage.

Customer acquisition costs (CAC) are rising as social media platforms become less effective at driving conversions. With ad engagement rates declining, brands are shifting investments toward alternative channels such as Google Ads, podcast sponsorships, and streaming service placements. Understanding where audiences are migrating is essential for maximising marketing ROI. Marketers must evaluate whether continued investment in these channels delivers sustainable returns or if it’s time to diversify into owned media and alternative digital touchpoints.

Social media detoxing is not a sign that digital marketing is failing but indicates that consumer preferences are evolving. Brands that recognise this shift early can adapt their strategies to maintain engagement without being overly dependent on social media platforms.

How Brands Can Stay Relevant in an Era of Digital Detox

As consumers disengage from social media, brands must rethink their marketing approach. The solution isn’t to fight the trend – it’s to adapt by diversifying digital touchpoints, strengthening direct customer relationships, and creating value beyond algorithm-driven platforms.

First-party data is becoming a brand’s most valuable asset.

Zero-party data strategies: collecting voluntarily shared consumer insights through interactive content, preference centres, and surveys.

AI-driven CRM systems: leveraging predictive analytics to anticipate customer behaviours and engagement patterns.

Direct-to-consumer models: building deeper relationships via email marketing, loyalty programs, and exclusive brand communities.

With social media engagement fluctuating, brands can no longer rely on third-party platforms to maintain customer relationships. Investing in email marketing, loyalty programs, and brand-owned communities ensures a more direct and sustainable connection with consumers. Email, in particular, is experiencing a resurgence, with open rates outperforming social media engagement rates. Brands focusing on personalised, high-value content in inboxes can build deeper relationships without competing against ever-changing social algorithms.

Brands must also embrace alternative digital spaces.

Community-driven platforms such as Discord, Substack, and brand-owned apps offer a way to engage audiences without relying on social feeds. These platforms foster deeper loyalty by creating spaces where consumers opt in for value-driven interactions rather than being bombarded by passive content. SMS marketing is another underutilised tool, boasting high open rates while offering a direct, personal channel for communication. However, brands must strategically use it, ensuring messages provide real value rather than feeling intrusive.

Offline engagement is also gaining importance once again.

The return of experiential marketing, pop-up activations, and real-world brand interactions allows brands to reach audiences in meaningful ways beyond digital screens. With consumers craving authenticity, brands that create real-world experiences, whether through in-person events or retail activations, can strengthen connections in ways social media alone cannot achieve.

Influencer marketing is evolving as well.

The traditional influencer model, which relied on celebrity endorsements and massive follower counts, is losing effectiveness as trust in influencers declines. Consumers are now looking for recommendations from micro-communities and real-life social circles. Brands that pivot toward peer-driven advocacy – leveraging customer testimonials, employee ambassadors, and brand superfans – will have a stronger foundation for long-term engagement.

The era of passive social media consumption is fading, and brands that rely solely on scrolling behaviour will struggle. The shift toward meaningful, value-driven engagement requires a new playbook, one that prioritises direct relationships, diversified digital ecosystems, and real-world touchpoints. The next section explores how market research can help brands navigate this transition and predict future consumer behaviours.

The Role of Market Research in Navigating the Detox Trend

Guesswork is not an option for brands adjusting to the social media detox movement. Understanding evolving consumer behaviour requires a data-driven approach, and market research plays a critical role in helping brands anticipate shifts, measure engagement beyond social media, and refine their strategies accordingly.

Predictive analytics is key to staying ahead of consumer behaviour trends. Instead of relying on retrospective engagement metrics from social platforms, brands should leverage AI-driven modelling to forecast how audiences will likely interact with digital content. Behavioural data analysis can identify early signals of declining engagement, helping brands pivot before they see a drop in visibility or conversion rates.

Consumer sentiment tracking is another essential tool. While traditional social listening tools focus on platform-based conversations, the social media detox movement means brands must expand their reach to alternative data sources. This includes direct surveys, focus groups, in-app engagement metrics, and customer service interactions. Understanding why consumers are disengaging from social platforms and what alternatives they prefer allows brands to adapt without losing their audience.

Longitudinal studies provide deeper insights into whether digital detoxing is a passing trend or a lasting behavioural shift. Brands should not only measure current engagement levels but track behavioural changes over time. Are consumers leaving platforms temporarily before re-engaging, or are they permanently reducing their social media presence? Are younger audiences more likely to embrace alternative digital experiences? These insights help brands build long-term strategies instead of reacting to short-term fluctuations.

Beyond digital, ethnographic research can uncover how consumer behaviours are evolving offline. Observational studies and in-depth interviews can provide a clearer picture of how consumers interact with brands in physical spaces, whether through in-store experiences, brand-hosted events, or offline word-of-mouth. This shift is crucial as brands look to re-engage audiences in ways that don’t rely on algorithm-driven visibility.

Relying solely on past engagement patterns is no longer sufficient. Market research offers brands a proactive approach to understanding shifting consumer behaviours, enabling them to adapt with precision rather than assumption.

Examples of Brands Successfully Adapting to the Social Media Detox Trend

Some brands are already ahead of the curve, recognising that relying solely on social media is no longer a sustainable marketing strategy. By diversifying their approach, prioritising first-party data, and investing in alternative engagement channels, these companies are maintaining strong consumer relationships despite the rise of digital detoxing.

One example is Lush, the UK-based cosmetics brand that made headlines by stepping away from social media altogether. Frustrated with algorithm-driven limitations and the growing toxicity of digital spaces, Lush removed itself from major platforms like Facebook, Instagram, and TikTok. Instead, the brand doubled down on email marketing, in-store experiences, and community-driven engagement. The result? A more direct, controlled communication strategy that allowed them to maintain brand loyalty while reinforcing their ethical values.

Image Credit: Lush

Another company adapting to the decline of social engagement is Patagonia. The outdoor apparel giant has long embraced an anti-advertising stance, prioritising storytelling over traditional digital campaigns. While many brands compete for social media attention with aggressive paid promotions, Patagonia invests in long-form content, sustainability reports, and documentary-style storytelling. The company builds a stronger emotional connection with its audience without relying on social media algorithms by publishing in-depth research and hosting real-world environmental initiatives.

Luxury brands are also rethinking their digital presence. Bottega Veneta, for example, strategically decided to delete its social media accounts in favour of an exclusive digital magazine and VIP community model. By creating a more controlled, high-value content ecosystem, the brand shifted attention away from mass-market social media feeds and toward more personalised, premium engagement.

Image Credit: The Impression

Even FMCG brands are adjusting. Oatly, known for its plant-based milk alternatives, has embraced offline marketing activations and guerrilla-style advertising to maintain visibility without overly relying on digital engagement. From eye-catching billboards to in-person brand experiences, Oatly’s approach shows awareness can be built in ways that don’t require consumers to be constantly online.

These brands demonstrate a fundamental shift – brands that successfully navigate the social media detox movement build direct, value-driven consumer relationships. The key takeaway? Brands must stop treating social media as the default marketing channel and start viewing it as just one of a broader, more resilient engagement strategy.

The Next Phase of Digital Detoxing

The rise of social media detoxing isn’t a fleeting trend; it’s a symptom of a larger shift in how consumers engage with digital platforms. While some users may eventually return, their behaviour will not be the same. The next phase of digital engagement will be defined by intentionality, privacy, and deeper value exchanges, forcing brands to rethink their long-term marketing strategies.

Social media platforms themselves are already adapting to this detox trend. Features like Instagram’s Quiet Mode and TikTok’s time management reminders signal that even tech giants recognise the risks of overexposure. Platforms will likely continue evolving, offering more user control over content consumption. However, these changes won’t necessarily benefit brands – if anything, they may further limit ad exposure and organic reach as users prioritise personal well-being over passive engagement.

Social media detoxing is not a rejection of digital engagement – it’s a demand for better digital experiences. Consumers are no longer willing to engage with brands passively; they expect intentionality, privacy, and authentic connections. For brands, the question is no longer whether they can survive without social media as their primary channel. The real question is whether they can afford to depend on it at all.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director