Survey design is an important part of doing business and market research. Put simply, it refers to the process of creating surveys that get responses.

This is important because it allows you to better understand the market and your customers, so you can make more data-driven decisions, and fix areas that are falling short. Done right, a good survey can be the driving force for huge positive change.

How to design a survey

Planning

The first stage of survey design is all about planning. This is where you’ll decide what you want to focus on, why you’re running a survey at all, who you want to target, and more.

If you don’t get this stage right, you’ll end up with a survey that doesn’t have any clear goals, or fails to achieve its objectives. To get any meaningful feedback from a survey, you need to be clear about what you’re trying to achieve.

This initial stage is extremely important and is not something to skim over or rush through. In fact, the planning stage should take up a large chunk of the overall process.

1. Figure out your goals

The goal of the survey is what gives it structure and influences every part of the process. Here are some examples of goals for surveys:

- Find out what customers think about your brand versus the competition

- Assess the main challenges faced by customers in your industry

- Learn what customer like the most and least about a specific product

Goals should typically be narrow enough that there is no risk of confusing your stakeholders or your respondents. Narrow goals also avoid overwhelming your respondents with questions.

A clearly defined goal helps the team draw inspiration and stay united and focused. Once you have decided on a goal, you’ll have a much better idea of what type of questions to ask, the type of respondents you want to reach , and so on.

In other words, you need to set a goal in order for the rest of the process to click into place.

2. Decide who you want to target with your survey

The next stage of the planning process involves deciding who will actually take part in your survey.

This is called the target population, and it should reflect the goal. For example, if you’re asking how your product impacts a person’s job it’s probably not a good idea to target people under 16, or people over 70 as they are unlikely to be working.

3. Choose the right sample

The target population you choose will often be too large to effectively survey. This means you’ll have to select a sample — a smaller group that represents the larger demographic. You can then take these results and extrapolate them to the wider population.

Done right, this group will be representative enough to act as a miniature version of the whole. Sampling allows you to achieve your goals with a fraction of the cost, time, and resources required to survey the entire target population, which in most cases, would simply not be possible.

4. Pick the right survey method

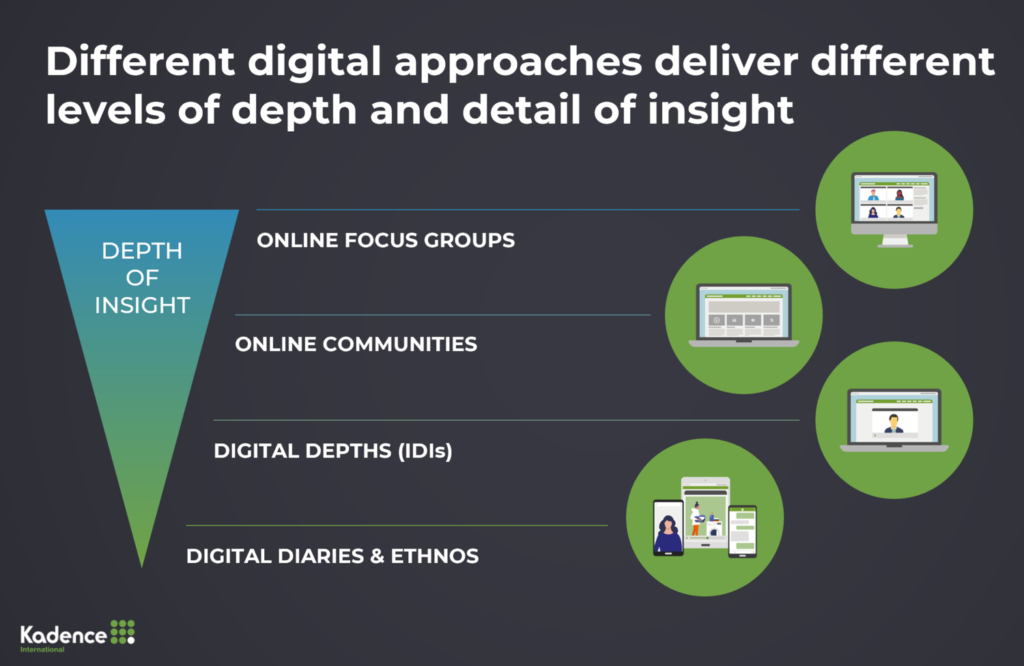

This stage of the planning process will be driven by your goal and your target demographic. Some examples of different methods include:

- Online Internet surveys

- CATI (computer aided telephone interviewing)

- Central location testing

Every method has its pros and cons. Online surveys enable you to reach a large number of people quickly, but they’re less appropriate if you’ve got a physical product you want people to interact with. Instead a central location test might be more appropriate in this instance.

Every survey is different. If your target population is mostly people over the age of 65 or in geographical locations where internet access is not widespread, online surveys will probably not be the best method. Likewise, a central location test might not work well if your target demographic is very busy.

Once you have decided on a goal, established a target population and a sample, and chosen the method for your survey, it’s time to get down to actually creating it.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Creating your survey

Creating your survey is all about making it as easy as possible for your respondents to read, understand, and answer. If you overwhelm them with information and confusing formats, they’ll quickly give up and you’ll end up with fewer answers and a smaller pool of data at the end.

Here are some ways to make your survey as effective as possible:

Use questions wisely

The best way to ask questions is sparingly. You need to ask enough to gather a good amount of information, but if you use too many you risk driving your respondents away.

It’s always best to start with a clear introduction that introduces the survey, explains the format, and addresses any initial questions the reader might have. You might then start with some screener questions (about age or job title, for example) to filter out any respondents who don’t match the target demographic.

- Don’t waste questions — only ask when necessary

- Ask one question at a time, combining multiple questions into one creates confusion

- Choose the right question type for your audience, mode of survey, and what you’re asking. Options include multiple-choice, open questions, closed questions, ratings, and so on.

- Keep your questions short, simple, and clear. Avoid using jargon and including unnecessary information.

- Design and layout is important — make it clear which questions to answer and how

Executing the survey

Once the survey is planned and created, it’s time to actually carry it out. If you have done the earlier stages correctly, this part should run smoothly. However, in practice, errors and unexpected setbacks are common. Here’s how to execute your survey in the best way possible:

Work with trained researchers

If your survey will be carried out in person or on the telephone, it’s important that your staff know how to ask questions. Make sure you’re working with a team that is trained to ask open-ended questions correctly, in a way that avoids confusion or tempts bias.

Pilot surveys

A common practice is to conduct a smaller pilot survey before the main one, which can help identify any problems with the survey and give you an opportunity to make some tweaks before sending it to the full sample group.

Avoiding bias

One of the main challenges when conducting surveys is bias. It’s easy to accidentally lead your respondents down a certain path and encourage them to answer in a certain way, which you must avoid in order to get accurate and valuable results. To minimize bias:

- Avoid leading questions like comparisons with other companies or products

- Keep questions as precise and simple as possible to eliminate the risk of misunderstanding

- Try to predict inherent biases in your target group and work to mitigate them

Analyzing and sharing results

After the survey is complete, the final steps are to analyze and share the results. This is an extremely important step, as this is where you put into practice what you learned and draw value from the survey.

It’s important to categorize and analyze the results properly. This process might be as simple as collecting the results in an excel spreadsheet, or it might be much more detailed, using a range of advanced analysis techniques..

Think about how the survey relates to your overall business and marketing, and how you can act on the insights you gained and use them to achieve your goals.

Create a summary report

A summary report is a great way to share your results with your stakeholders in the business. It’s a document that breaks down what your survey set out to achieve and what the key findings were. We regularly create summary reports, as well longer, more detailed reports for our clients.

Make sure to clearly show what your aims were and what you learned, and present this in a way that anyone – regardless of market research literacy – can get to grips with. It’s worth working with a good designer to present the findings in the best way possible. At Kadence we have our own design team who help us to create impactful reports that make data easy to understand and act upon.

Survey design can seem like a challenging process, and it does require input and collaboration from many parts of the company.

However, the rewards are worth it. A well-designed survey can provide a much more intimate understanding of your customer base and how your products and services are received. It can yield incredibly valuable feedback and prompt much-needed change.

To find out how Kadence can help your organisation plan more effective surveys and harness data for maximum effect, reach out to request a proposal.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director