B2B marketers have traditionally relied on account-level intent data, measuring company-wide engagement signals – website visits, content downloads, and webinar attendance – to identify potential buyers. But as decision-making power fragments across multiple stakeholders, these broad indicators are proving unreliable. Marketers aren’t just missing key players in the buying process; they’re wasting valuable resources targeting the wrong ones.

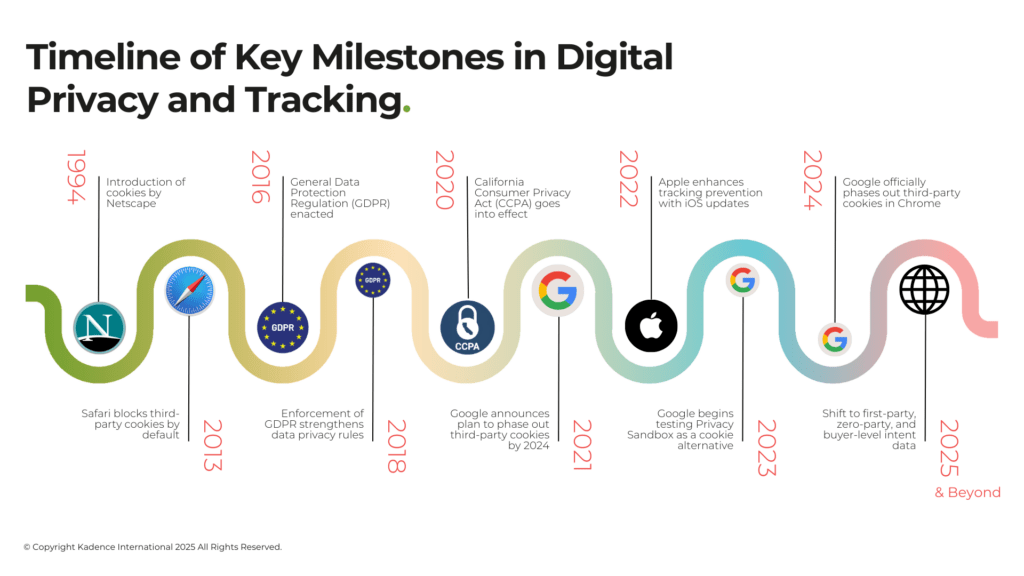

The playbook for digital tracking is being rewritten. With third-party cookies nearing extinction and privacy laws tightening, marketers are losing access to the passive behavioural insights they once took for granted. Marketers who once depended on aggregated company data to guide outreach are finding it increasingly difficult to pinpoint high-intent buyers. At the same time, the B2B buying journey has become more independent, with decision-makers conducting research long before speaking with vendors.

To navigate these shifts, companies are turning to buyer-level intent data, a more precise approach that focuses on individual engagement rather than generalised company activity. By tracking specific behaviours – such as downloading whitepapers, attending webinars, or engaging with product demos – marketers can identify real decision-makers, improve targeting, and accelerate the sales cycle.

The impact of this shift is already reshaping how businesses identify and engage potential buyers. The way B2B buyers engage has changed – and marketers are struggling to keep up. A 2023 Demand Gen Report revealed that 68% of B2B buyers now complete much of their research independently, long before speaking with a sales rep. This shift means old-school lead tracking methods – waiting for buyers to fill out a form or request a demo – are losing relevance fast. Account-level intent data – long considered a reliable indicator of interest – now often misdirects marketing efforts by signalling company-wide activity without revealing who within the organisation is actually making decisions.

The inefficiencies are not just inconvenient – they are costly. Forrester (2024) reports that companies relying solely on account-level intent data misallocate up to 40% of their sales and marketing resources by targeting the wrong contacts. In response, leading enterprises such as Adobe, Salesforce, and IBM are investing in first-party and zero-party data strategies to refine how they track and engage actual buyers, shortening sales cycles and improving marketing ROI.

Marketers who continue to rely on outdated tracking models may soon struggle to keep up. As third-party tracking fades and precision targeting becomes the industry standard, companies that fail to adapt risk falling behind competitors who have already embraced buyer-level insights.

The End of Account-Level Intent Data?

Account-level intent data is no longer an asset – it’s a liability. The strategy that once shaped demand generation is now misleading marketers and misallocating budgets. Marketers have relied on broad signals – such as employees from the same company visiting a website – to gauge interest. Yet these indicators rarely reveal who within the organisation has the authority to buy.

The inefficiencies are hard to justify. Studies show that nearly half of marketing budgets are misallocated because traditional tracking targets businesses, not the people making purchasing decisions. A recent LinkedIn B2B Institute report underscores the problem: only 17% of B2B decision-makers engage with cold outreach, making a scattershot approach increasingly ineffective.

The Cookiepocalypse: A Catalyst for Change

At the same time, data privacy laws and the decline of third-party cookies are forcing companies to rethink their strategies. With Google’s 2024 cookie phase-out, digital marketing is entering uncharted territory. For years, third-party cookies provided a passive, behind-the-scenes view of buyer behaviour, allowing companies to infer intent without direct engagement. Now, with GDPR in Europe and CCPA in California tightening restrictions, the industry is at a crossroads: marketers must transition to first-party tracking or risk losing buyer visibility altogether.

The shift away from account-level tracking isn’t just about privacy concerns – it’s about effectiveness. Without third-party cookies or unrestricted tracking, marketers can no longer rely on aggregated company activity to infer buying intent. A company’s employees may be researching solutions, but without knowing who is leading the conversation, outreach efforts remain a gamble.

Industry Perspective: Why Marketers Are Moving On

Most marketing teams still get one thing wrong: they target companies instead of the people making decisions. Lee Odden, CEO of TopRank Marketing, sees this flaw firsthand:

“If you don’t know who within an organisation is actively evaluating a purchase, you’re working with incomplete data and hoping for the best – rather than making informed, strategic decisions.”

This realisation is pushing B2B firms toward buyer-level intent tracking, a more precise and privacy-compliant approach that focuses on identifying real decision-makers rather than broad company interest.

The Rise of Buyer-Level Intent Data

As traditional tracking methods fall short, buyer-level intent data is emerging as the solution. Unlike broad company-wide signals, this approach focuses on real individuals actively researching and evaluating solutions. For sales and marketing teams struggling with inefficiencies, this shift is more than a tactical adjustment – it’s a competitive necessity.

A More Targeted Approach

Buyer-level intent data captures specific behavioural signals that indicate a prospect’s actual interest. Instead of aggregating website visits or company-wide engagement, this method pinpoints:

- Who downloaded a whitepaper or attended a webinar, signalling early-stage interest?

- Who engaged with case studies or product demos, indicating deeper evaluation?

- Who interacted with sales emails or initiated direct contact, revealing purchase readiness.

By mapping these real-time behaviours, marketing teams can craft more personalised outreach, while sales teams can engage high-intent buyers at the right moment, increasing efficiency and conversion rates.

Adoption Across the Industry

Leading B2B firms are overhauling their sales strategies by shifting to buyer-level intent tracking. Instead of casting a wide net, they are using real-time behavioural signals to prioritise engagement with actual decision-makers. By aggregating behavioural signals across digital channels, these tools help companies separate genuine prospects from passive interest. Some solutions integrate AI-driven analytics to prioritise outreach, identifying which individuals within an organisation are actively evaluating a purchase rather than relying on vague company-wide activity.

The results are significant. A shift toward buyer-level intent tracking isn’t just theoretical – it’s driving real revenue gains. In one case, companies leveraging intent-driven targeting reported a 32% jump in lead-to-sale conversions, according to a Heinz Marketing study. Instead of chasing broad signals, these firms focused on high-intent buyers and saw immediate results.

A Data-Driven Competitive Edge

With B2B sales cycles becoming more complex, companies that pinpoint individual decision-makers are gaining a clear edge over competitors still relying on outdated tracking models. Businesses investing in buyer-level intent strategies report:

- Higher engagement rates, thanks to more relevant, data-driven outreach.

- Shorter sales cycles, as sales teams connect with prospects at the right moment.

- Improved marketing efficiency, with resources directed toward buyers already in-market.

The shift is no longer optional – it’s a necessity for companies looking to stay ahead in a landscape where precision targeting is becoming the industry standard.

How Companies Are Using It

For businesses adopting buyer-level intent tracking, the results go beyond theory. By pinpointing decision-makers rather than chasing vague company-wide signals, sales and marketing teams are refining how and when they engage high-intent prospects. Instead of launching broad campaigns hoping to reach the right people, companies are now delivering highly targeted outreach based on real-time behavioral data.

Precision in Sales Outreach

The biggest transformation is in how sales teams prioritise and engage leads. Instead of filtering prospects by job title or company size, businesses are leveraging real-time intent signals to determine who is actively researching solutions and ready to buy. This shift allows for more strategic engagement, reducing wasted effort on unqualified leads and focusing resources where they matter most.

Tech giants like Adobe and Salesforce have already embedded buyer-level intent tracking into their sales enablement platforms, refining when and how their teams engage prospects. By analyzing interactions with content, pricing pages, and product demos, their sales reps are no longer relying on cold outreach or guesswork – they are reaching buyers at the right time, with messaging aligned to their specific interests. The result? Higher response rates and fewer wasted efforts.

AI-Powered Insights and Predictive Analytics

This shift isn’t just about who to contact – it’s about when. AI-driven tools are now deciphering behavioural signals to predict buying intent with unprecedented accuracy. These platforms track real-time engagement patterns – such as how often a prospect revisits a pricing page or downloads a product whitepaper – helping sales teams determine when a buyer is nearing a decision.

A 2024 Forrester study found that a leading cloud software company saw a 45% increase in engagement rates after abandoning traditional lead scoring in favour of AI-powered buyer intent tracking. Sales reps no longer pursued cold prospects – instead, they prioritised high-intent buyers, reducing their sales cycle length by 25% and significantly improving conversion rates.

Industry Perspective: A More Strategic Approach

Matt Heinz, President of Heinz Marketing, sees this shift as a defining moment in sales strategy:

“With buyer-level intent, sales teams don’t just know who to target – they know when and why. The difference between a warm lead and a ready-to-buy lead is timing, and this level of insight allows teams to focus their efforts where they’ll have the biggest impact.”

In an industry where deals are won or lost based on timing, acting too early means wasting resources; acting too late means losing to a competitor. Buyer-level intent tracking eliminates the guesswork, giving sales teams a real-time view into when a prospect moves from research to serious consideration.

A Competitive Edge in B2B Marketing

Companies that have moved beyond broad account-level tracking are seeing the benefits firsthand. By aligning outreach with actual buyer behaviour, sales and marketing teams report:

- Higher engagement rates, as prospects receive outreach tailored to their stage in the buying process.

- More effective content strategies, with marketing teams producing insights that match real decision-making needs.

- Shorter sales cycles, as sales teams identify and engage buyers before they formally enter the pipeline.

As B2B buying behaviour grows more complex, relying on outdated tracking models is no longer sustainable. Companies still measuring broad company engagement rather than individual buyer activity risk wasting resources on leads that will never convert. Meanwhile, competitors using buyer-level insights are moving faster, engaging smarter, and closing deals while others are still chasing prospects that have already made a decision.

Ethical Considerations and Privacy Compliance

As companies shift to buyer-level intent tracking, the debate over data privacy and ethical marketing is growing. With regulators and consumers pushing for greater transparency, businesses that fail to adapt risk eroding trust and facing legal scrutiny. Unlike third-party tracking – where users are often monitored without their knowledge – buyer-level intent data operates on consent.

Why Opt-In Data Matters

The difference isn’t just technical – it’s fundamental. Traditional intent tracking relied on third-party cookies and passive data collection, often gathering user behaviour without explicit approval. Buyer-level tracking, in contrast, is built on opt-in engagement, meaning prospects knowingly share their information. This includes:

- Webinar registrations and gated content downloads.

- Surveys and preference selections.

- Direct interactions with sales and marketing campaigns.

A recent TrustArc study found that 73% of B2B buyers prefer companies that are transparent about how their data is used, reinforcing the need for clear, ethical data practices.

A Legal and Competitive Shift

The tightening of privacy laws worldwide is forcing companies to rethink how they collect and use data. Regulations such as GDPR in Europe and CCPA in California have already placed strict limits on tracking without consent, and Google’s Privacy Sandbox initiative is set to further restrict access to behavioural insights. Businesses that fail to adapt risk not only compliance issues but also losing consumer trust in an era where privacy expectations are higher than ever.

Unlike third-party tracking, first-party buyer intent strategies comply with evolving regulations by gathering data only from individuals who have actively opted in. But knowing who is engaging isn’t enough – companies need to understand what’s driving them.

This is where market research becomes essential. Buyer-level intent tracking may show who downloads a whitepaper or attends a webinar, but it doesn’t explain why they are searching, what pain points they are trying to solve, or what barriers exist before a purchase. Without deeper research, even the most advanced intent tracking risks misinterpreting engagement signals.

Market Research’s Role in the Buyer Intent Revolution

Buyer-level intent tracking reveals who is engaging and how they behave – but without market research, the why behind their decisions remains a mystery. Without insights into buyer motivations, barriers, and triggers, intent signals risk being misinterpreted, leading sales teams to pursue the wrong prospects. Tracking behavioural data is only one piece of the puzzle – understanding the motivations behind those behaviours is what turns data into strategy.

Traditional quantitative and qualitative research methods provide the context needed to validate and refine intent signals, ensuring companies aren’t just chasing clicks but engaging with real buyers who have a clear path to purchase. By combining survey research, focus groups, and ethnographic insights with real-time behavioural tracking, businesses can move beyond surface-level engagement data and uncover why buyers are searching, what they need, and what factors influence their decisions.

Market research also plays a crucial role in segmenting intent data effectively. Not all high-engagement prospects are equally valuable – without proper segmentation, companies risk wasting resources on buyers who may be interested but lack decision-making authority or budget alignment. By integrating attitudinal and psychographic research into intent tracking, businesses can build a complete picture of their buyers – not just who they are but what drives them to act.

The Future of Buyer Intent Tracking

B2B marketing is moving into a new phase, driven by AI, privacy-first strategies, and shifting data collection models. Companies that once relied on broad third-party tracking are now investing in AI-driven analytics and zero-party data to better understand and engage real buyers. The focus is shifting from passive tracking to active, consent-based insights, giving businesses a clearer, more accurate picture of buyer behaviour without compromising privacy.

AI’s Role in Predicting Buyer Behavior

Advancements in machine learning and predictive analytics are transforming how companies interpret intent signals. AI-driven platforms now track patterns of engagement across multiple touchpoints – from whitepaper downloads to webinar participation – allowing businesses to determine not just who is interested, but when they are likely to act. Instead of relying on broad lead scoring models, sales teams can now prioritise real-time buyer readiness, increasing conversion rates and shortening deal cycles.

The End of Third-Party Dependence

With Google’s phase-out of third-party cookies, businesses are being forced to rethink how they collect and apply customer data. The reliance on passive tracking is fading, replaced by first-party and zero-party data strategies that capture explicitly shared intent signals rather than inferred behaviour. This shift is not just about compliance – it’s about building trust and credibility in a market where buyers are increasingly wary of invasive tracking practices.

Industry Outlook: What’s Next?

Industry forecasts suggest that the shift to buyer-level intent tracking is only accelerating. Research shows that companies shifting to buyer-level intent tracking are already seeing a measurable advantage. In one industry survey, B2B firms using AI-driven buyer intent models reported higher engagement rates and faster sales cycles compared to those relying on account-based signals. Companies that fail to make this transition will not only struggle with lead quality – they risk being left behind in a market that increasingly values data transparency and hyper-personalised engagement.

A New Reality for B2B Marketing

For B2B companies, buyer-level intent tracking is no longer an emerging trend – it’s the new reality. The shift away from third-party tracking and broad account-level signals is reshaping how businesses generate demand, allocate resources, and close deals. In a competitive environment where timing, precision, and ethical data collection are becoming key differentiators, companies that fail to adapt will find themselves chasing leads that never convert while competitors secure high-intent buyers first.

This isn’t just an incremental improvement – it’s a fundamental restructuring of how marketing and sales teams identify and engage potential customers. Companies still relying on outdated tracking models will continue wasting budgets on low-quality leads, while those leveraging buyer-level insights will increase efficiency, shorten sales cycles, and improve conversion rates.

This isn’t just an evolution – it’s an ultimatum. The B2B world is changing fast, and the companies that master buyer-level intent tracking will control the future of sales and marketing.

The cost of hesitation? Wasted budgets. Slower deal cycles. Watching competitors close deals that should have been yours.

The question isn’t whether intent tracking will define the next era of demand generation – it already is. The only real question is whether your company will lead the shift, or get left behind.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director