Understanding the size of your target market can be the difference between launching a wildly successful product and sinking resources into an untapped and unprofitable niche.

Accurate market size calculation is crucial to business success. It helps senior leaders navigate complex market landscapes and make informed strategic decisions. Understanding your market’s true potential is critical whether you’re planning to enter a new market or launch a product. Companies risk overestimating opportunities without precise data, leading to misallocated resources and potential failure.

Market size calculations grounded in thorough research offer brands a strategic advantage. By analyzing consumer demand, competitive landscapes, and market trends, brands can identify untapped opportunities and avoid costly missteps. This data-driven approach is especially important in international market expansion, where cultural nuances, economic conditions, and purchasing behaviours vary significantly across regions.

To stay competitive, senior leaders must leverage AI-driven predictive models, real-time data collection, and scenario analysis. These advanced tools provide a clearer, more dynamic view of market potential, allowing brands to adapt to changes in consumer behaviour, economic conditions, and competitive landscapes.

What is Market Size?

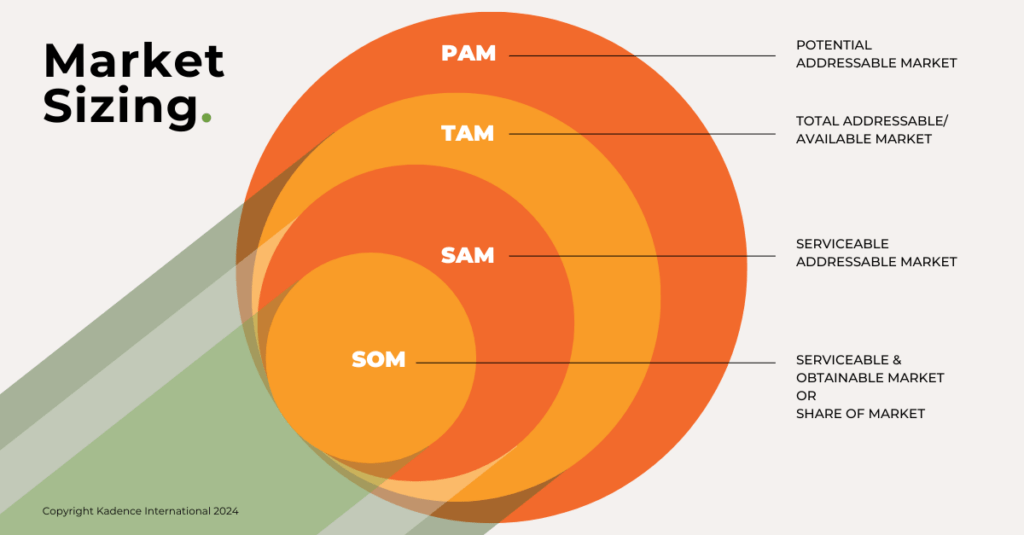

Market size represents a business’s total revenue or sales volume within a specific market. It encompasses two primary components:

- Total Addressable Market (TAM): The total demand for your product or service.

- Serviceable Available Market (SAM): The portion of the TAM that is realistically targetable given your resources, competition, and market position.

While TAM offers a macro-level overview, SAM provides actionable insight, allowing you to focus on the areas with the highest growth potential.

Why Market Size Matters for Businesses

Understanding market size is essential for companies because it helps set realistic goals and growth strategies.

Whether launching a new product or entering a new market, knowing the potential market size can inform decisions about product development, marketing efforts, and resource allocation.

For example:

- Product Launches: Calculating market size helps companies assess whether there’s enough demand to justify investing in product development. It allows brands to target segments with high growth potential, avoiding wasted efforts on oversaturated or declining markets.

- Market Entry Strategies: For companies looking to expand into new regions, understanding the size of the potential market helps identify opportunities. It also helps tailor entry strategies based on local consumer behaviours, economic conditions, and competitive landscapes.

- Resource Allocation: A clear understanding of market size allows companies to allocate budgets, staffing, and marketing resources more effectively. It ensures investments are directed toward the most promising opportunities, improving ROI and minimising risks.

Hypothetical Example: The EV Market in the Philippines

To illustrate the process, consider a hypothetical scenario in which a major global automotive brand is contemplating entering the electric vehicle market in the Philippines. The company begins by calculating the market size and analyzing the country’s growing middle-class population, increasing urbanisation, and government incentives for green technology. Based on these factors, they estimate the total addressable market (TAM) and the serviceable available market (SAM) for EVs.

The insights from this research allow the company to focus its entry strategy on urban areas with the highest potential for EV adoption. By strategically allocating resources toward infrastructure partnerships for charging stations, the brand positions itself as a leader in sustainable transportation within the Philippines.

This example demonstrates how understanding market size gives brands the insights to make informed decisions, driving success in product launches and market expansions.

Key Approaches to Calculating Market Size

Calculating market size effectively requires a combination of traditional methodologies and AI-driven models for dynamic predictions. Here are the key approaches and their application in today’s fast-changing global markets:

Top-Down Approach for Market Sizing

The top-down approach starts with broad industry data, such as government reports, and narrows it down to your target market. While useful for estimating large markets, it can often overlook local nuances and consumer behaviour specifics.

AI Forecasting Models:

Modern AI tools enhance the top-down approach by using predictive analytics to project future demand. These models analyze vast data sets, including historical market data, competitor trends, and consumer sentiment, to provide more accurate predictions.

Example Scenario:

The global automaker in our previous example entering the EV market in the Philippines could start by analyzing the $500 billion global EV market. By using AI models, they can refine their estimate to account for specific factors like EV infrastructure readiness, consumer preferences, and government incentives. This dynamic model would forecast how the market might grow over time, offering more precise insights than static industry reports.

Bottom-Up Approach to Determine Market Size

The bottom-up approach is more granular, focusing on data from local surveys, sales figures, and consumer interviews. It provides precise, actionable insights by starting at the ground level and scaling upwards.

Predictive Analytics for Consumer Behavior:

Predictive analytics, driven by machine learning, can analyze customer behaviour patterns from past transactions, providing dynamic insights into future purchasing trends. This allows brands to scale their bottom-up analysis beyond traditional surveys.

Example Scenario:

For a company entering the plant-based food market in Japan, real-time consumer surveys combined with AI-based behaviour analysis could reveal current consumption trends and predict shifts in preferences, such as increasing demand for eco-friendly or organic products. This insight allows for more accurate scaling of market size and better-informed product development.

Hybrid Approach to Market Sizing

The hybrid approach integrates top-down and bottom-up methods, offering a comprehensive view by blending industry-wide data with detailed local insights.

Scenario Analysis:

Scenario analysis allows companies to project different future outcomes based on various market conditions, such as economic downturns or sudden shifts in consumer behavior. This approach helps companies develop a range of potential market sizes, reducing reliance on a single estimate and improving strategic flexibility.

Example Scenario:

A beauty brand entering China’s cruelty-free market might use top-down reports estimating the total beauty market at $60 billion and supplement this with consumer surveys. Through scenario analysis, the brand could model how different factors, such as regulatory changes or social movements, might affect demand for cruelty-free products, resulting in a more adaptive market strategy.

Steps to Calculate Potential Market Size

Accurately calculating market size requires data, advanced tools, and strategic foresight.

Below are four advanced steps for senior leaders to ensure robust and actionable market size calculations:

- Step 1: Define Your Target Market with AI and Predictive Modeling

Identifying your target audience is essential, but doing it with predictive modelling enhances precision. Machine learning algorithms can segment your audience based on historical data, real-time transactions, and behavioural cues, helping you identify the highest-value customers.

For instance, in Japan, using AI to analyze the purchasing patterns of senior grocery buyers could reveal untapped market segments or emerging preferences, such as increased demand for organic products among older consumers.

- Step 2: Analyze Market Demand Using Real-Time Data

Relying on static data is risky for brands. Analyzing real-time data—such as digital transaction flows, social media activity, or mobile app usage—offers a dynamic view of market demand.

Example Scenario:

In Vietnam’s fast-fashion market, brands could use social listening tools and real-time purchase data from e-commerce platforms to predict upcoming fashion trends. By analyzing how consumers interact with fast-fashion brands online, the company could refine its market demand estimates and optimise its product range accordingly.

- Step 3: Identify Competitors and Leverage Competitive Intelligence

Understanding the competitive landscape goes beyond identifying your competitors. It involves leveraging competitive intelligence tools that track pricing strategies, product launches, and consumer loyalty in real time.

AI-Powered Competitor Analysis:

AI tools can continuously monitor competitors’ activities, providing alerts on market shifts, new product launches, or changes in pricing strategies. This allows companies to stay agile and adjust their market size calculations accordingly.

Example Scenario:

In Singapore’s online gaming sector, AI-powered competitor intelligence can track shifts in consumer preferences across platforms, allowing a new entrant to identify untapped niches within a highly saturated market.

- Step 4: Estimate Market Value with Dynamic Forecasting Models

Traditional market value estimation methods involve static calculations of potential revenue. Today, dynamic forecasting models allow brands to estimate revenue based on real-time data streams and projected market conditions.

Example Scenario:

In India’s digital payment space, AI-driven models could analyze user transaction patterns, banking access, and digital literacy trends to offer projections that reflect current and future market opportunities. This allows companies to scale more effectively, planning for changes in consumer adoption rates or regulatory policies.

Common Challenges in Calculating Market Size (and How to Overcome Them)

Senior leaders and market researchers face several challenges when calculating market size, but these obstacles can be mitigated using advanced tools and strategies:

- Data Limitations: Use AI and machine learning to fill gaps, generate forecasts, and continuously refine your data sets with real-time information.

- Rapidly Changing Conditions: Invest in scenario analysis to account for multiple possible futures, preparing for changes in demand or economic conditions.

- Regional Differences: Use localised AI-driven models to account for cultural, regulatory, and economic variations across regions.

- Overestimating TAM: Use AI to break down TAM into more realistic segments and predict which parts of the market are truly serviceable and attainable.

Actionable Recommendations for Market Leaders

Accurately calculating market size is not a one-time task; it is a dynamic and ongoing process that demands a combination of data-driven insights, predictive analytics, and strategic foresight.

For senior leaders—brand managers, product managers, researchers and CMOs—leveraging the right approaches unlock growth opportunities and helps navigate complex market conditions.

Here are key takeaways from our global research projects for strategic decision-making:

- Leverage AI and Predictive Analytics

AI-driven tools should be integrated into your market research strategy to analyze data dynamically, predict trends, and continuously adjust market size calculations. Machine learning algorithms can track consumer behaviour in real-time, allowing for precise market size predictions, especially in rapidly changing industries like tech and healthcare.

Tip: Use AI to enhance traditional market size calculations by incorporating real-time data, predictive analytics, and automated updates. This allows for a more dynamic and accurate understanding of market potential. For example, predictive models can forecast how emerging technologies may impact digital payments or consumer behaviour shifts in fast-fashion markets.

- Apply Tailored Strategies for Specific Industries and Regions

Market size calculations should be tailored to the industry and region’s unique characteristics. Each sector—whether technology, healthcare, or retail—has different market dynamics, while each region introduces variables such as cultural differences, economic conditions, and regulatory frameworks.

Tips for Tailoring Market Size Calculations:

- Industry-Specific: In industries driven by innovation, such as automotive or tech, emerging trends and technological advancements are incorporated into market size calculations. In traditional sectors like retail, historical data and consumer behaviour patterns may provide more stable insights.

- Regional Adaptation: For global companies, segment market analysis by region and factor in local consumer preferences, regulatory conditions, and cultural nuances. For example, a mobile-first strategy may be essential in the digital payments space in India, while sustainability and cruelty-free preferences may shape the beauty market in the UK.

- Focus on Serviceable Market Segments for Realistic Growth

Overestimating the Total Addressable Market (TAM) often leads to inflated expectations. Senior leaders should instead focus on the Serviceable Available Market (SAM) and Serviceable Obtainable Market (SOM)—the realistic segments where your brand can effectively compete and capture market share.

Tips for Targeting Serviceable Markets:

- Narrow Market Segments

Identify key market segments that align with your brand’s strengths and competitive advantage. Use detailed customer personas and AI-driven behavioural analytics to focus on high-potential groups.

- Assess Market Entry Barriers

Consider competitive pressures, pricing, and regulatory hurdles to understand how much of the SAM is realistically achievable. For instance, new digital payment market entrants must analyze user adoption rates and infrastructure readiness to set realistic growth targets.

- Adopt Scenario Analysis for Greater Flexibility

Markets evolve rapidly, making it essential to develop agile, flexible strategies. Scenario analysis allows senior leaders to project multiple outcomes based on different market conditions—economic shifts, regulatory changes, or technological breakthroughs—providing a range of potential market sizes and reducing reliance on a single estimate.

Tip: Model different market projections, such as how an economic downturn might affect consumer demand or how technological advancements could open new market opportunities. This flexibility allows leaders to adjust their strategies quickly in response to evolving market dynamics, staying resilient and competitive. - Leverage Continuous Market Research for Agile Decision-Making

Relying on static, one-time market size estimates is insufficient in today’s fast-moving market environments. Continuous market research enables brands to stay agile, quickly respond to changing consumer behaviours, and seize new opportunities as they emerge.

Tips for Continuous Research:

- Adopt Real-Time Data Tools

Implement tools for ongoing data collection and analysis, such as digital analytics platforms, AI-based social listening tools, and automated consumer surveys. These provide immediate insights into consumer trends as they develop.

- Periodic Market Size Reviews

Regularly review and update your market size calculations to reflect current trends and external shifts. Dynamic forecasting models can help adjust strategies to respond to sudden market shifts, such as regulatory changes or competitive disruptions.

- Collaborate Across Departments for a Holistic View

Market size calculations should not be isolated within marketing or strategy departments. Instead, a cross-functional approach incorporating sales, finance, product development, and operations insights ensures a more comprehensive and actionable view of market potential.

Tips for Cross-Department Collaboration:

- Engage Sales Teams

Sales teams directly contact customers and can provide valuable insights on demand patterns, emerging consumer needs, and market saturation. Their input ensures market size estimates reflect actual market conditions.

- Collaborate with Finance

Align market size calculations with revenue forecasts. By collaborating with the finance team, brands can ensure growth targets are realistic, achievable, and backed by sound financial analysis.

- Prioritise Data-Driven Decision-Making

Data is the foundation of accurate market size calculations. Senior leaders should prioritise decisions based on robust data trends and predictive analytics rather than relying on intuition or anecdotal evidence. This approach minimises the risk of misallocating resources and allows brands to adjust their strategies as market conditions evolve.

Tips for Data-Driven Decision-Making:

- Use Multiple Data Sources: Combine primary and secondary research, internal sales data, AI-based analytics, and third-party reports to build a holistic view of market potential.

- Validate Assumptions Continuously: Regularly validate assumptions by cross-referencing updated industry reports, competitor analysis, and customer feedback. This ensures your market size estimate evolves alongside real-time data, allowing for more accurate and reliable forecasts.

Final Thoughts

Calculating market size is no longer a one-time exercise but a continuous process enhanced by AI-driven tools, predictive models, and real-time data. By leveraging advanced analytics, senior leaders can make more informed decisions, adapt to market shifts, and drive sustainable growth. With the right strategies in place, brands can confidently navigate uncertainty and capitalise on the full potential of their target markets.

Now is the time to invest in the market research services, tools and insights needed to refine your market size calculations and stay competitive globally.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director