You might associate Japan more with tea ceremonies than coffee pots, but recent trends reveal a complex and evolving coffee culture that might surprise you. According to the comprehensive 2024 “Coffee Survey” conducted by our sister company, Cross Marketing Inc., which involved men and women aged 20 to 69 across all 47 prefectures, the dynamics of coffee consumption in Japan are shifting in fascinating ways.

The Historical Brew

Japan has a long history with coffee. Japanese brewing methods and equipment can be found in cafés from New York to London and Taipei.

Coffee in Japan started with the introduction of foreign trade and importation.

While it is true that coffee was not always a staple in Japan, its introduction in the late 19th century marked the beginning of a thriving coffee culture.

Traditionally, green tea was a dominant beverage in Japan until a significant cultural transition occurred.

In her book “Coffee Life In Japan,” Boston University Professor Merry White traces Japan’s coffee craze from the turn of the twentieth century, when Japan helped launch the Brazilian coffee industry, to the present day, when the distinct Japanese approach to coffee is making its mark across Europe and America.

The rise in coffee’s popularity occurred after Japan concluded its 275-year period of national seclusion, during which trade with foreign nations was strictly restricted. Following the end of this isolation, the introduction of Western culture made the Japanese more receptive to adopting Western ways of life into their everyday practices. This shift played a key role in boosting the demand for coffee. Over the decades, Japan has developed a unique coffee scene, from the traditional kissaten, serene settings ideal for enjoying dark brews to the modern influx of Western-style coffee chains.

Japanese kissatens go beyond being mere traditional coffeehouses. They serve as pivotal community hubs, embracing omotenashi—showing hospitality and respect and dedicating time to engaging with their regular patrons.

The Japanese are now globally known for their expertise in various coffee brewing methods, such as the siphon style and pour-over technique, each requiring specific equipment.

Daily Coffee Habits in Japan

Convenience plays a crucial role in the coffee habits of many Japanese.

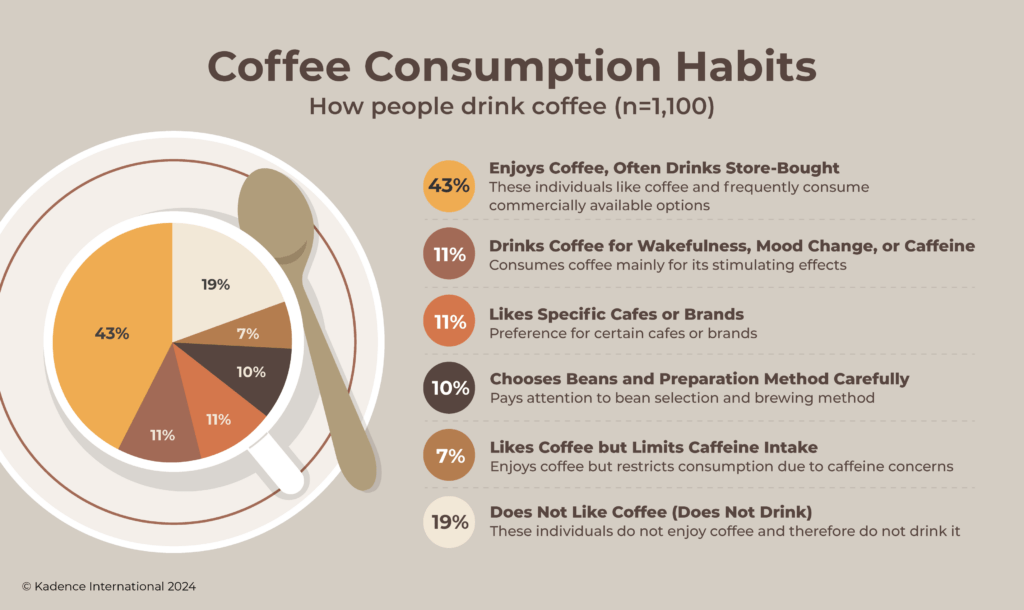

Our survey revealed that 40% of Japanese people purchase coffee from stores, indicating a strong preference for ready-made options over home-brewed ones. Instant coffee has become the go-to choice for in-home consumption. With 42% of respondents choosing instant varieties, it’s clear that convenience plays a crucial role in the coffee habits of many Japanese.

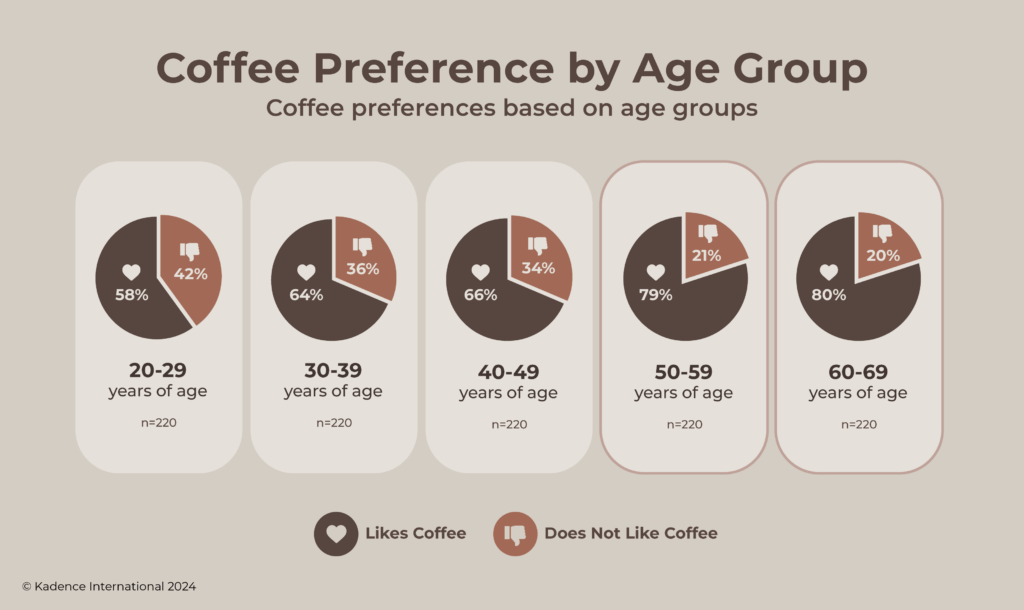

Notably, the preference for instant coffee skews significantly with age: 54% of those in their 60s prefer instant coffee, suggesting that older generations value the ease and speed of preparation. Meanwhile, younger demographics show a lower enthusiasm for coffee overall, with less than 60% of those in their 20s expressing a preference for the beverage.

Packaging Preferences and Perceptions

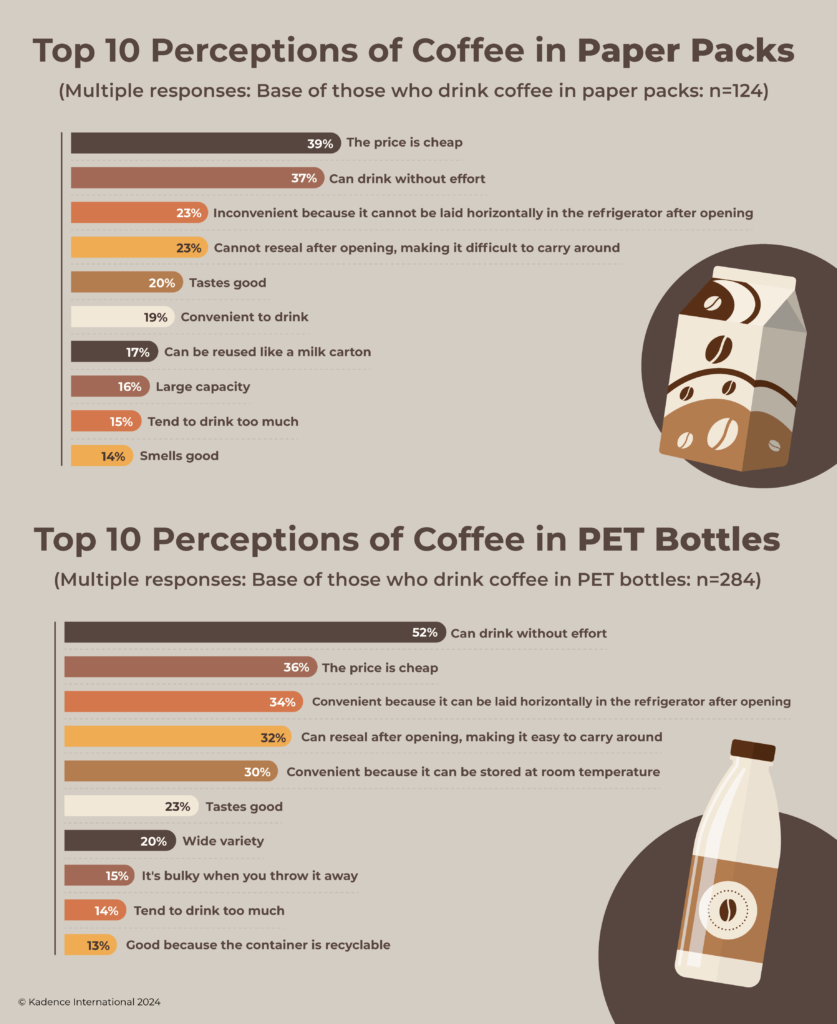

The survey also shed light on how packaging influences consumer preferences in Japan. Coffee in plastic bottles received high praise, with 52% of respondents appreciating the hassle-free experience. They also valued the affordability and convenience of storing bottles horizontally in the fridge.

Conversely, coffee in paper cartons was met with mixed reviews. While being seen as “cheap” and “easy to drink,” criticisms such as difficulty in storage after opening and poor portability highlighted significant drawbacks.

Economic Factors Influencing Coffee Consumption in Japan

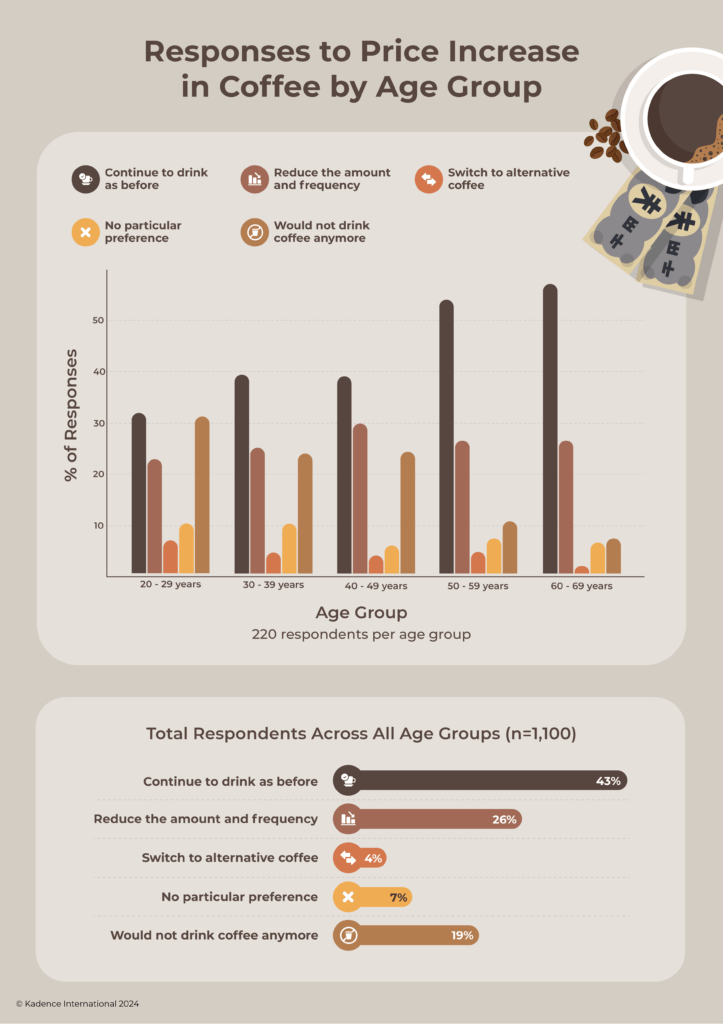

How consumers react to increased costs is telling at a time of fluctuating prices. 43% of respondents indicated they would continue their coffee consumption as usual even if prices rose. This loyalty suggests a deep-seated affection for coffee, particularly among those in their 50s and 60s, more than half of whom would maintain their habits regardless of cost.

Yet, economic pressures are not without effect. A considerable 26% of participants admitted they would reduce their coffee intake should prices climb, underlining the balance between desire and affordability.

Curiosity for Coffee Alternatives in the Japanese Beverage Market

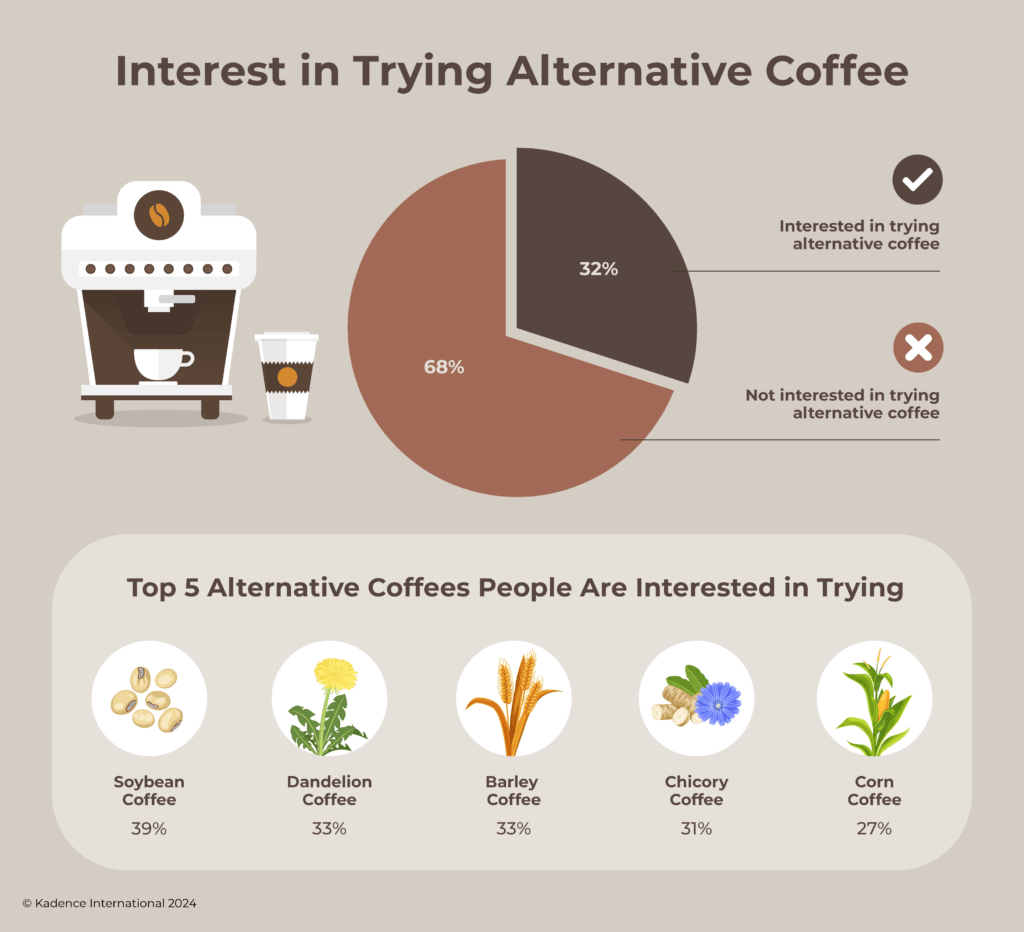

The survey introduced an intriguing aspect of Japan’s coffee scene: the openness to alternative coffee options. About 32% of respondents were willing to try alternatives such as soybean coffee, dandelion coffee, and brown rice coffee. This curiosity reflects a growing interest in diverse and possibly healthier coffee options, dovetailing with global dietary diversity and sustainability trends.

Regional Variations and the Impact of Tourism

Coffee consumption is not uniform across Japan. Certain regions, especially major cities and tourist hubs, show higher coffee shop density and diversity. Tourism’s influence cannot be underestimated, as visitors often seek out renowned coffee spots, contributing to local economies and spreading coffee culture globally.

Insights for Coffee Brands and Cafes

- Highlight Refreshing Qualities: Promote iced coffee as a refreshing and stylish beverage for on-the-go consumption.

- Emphasise Convenience: Market iced coffee as a convenient option for busy individuals who need a quick caffeine fix.

- Create Comforting Atmosphere: Position hot coffee as a comforting and relaxing choice, perfect for leisurely and reflective moments.

- Offer Variety: Ensure various iced and hot coffee options to cater to different consumer moods and occasions.

- Seasonal Promotions: Leverage seasonal changes by promoting iced coffee more heavily during warmer months and hot coffee during colder months.

- Lifestyle Alignment: Align product offerings with the lifestyle preferences of target audiences, emphasising the light and stylish nature of iced coffee and the comforting attributes of hot coffee.

- Location-Based Marketing: Consider the typical activities and pace of life in different locations to tailor offerings (e.g., busy urban areas might see higher demand for iced coffee).

- Personalised Experiences: Offer personalised coffee experiences that cater to individual preferences, enhancing customer satisfaction and loyalty.

- Cross-Promotions: Partner with lifestyle brands to promote the stylish aspects of iced coffee and with wellness or relaxation brands to highlight the comforting nature of hot coffee.

Case Study

Starbucks: Localising for Success in Japan

Image Credit: Timeout

Strategic Entry through Partnership

When Seattle-based global coffee chain Starbucks decided to enter the Japanese market, it strategically partnered with Sazaby League, a renowned retailer and restaurant chain in Japan. This 50–50 partnership, formed in the initial stages, was a significant move as it minimised the risks of venturing into a foreign market. Sazaby League’s deep understanding of the local market and established goodwill helped Starbucks smoothly integrate into the Japanese market. This partnership laid a strong foundation, and in 2004, after gaining confidence and market insight, Starbucks took full ownership and continued to expand.

Adapting to Cultural Nuances

Fun Fact: In Japan, Starbucks is commonly known as Sutaba (スタバ), reflecting its integration into Japanese culture.

Understanding the cultural differences was crucial for Starbucks. Recognising the prominence of tea in Asian cultures, Starbucks adapted its menu to include a variety of teas, including matcha, alongside its popular blended beverages like Frappuccinos and juices. Seasonal innovations such as unique drinks, mugs, and tumblers were introduced to cater to local tastes. Portion sizes were adjusted to be smaller and less sweet to align with Japanese preferences. This cultural sensitivity extended to customer service, where Starbucks tailored its approach to provide exceptional service and customised menus.

Respecting Privacy and Ambiance

Unlike in the USA, where Starbucks is known for its casual and social environment, Japanese cafes emphasise privacy and tranquility. In Japan, orders are assigned numbers instead of names to respect customers’ desire for privacy. The cafes offer a quiet and peaceful atmosphere, in contrast to the bustling environment in other countries. This adjustment reflects Starbucks’ understanding of Japanese cultural norms and preferences.

Architectural Integration

Image Credit: Matcha

Starbucks Japan showcases some of the most beautiful and unique store designs, incorporating local architectural styles. The company hired local architects and designers to create cafes that blend seamlessly with the Japanese environment. A notable example is the Dazaifu Tenmangu Omotesando Store in Fukuoka, designed by Kengo Kuma using the traditional Kigumi technique. It is a unique concept store featuring stunning traditional woodwork with a modern feel. This technique involves arranging wooden joints without nails, creating a harmonious blend of contemporary and traditional elements inspired by Shintoism, a prevalent religion in Japan. It is located on the way to the Shinto shrine Dazaifu Tenmangu.

Social Media Localization

Image Credit: Starbucks Japan Instagram Page

With a consumer base primarily comprising teenagers and young adults, Starbucks effectively utilises social media for promotion and analysis. Starbucks Japan boasts 3.8 million followers on Instagram, 8.5 million followers on Twitter, 3.8 million on Instagram, and 1.2 million on Facebook. Localised in Japanese, these platforms allow Starbucks to engage with its audience by sharing trending topics, new products, promotions, and aesthetically pleasing coffee images. The seasonal Sakura collection, for instance, is widely promoted through these channels, showcasing the brand’s ability to connect with local trends and preferences.

Continuous Expansion and Innovation

Starbucks Japan first launched its Sakura collection in 2020. As part of its seasonal promotion, it featured cherry blossom-flavored beverages and in-store augmented reality (AR) experiences.

Image Credit: Starbucks Japan -Sakura 2024 collection

Starbucks’ continuous expansion in Japan and other CAP (China and Asia Pacific) regions highlights its successful adaptation and growth strategy in diverse markets.

The Future of Coffee in Japan

Looking ahead, the coffee industry in Japan is poised for innovation. With technological advancements such as sophisticated coffee vending machines and app-based ordering systems, the future looks promising. Moreover, the growing interest in sustainable practices could reshape the industry, making it more eco-friendly and appealing to new coffee drinkers.

Implications of our report for Marketers and Retailers

These insights from our 2024 Coffee Survey offer several actionable points for beverage brands. The strong market for instant and store-bought coffee highlights the importance of convenience and ease of use in product development and marketing strategies. The interest in alternative coffees suggests a niche market that could be expanded with targeted promotions and educational campaigns about the benefits of these non-traditional options.

Understanding demographic preferences can also help tailor products and marketing messages. For example, targeting older demographics with traditional coffee products while introducing younger consumers to innovative alternatives might yield better results.

As Japan’s coffee culture continues to evolve, it presents unique opportunities and challenges for the coffee industry. Brands that can adeptly navigate these changing preferences while offering products that align with the values and lifestyles of different age groups will likely succeed in this dynamic market.

Japan’s coffee culture is a vibrant landscape of old and new, where traditional values meet modern convenience and innovation. As consumer preferences evolve and new trends emerge, the coffee industry continues to adapt, promising a dynamic future for coffee in Japan. Understanding and leveraging these shifts will be key for brands looking to thrive in this market, ensuring that coffee remains a beloved beverage choice across all demographics.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director