In today’s fiercely competitive market, brand perception plays a critical role in determining the success of a product. According to a recent survey, over 90% of consumers consider their perception of a brand when making purchasing decisions. In other words, how a customer perceives a brand can significantly impact the buying behaviour and loyalty towards the product.

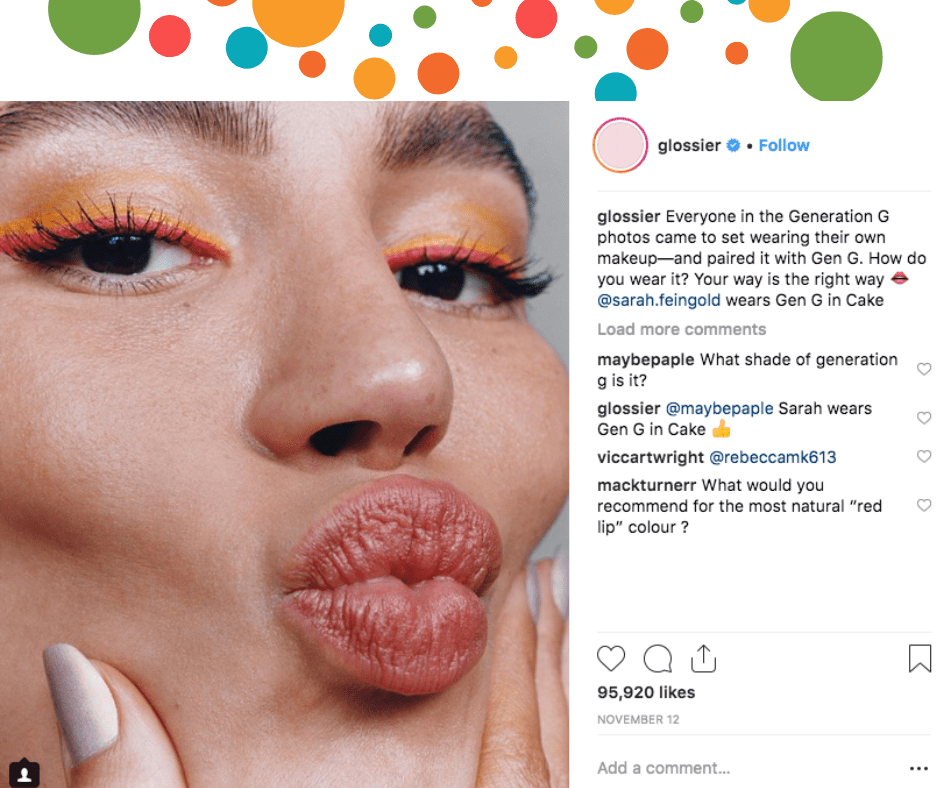

Moreover, in the era of social media, where customer feedback and reviews are readily accessible, building and maintaining a positive brand perception is more challenging than ever. It requires a deep understanding of customer needs and preferences, a clear differentiation strategy, and consistent execution across all touchpoints.

This is where market research comes in. It provides valuable insights into customer perceptions, attitudes, and behaviours, which can help shape and improve brand perception. By leveraging market research, companies can gain a competitive edge by better understanding their customers and building a strong and distinctive brand.

In this blog, we will explore the role of brand perception in product marketing and provide insights from market research that can help Product Marketing Managers build and maintain a positive brand image for their products.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Understanding Brand Perception

Brand perception refers to how customers perceive and evaluate a brand. It is formed through a combination of experiences, associations, and beliefs that customers have about a brand.

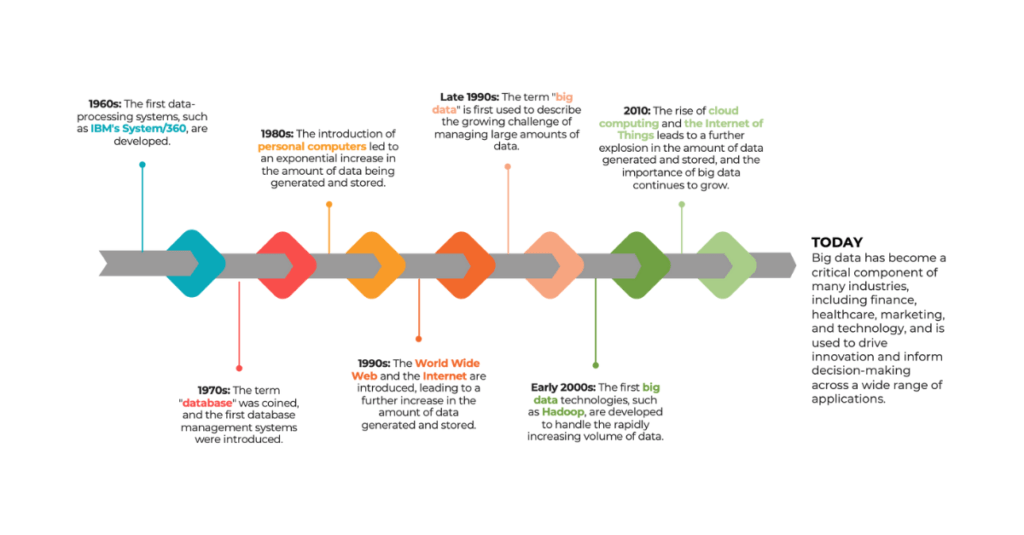

The term “brand perception” was first coined by David Aaker, a brand strategist and author, in his 1991 book, “Managing Brand Equity.” Since then, brand perception has become central to marketing research and strategy.

Brand perception is shaped by a variety of factors, including product quality, customer experience, and advertising. A study conducted by PwC found that 73% of consumers consider product quality as the most important factor in their perception of a brand. In contrast, poor customer experience can significantly damage a brand’s reputation. According to a study by NewVoiceMedia, 86% of consumers are willing to pay more for a better customer experience.

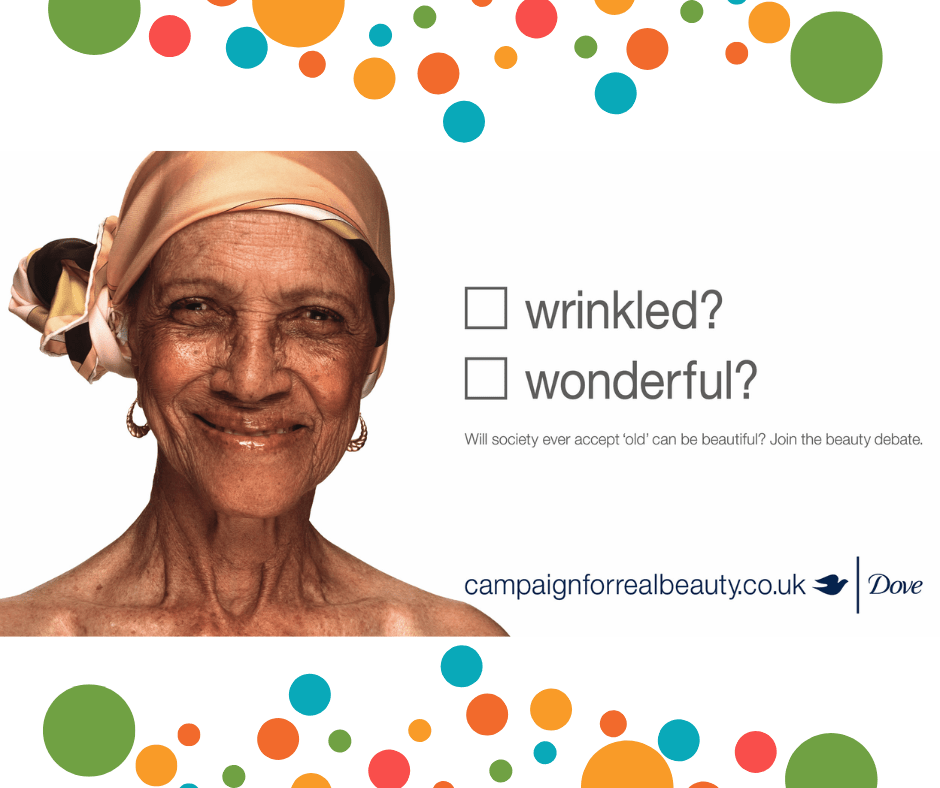

Advertising plays a crucial role in shaping brand perception. A company’s advertising message can influence customers’ beliefs and attitudes toward the brand. For example, Nike’s “Just Do It” campaign has helped to create a perception of the brand as one that promotes motivation, empowerment, and self-expression.

However, brand perception is not solely shaped by the company’s actions. External factors, such as media coverage, social media buzz, and word-of-mouth, also play a significant role. In 2019, Malaysian airline company AirAsia faced negative media coverage and social media buzz after a safety incident involving one of its planes. The incident sparked concerns about the airline’s safety record and raised questions about the company’s brand perception. AirAsia responded quickly to the incident, issuing a statement and working to address customer concerns. The company also implemented new safety measures and invested in training programs to improve its safety record. By taking swift action and prioritising safety, AirAsia maintained its brand perception and continued growing its business in the competitive airline industry.

Understanding brand perception is crucial for Product Marketing Managers. By understanding how brand perception is formed and the various factors that influence it, companies can develop effective marketing strategies that build and maintain a positive brand image.

The Impact of Brand Perception

Brand perception has a significant impact on the success of a product. Positive brand perception can lead to higher sales, increased market share, and greater customer loyalty. In contrast, a negative brand perception can significantly damage a product’s success.

One study found that brands with a strong and positive perception outperform those with a weak or negative perception by 20%.

Additionally, according to a report by Deloitte, customers are willing to pay up to a 16% price premium for products from brands they trust.

Cadbury has built a strong and positive brand perception around its chocolate. It is associated with high quality, indulgence, and nostalgia. This has helped Cadbury maintain its market-leading position in the UK’s chocolate market, despite the entry of many competitors over the years.

Similarly, in Singapore, Shangri-La Hotels has built a positive brand perception around luxury, hospitality, and attention to detail. It has used this perception to differentiate itself from competitors and attract high-end customers.

Brand perception has a significant impact on the success of a product. Companies that build and maintain a positive brand perception can outperform their competitors and attract a loyal customer base. By understanding the impact of brand perception, Product Marketing Managers can develop effective marketing strategies that leverage their brand’s strengths and address any weaknesses.

Conducting Market Research

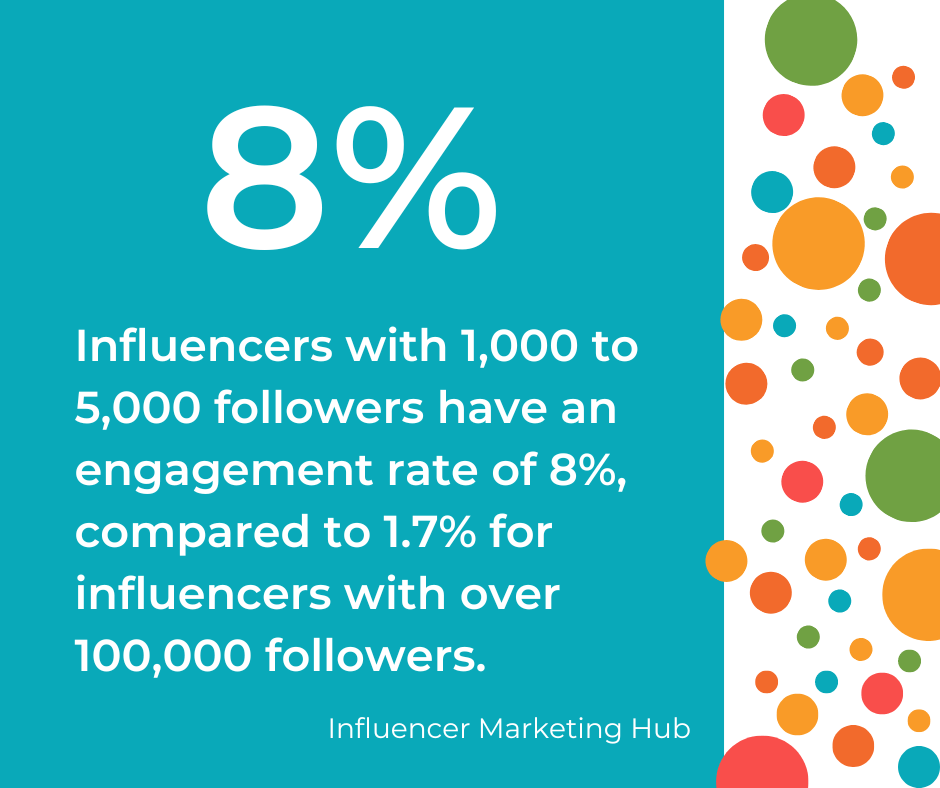

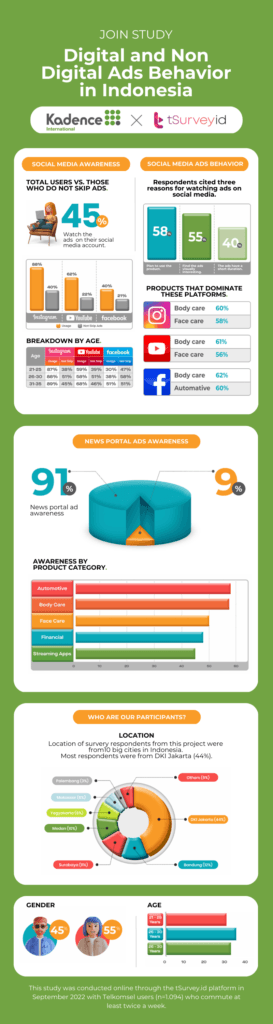

Market research is crucial for understanding brand perception and gaining insights into customer behaviour. Surveys, focus groups, and social media monitoring are just a few of the methods that can be used to gather insights into customer perceptions and preferences.

Surveys are a common market research method that asks customers about their brand perceptions. Surveys can be conducted online or in person and tailored to specific customer demographics or preferences. Surveys can help companies understand customer perceptions of their brand, identify strengths and weaknesses, and gain insights into areas for improvement.

Focus groups are another market research method involving bringing customers together to discuss their perceptions of a brand. Focus groups can help companies understand how customers perceive their brand and how they interact with it. They can also provide insights into customer preferences and attitudes toward different product features.

Social media monitoring is a relatively new market research method involving analyzing social media conversations about a brand. Social media monitoring can help companies understand how customers perceive their brand, identify areas for improvement, and gain insights into emerging customer trends.

By leveraging market research, Product Marketing Managers can gain a deep understanding of their brand’s perception and develop effective marketing strategies that address their customers’ needs and preferences.

Interpreting Market Research

Interpreting market research findings is essential for gaining insights into brand perception and shaping product marketing strategies. To interpret market research findings effectively, brands must first identify key themes and patterns in the data. They should also compare and contrast the findings to identify any discrepancies or areas of inconsistency.

Once the key themes and patterns are identified, companies can use the findings to shape their product marketing strategies. For example, suppose a company’s market research finds that customers perceive their brand as low-quality. In that case, it might focus on improving the quality of its products and repositioning its brand as a high-quality option.

Market research can also provide insights into emerging customer trends and preferences. If a company’s market research finds customers increasingly interested in sustainability, they might develop new products or marketing campaigns highlighting their commitment to sustainability.

Companies can also use market research to identify opportunities for differentiation. If market research reveals that a brand’s customers value high-quality customer service, it might focus on developing a customer service strategy that sets them apart from its competitors.

Interpreting market research findings is essential for gaining insights into brand perception and shaping effective product marketing strategies. By identifying key themes and patterns, companies can use market research to address customer needs and preferences, identify opportunities for differentiation, and stay ahead of emerging customer trends.

Calculating Brand Perception

While there is no one-size-fits-all formula for calculating brand perception, Product Marketing Managers can use various methods to measure their brand’s perception.

Some common measurables are customer satisfaction, brand awareness, and brand loyalty. In addition, brands may develop their own measures that are specific to their brand and marketing goals.

Customer satisfaction is a key metric that can provide insights into brand perception. By measuring customer satisfaction through surveys or other means, Product Marketing Managers can better understand how customers perceive their brand and what factors are most important to them. For example, a hotel chain might measure customer satisfaction by tracking guest reviews on social media and review sites such as TripAdvisor or Booking.com.

Brand awareness is another measurable to consider. This can be measured by tracking how many people are aware of the brand and how well they understand the brand’s value proposition. Companies can use surveys or other methods to track brand awareness and compare their brand awareness to that of their competitors. For example, a new online retailer might track brand awareness by conducting market research to assess how many people are aware of their brand compared to established players in the market.

Brand loyalty is also an important measure of brand perception, reflecting customers’ commitment to a brand. Companies can track brand loyalty through metrics such as repeat purchases, customer retention rates, and customer lifetime value. For example, a subscription-based service might track customer retention rates to understand how well they are retaining customers and how this may be impacted by changes in their service offering or pricing.

There are also some indicators that brand perception may be declining, such as negative reviews, social media backlash, declining sales, or decreased customer loyalty. By monitoring these indicators, marketers can take action to address any issues that may be impacting brand perception.

For example, in the fashion industry, negative reviews, declining sales, or decreased social media engagement may indicate a decline in brand perception. In response, a fashion brand might adjust its marketing strategy, improve product quality, or invest in customer service to enhance the customer experience and win back customers.

Measuring customer satisfaction, brand awareness, and brand loyalty can provide valuable insights into how customers perceive a brand. Monitoring indicators of declining brand perception can help companies address any issues and improve brand perception over time.

Brand Perception and Product Launches

Brand perception’s role in a product launch’s success cannot be overstated. A strong brand perception can generate excitement and anticipation for a new product, while a weak brand perception can make gaining traction in the market more challenging.

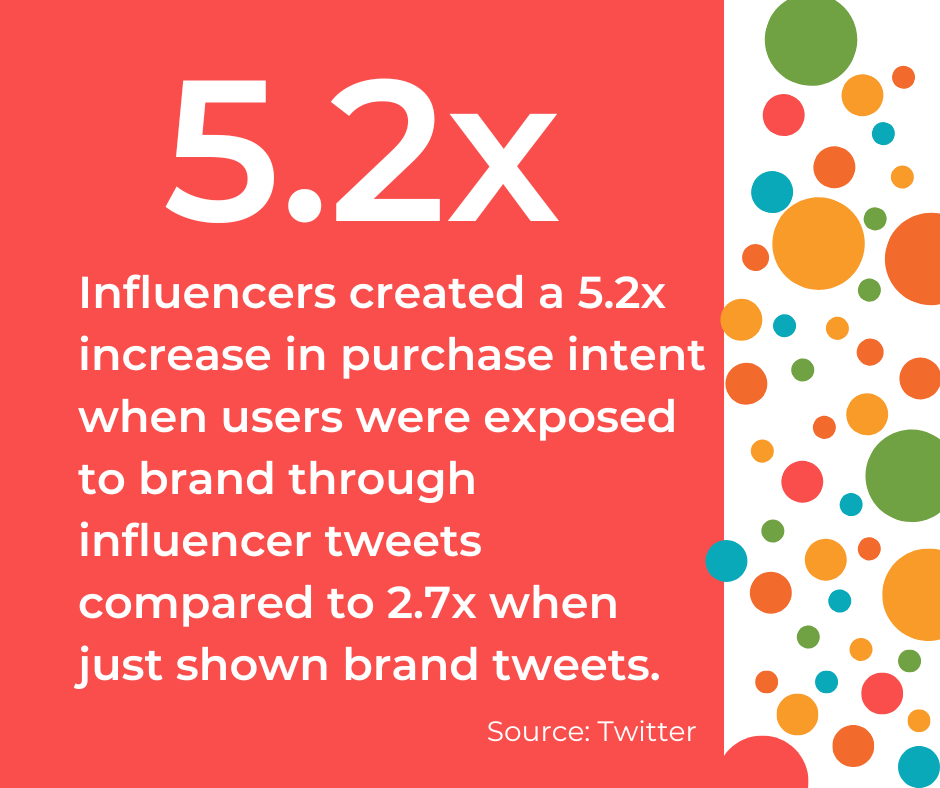

Product Marketing Managers must leverage their brand perception and use market research to inform their product launch strategies to ensure success. Market research can help identify customer preferences and trends, allowing the development of products that align with these preferences. By leveraging their brand perception, companies can create products aligned with their customer’s expectations, generating significant buzz and excitement around the product launch.

To maximise the impact of a product launch, companies must also focus on creating a strong brand story and messaging that resonates with their target audience. This messaging should focus on the product’s unique benefits and how it meets the needs and desires of the target audience. Marketers can craft compelling and relevant messaging by using market research to develop a deep understanding of their target audience.

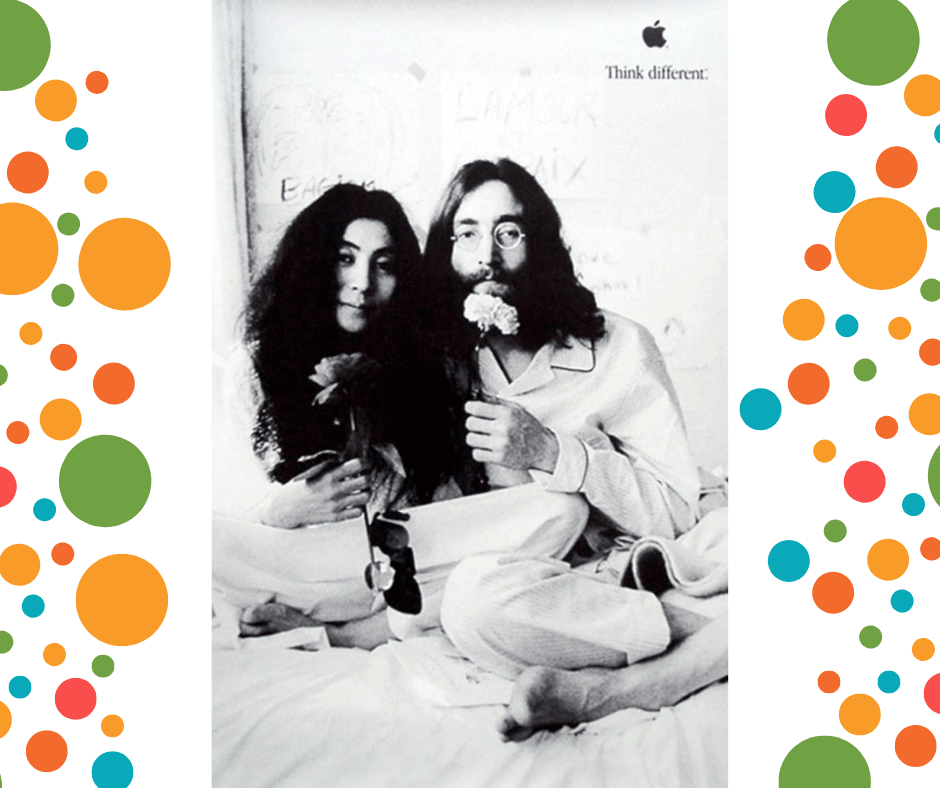

One example of a successful product launch that leveraged brand perception is the release of the iPhone in 2007. Apple’s strong brand perception around innovation, design, and quality helped to generate significant anticipation and buzz around the iPhone before its launch. As a result, the product gained considerable market share and established a loyal customer base.

Overall, the success of a product launch is heavily influenced by brand perception. By leveraging market research and developing a deep understanding of their target audience, companies can create products that align with customer preferences and generate significant excitement around the launch. Additionally, by developing a strong brand story and messaging, companies can establish a meaningful connection with their target audience and establish themselves as a leader in their industry.

Managing Brand Perception

Managing brand perception is an ongoing process that requires a deep understanding of customer preferences and trends. To maintain a positive brand image over time, companies must consistently deliver high-quality products and services, invest in customer service and support, and respond effectively to negative feedback.

One key strategy for managing brand perception is to consistently deliver high-quality products and services. This includes investing in product development and quality control, ensuring that products meet customer expectations, and continually innovating to stay ahead of competitors. By delivering high-quality products and services, companies can establish a strong reputation and build a positive brand perception over time.

Investing in customer service and support is also critical for managing brand perception. This includes providing prompt and effective customer service, being responsive to customer needs and concerns and continually monitoring and improving the customer experience. Companies can build customer loyalty and strengthen brand perception by investing in customer service and support.

Inevitably, companies will receive negative feedback from time to time, whether it be through social media, online reviews, or other channels. The key to managing negative feedback is to respond effectively and in a timely manner. This includes acknowledging the customer’s concerns, addressing the issue directly, and taking steps to prevent similar problems from occurring. By responding effectively to negative feedback, companies can demonstrate their commitment to customer satisfaction and build trust with their customers.

In the early 2010s, McDonald’s saw a decline in brand perception due to negative media coverage around the healthiness of its menu items. To turn this around, the company introduced several new menu items, such as salads and fruit smoothies, to appeal to health-conscious consumers. McDonald’s also focused on improving the customer experience by investing in restaurant renovations and digital ordering systems.

Brand perception plays a critical role in the success of any product marketing strategy. By understanding how brand perception is formed, how it affects consumer behaviour, and how to measure and manage it, Product Marketing Managers can ensure that their products and services resonate with customers and generate the desired business outcomes.

Market research is a valuable tool for understanding and shaping brand perception. By using methods such as surveys, focus groups, and social media monitoring, companies can gain insights into customer preferences and behaviour, which can then be used to inform product development, marketing campaigns, and customer experience strategies.

Effective brand management requires a commitment to quality, innovation, and customer service. By consistently delivering high-quality products and services, investing in customer support and engagement, and responding effectively to feedback, companies can build a positive brand perception over time and establish themselves as leaders in their industry.

Key takeaways:

- Brand perception is critical to the success of product marketing strategies.

- Market research is an essential tool for understanding and shaping brand perception.

- Effective brand management requires a commitment to quality, innovation, and customer service.

As a global market research firm, Kadence International can help companies navigate the complexities of brand perception and consumer behaviour. With expertise in a range of research methods and a deep understanding of different markets and industries, we can provide the insights and guidance that companies need to succeed. Request a proposal today.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director