The academic and business press may have criticized customer rewards for being cheap promotional tools and short-term fads, but they have been around forever, and more brands are embracing rewards programs rather than shying away from them. Many organisations are investing millions of dollars in creating and executing innovative rewards programs, ranging from frequent flyer offers by airlines to reduced fees by telecommunications companies to increase and retain their customer base.

Customer loyalty programs remain a popular marketing strategy brands use to increase customer retention and promote customer loyalty. These programs typically offer rewards, discounts, or other incentives to customers who make repeat purchases or engage in other loyal behaviours.

But do they really work?

In today’s business landscape, it is becoming increasingly common for senior leaders to request that their marketing teams evaluate the potential impact of loyalty marketing initiatives.

The fundamental question is whether such programs foster additional customer loyalty beyond what would typically result from the inherent value of the product or service offered. Additionally, brands must scrutinise their loyalty programs to determine whether they truly encourage customers to spend more or merely incentivise them to make repeat purchases. And in a highly competitive marketplace, are loyalty marketing programs a viable solution for every organisation seeking to improve customer loyalty?

Engineering the economics of a loyalty program’s structure is key.

It is a well-known fact in business and marketing that retaining customers is more valuable than acquiring new ones, which is why rewarding frequent buyers makes sense.

So how can a brand go wrong with a simple loyalty program?

While you can get people to buy again from you by offering them rewards, how do you ensure you also profit when you get a repeat purchase?

This is where many loyalty programs fall short. A lot goes into creating an effective rewards program. First, it has to be good enough to change the customer’s behaviour in your favour, and yet, it should not be so generous that it shrinks margins. You must also understand your consumers, as the same reward often encourages varying purchase behaviours.

Our research at Kadence has uncovered some patterns in successful and effective loyalty programs. These findings may be used as a toolkit to create a successful rewards program for any consumer-facing brand.

Let’s explore with real-world examples how to ensure the effectiveness of a customer loyalty program, but first, let’s dive into the origins of loyalty programs and how they work.

History and Origins of Loyalty Programs

The origins of loyalty programs can be traced back to the late 18th century when American retailers began offering customers copper tokens that could be redeemed for goods. However, it was in the 1980s that loyalty programs began to gain widespread popularity. American Airlines AAdvantage program is often credited as the first modern loyalty program, launched in 1981. Since then, loyalty programs have become an increasingly popular marketing tool brands use in various industries, from retail and hospitality to finance and healthcare.

What goals do loyalty programs strive to achieve?

While loyalty programs do not create an unwavering devotion or faithfulness to a brand in the true sense of the word, they can help accomplish many business goals. It is critical to start with a goal. What are we trying to achieve with the loyalty program? Is the goal to keep customers from moving to other brands, or is it to prompt customers to make additional purchases they would not have typically made, or is it to get a larger share of the wallet?

Once you know your goal, it’s easier to zero in on the most suitable loyalty program structure and engineer an economically viable rewards program.

For brands with a higher lifetime value, like a mobile service or internet provider, it is crucial to keep the customers from falling off into the hands of the competitor. The goal for such companies is often to create a loyalty program that makes the exit difficult for customers because of the incentives or point system.

How do loyalty programs work?

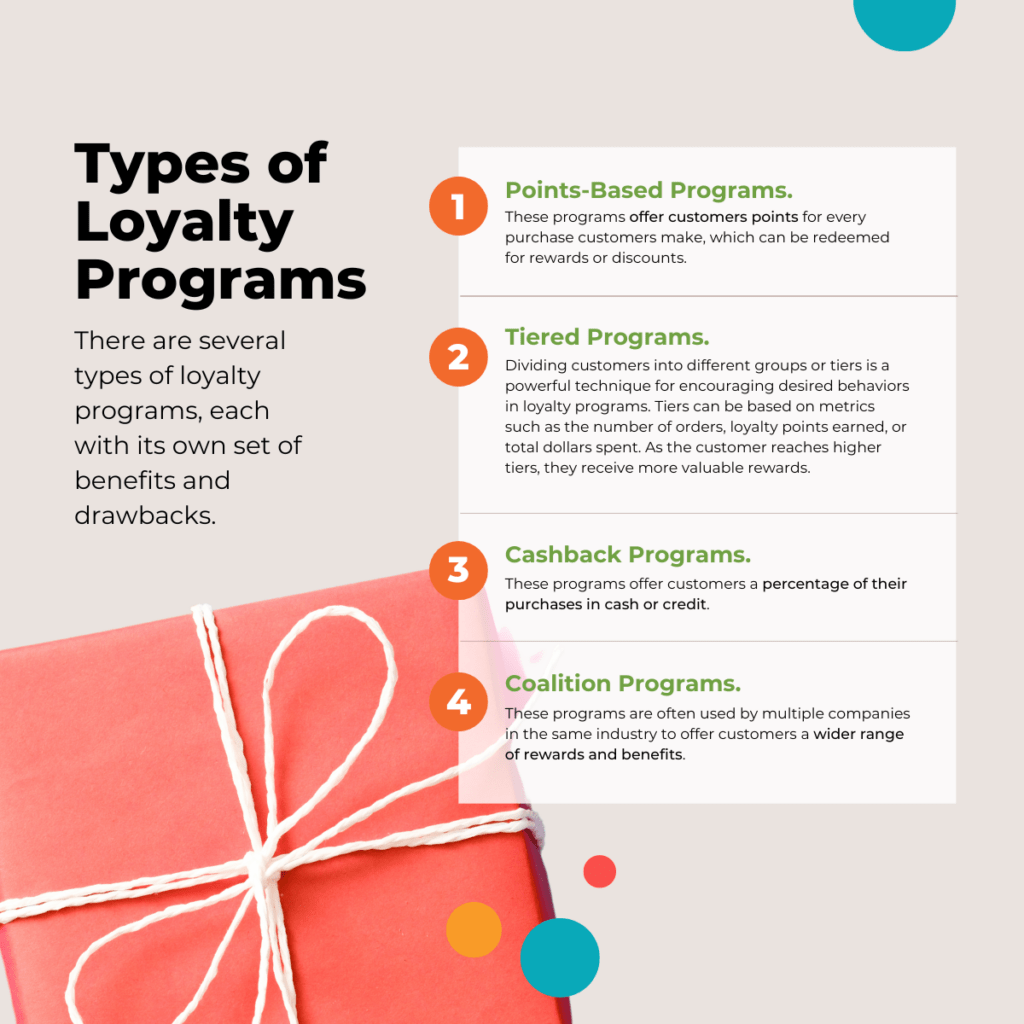

Customer loyalty programs are designed to encourage repeat business from customers by offering them incentives and rewards for their loyalty. The programs provide customers with points, discounts, freebies, or other rewards based on their level of engagement with a business or brand.

Customers typically sign up for the loyalty program by providing their contact information, such as name, email, and phone number. They then earn points or rewards by making purchases referring friends, or engaging with the brand in other ways.

As customers accumulate points or reach certain milestones, they can redeem them for rewards such as free products, discounts on future purchases, or exclusive perks.

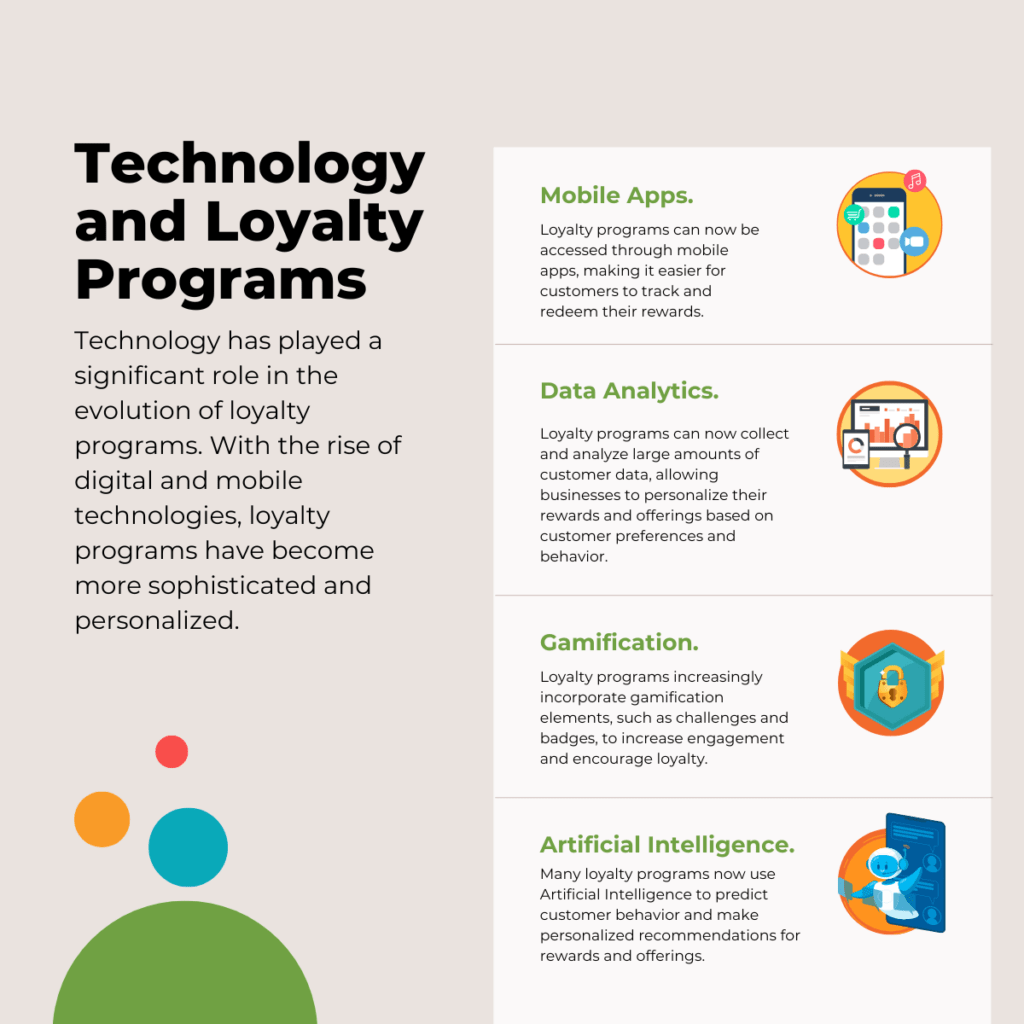

Loyalty programs also provide businesses with valuable customer data, which can be used to personalise marketing messages, improve customer experiences, and tailor rewards to individual preferences.

Any customer loyalty program aims to foster long-term customer relationships, increasing retention and loyalty and ultimately driving revenue growth.

Many brands have recently flipped the script on tiered loyalty programs.

When T-Mobile, a wireless voice, messaging, and data services provider, sought a fresh approach to express gratitude for its customers’ support and rapid growth, it went against the tide. Seeing that traditional loyalty programs were a decent way to generate additional sales but a lousy way to thank customers, T-Mobile wanted to prove the brand’s loyalty to customers instead of the other way around.

The result was T-Mobile Tuesdays, a customer appreciation program that offered simple, easy access to free stuff and great deals every Tuesday without forcing customers to spend more with T-Mobile. It was a fresh take on loyalty programs that proved to be highly successful, with customers enjoying well over $1 billion worth of freebies and exclusive discounts in the five years since the program began. In contrast to most companies’ traditional loyalty programs that ask too much of their customers and give little back in return, T-Mobile’s program is unique in that it values and rewards all customers equally.

Many brands utilise loyalty programs to sell other products and services. This helps them set their sights higher to capture sales that would otherwise not be made. Multi-tiered rewards work best in this scenario. An increasing number of airline and retail brands use this reward system. Sephora has been very successful with its VIB program, which provides rewards and incentives commensurate with the value of purchases made within a given year.

A point-based system works well for the goods and services we frequently purchase in smaller quantities. Many hotels, grocery stores, and retailers use this system to reward customers based on points for every dollar spent. Customers are more likely to consolidate purchases with a single brand when rewarded in cash.

Well-thought-out rewards or loyalty programs also help brands access valuable customer data. So while many grocery store programs may not promote loyalty because they are just giving out a membership card for special pricing, they have a wealth of information about their customers, which allows them to customise offers for every customer. However, orchestrating the insights from data requires a substantial investment in data analysis tools and a dedicated team for the job.

How consumer psychology plays a crucial role in the structure and type of rewards program.

Numerous studies have indicated that members tend to utilise loyalty programs more frequently as they progress further in the program, while their participation initially is uncertain.

At the beginning of their membership, they may feel distant from the rewards since they have yet to make any progress and need to understand how achievable the goals are. This is where the principle of the endowed progress effect comes into play. The endowed progress effect states that people with artificial advancement toward a goal exhibit greater persistence toward reaching it. This is used to create effective loyalty programs to prevent customers from losing interest in the loyalty program. This is why many brands throw in bonus points to get them started.

While a growing number of brands offer a buy–ten-get-one-free promo to keep customers from going to competitive brands, it may be more valuable to create a program that provides customers with a taste of something new and increases the range of products or services they buy from you. For instance, the US-based fast-casual chain Panera Bread offers a pastry or other such item to reward its regulars. Starbucks offers many different rewards, including free drinks, food items, and even merchandise, which must be redeemed within a period. This also helps promote the app as it helps keep track of the rewards.

Many airlines use this strategy and upgrade their travellers to business class when they have empty seats, which gives their regular customers a taste of luxury and motivates them to purchase in the future.

The importance of measuring the effectiveness of customer loyalty programs.

While customer loyalty programs can effectively increase customer retention and loyalty, they often fall flat. It is critical to measure the effectiveness of these programs to ensure they achieve the desired results. This is where market research comes in.

Market research is invaluable in devising the most effective loyalty programs and measuring their effectiveness.

Here are some reasons why measuring loyalty programs is essential:

Know the ROI of your loyalty program.

Measuring the effectiveness of a loyalty program allows companies to determine the Return On Investment (ROI) of their loyalty program. This helps brands understand the costs and benefits of the program and whether it is worth continuing or making changes.

Customer Retention.

If the program is not effectively retaining customers, brands may need to make changes to improve its effectiveness.

Customer Satisfaction.

This information can be used to identify areas for improvement and make changes to better meet the needs and preferences of customers.

Competitive Advantage.

A well-designed and effective loyalty program can provide a competitive advantage for companies. Measuring the program allows brands to understand how they perform compared to their competitors, make changes to improve their program, and stay ahead of the competition.

Customer Insights.

By tracking customer spending, engagement, and satisfaction, brands can better understand customers and make data-driven decisions about loyalty programs and other marketing initiatives.

How to use market research to measure the effectiveness of customer loyalty programs.

Customer loyalty programs are an effective way to increase customer retention and loyalty. However, it is essential to measure their effectiveness to ensure they achieve the intended results. Market research allows brands to make data-driven decisions that drive customer loyalty and revenue growth.

Step 1: Define Your Objectives.

The first step in measuring the effectiveness of a customer loyalty program is to define your objectives. What are you hoping to achieve with your program? Is it improved customer retention, increased customer spending, or something else?

Defining your objectives will help you determine the metrics you need to measure and the research methods you will use.

Step 2: Choose Your Metrics.

Once you have defined your objectives, you need to choose the metrics you will use to measure the effectiveness of your loyalty program.

Some standard metrics used to measure loyalty program effectiveness include:

- Customer retention rate: The percentage of customers who continue to do business with your company after joining your loyalty program.

- Customer spending: The amount of money customers spend on your products or services after joining your loyalty program.

- Customer satisfaction: Customers’ satisfaction with your loyalty program and your company overall.

- Referral rate: The number of customers who refer new customers to your company.

Step 3: Conduct Market Research.

Once you have defined your objectives and chosen your metrics, it’s time to conduct market research to measure the effectiveness of your loyalty program.

You can use several research methods, including surveys, focus groups, and interviews.

Surveys are one of the most common research methods used to measure the effectiveness of customer loyalty programs. Surveys can collect data on customer retention, spending, satisfaction, and referral rates. They can be conducted online, by phone, or in person and can be targeted to specific groups of customers.

Focus groups and interviews are also effective research methods for measuring loyalty program effectiveness. These methods allow you to gather more in-depth customer feedback and understand their experiences with your loyalty program.

Step 4: Analyse Your Data.

Once you have collected your data, it’s time to analyse it. Look for patterns and trends in your data and compare them to your objectives and metrics. This will help you understand your loyalty program’s effectiveness and identify improvement areas.

Step 5: Make Improvements.

Based on your analysis, make any necessary improvements to your loyalty program. This could involve changing your rewards program, improving your customer service, or making other changes to meet the needs and expectations of your customers.

Many brands are using market research to measure the effectiveness of their customer loyalty programs.

Examples of global brands doing rewards right.

Starbucks is known for its highly successful customer loyalty program, Starbucks Rewards. Sephora’s Beauty Insider Program is another successful loyalty program that uses market research to measure effectiveness. The Insider tier is free to join, while VIB and Rouge tiers require customers to spend specific amounts yearly.

Sephora’s tiered program is highly impactful due to the sense of exclusivity created by the upper tiers. Tiered programs are successful when the upper tiers have a limited number of members, typically around 10%. This way, the most loyal customers feel a sense of accomplishment, motivating other customers to strive for the same. Sephora’s Beauty Insider program segments customers into three groups: Beauty Insiders, VIB, and VIB Rouge, effectively establishing a hierarchy.

Tiers contribute to the gamification aspect of Sephora’s loyalty program and influence customer behaviour, and motivating customers to strive for each new tier is the key to high engagement. Sephora has mastered this strategy, as evident from the feedback shared by its members on social media.

The program offers customers exclusive discounts, free samples, and other perks that align with its customer base. The brand also uses AI to make personalised recommendations.

In the retail world, Amazon Prime, US-based Target Circle, India-based Flipkart Plus, Japan-based Rakuten Super Points, China-based Tmall Super Member, Singapore-based GrabRewards, and UK-based Tesco Club cards are excellent examples, as are many frequent flier programs like the Southwest rapid rewards card.

Ensuring the effectiveness of a company’s loyalty program involves first defining its purpose. This entails meticulously considering the program’s design elements, including the rewards’ value and type and the methods of awarding and redemption. The key to a successful program is its efficient and consistent implementation.

Loyalty programs have come a long way since their inception in the late 18th century. From American Airlines’ AAdvantage program to the modern loyalty programs of today, these have become essential marketing tools brands use to increase customer loyalty and drive revenue. While expecting absolute loyalty may be unrealistic, businesses can achieve long-term relationships with satisfied customers, serving as a valuable competitive advantage. With the help of technology, loyalty programs are becoming increasingly personalised, sophisticated, and effective and are likely to continue evolving in the years to come.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Are you reading this on a mobile device? If you are, you’re not alone. Over 50% of global internet usage is now on mobile devices, and this number will only continue to grow.

As we spend more and more time on our phones and tablets, it’s become increasingly important for brands to ensure that their websites are optimised for mobile users. But what does “mobile optimisation” actually mean? And why is it so important for brands to prioritise mobile responsiveness in their website design?

In this blog, we’ll explore the answers to these questions and more. But first, let’s take a closer look at one fascinating statistic: 48% of users say that if a website isn’t mobile-friendly, they take it as a sign that the business doesn’t care (Google). Ouch. That’s a lot of potential customers who could be turning away from your website if it’s not optimised for mobile. So, let’s dive in and find out how to ensure that your website provides a great user experience for mobile users.

The rise of mobile usage.

Now that we’ve seen the importance of mobile responsiveness in website design let’s dive deeper into why it matters so much, especially for large multinational companies. The rise of mobile usage is one key factor.

According to a recent report by Statista, over half of all internet usage is now happening on mobile devices. If your website isn’t optimised for mobile, you’re missing out on a massive audience of users accessing the web exclusively through their phones and tablets.

But it’s about more than just reaching more users. Mobile responsiveness also directly impacts user experience (UX), which is crucial for brands that want to build trust and loyalty with their customers. Users who visit your website on a mobile device expect it to be fast, easy to navigate, and visually appealing. If your website doesn’t meet these expectations, users will likely become frustrated and move on to a competitor’s site. In fact, Google reports that 57% of users say they won’t recommend a business with a poorly designed mobile site, so the stakes are high.

For multinational brands, the impact of mobile responsiveness on UX is even more critical. These companies often have global audiences, meaning users access their sites from a wide range of devices and internet connections. Ensuring your website is optimised for mobile can bridge the gap between users in different regions and provide everyone with a consistent, positive experience.

Mobile-first design.

As we’ve seen, mobile responsiveness is crucial for providing a great user experience on your website. But it’s not just about ensuring your site looks good on mobile devices – it’s also about designing it with mobile users in mind. That’s where mobile-first design comes in.

The concept of mobile-first design is exactly what it sounds like: designing your website with mobile users as the primary audience. This means prioritising things like page speed, streamlined navigation, and clear, concise content that’s easy to read on smaller screens. By focusing on mobile-first design, you can create a website that’s not just responsive to different devices but explicitly optimised for mobile users’ needs and expectations.

Mobile-first design is becoming increasingly important in the context of user experience optimisation for a few key reasons. First, as we’ve seen, more and more users are accessing the internet exclusively through mobile devices. This means that designing for mobile-first is not just a nice-to-have – it’s a necessity for reaching a large and growing audience.

Second, designing for mobile-first can make creating a great user experience easier across all devices, not just mobile. By focusing on the essentials of mobile design – things like fast load times, streamlined navigation, and clear content – you can create a strong foundation for your website that can be easily adapted for larger screens as well.

Best practices for mobile responsiveness.

Now that we understand the importance of mobile responsiveness and mobile-first design let’s dive into some best practices for optimising your website for mobile users.

- Prioritise page speed: Mobile users expect fast load times, so optimising your website for speed is essential. This can include compressing images, minifying code, and using a content delivery network (CDN) to reduce load times.

- Streamline navigation: Mobile screens are small, so making it easy for users to find what they’re looking for on your website is important. Keep your navigation menu simple and intuitive, and ensure all links and buttons are large enough to tap easily on a touchscreen.

- Use responsive design: Responsive design allows your website to adapt to different screen sizes automatically. This means that your website will look great and function properly whether a user is accessing it on a desktop, tablet, or smartphone.

- Optimise content for mobile: Mobile users are often looking for specific information quickly, so it’s essential to ensure that your content is clear, concise, and easy to read on a small screen. Use shorter paragraphs, larger fonts, and plenty of white space to make your content more mobile-friendly.

- Consider mobile-specific features: Several features can help to enhance the mobile user experience, such as click-to-call buttons, mobile-friendly forms, and swipeable carousels. Consider incorporating these features into your website design to make engaging with your content easier for mobile users.

By following these best practices, you can create a website that provides a great user experience for mobile users. Remember, designing for mobile-first isn’t just about making sure your website looks good on a smartphone – it’s about prioritising the needs and expectations of mobile users throughout the design process. By doing so, you can create a website that’s responsive to different devices and optimised for your users’ needs, no matter how they access your site.

The Technical Side of Mobile Responsiveness

While mobile-first design is a crucial element of optimising the user experience on your website, it’s essential to pay attention to the technical side of mobile responsiveness.

Several technical considerations can impact your website’s ability to adapt to different screen sizes and devices, such as CSS and media queries.

CSS, or Cascading Style Sheets, is a language used to describe the presentation of web pages, including layout, fonts, and colours. CSS can be used to create responsive designs by specifying different styles for different screen sizes. For example, you can use CSS to specify that an image should be a certain width on a desktop screen but scale down to a smaller size on a mobile device.

Media queries are a key component of responsive design that allows websites to adapt to screen sizes by applying different styles based on the device’s screen width. Media queries can specify different styles for a wide range of devices, from large desktop screens to small smartphone screens.

In addition to CSS and media queries, several other technical considerations can impact mobile responsiveness, such as page load times, image optimisation, and responsive frameworks like Bootstrap or Foundation.

By understanding the technical side of mobile responsiveness and implementing best practices like CSS and media queries, you can create a website that provides mobile users with a seamless and engaging experience. While it may seem daunting to dive into the technical details, many resources are available to help you get started, such as online tutorials, forums, and developer documentation.

Remember, mobile responsiveness is not just about making your website look good on a smartphone – it’s about providing a great user experience for a large and growing audience of mobile users.

Mobile Optimisation and SEO: A Match Made in User Experience Heaven

We’ve already discussed how mobile optimisation can impact user experience on your website, but did you know that it can also significantly impact your search engine rankings? Google, the world’s most popular search engine, has made it clear that mobile optimisation is a key factor in its algorithm for ranking search results.

Google has even rolled out mobile-first indexing, prioritising a website’s mobile version when determining its search engine ranking. If your website isn’t optimised for mobile, you could miss out on a significant amount of organic search traffic.

But why does mobile optimisation have such a big impact on SEO? It all comes down to user experience. Google’s primary goal is to provide its users with the best possible search results, including ensuring that the websites they recommend offer a great user experience on all devices. Mobile-friendly websites are not only easier for users to navigate and read, but they also load faster and have lower bounce rates, which are all factors that Google considers when determining search rankings.

In addition to mobile-first indexing, Google offers many tools and resources to help you optimise your website for mobile users, such as the Mobile-Friendly Test and PageSpeed Insights. These tools can help you identify areas where your website may fall short in mobile optimisation and provide recommendations for improving your mobile user experience.

By prioritising mobile optimisation in your website design, you can improve your user experience for mobile users and your search engine rankings and drive more organic traffic to your site. So, if you haven’t already, it’s time to prioritise mobile optimisation for your website.

Essential Tools and Resources for Mobile Optimisation

Implementing mobile-first design and optimising your website for mobile users can seem like a daunting task. Still, several tools and resources are available to help you get started. Here are some essential tools and resources for mobile optimisation to help you test and improve your website’s mobile responsiveness.

- Google’s Mobile-Friendly Test: This free tool from Google allows you to test your website’s mobile responsiveness and provides recommendations for improving your mobile user experience.

- PageSpeed Insights: Another free tool from Google, PageSpeed Insights analyses your website’s performance on desktop and mobile devices and provides suggestions for improving page speed and user experience.

- Responsive design frameworks: Frameworks like Bootstrap and Foundation can help you create responsive designs more quickly and easily by providing pre-built CSS and JavaScript components that are optimised for mobile devices.

- Mobile-specific plugins: If you’re using a content management system like WordPress or Drupal, several plugins are available that can help you optimise your website for mobile users, such as WPtouch and Drupal Mobile.

- Online tutorials and forums: A wealth of online resources are available to help you learn more about mobile optimisation, from tutorials on responsive design to forums where you can connect with other developers and designers.

Mobile Optimisation and E-commerce: Why It Matters and How to Get it Right

In today’s digital landscape, e-commerce is more important than ever, with consumers increasingly turning to online shopping for their retail needs. And with mobile devices accounting for more than half of all internet traffic, e-commerce websites must be optimised for mobile users.

Mobile optimisation is essential for e-commerce websites because mobile users often have different needs and behaviours than desktop users. For example, mobile users may look for specific products or information quickly or be more likely to make impulsive purchases. To optimise the mobile user experience for e-commerce, it’s important to understand these needs and behaviours and design your website accordingly.

So, what are some best practices for optimising e-commerce sites for mobile users? Here are a few key considerations:

- Streamline the checkout process: Mobile users want a quick and easy checkout process, so minimising the number of steps required to complete a purchase is important. Consider using a one-page checkout process, offering guest checkout options, and enabling mobile payment methods like Apple Pay and Google Wallet.

- Optimise product pages for mobile: Product pages are a key element of e-commerce websites, so it’s crucial to ensure they’re optimised for mobile users. This can include using high-quality product images, providing clear product descriptions, and including reviews and ratings.

- Use mobile-specific features: Several mobile-specific features can enhance the e-commerce user experience, such as click-to-call buttons, mobile-friendly forms, and push notifications. Consider incorporating these features into your website design to make engaging with your content easier for mobile users.

- Test and optimise: As with any aspect of website design, testing and optimising your e-commerce website for mobile users is essential. Use tools like Google’s Mobile-Friendly Test and PageSpeed Insights to identify areas for improvement and make iterative changes over time.

Optimising your e-commerce website for mobile users can improve user experience, drive more conversions, and ultimately increase revenue. So, prioritise mobile optimisation in your strategy, whether you’re designing a new e-commerce site or optimising an existing one.

How a Market Research Agency Can Help Your Brand Achieve Mobile Optimisation Success

Achieving mobile optimisation success can be complex and challenging, requiring a deep understanding of user behaviour, design best practices, and technical considerations. This is where working with a market research agency can be an invaluable asset for brands looking to improve their mobile user experience.

A market research agency can provide many services and solutions to help brands optimise their website for mobile users. Here are a few examples:

- User research: A market research agency can conduct user research to gain insights into how your target audience interacts with your website on mobile devices. This can include surveys, focus groups, and usability testing to identify pain points and opportunities for improvement.

- Design and development: A market research agency can work with your team to design and develop a mobile-first website that prioritises user experience and incorporates best practices for mobile optimisation. This can include creating responsive designs, optimising page speed, and implementing mobile-specific features.

- Analytics and optimisation: A market research agency can help you measure the impact of your mobile optimisation efforts by analysing data and identifying areas for improvement. This can include A/B testing, heat mapping, and user behaviour tracking to fine-tune your mobile user experience over time.

- Competitive analysis: A market research agency can conduct a competitive analysis to identify how other brands in your industry are approaching mobile optimisation and provide recommendations for differentiating yourself and providing a better user experience.

By working with a market research agency, brands can ensure their mobile user experience is optimised for their target audience and aligned with their overall business goals. Whether you’re looking to improve your website’s load times, streamline the checkout process, or implement mobile-specific features, a market research agency can provide the expertise and support you need to achieve mobile optimisation success.

Key Takeaways

Mobile optimisation is an essential aspect of user experience optimisation for large multinational companies. With the rise of mobile usage, users expect websites to be fast, easy to navigate, and visually appealing on their mobile devices.

By prioritising mobile-first design and following best practices for mobile optimisation, companies can create a website that not only meets these expectations but exceeds them.

While we’ve discussed the importance of mobile-first design and the impact of mobile optimisation on search rankings and e-commerce, it’s also important to consider the technical side of mobile responsiveness and the tools and resources available to help you achieve mobile optimisation success. Companies can gain a competitive edge by using these tools and resources and working with a market research agency to provide a seamless and engaging experience for mobile users worldwide.

Ultimately, mobile optimisation is not just about making your website look good on a smartphone – it’s about providing a great user experience for a large and growing audience of mobile users. By prioritising mobile optimisation, brands can build customer trust and loyalty, improve search rankings, drive more conversions and revenue, and ultimately stay ahead in today’s fast-paced digital landscape.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Trusted by

Imagine this: it’s the year 2033, and you’re a market researcher tasked with analysing a massive dataset of consumer responses to a new product launch.

In the past, this would have taken you weeks, if not months, of manually sorting through surveys, analysing focus group transcripts, and summarising the findings. But now, with the help of Large Language Models (LLMs), the task is completed in a matter of days.

You simply upload the dataset to your computer, and within minutes, the LLM has sorted through and prioritised the responses, highlighting key themes and sentiment analyses that give you a comprehensive understanding of what consumers think about the product.

This hypothetical scenario may seem far-fetched, but with the rapid advancement of LLM technology in recent years, it’s closer than you might think. Large Language Models have the potential to revolutionise the market research industry, transforming the way we analyse and interpret data and making our jobs easier and more efficient.

But what exactly are Large Language Models, and how do they work? This article will explore the world of LLMs and their impact on market research. We’ll delve into their potential uses in market research, including summarising responses, automating reporting, and identifying themes and sentiments. We’ll also discuss the potential risks of using LLMs in market research.

What are Large Language Models?

Before we dive into how Large Language Models (LLMs) are changing market research, let’s take a step back and explore what LLMs are and how they work.

At their core, LLMs are algorithms designed to predict the next word or phrase in a sequence based on the relationships between words in a large dataset. To accomplish this, LLMs use a technique called unsupervised learning, where the algorithm is given a large amount of data and left to find patterns and relationships on its own.

One of the most well-known examples of LLMs is ChatGPT (Generative Pre-trained Transformer), developed by OpenAI. ChatGPT is one of the largest LLMs, with 175 billion parameters, allowing it to perform various tasks with impressive accuracy.

So how does an LLM work in practice? Let’s take a simple example: predicting the next word in the sentence “The cat sat on the ____”. An LLM trained on a large dataset would be able to predict that the most likely word to complete the sentence is “mat”, followed by “chair”, “table”, and so on.

The power of LLMs comes from their ability to learn statistical relationships between words through their co-occurrences in large datasets. An LLM can identify patterns and correlations between words and phrases that a human researcher might miss by analysing massive amounts of text data.

But it’s important to note that LLMs are not sentient beings and do not wholly understand language. Instead, they rely on statistical associations and correlations to make predictions, sometimes leading to errors or misunderstandings.

Despite these limitations, the potential applications of LLMs in market research are vast and varied. In the next section, we’ll explore some of the ways LLMs are changing the field of market research.

The Potential of Large Language Models in Market Research

Large Language Models have the potential to revolutionise the way market research is conducted. They can speed up processes, enhance accuracy, and identify trends that human researchers might miss.

Here are some of the potential applications of LLMs in market research:

- Summarisation: Market research generates vast amounts of data through surveys, qualitative interviews, and focus groups. LLMs can quickly summarise, order, and prioritise responses, allowing researchers to create a narrative for clients more efficiently.

- Automated reporting: Market research also produces large volumes of quantitative data that need sorting, summarising, and presenting. LLMs can quickly organise and create draft headlines based on charts, tables, models, and executive summaries.

- Topic/theme identification: LLMs can analyse different attitudinal datasets or open APIs to digital platforms, identify themes, and assess sentiment, affinity, and brand perceptions, providing researchers with insights to refine their research.

- Prediction: LLMs can extract embeddings (mathematical representations) that other machine learning models can use to predict outcomes of interest. For instance, they can predict the performance of a TV ad based on the dialogue or relate people’s qualitative experience interacting with a service representative to their brand loyalty or churn.

- Intelligent interviewing: Conversational AI can be used to automate and standardise the process of designing quant questionnaires. Additionally, conversational AI will come on in leaps and bounds, responding to previous answers and routing questions accordingly.

- Text data cleaning: Cleaning text data is crucial to the operational process. LLMs can check for gibberish and spelling errors much better than autocorrect ever did.

- Creative Writing: LLMs can be used to create discussion guides, initial drafts of presentations, marketing copy, and concept statements.

- Conversational search queries: With LLMs, an intelligent agent can sit on top of data platforms, analysing potentially massive databases and fetching results back in natural language.

These are just a few examples of how LLMs are changing market research. LLMs offer a level of efficiency, accuracy, and scalability unparalleled by traditional market research methods. However, there are risks associated with using LLMs, which we will explore in the next section.

Risks Associated with Large Language Models

While Large Language Models offer immense potential to the market research industry, there are risks associated with their use. Here are some of the risks that researchers and organisations should be aware of:

- Hallucinations and false predictions: LLMs may make incorrect predictions, particularly when they encounter novel or ambiguous data. Sometimes, they may even make things up or ‘hallucinate,’ leading to false predictions.

- Bias reinforcement: LLMs learn from the data they are trained on. If the training data contains biases, the LLM may reinforce them in its predictions.

- Ethical issues: LLMs can raise ethical issues concerning privacy, consent, and intellectual property. For instance, using data scraped from social media platforms without users’ consent may raise ethical concerns.

- Limited understanding: LLMs are limited in understanding language and interpreting data. They rely on statistical associations and correlations to make predictions, and there are limitations to how much they can understand and learn.

- Legal issues: There may be legal issues related to the use of LLMs, particularly regarding intellectual property and privacy laws.

- Lack of transparency: LLMs are often black boxes, meaning it is difficult to understand how they arrive at their predictions. This lack of transparency can be problematic, particularly when the predictions have significant implications.

- Dependence on data quality: LLMs require high-quality data to perform effectively. If the data used to train an LLM is of low quality, the predictions made by the model may be inaccurate.

Large Language Models offer immense potential to the market research industry, allowing researchers to process vast amounts of data more efficiently and accurately than ever. However, researchers and organisations must be aware of the risks associated with their use and take steps to mitigate them.

LLMs are not a magic solution that can replace human researchers entirely, but they can significantly enhance the work that researchers do. The key is to approach LLMs with caution, ensuring that they are used ethically and responsibly to realise their full potential.

Best Practices for Using Large Language Models in Market Research

To ensure that Large Language Models are used ethically and responsibly in market research, following some best practices is essential. Here are some guidelines for using LLMs in market research:

- Understand the limitations: It’s crucial to understand the limitations of LLMs and to avoid overestimating their capabilities. LLMs are not sentient beings and cannot replace human researchers entirely.

- Use high-quality data: LLMs require high-quality data to perform effectively. Researchers should ensure that the data used to train an LLM is representative, unbiased, and of high quality.

- Address potential biases: LLMs may learn from biased data and reinforce those biases in their predictions. Researchers should be aware of this risk and take steps to address potential biases in the data.

- Ensure transparency: LLMs are often black boxes, making understanding how they arrive at their predictions difficult. Researchers should ensure that the LLMs used in their research are transparent and that the methods used to arrive at predictions are clearly documented.

- Ethical considerations: Researchers should be aware of ethical considerations related to privacy, consent, and intellectual property when using LLMs in market research. It’s essential to obtain participants’ consent and ensure that data is used ethically.

- Verify predictions: It’s crucial to verify the predictions made by LLMs to ensure their accuracy. Researchers should take a critical approach to LLM predictions and verify them through human review.

- Partner with experts: LLMs are complex and require expertise to use effectively. Researchers should partner with experts in the field to ensure that LLMs are used correctly and ethically.

By following these best practices, researchers can use LLMs effectively in market research and ensure they are used ethically and responsibly. LLMs offer immense potential to the market research industry, and by using them responsibly, we can unlock their full potential while avoiding potential risks.

The Future of Large Language Models in Market Research

As we have seen, Large Language Models offer immense potential to the market research industry. With their ability to process vast amounts of data more efficiently and accurately than ever, LLMs can revolutionise market research. However, their use must be approached with caution, and researchers must take steps to mitigate potential risks.

The future of Large Language Models in market research is exciting. With advances in technology and data quality, LLMs will become more sophisticated and effective, enabling researchers to gain insights into consumer behaviour and preferences that were previously impossible to obtain. As LLMs evolve, we can expect them to play an increasingly critical role in the market research industry.

However, it’s important to remember that LLMs are not a replacement for human researchers. While they can significantly enhance researchers’ work, they cannot replace human insight and intuition. LLMs should be used with human researchers, and their predictions should always be verified through human review.

Large Language Models are changing the face of market research, offering new and exciting possibilities for the industry. While risks are associated with their use, they can be mitigated through responsible and ethical use. By following best practices and partnering with experts in the field, market researchers can harness the full potential of Large Language Models to gain insights into consumer behaviour and preferences that were previously impossible to obtain. The future of market research is bright, and Large Language Models will undoubtedly play a critical role in shaping it.

The Ethical Considerations of Large Language Models

While the potential of Large Language Models is vast, ethical considerations must be taken into account. One of the most significant concerns is the potential for bias in the data used to train Large Language Models.

Large Language Models are trained on massive datasets that include vast amounts of text from a wide range of sources. However, these datasets can consist of biases and stereotypes in the data. For example, suppose a dataset includes a disproportionate amount of text from male authors. In that case, the Large Language Model may learn to associate certain words or concepts with men more than women.

This can have significant implications for the accuracy and fairness of the predictions made by Large Language Models. For example, if a Large Language Model is used to make hiring recommendations, it may unintentionally perpetuate gender or racial biases in the data used to train it.

Another concern is the potential for Large Language Models to generate misleading or harmful content. Large Language Models can generate fake news, propaganda, or hate speech, which can have significant real-world consequences.

To address these concerns, businesses and researchers must take steps to mitigate the risks associated with Large Language Models. This includes using diverse and representative datasets to train models, ensuring transparency in the use of Large Language Models, and actively monitoring and addressing potential biases in the predictions made by the models.

While Large Language Models offer immense potential to businesses and researchers, their use must be approached with caution and responsibility. By addressing the ethical considerations associated with Large Language Models, we can ensure that they are used to benefit society as a whole.

Final thoughts

Large Language Models are changing how we interact with technology, opening up new possibilities for businesses and researchers alike. From market research and customer service to content creation and data analysis, Large Language Models have the potential to revolutionise the way we operate in almost every industry.

However, as with any new technology, there are ethical considerations that must be taken into account. Ensuring the accuracy and fairness of Large Language Models is critical, particularly regarding decision-making processes that can have significant real-world consequences.

Moving forward, brands and researchers must approach the use of Large Language Models with caution and responsibility, taking steps to address the ethical considerations associated with this technology. By doing so, we can ensure that Large Language Models are used to benefit society as a whole rather than perpetuating biases and perpetuating harm.

Overall, the potential of Large Language Models is enormous, and we’re just beginning to scratch the surface of what this technology can do. The future of business and research is bright, and with Large Language Models leading the way, we’re sure to see some exciting developments in the years to come.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

The workplace is changing rapidly, and one of the most significant drivers of this change is automation. From factory floors to office cubicles, machines are taking over many tasks humans once did. While this shift has undoubtedly brought benefits in terms of efficiency and productivity, it has also raised concerns about the future of work. Will there be enough jobs for humans in an automated world? And what skills will be most valuable in this new landscape?

One thing that’s clear is that human creativity will remain essential, even as machines become increasingly sophisticated. While automation can handle routine tasks and process large amounts of data, it cannot replicate the unique perspective and problem-solving abilities of the human mind. Creativity will remain a critical asset in the workplace of the future.

In this article, we’ll explore the rise of automation and its impact on the workforce. We’ll also discuss the value of human creativity and its role in the future of work. Finally, we’ll offer some tips and strategies for companies that want to foster creativity in their workforce and stay ahead of the curve in this rapidly changing landscape.

The Rise of Automation

Automation is not a new phenomenon, but recent technological advances have made it more widespread than ever before. From self-driving cars to chatbots, machines are taking over an increasing number of tasks that were once done by humans. According to a recent report, up to 375 million workers (about 14% of the global workforce) may need to switch occupations or acquire new skills by 2030 due to automation.

Some industries are more likely to be impacted than others. For example, manufacturing has already seen significant job losses due to automation, and service industries like retail and hospitality are also at risk. Even traditionally white-collar jobs like accounting and legal services are not immune to automation, as machines become better at analyzing data and processing information.

While automation can bring benefits in increased efficiency and lower costs, it also has drawbacks. One of the main concerns is that it will lead to job losses, particularly in industries where routine tasks are being automated. There are also concerns about the impact on the quality of jobs that remain, as many of the tasks that cannot be automated are low-paying and low-skilled.

Despite these concerns, there are also reasons to be optimistic about the future of work. As automation takes over routine tasks, there will be a growing need for workers who can think creatively and develop innovative solutions to complex problems. This is where human creativity comes in.

The Value of Human Creativity

One of the main advantages of human creativity is that it allows us to do things that machines cannot. While machines are great at processing large amounts of data and following set rules, they cannot think outside the box or come up with truly novel ideas.

Creativity is also essential for innovation. To stay competitive, companies must constantly come up with new products, services, and ways of doing things. This requires the ability to think creatively and the willingness to take risks and try new things.

- 90% of business leaders believe that the skills needed in the future will differ from those required today (source: Deloitte).

Another benefit of human creativity is that it allows us to connect with other people on an emotional level. Machines may be able to process information and provide answers, but they cannot replicate the empathy and understanding that comes from human interaction. This is particularly important in industries like healthcare and education, where human connection is essential to the work being done.

“The future of work is not about replacing humans with machines; it’s about augmenting human capabilities with technology.” – Satya Nadella, CEO of Microsoft.

In an increasingly automated world, the value of human creativity will only continue to grow. As machines take over routine tasks, workers who can think creatively and come up with innovative solutions will be more valuable than ever. This means that companies will need to invest in fostering creativity in their workforce and finding ways to tap into their employees’ unique perspectives and problem-solving abilities.

The Future of Work

As automation continues to transform industries, the workforce is likely to change in significant ways. Some jobs will become obsolete, while new roles will emerge due to automation.

For example, there will be an increasing demand for workers who can design and program machines, as well as those who can manage and maintain them. There will also be a growing need for workers who can analyse and use data to make informed decisions. However, even in these roles, creativity will remain essential.

One area where creativity plays a critical role is problem-solving. As machines take over routine tasks, workers will be free to focus on more complex problems that require a human touch. This could include customer service, product design, and strategic planning.

- Creativity will be one of the top three most important skills for workers in 2025 (source: World Economic Forum).

To succeed in this new landscape, workers must be adaptable and willing to learn new skills. They will also need to be comfortable with ambiguity and able to think creatively about complex problems.

For companies, this means investing in their workforce and providing opportunities for training and development. It also means creating a culture that values creativity and encourages collaboration and innovation.

The Role of Market Research

Market research can play a valuable role in helping companies stay ahead of the curve within the changing work landscape. By conducting research and gathering insights about the skills and attributes that will be most valuable in the future, companies can better prepare their workforce and position themselves for success.

Market research can be beneficial in identifying the skills and attributes that will be most in demand in the future. For example, a company might conduct research to identify the skills required for jobs that are likely to emerge due to automation. They might also gather insights about the skills that will be most valuable in industries that are likely to be less impacted by automation.

Market research can also help companies better understand the needs and preferences of their workforce. For example, a company might conduct research to gather insights about what motivates employees and what types of work environments are most conducive to creativity and innovation.

Finally, market research can help companies identify opportunities for innovation and growth. By gathering insights about changing customer needs and preferences, companies can develop new products and services that meet those needs and stay ahead of the competition.

- Investment in retraining and reskilling could generate up to $11.5 trillion in global economic activity by 2028 (source: Oxford Economics).

To succeed in the future of work, companies must be proactive and adaptive. By leveraging the insights provided by market research, they can position themselves for success and ensure that their workforce is equipped with the skills and attributes needed to thrive in an increasingly automated world.

Fostering Creativity in the Workplace

Companies must foster creativity in their workforce to stay competitive in an increasingly automated world. Here are some tips and strategies for doing so:

- Encourage Collaboration: Collaboration is essential for creativity. Encourage your employees to work together and share ideas. Create opportunities for cross-functional teams to work on projects together.

- Provide Training and Development: Invest in your workforce by providing opportunities for training and development. This could include things like workshops, courses, and coaching.

- Create a Culture of Innovation: Foster a culture that values innovation and encourages employees to take risks and try new things. Celebrate successes and learn from failures.

- Embrace Diversity: A diverse workforce brings diverse perspectives and ideas. Embrace diversity and create a culture that values inclusivity.

- Provide Time and Space for Creativity: Creativity requires time and space to flourish. Provide your employees with the time and resources they need to be creative.

Industries Where Human Creativity is Critical

While healthcare and education are two industries where human connection is essential, there are many other industries where creativity plays a critical role. Here are some examples:

- Advertising: Advertising is all about creativity. Companies need to be able to create compelling messages and visuals that capture the attention of their target audience. This requires creative thinking and the ability to anticipate trends and stay ahead of the competition.

- Design: Designers create everything from product packaging to digital interfaces. To be successful in this field, designers need to be able to think creatively and come up with innovative solutions to design problems.

- The Arts: From visual art to music to theatre, the arts are all about human creativity. Whether it’s composing a new piece of music or creating a new painting, artists rely on their creativity to express themselves and connect with their audience.

- Fashion: The fashion industry is all about creativity and innovation. From designing new clothing lines to creating eye-catching window displays, fashion professionals need to be able to think outside the box and come up with new and exciting ideas.

Preparing Students for the Jobs of the Future

With automation rapidly transforming the workforce, it’s essential to consider how education can be adapted to prepare students for future jobs. Here are some ways that education can help prepare students for the changing landscape of work:

- Teaching Problem-Solving Skills: Problem-solving is a critical skill in an automated world. Workers will need to be able to analyse complex problems and come up with creative solutions. Schools can teach problem-solving skills by allowing students to work on real-world problems and encouraging them to collaborate and think creatively.

- Fostering Critical Thinking: Critical thinking is another vital skill for the future of work. Workers must be able to analyse data and information and make informed decisions. Schools can foster critical thinking by teaching students how to evaluate information and arguments and encouraging them to think critically about the world around them.

- Encouraging Creativity: As discussed, human creativity will be a critical asset in an automated world. Schools can encourage creativity by providing students with opportunities to express themselves through art, music, and writing and by encouraging them to think outside the box and develop innovative solutions to problems.

- Teaching Digital Skills: As automation becomes more widespread, digital skills will become increasingly important. Schools can prepare students for the future of work by teaching them how to use technology effectively and adapt to new digital tools and platforms.

The Impact of Automation on Workers

While automation has many benefits in terms of increased efficiency and productivity, it also has the potential to impact workers negatively. Here are some of the potential negative impacts of automation on workers:

- Job Loss: The most apparent impact of automation is the potential for job loss. As machines take over routine tasks, workers in these fields may find themselves out of work. This can be particularly difficult for workers lacking the skills or resources to transition to new roles.

- Reduced Job Security: Even workers not directly impacted by automation may find themselves at risk of reduced job security. As companies increasingly rely on automation to cut costs and increase efficiency, workers may face layoffs or reduced hours.

- Lower Wages: In some cases, automation can lead to lower wages for workers. This may happen if machines can perform tasks more quickly and efficiently than humans, decreasing the value of human labour.

- Need for Retraining: For workers displaced by automation, retraining will be essential. However, it may be difficult for some workers to access the resources and support needed to learn new skills and transition to new roles.

As automation continues to transform the workforce, it will be necessary for companies and policymakers to consider how to mitigate the potential negative impacts on workers. This could include investing in programs to retrain displaced workers, providing job security and fair wages, and supporting workers as they adapt to the changing work landscape.

- 30% of workers are at high risk of being displaced by automation by the mid-2030s (source: PwC).

Overall, while automation has many benefits, it’s important to remember that it also has the potential to impact workers significantly. By taking steps to mitigate these impacts, we can ensure that the benefits of automation are shared more equitably and that workers can thrive in the changing work landscape.

In the face of automation, getting caught up in concerns about job loss and economic disruption is easy. However, it’s important to remember that automation also brings benefits in terms of increased efficiency and productivity. The key is to find the right balance between automation and human creativity.

“In an increasingly automated world, creativity is the new literacy.” – Gerard Adams, entrepreneur and investor.

As we’ve seen in this article, human creativity will remain essential in the future of work. While machines are great at routine tasks and processing large amounts of data, they cannot replicate the unique perspective and problem-solving abilities of the human mind. Companies that foster creativity in their workforce will be better positioned to thrive in the changing work landscape.

In addition to fostering creativity, companies must consider the impact of automation on workers. While automation can bring many benefits, it also has the potential to negatively impact workers through job loss, reduced job security, and lower wages. As such, companies and policymakers should consider how to mitigate these impacts and ensure that workers can thrive in an increasingly automated world.

“Automation can liberate human beings from the burden of repetitive work and free us to pursue more creative and fulfilling activities.” – Klaus Schwab, Founder and Executive Chairman of the World Economic Forum.

Market research can play an important role in helping companies stay ahead of the curve and identify the skills and attributes that will be most valuable in the future. By leveraging the insights provided by market research, companies can position themselves for success and ensure that their workforce is equipped with the skills and attributes needed to thrive in an increasingly automated world.

Preparing students for the jobs of the future will require a combination of traditional academic skills and newer digital and creative skills. By adapting their curriculum and teaching methods, schools can help ensure that students have the skills and attributes needed to succeed in an increasingly automated world.

The future of work is likely to be characterised by a blend of automation and human creativity. By balancing these two forces, companies can position themselves for success and ensure they can thrive in the changing work landscape. However, companies and policymakers need to consider the impact of automation on workers and for schools to prepare students for the jobs of the future. By taking a holistic approach, we can ensure that the benefits of automation are shared more equitably and that workers and students can thrive in the changing landscape of work.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Great branding doesn’t just happen overnight.

The most successful brands in the world owe their success, in part, to the strategic implementation of market research.

Every aspect of their branding— down to the last curve in the typeface, has been carefully crafted using insights gained through market research.

Think of any iconic brand, and you’ll undoubtedly see how great branding goes beyond how a brand looks and feels; it’s what evokes emotions in the minds of consumers.

Brand recognition and reputation are crucial for a company’s success. A strong brand can create customer loyalty and trust, differentiate a company from its competitors, and increase market share. However, building a successful brand requires careful planning and execution. This is where market research comes in.

Market research helps brands develop a branding strategy that resonates with their target audience and creates a strong and lasting impression. In this blog post, we will discuss the role of market research in developing successful branding strategies and provide examples of leading global brands and case studies.

Understanding the Target Audience

One of the most critical components of branding is understanding the target audience. This includes identifying their needs, preferences, and behaviors. Market research can provide insights into the target audience’s demographics, psychographics, and buying habits. This information can help companies to tailor their branding strategy to the specific needs of their customers.

Dove’s “Campaign for Real Beauty” was a successful branding strategy based on market research. The campaign targeted women who felt the beauty industry promoted unrealistic and unattainable beauty standards. Dove’s research showed only 2% of women described themselves as beautiful. The campaign featured images of real women with different body types and skin tones, promoting the idea that every woman is beautiful. The campaign was successful because it spoke to the needs of Dove’s target audience and challenged traditional beauty standards.

Differentiation from Competitors

Another crucial aspect of branding is differentiation from competitors. Companies must identify what differentiates them from their competitors and highlight these unique selling points in their branding strategy. Market research can help companies identify and compare their strengths and weaknesses.

Apple’s branding strategy is based on differentiation from its competitors. Apple’s research showed consumers were frustrated with the complexity of technology and the lack of intuitive design. Apple’s products are designed to be simple and easy to use, which sets them apart from their competitors. Apple’s branding strategy highlights the company’s commitment to design, simplicity, and innovation, creating a loyal customer base.

Creating Brand Awareness and Recognition

Creating brand awareness and recognition is another critical branding component. Companies must ensure their brand is visible and memorable to their target audience. Brand awareness research can help companies identify the most effective channels for reaching their target audience and create messaging that resonates with them.

Coca-Cola’s “Share a Coke” campaign was a successful branding strategy for creating brand recognition. The campaign featured Coke bottles with common names printed on them, encouraging customers to share a Coke with their friends and family. The campaign was successful because it created a sense of personalisation and connection with the brand, which increased brand recognition and loyalty.

How to conduct market research to shape powerful brands.

Branding is a crucial aspect of any business, and conducting market research is essential in developing a successful branding strategy. Market research can provide valuable insights into consumer behaviour, preferences, and attitudes, which can be used to develop a branding strategy that resonates with the target audience.

- Define the Research Objectives.

The first step in conducting market research for branding is to define the research objectives. This involves identifying the research goals, such as understanding consumer behaviour, preferences, or attitudes, and designing a clear research plan to achieve these objectives.

- Identify the Target Audience.

The next step is to identify the target audience. This involves defining the target audience’s demographics, psychographics, and behaviours, including their needs, wants, and preferences. The target audience should be clearly defined to ensure the research is focused and the insights gained are relevant.

- Select the Research Methodology.

The third step is to select the research methodology. Several market research methodologies are used for branding research, including surveys, focus groups, in-depth interviews, and ethnographic research. The research methodology should be appropriate for the objectives and the target audience.

- Develop the Research Instrument.

Once the research methodology has been selected, the next step is to develop the research instrument. This involves designing the survey, focus group guide, interview questions, or ethnographic research plan. The research instrument should be designed to collect relevant data and provide insights into the target audience’s needs, wants, and preferences.

- Collect and Analyse the Data.

The next step is to collect and analyse the data. This involves collecting the data using the selected research methodology and analysing the data to identify patterns and trends. The data should be analysed using statistical methods like regression or factor analysis to identify significant insights.

- Develop the Branding Strategy.

The last step is to develop the branding strategy. This involves using the insights gained from market research to develop a branding strategy that resonates with the target audience. The branding strategy should be developed with the target audience in mind and to meet their needs and preferences.

Methods for Conducting Market Research for Branding

- Surveys

Surveys are one of the most commonly used market research methods for branding research. Surveys can be conducted online, in person, or by phone and can be used to collect quantitative data on consumer behaviour, preferences, and attitudes.

- Focus Groups

Focus groups involve bringing together a small group of people to discuss a specific topic, such as a brand or product. Focus groups can be used to collect qualitative data on consumer behaviour, preferences, and attitudes.

- In-Depth Interviews

In-depth interviews involve one-on-one interviews with participants to gather detailed information about their behaviour, attitudes, and preferences. In-depth interviews can provide valuable insights into consumer behaviour and preferences.

- Ethnographic Research

Ethnographic research involves observing and studying people in their natural environment. This methodology is useful for understanding consumer behaviour and preferences in a specific cultural context.

Iconic brands and how they differentiate themselves.

Let’s take a closer look at other brands that illustrate the role of market research in developing successful branding strategies.

Airbnb evolved its brand identity and strategy.

Before adopting the slogan “belong anywhere,” Airbnb’s message was to “travel like a human.” The change came to light in 2014 when founder Brian Chesky realised that Airbnb was more than a tool people used to travel.

Airbnb’s branding strategy is based on differentiation from traditional hotels. Airbnb’s market research showed that travellers sought unique and authentic travel experiences not found in traditional hotels. Airbnb’s branding strategy highlights the company’s commitment to providing travellers with a more personal and local travel experience. The company’s messaging focuses on the idea that travellers can “live like a local” and experience a city like a resident. This branding strategy has been successful because it speaks to the needs of Airbnb’s target audience and sets the company apart from its competitors.

One main ingredient in Nike’s messaging is to “bring inspiration and innovation to every athlete.”

Nike’s branding strategy is based on creating a strong emotional connection with its target audience. Nike’s market research showed that its target audience sought more than just shoes or athletic apparel. Nike’s branding strategy highlights its commitment to inspiring and empowering athletes and promoting a “just do it” attitude. Nike’s messaging and advertising campaigns are designed to evoke a sense of inspiration and motivation in its target audience. The company has also created a strong emotional connection with its customers by associating itself with high-profile athletes such as Michael Jordan and Serena Williams. This branding strategy has been successful because it speaks to the emotional needs of Nike’s target audience and creates a strong and lasting impression.

Pepsi’s branding strategy is based on differentiation from its main competitor, Coca-Cola.

Pepsi’s market research showed that its target audience sought a bolder, more exciting alternative to Coca-Cola. Pepsi’s branding strategy highlights the company’s commitment to providing a more youthful and dynamic brand image. The company’s messaging and advertising campaigns are designed to evoke a sense of excitement and energy in its target audience. Pepsi’s branding strategy has also successfully created memorable advertising campaigns, such as the “Pepsi Challenge” and the “Pepsi Max Unbelievable” campaign. These campaigns have created a strong and lasting impression on Pepsi’s target audience.

“If you’re going to be competitive, if you’re going to be comparative, if you’re going to be head-on, there’s a lot at risk,”

-Susan Fournier, Dean of the Questrom School of Business at Boston University

Market research plays a crucial role in developing successful branding strategies. Understanding the target audience, differentiating from competitors, and creating brand awareness and recognition are essential to a successful branding strategy.

Market research can provide companies with valuable insights into their target audience and help them to tailor their branding strategy to their specific needs. Successful global brands such as Apple, Nike, and Coca-Cola have used market research to develop branding strategies that resonate with their target audience and create a strong and lasting impression. By investing in market research, companies can create successful branding strategies that set them apart from their competitors and build a loyal customer base.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

The world has long predicted the massive potential of Asia’s rise, but it’s time for the rest of the world to adjust its outlook. The reality is that the future has arrived even sooner than anticipated.

According to the Asian Development Bank (ADB), developing economies in Asia and the Pacific are expected to experience faster growth this year, fueled by the easing of pandemic restrictions and boosting consumption, tourism, and investment. The region’s growth prospects are particularly brightened by the reopening of the People’s Republic of China (PRC), which has shifted away from its zero-COVID strategy.

The ADB’s Asian Development Outlook (ADO) April 2023 report projects that economies in Asia and the Pacific will grow by 4.8% this year and the next, representing an improvement over the 4.2% growth rate seen in 2022. While developed countries are facing a growth slowdown, the emerging economies in Asia are set to thrive, with projections suggesting excluding the PRC; developing Asia is forecasted to grow 4.6% this year and 5.1% in 2024. Meanwhile, the region’s inflation is expected to gradually moderate towards pre-pandemic levels, although there may be considerable variation across different economies.

What’s fueling this growth? Favorable demographic trends with a young population, a growing middle class, and high-tech adoption rates are just a few factors responsible for this upward trend. With such impressive growth rates, it’s no surprise that more and more companies are expanding their operations and eyeing entry into these markets.

Exciting factors like a burgeoning middle class, ongoing urbanisation, and high technology adoption in countries like India, Vietnam, and the Philippines contribute to this explosive growth. But, hold on, there are risks involved too.

Cultural and language barriers and the need for more information and data make market research in these markets more challenging. Are you ready to take the plunge and seize the opportunities offered by these emerging economies?

With an impressive growth rate, it’s no wonder businesses worldwide are turning their attention to these emerging economies, eager to tap into their enormous potential. But, to successfully penetrate these markets, comprehensive market research is crucial. In this blog post, we’ll explore how to conduct market research in emerging markets in Asia and identify the key factors to consider with real-world examples of global brands and how they entered these markets.

- Understand the Market.