The grooming industry for men in Thailand is driven by cultural influences, evolving consumer behaviours, and economic growth.

Gone are the days of male grooming defined by Gillette razors in black packaging with neon accents. In the past, it was assumed men cared little about self-care, and grooming products were designed for convenience over quality.

Fast-forward to today, and the male grooming market has evolved significantly. Thanks to shifting perceptions of masculinity, the rise of social media, and influential male figures, self-care and self-expression are now integral to modern masculinity. Thai men are embracing skincare, cosmetics, and grooming routines as essential parts of their daily routines, driving a wave of innovation and growth in the industry. Brands have adapted, focusing on effective ingredients and gender-neutral packaging. Today’s male grooming industry is not just about appearance but also empowerment, fueled by education and evolving cultural norms.

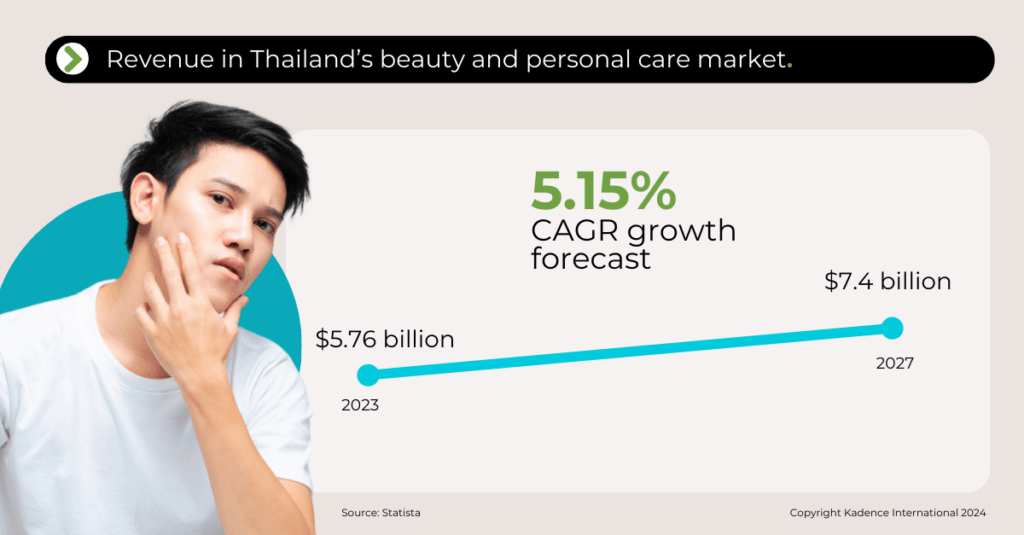

This trend mirrors the global growth in male grooming, projected to reach $115 billion by 2028, up from $80 billion in 2022, according to Statista. Thailand is a key player in this expanding market, influenced by unique local preferences and international trends. Within Asia, Japan, South Korea, and Thailand are the top men’s beauty products consumers.

Worldwide Beauty Trends and Its Impact on Thailand

The global male grooming market has evolved from basic hygiene products to a broader range of skincare, cosmetics, and grooming tools. In Western markets, men are increasingly experimenting with products to enhance their appearance and well-being. Brands like The Ordinary and Fenty Beauty have embraced gender-neutral packaging and a focus on efficacy, allowing men to participate in self-care without the constraints of traditional gender norms.

In 2021, the Bangkok Post reported about one-third of Thai men between 25 and 34 had purchased foundation or lipstick within the last year.

Thailand reflects many of these global trends but with distinct local influences. Thai men, particularly in urban areas like Bangkok, are heavily influenced by K-pop and J-pop culture, where male idols have redefined beauty standards. This has driven demand for BB creams, facial masks, and subtle cosmetics. While gender-neutral branding is gaining traction globally, Thai brands often still associate grooming products with traditional gender roles. However, this is changing as younger generations embrace more diverse grooming practices, blending global influences with local preferences.

Image Source: Instagram

Thailand’s Male Grooming Market

Market Overview

Thailand’s male grooming market is thriving, driven by changing perceptions of masculinity, the influence of pop culture, and growing awareness of personal grooming as part of overall health and well-being. Men are increasingly adopting skincare routines and cosmetics traditionally associated with women, with younger generations viewing grooming as essential to self-care and self-expression.

Thailand’s dynamic consumer market supports this growth. Urban centres like Bangkok have become hubs for male grooming trends fueled by a young, tech-savvy population. E-commerce platforms like Lazada and Shopee have made it easier for men across Thailand to access a wide range of grooming products, contributing to rapid market expansion.

Market Growth and Demand

Thailand’s male grooming market is projected to grow significantly. The Asia-Pacific male grooming market, which includes Thailand, is expected to reach $15.1 billion by 2030. In Thailand, this growth is particularly evident in the skincare segment, with products like cleansers, moisturisers, and sunscreens becoming staples in men’s daily routines.

E-commerce has been crucial in expanding the market, making premium and niche products more accessible to men nationwide, including in rural areas. The growing number of male grooming salons and barbershops in urban areas reflects the increasing demand for professional grooming services, further driving market growth.

Consumer Demographics

Thai male grooming consumers are diverse, with urban men, particularly in Bangkok, leading the trend. These consumers, typically aged 18 to 35, are influenced by global beauty trends, social media, and celebrity endorsements. They are also more willing to invest in premium grooming products, viewing them as essential to maintaining their appearance and well-being.

In contrast, rural male consumers focus more on practicality and affordability. While demand for grooming products is growing in these areas, it is often driven by basic hygiene needs. However, with the rise of e-commerce, even rural consumers are exploring more advanced grooming options as they become more accessible.

Income levels also play a significant role in shaping grooming habits. Higher-income consumers tend to gravitate toward premium products, while middle and lower-income consumers focus on affordable yet effective options. However, across all income levels, there is a growing awareness of the importance of grooming, driven by social media influence and peer pressure.

Cultural Shifts and Influences in Thailand

Redefining Masculinity

Thailand’s younger generation is leading a cultural shift in perceptions of masculinity. Grooming is no longer seen as compromising one’s masculinity but as an essential aspect of self-care and confidence. Social media platforms like TikTok and Instagram play a pivotal role in this shift by giving visibility to men who embrace grooming as part of their identity, further normalising these behaviours. This growing acceptance of self-expression through grooming reflects a broader trend in which traditional gender norms are being redefined.

Influence of K-pop and J-pop

Regional pop culture, particularly from South Korea and Japan, has significantly influenced male grooming trends in Thailand. K-pop idols like BTS and EXO have set new standards of modern masculinity with flawless skin and polished looks, inspiring Thai men to adopt similar grooming routines. Products like BB creams, light foundations, and skincare routines that emphasise achieving the “glass skin” look are particularly popular among Thai men influenced by these trends.

Similarly, J-pop idols and actors are admired for their meticulous grooming, contributing to more sophisticated habits among Thai men. These pop culture icons have made grooming an integral part of self-expression for many Thai men, blending global beauty trends with local cultural norms.

Local Celebrity Endorsements

Local Thai celebrities also play a crucial role in shaping male grooming trends. Actors and singers like Mario Maurer and Nadech Kugimiya have become powerful advocates for grooming products, using their influence to promote a more modern and diverse view of masculinity. These campaigns have broken down traditional gender barriers, encouraging Thai men to invest in their appearance.

For example, Mario Maurer’s endorsements for various skincare brands have resonated with Thai men, who see him as a relatable figure. Similarly, Nadech Kugimiya’s campaigns for premium skincare products have helped elevate the market, making higher-quality grooming solutions more aspirational and accessible to a wider audience.

The Role of Male Beauty Influencers in Thailand’s Grooming Boom

Male beauty influencers are increasingly driving the male grooming market in Thailand, using platforms like Instagram, TikTok, and YouTube to reach a broad and engaged audience. These creators are not only normalising grooming and makeup for men but are also helping to reshape cultural norms around masculinity in the country. Their content resonates with younger generations, who are more open to experimenting with beauty products and grooming routines.

Key Examples:

- Kacha Nontanun: A popular Thai singer and actor, Kacha frequently shares grooming tips with his fans on social media, discussing everything from skincare routines to makeup looks. His influence has made grooming more accessible to Thai men, encouraging them to invest in products that enhance their appearance.

- Tae Darvid: Known for his flawless skin and polished appearance, actor and beauty influencer Tae Darvid regularly collaborates with beauty brands to promote skincare and grooming products tailored to men. His presence on Instagram has made him a key figure in Thailand’s male grooming market.

- Poom Pattaranuwat: Renowned for his stylish looks and detailed skincare routines, Poom is another influential figure in Thailand’s beauty scene. His content often focuses on skincare solutions to address concerns like acne and oily skin, resonating with his male followers.

These influencers have become central figures in the growing acceptance of male grooming in Thailand. They’ve introduced new grooming products tailored to Thai men’s needs through their collaborations with local and international beauty brands. By promoting beauty as part of self-expression and self-care, they’ve contributed significantly to the cultural shift that views grooming as an essential aspect of modern masculinity.

As the popularity of male beauty influencers continues to rise, brands are increasingly partnering with these creators to reach younger audiences. This trend is expected to grow, further expanding the male grooming market in Thailand and offering new opportunities for brands to innovate and engage with this dynamic consumer segment.

Opportunities for Global Beauty Brands

Market Entry Strategies

Global brands looking to enter the Thai male grooming market should focus on localisation. Here are some strategies:

- Leverage Local Influencers: Collaborating with Thai celebrities and influencers is essential for building credibility. Influencers can help global brands localise their message, making products more relatable to Thai consumers.

- Tailor Marketing Messages: Marketing campaigns should align with local values and aesthetics. Avoid overly Westernised approaches and resonate with the Thai audience through culturally relevant messaging.

- Adapt Product Formulations: Consider Thailand’s humid climate. Lighter, non-greasy formulations are preferred, and products should be tailored to address common skin concerns in the region.

- Minimalist Packaging: Reflecting the sleek and modern aesthetics seen in K-beauty trends can appeal to Thai consumers who favour simple yet sophisticated designs.

Case Study: G&M Cosmetics’ Entry into Thailand

G&M Cosmetics, an Australian brand, successfully entered Thailand’s beauty market by leveraging online channels such as Lazada and Shopee to reach digitally savvy Thai consumers.

Recognising the high demand for natural and clean beauty products, G&M introduced its P’URE Papayacare range, which resonated strongly with local consumers. After achieving success online, G&M expanded into brick-and-mortar retail through a partnership with Tops Club, a retail chain owned by Central Retail.

Their vegan, natural skincare focus aligned perfectly with Thai consumers’ preference for safe, gentle products, helping the brand establish a strong market presence. G&M also utilised local events and influencer partnerships to boost visibility and engagement. This multi-channel approach demonstrates the importance of understanding local preferences and using digital and physical retail strategies to build a brand in Thailand.

Product Innovation

The Thai male grooming market offers substantial opportunities for innovation:

- Skincare Focus: Products that address acne, oily skin, and sun protection are in high demand. Global brands can innovate by offering:

- Oil-control moisturizers

- Lightweight sunscreens

- Anti-ageing serums for men

- Cosmetics for Men: BB creams, concealers, and tinted moisturizers providing natural coverage are gaining popularity. Global brands can cater to this growing demand for subtle cosmetics.

- Advanced Grooming Tools: High-quality grooming tools, such as precision razors and electric shavers, appeal to tech-savvy Thai men who prioritise efficiency in their grooming routines.

Case Study: Better Way (Thailand) Co., Ltd.

Image Source Mistine – Instagram Feed

Background

Better Way is the parent company of Mistine, one of Thailand’s largest beauty and personal care brands. Mistine is a household name in Thailand, known for its wide range of affordable products, including cosmetics and personal care items. Recently, Mistine has expanded its offerings to include male grooming products to capitalise on the growing trend.

Strategy

Mistine’s strategy involved launching a dedicated line of male grooming products catering to specific skin concerns such as acne and oily skin. The brand focused on using locally sourced ingredients appealing to Thai consumers. Mistine also heavily invested in marketing campaigns featuring popular Thai celebrities and influencers to promote its male grooming products, reinforcing how grooming is essential for modern men.

Results

Mistine’s male grooming products gained traction quickly, thanks to the brand’s strong reputation and effective marketing campaigns. The brand’s use of local influencers helped make male grooming more mainstream, resulting in increased market share in the competitive grooming sector.

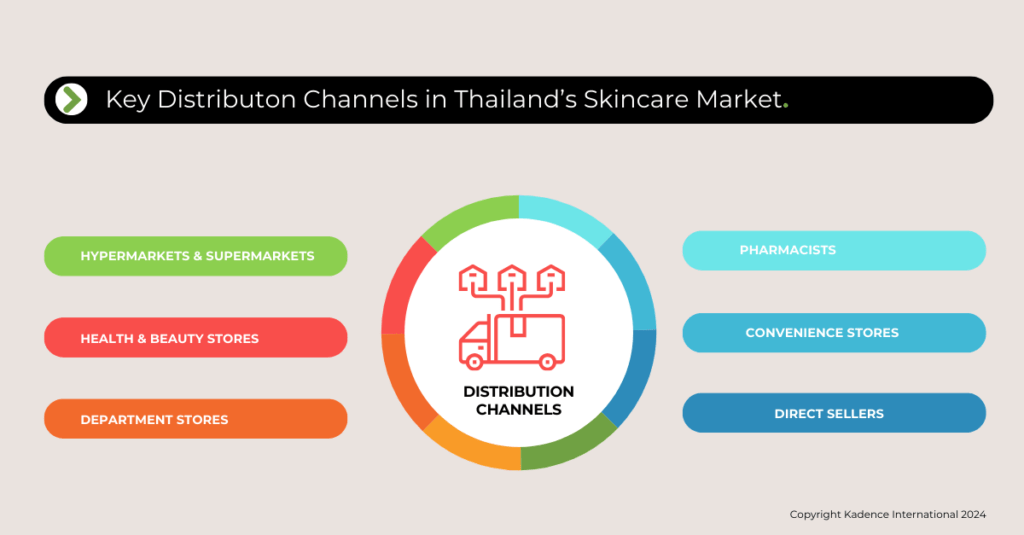

Distribution and E-commerce

E-commerce plays a crucial role in reaching Thai male grooming consumers. To succeed, global brands should:

- Focus on E-commerce Platforms: Establish a strong online presence on popular platforms like Lazada, Shopee, and JD Central, which dominate the Thai online shopping space.

- Localised E-commerce Strategies: Engage Thai consumers through localised strategies such as influencer partnerships for product launches, live-streaming events, and easy payment options.

- Hybrid Distribution Approach: While e-commerce is essential, physical stores still play a role in product discovery. Pop-up stores or collaborations with local retailers can provide opportunities for consumers to experience products in person.

Thanks to the trailblazing efforts of brands like Fenty Beauty, which has redefined inclusivity in cosmetics with its gender-neutral approach, and dedicated men’s grooming lines from heavyweights like Tom Ford and Hims, the boundaries of the male grooming industry are continuously expanding and reshaping perceptions of masculinity.

Thailand’s male grooming market is poised for continued growth, driven by cultural shifts, rising awareness of self-care, and the influence of regional pop culture. Global brands that adapt to local preferences and embrace innovative strategies will be well-positioned to capitalise on this dynamic market.

To stay ahead of emerging trends in the global beauty industry, download our Global Consumer Trends Report in the Beauty Industry here. This report delves deeper into the trends shaping the future of beauty and cosmetics worldwide.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director