Contextual advertising is quickly becoming the go-to solution for a cookieless world.

With the evolution of technology, consumers have been exposed to various online ads, including banner and video ads. These ads have been either contextual —based on the content of a web page, or behavioural —served to a consumer based on their web-browsing behaviour.

To better understand consumer preference, Harris Poll recently conducted a study investigating consumer opinions on relevant online ads and their views on using their browsing history for advertisement targeting.

The survey revealed that 65% of respondents are more likely to be tempted to purchase from an ad relevant to the page they are currently viewing, whereas only 35% expressed a preference for an ad based on their web-browsing activities from the past month.

Contextual targeting is an effective advertising technique that can improve the relevancy and success of your ad campaigns. By understanding how it works and taking the necessary steps to get started, you can create successful campaigns that reach your target audience and drive results.

What is contextual advertising?

Contextual advertising is an innovative marketing method that creates highly targeted advertising campaigns based on a person’s online content. When displaying an ad, contextual advertising considers various factors to ascertain what content is the most appropriate for users. It seeks out potential prospects by considering contexts like the material of a web page, area, or meteorological conditions.

For instance, an article about nutrition could show ads for vitamin supplements, while a travel website might feature advertisements for hotels and tour operators.

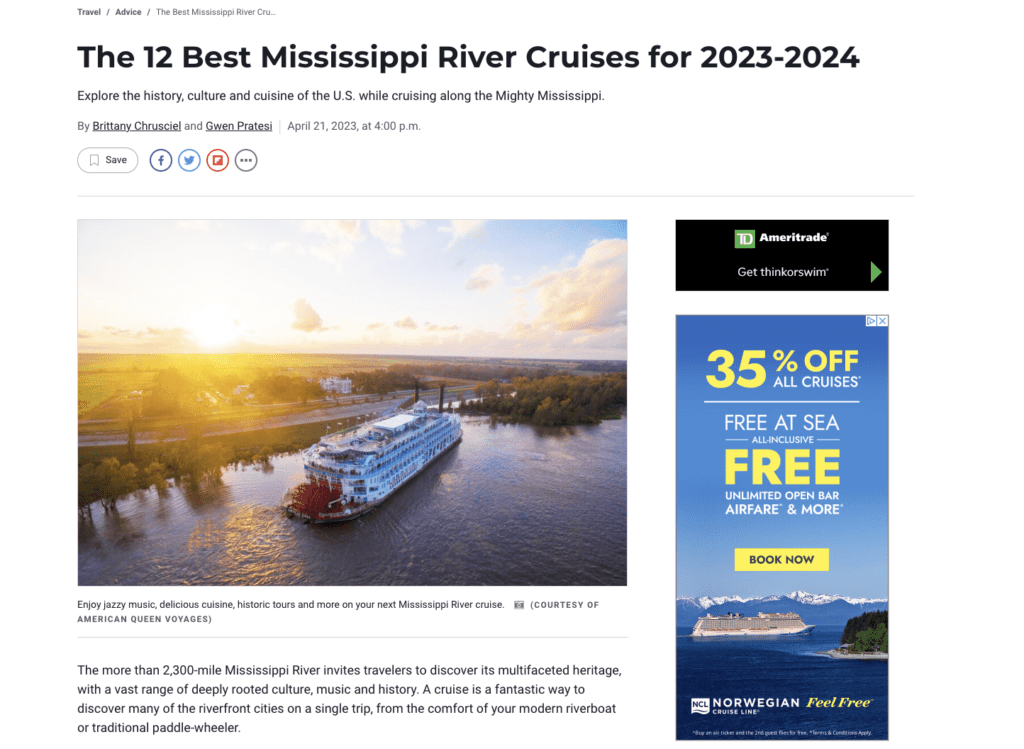

This article on the “12 Best Mississippi River Cruises for 2023-2024” shows a display ad for Norwegian cruises.

How does contextual advertising work, and how to get started?

Contextual targeting is an online advertising technique that targets specific audiences based on the context of the website or app they are using. It allows advertisers to serve ads relevant to the user’s content, improving the likelihood of a click or conversion. So, how does it work?

Contextual targeting analyses a web page or app’s content and determines the main theme or topic. This could be done through the use of keywords or through natural language processing (NLP), which uses algorithms to understand the meaning of the text. Once the content topic is determined, advertisers can use this information to show relevant ads to users who are most likely to engage with the content.

Getting started with contextual targeting requires a few steps. First, determine your advertising goals and target audience. Then, find a contextual targeting platform that aligns with your needs. Some popular platforms include Google Ads, Facebook Ads, and AdRoll.

Once you select your platform, you can create your ad campaigns. Make sure to choose relevant keywords and topics for your ad groups, and use creative that aligns with the content on the web page or app. Testing and optimising your campaigns is crucial to success, so regularly analyse your data and make necessary changes.

The concept of contextual advertising is quite simple. Crawlers search the web and organise pages based on their semantic context. When someone visits the page, the ad server obtains the content information, which it compares with relevant ads according to keywords and other content-based criteria. The more efficient the system is at understanding the proper context of the page, the better the ad matching will be. For example, a contextual advertisement for a hardware store could appear beside an article on home improvement.

How is contextual advertising different from behavioural advertising?

Contextual and behavioural advertising are two different forms of online marketing often used to target audiences in unique ways. While they share similar goals of delivering relevant and engaging content to potential customers, they use distinct strategies.

Contextual advertising relies on analysing the webpage’s content or app on which the advertisement will be displayed. The goal is to match the ad to the specific topic of the webpage in the hopes that the user will be more likely to engage with it. For example, if someone is browsing a skincare blog, a contextual ad might display an advertisement for a personal care or makeup brand.

On the other hand, behavioural advertising uses information about the user’s online behaviour to deliver ads tailored to their interests and past activity. This involves tracking users’ browsing and search history to understand their interests, behaviours, and purchasing habits. This allows for highly personalised advertising, with highly relevant ads appearing on the platform based on the user’s past behaviours.

Consumers are, by and large, uncomfortable with ads that require personal information.

So contextual and behavioural advertising share similar goals but use vastly different strategies. Ultimately, the best approach will depend on the brand, audience, and desired outcome. Regardless of the method, the goal remains to deliver engaging, relevant content to potential customers.

Ways brands can use contextual advertising to drive results

The modern marketing world has presented several innovative and powerful ways for businesses to target their customers. One such method is contextual advertising, which considers multiple factors such as location data, weather conditions, and content on a page to tailor the ad experience for a given user accurately.

Weather-triggered advertising is an excellent example of how this can increase engagement and, ultimately, purchases. For instance, a cold beverage brand could use location and weather data to send targeted ads to customers on hot days, or a retailer selling rain gear could increase foot traffic with ads on rainy days.

- Google AdSense is one of the most popular contextual advertising tools and allows businesses to target customers based on the content they’re viewing. For example, if you have a travel blog, you may receive ads from airline and tour providers.

- In-game and in-video advertising are also great ways to use contextual ads. In-game ads often appear before the game loads and during the game, and YouTube has been incorporating in-video ads for a while now.

- Native advertising is another type of contextual advertising that presents sponsored content in the same format as other content on the website while personalising the ad experience based on location and other data.

- Dynamic Creative Optimisation (DCO) is a strategy that takes contextual advertising further and makes it more effective. AI platforms use consumer engagement data and other relevant signals to determine the best creative for each individual user.

- Conversational marketing is a powerful tool that allows companies to offer customers more personalised recommendations and to provide them with more relevant messaging.

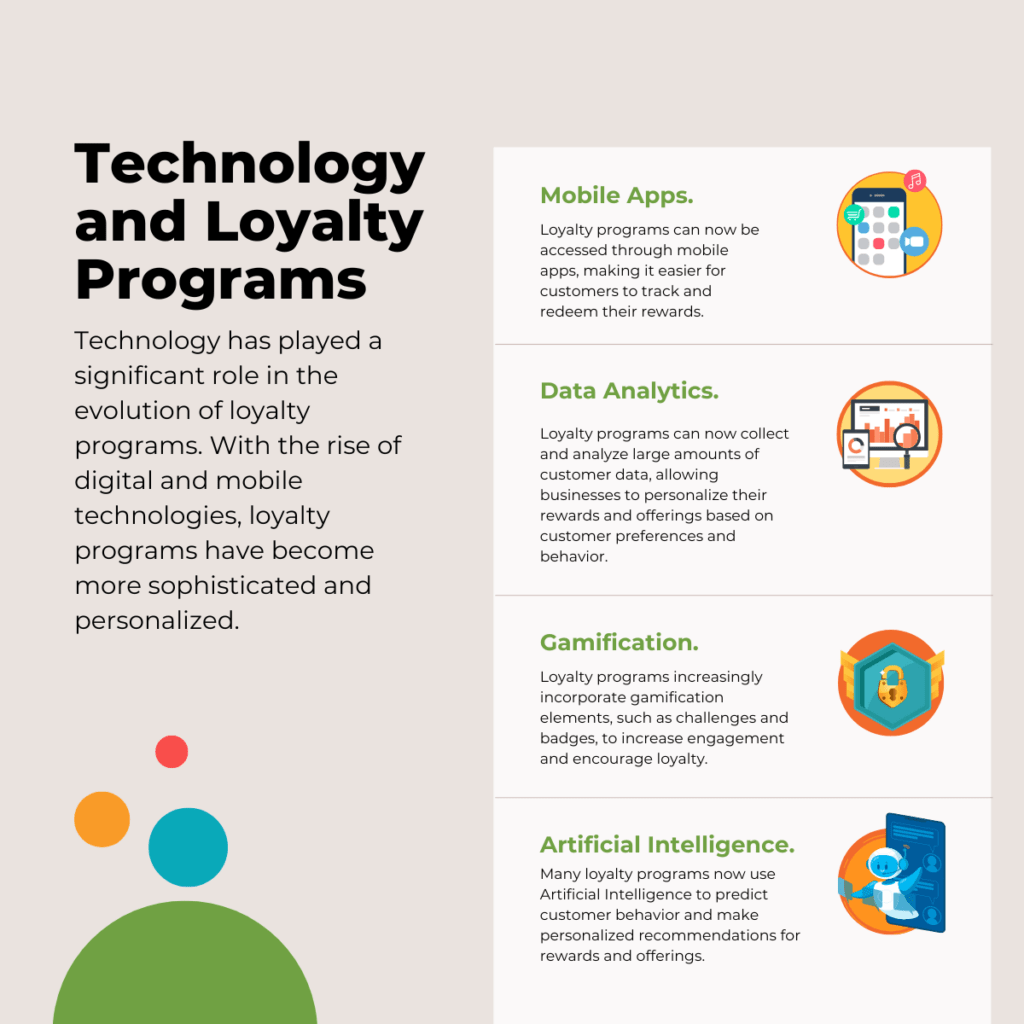

- AI advertising considers all of these factors and can use machine learning to understand how likely a user will take a specific action, helping businesses increase engagement and drive better outcomes.

Contextual targeting uses first-party data

Contextual targeting can use first-party data to incorporate commerce indicators into the existing contextual signals and construct product affinity scores for each URL. This allows marketers to narrow in on the most impactful pages and products. Considering the recent phasing out of third-party cookies, contextual targeting has returned to the limelight since it doesn’t rely on cookies.

In today’s digital landscape, delivering relevant advertising to audiences while respecting their privacy has become increasingly challenging. The demise of third-party cookies, a staple for tracking users across the web, has made it more difficult for advertisers to create personalised campaigns that target the right users at the right time.

That’s where contextual advertising comes in. Rather than relying on user data to deliver ads, contextual advertising uses the content of the website or app the user is currently browsing to determine which ads to display. This means the ads users see are related to the content they’re engaging with rather than just based on their browsing history.

Why is contextual advertising so crucial in a cookieless world?

Contextual advertising allows advertisers to continue to reach their desired audiences without infringing on their privacy. It also helps to ensure users are shown ads relevant to their interests and needs rather than just what they’ve recently searched for online.

Contextual advertising also allows for greater flexibility and creativity in ad creation. With cookie-based advertising, advertisers were limited by the data available to them about users. But contextual advertising focuses on the content and the context in which the ad will be displayed. This allows for more imaginative and impactful ads that resonate deeply with users.

Contextual advertising is more important than ever in a cookieless world because it allows advertisers to continue to reach their desired audiences while respecting user privacy and encourages greater creativity and flexibility in ad creation. With contextual advertising, the future of digital advertising looks bright.

Uses of Contextual Advertising

Contextual advertising is a type of advertising that targets users based on their online behaviour, such as their search history or the content they have recently viewed. This form of advertising is becoming increasingly popular and offers several advantages for businesses.

Contextual advertising is used to improve targeting. By understanding what content a user has been viewing, businesses can tailor their ads to match their interests. For example, a golf equipment retailer might target users who have recently searched for golf sets or have visited golf tutorial websites.

Contextual advertising is used to help increase ad relevance. By targeting users actively looking for specific products or services, businesses can increase the likelihood that they will click on their ads. This can lead to higher click-through rates and, ultimately, higher conversions.

Contextual advertising is also used to reduce ad waste. By targeting only those users likely to be interested in a particular product or service, businesses can save money on advertising and ensure the right people see them.

Contextual advertising offers a range of benefits for businesses looking to reach their target audience. Companies can use data to understand user behaviour and interests to create targeted and relevant ads that drive conversions and help grow their bottom line.

How New Balance harnessed the power of contextual advertising

To give an excellent example of the power of contextual advertising, let’s look at the New Balance campaign. This global athletic brand launched a unique running event by projecting its ads onto a nearby billboard. Instead of relying on cookie data for personalised ads, New Balance harnessed the power of contextual advertising.

Using sophisticated algorithms, New Balance’s campaign recognised people running past the billboard, thanks to special sensors, and adapted the content to reflect their goals and interests. They encountered content tailored to their activity level, aspirations, and preferences as they continued to run.

This illustrates how contextual advertising isn’t limited by personalisation based on cookies. Instead, the content is chosen in real-time, according to contextual clues, such as physical activity and digital trends. In addition, it can reach target audiences who might otherwise be unreachable by cookie-based campaigns.

Thanks to this more granular approach, marketers can zero in on their target market with precision and tailor the message more accurately to each consumer. Contextual advertising offers greater reach by allowing marketers to think beyond traditional channels, leading to better engagement with potential customers.

Beyond New Balance’s billboard example, contextual advertising uses geographical location and weather information. By tapping into these factors, marketers can modify ads for the best user experience, depending on the time of day, geographical location, and current conditions. This has the potential to provide a more immersive user experience.

Ultimately, this approach creates campaigns that not only target the right person but also create the proper context, building higher engagement and greater chances of conversions. It offers far more than a cookie-based approach ever could.

Given the impending changes to cookie use and its limitations, it’s clear that contextual advertising is the future of digital marketing. As companies come to terms with the post-cookie era, those that switch to contextual marketing early will find it easier to remain ahead of the competition.

Advantages of contextual advertising over behavioural advertising

More in-the-moment ads lead to enhanced relevance.

Contextual advertising enables brands to display ads highly relevant to the user’s immediate interests based on the web page or app content they are currently consuming. In contrast, personalised advertising depends on the user’s past behaviour, which may not accurately reflect their current needs or preferences.

Better Engagement.

Since contextual advertising is directly related to the content the user is (currently) viewing, it has a better chance of grabbing their attention and prompting them to act. This leads to a higher click-through rate and better conversion rates than behavioural advertising, which may seem intrusive or irrelevant to the user.

Reduced Intrusiveness.

Contextual advertising is less intrusive as it does not depend on tracking the user’s online behaviour or gathering personal data. Users may perceive behavioural advertising as intrusive, leading to privacy concerns and brand distrust.

Increased Brand Safety.

With contextual advertising, brands can ensure their ads are displayed on content that aligns with their values and messaging, reducing the risk of association with controversial or inappropriate content. In contrast, personalised advertising may place ads in contexts that do not match the brand’s image, negatively impacting a brand’s reputation.

Better Performance and ROI.

Contextual advertising is often more cost-effective than behavioural advertising, requiring less data collection and analysis. Brands can also achieve higher conversion rates and ROI as contextual ads are displayed to users who are already interested in related content. This leads to a better return on investment compared to behavioural advertising, which can be hit or miss depending on the accuracy of the user’s past behaviour data.

Challenges in contextual advertising

Inappropriate Ad Placement.

One of the biggest challenges of contextual advertising is ensuring the ad is placed appropriately on a website. A contextual ad may contain content that could be considered inappropriate or offensive for some visitors, so it’s crucial to ensure the ad is displayed only in the right context.

Competition.

Another challenge for contextual advertising is the competition in the online advertising space. Thousands of other ads run at any given time, and many are targeted toward the same audience, making it harder for your ad to stand out.

Lack of Targeted Audience.

Ensuring that the right audience sees your contextual ad can be challenging. If the ad is placed on the wrong website, it will likely not reach its intended audience, which means it won’t generate the expected traffic or conversion rates.

You must keep a close eye on your contextual ads as some contexts are too broad for precise targeting, and with so many possible placements, your ad may be quickly out of sight and out of mind.

Difficulty in Tracking Results. With contextual advertising, tracking the results can be difficult as it’s challenging to know if the ad led to a specific conversion or had any impact. The metrics available for measuring success can be confusing and limited.

Ad-blocking Technology.

Another significant challenge of contextual advertising is ad-blocking technology, which blocks contextual ads on websites. This makes it harder to reach your intended audience and decreases the likelihood of the ad being clicked or generating a conversion. As more people adopt ad-blocking software, contextual advertisers must find creative ways to ensure their ads still reach their target audience.

As marketers have observed, while people prefer ads that are personalised and tailored to their interests, they remain apprehensive about revealing their Personally Identifiable Information (PII) to brands.

This trepidation is corroborated by many recent studies, revealing that many consumers find it creepy when brands collect their data and browsing habits to deliver targeted ads.

So, what is the best way for brands to produce personalised ads without causing consumers to feel uncomfortable?

Using contextual ads is one way, as many studies imply consumers find contextual ads more appealing than behavioural ads, as they do not collect any of the user’s personal details. With many tech giants like Apple and Google discontinuing support for third-party cookies, we are seeing a gradual fading out of third-party identifiers, leaving brands to depend on first-and-zero-party data gathered directly from customers.

Such data, when properly collected, gives brands an advantage in serving their customers with more pertinent ads.

Another critical aspect is building trust. Transparency regarding data collection and the brand’s intentions with that data is paramount to building and retaining consumer trust.

In a cookie-less world, the significance of contextual advertising cannot be emphasised enough. It is no longer sufficient to rely on user data, especially since there is an increasing demand for privacy and a decline in the use of cookies. Contextual advertising provides targeted and relevant ads and allows brands to maintain their ad campaigns in a way that respects users’ privacy. With the right approach, contextual advertising can improve the user experience, drive conversions and ROI, and boost overall business growth.

The cookie may be crumbled, but the potential of contextual advertising is limitless. As we navigate the evolving digital landscape, embracing the power of context and its place in advertising will become increasingly important.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director