A billion people depend on India’s wheat harvests. What happens when the heat rises too fast for crops to survive?

Export bans. Soaring grain prices. A scramble for alternatives. Across Asia and beyond, food systems are under strain as extreme weather makes staple crops increasingly unpredictable. In response, scientists in China have developed drought-resistant rice to protect food security, yet consumer scepticism remains high.

Meanwhile, in the US, biotech giants like Bayer and Syngenta are pushing climate-proof seeds, but supermarket shelves still prominently feature “Non-GMO” labels – proof that consumer hesitation lingers despite scientific advancements.

This paradox defines the future of food security. Climate change is upending agriculture at an unprecedented pace – longer droughts, erratic rainfall, and rising temperatures are cutting into global crop yields. In response, agribusinesses and research institutions are racing to develop climate-resilient crops that can withstand these harsh conditions. The science is advancing rapidly, but will consumers accept it in time?

The science behind genetically engineered crops is well-established, yet scepticism remains deeply entrenched. Public attitudes vary widely: China and India are ramping up biotech adoption to secure food supplies, while Japan and the UK remain resistant, prioritising “natural” and organic labels. Meanwhile, Southeast Asia – a critical agricultural hub – faces a delicate balancing act, weighing the urgency of food security against long-standing cultural reservations about modified crops.

The question now is whether scientific innovation can outpace consumer scepticism. As extreme weather disrupts global food systems, climate-resilient crops could be the key to stabilizing agriculture. But will they gain mainstream acceptance in time, or will regulatory delays and public distrust slow their adoption? The outcome could determine whether the world’s farmers can keep feeding a growing population in an era of climate volatility.

The Climate Crisis Driving Innovation

Climate change is no longer a looming threat – it is already redrawing the global agricultural map. Farmers in some of the world’s most productive regions are contending with crippling droughts, unpredictable monsoons, and heat waves that arrive earlier and last longer. Yields are dropping, and supply chains are fraying. The stakes are high: without immediate adaptation, food security in major economies will be under serious threat within the next two decades.

Science has a solution – but can it scale fast enough? Researchers are developing crops that withstand floods, survive heat waves, and thrive in drought-stricken soil. Yet the challenge isn’t just in the lab. Getting these climate-resilient crops into the hands of farmers – before extreme weather renders existing varieties obsolete – is the real test.

The Data on Climate Impact on Agriculture

The warning signs are already here. In some of the world’s biggest agricultural hubs, extreme weather is slashing yields and reshaping the future of food production.

- United States: The US Corn Belt, which supplies nearly a third of global corn exports, is in jeopardy. The USDA warns that by 2050, heat stress could cut corn yields by 30% – and in some areas, losses could reach 44%. California’s almond industry is already feeling the strain, with water shortages forcing growers to abandon thousands of acres of orchards.

- Asia: Rice, the staple for more than half the world’s population, is under direct threat. FAO projections show that by 2050, rice yields across Asia could fall by 15% due to rising temperatures and unpredictable monsoons. Thailand and Vietnam – two of the world’s biggest rice exporters – are already struggling with prolonged droughts, shaking global supply chains.

- Indonesia and the Philippines: Archipelagic nations like Indonesia and the Philippines aren’t just battling drought – they’re losing farmland to the sea. Salinisation is creeping inland, making traditional rice paddies unviable. Farmers are being forced to pivot to salt-tolerant and flood-resistant varieties, but adaptation is slow.

- Singapore: As a nation that imports more than 90% of its food, Singapore is acutely vulnerable to agricultural disruptions. To counter this, it is betting on vertical farms and gene-edited crops as a way to build a more self-sufficient food supply.

The Urgency for Climate-Resilient Crops

As climate extremes intensify, scientists are in a race against time to engineer crops that can survive the chaos. Governments and research institutions are doubling down on drought-proof wheat, flood-resistant rice, and heat-tolerant corn – hoping to keep food supplies stable in an increasingly unpredictable world.

- China: In the country’s northern plains, farmland is turning to dust. Desertification is creeping southward, threatening wheat and rice yields in one of the world’s biggest food producers. In response, China is fast-tracking drought-resistant crop trials, hoping to shore up food security before harvests take a major hit.

- Indonesia: Rice paddies are drowning. Every year, typhoons and monsoon floods submerge vast swathes of farmland, wiping out crops overnight. Now, the government is betting on submergence-resistant rice – strains designed to survive weeks underwater. If successful, these biotech varieties could become a lifeline for Southeast Asia’s most populous nation.

- Singapore: In a city where farmland is scarce, food security is a growing concern. The island nation imports more than 90% of its food, leaving it vulnerable to supply chain shocks. To counter this, Singapore is betting on gene-edited crops and vertical farms, pushing the boundaries of high-tech agriculture. The government’s 30 by 30 initiative is a bold attempt to produce 30% of the country’s nutritional needs locally by 2030 – a challenge for a nation where skyscrapers vastly outnumber fields.

The science is clear – climate change is moving faster than agriculture can adapt. Farmers are already struggling to keep up. The real battle now isn’t just about innovation – it’s about trust. Will policymakers and the public embrace the science in time to prevent a global food crisis?

The Science Behind Climate-Resilient Crops

The fight to secure the future of food is happening in laboratories as much as in fields. As rising temperatures, droughts, and erratic weather threaten global harvests, scientists are engineering crops that can survive extreme conditions. But not all solutions are the same – some rely on age-old techniques, while others push the boundaries of genetic science.

GMOs vs. CRISPR vs. Selective Breeding: What’s the Difference?

- Genetically Modified Organisms (GMOs): This approach involves inserting foreign DNA into a plant’s genome to introduce traits that wouldn’t naturally occur. The most well-known example is Bt corn, which carries a gene from the soil bacterium Bacillus thuringiensis – allowing it to produce a protein lethal to insect pests but harmless to humans. Despite widespread use, GMOs remain a flashpoint of debate, with critics raising concerns over long-term ecological impact and corporate control of seeds.

- CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats): A revolution in genetic science, CRISPR offers a scalpel-like precision compared to the blunt instrument of traditional GMOs. Instead of inserting foreign DNA, this gene-editing tool allows scientists to modify a plant’s own genes, enhancing traits like drought resistance or disease immunity without introducing external genetic material. Because CRISPR mimics natural mutations, regulators in countries like Japan and the UK are moving to fast-track approvals, arguing it is closer to selective breeding than traditional genetic modification.

- Selective Breeding: The oldest agricultural tool in human history, selective breeding has shaped the crops we eat today – from sweeter apples to drought-hardy wheat. Farmers crossbreed plants with favourable traits over multiple generations, slowly refining resilience, flavour, and yield. But in a world where climate change is accelerating, this slow, incremental process may no longer be enough. Unlike CRISPR or GMOs, selective breeding is constrained by what exists in nature, limiting how quickly crops can adapt to rising temperatures and shifting rainfall patterns.

Golden Rice: A Case Study in Asia

A bowl of rice can mean the difference between sight and blindness. In parts of Asia, where rice is a staple but diets lack essential nutrients, millions of children suffer from vitamin A deficiency (VAD), a condition that can cause blindness and even death. Enter Golden Rice – a genetically engineered grain designed to deliver life-saving nutrients to those who need them most. But despite its promise, this crop has spent more time in policy debates than in the hands of farmers.

In the 1990s, scientists Ingo Potrykus and Peter Beyer set out to solve a deadly problem – how to infuse rice, the primary food source for billions, with a nutrient that could save lives. Their solution: Golden Rice, a genetically modified variety engineered to produce beta-carotene, the precursor to vitamin A. Its distinctive golden hue isn’t just for show – it’s a sign that the grain carries the potential to prevent blindness and child mortality across Asia.

But Golden Rice’s journey from lab to field has been anything but smooth. Activists have torched test plots, anti-GMO campaigns have labelled it “Frankenfood,” and bureaucratic red tape has stalled its approval for years. While scientists hail it as a game-changer for nutrition, critics argue that it opens the door to greater corporate control of the food system and unknown environmental risks. The question remains: is the world ready to accept a genetically engineered solution to malnutrition?

After two decades of political battles and scientific trials, Golden Rice has finally reached farmers’ fields. In 2021, the Philippines became the first country to approve it for commercial cultivation, marking a milestone in the fight against malnutrition. Other nations, including Bangladesh and India, are still weighing its adoption. But even with regulatory green lights, the biggest hurdle remains: Will consumers embrace it?

Science alone won’t decide the fate of Golden Rice – trust will. Dr. Adrian Dubock, one of its leading advocates, believes acceptance hinges on education and transparency. “The successful deployment of biofortified crops like Golden Rice depends not only on scientific innovation but also on building public trust,” he says. That trust, however, has been decades in the making – and is still far from guaranteed.

The Global Divide on Consumer Trust

A technology that can feed the world is also one of the most divisive. While some countries champion biotechnology as the future of farming, others reject it outright, driven by deep-seated cultural beliefs, political decisions, and misinformation. The result? A fractured global food system, where scientific breakthroughs face vastly different levels of consumer acceptance – shaping everything from government policy to supermarket shelves.

Consumer Perception Across Key Markets

- United States: Once a battleground for GMO opposition, the US is slowly shifting toward acceptance. A 2020 Pew Research Center survey found that 27% of Americans believe GMOs are safe to eat, while 38% consider them unsafe. Yet, old fears die hard. Supermarket aisles are still packed with “non-GMO” labels, even on foods that have no genetically modified equivalent – more a marketing strategy than a scientific necessity.

- China: The government wants biotech crops, but the people remain unconvinced. A 2023 China Agricultural University study found that 55% of Chinese consumers still oppose eating GM foods, citing safety concerns and deep distrust of corporate-controlled agriculture. Yet Beijing isn’t waiting for public sentiment to change. By classifying CRISPR-edited crops as “precision breeding” rather than genetic modification, regulators are pushing forward with gene-edited agriculture – betting that branding will make all the difference.

- India: Farmers embrace GM crops. Consumers reject them. The divide couldn’t be clearer. While Indian farmers widely cultivate pest-resistant genetically modified cotton, a Statista survey found that 45% of Indian consumers actively avoid GM foods, citing fears of health risks. Despite this, the government is inching toward approving GM mustard – a decision that has sparked protests and political infighting.

- Japan and the United Kingdom: Few places are more resistant to biotech foods than Japan and the UK. In Japan, over 70% of consumers favour “natural” labels, and government restrictions on GMOs remain among the toughest in the world. The UK, meanwhile, has begun rethinking its stance post-Brexit, with officials debating whether gene-edited crops should be regulated separately from traditional GMOs. But consumer sentiment hasn’t caught up to policy changes – demand for organic and non-GMO options remains strong.

- Southeast Asia: A region caught between food security concerns and biotech scepticism. The Philippines made history as the first nation to approve Golden Rice, but protests from anti-GMO activists have slowed its rollout. In Indonesia and Thailand, gene-edited crops are being tested, but public scepticism keeps governments cautious. Meanwhile, Singapore – a leader in agritech – is moving ahead with lab-grown and gene-edited foods, though consumer acceptance remains uncertain.

The Role of Misinformation in Fueling Skepticism

Fear spreads faster than facts. Nowhere is this more evident than in the debate over genetically modified foods. Social media has supercharged public scepticism, fueling viral claims about “Frankenfoods” and exaggerated health risks. A recent study in Nature Food found that misinformation about GMOs spreads six times faster than science-backed evidence – giving fear an outsized influence on consumer perception.

“The future of billions of people literally depends on changing the narrative about how we view genetically modified food and genetic technologies,” says Professor Ian Godwin, a plant geneticist at the University of Queensland. “Misinformation has distorted public perception, and we need to refocus the conversation on science, safety, and the role of biotechnology in food security.”

The real challenge isn’t just growing climate-resilient crops – it’s convincing consumers to accept them. With climate change straining global food supplies, the gap between scientific innovation and public perception has never been wider. If biotech crops are to help feed the future, winning public trust may matter just as much as the next agricultural breakthrough.

The Industry’s Strategy to Win Over Consumers

Science is on one side. Public opinion is on the other. Despite overwhelming evidence that genetically engineered crops are safe, scepticism remains one of the biggest hurdles to widespread acceptance. In response, the biotech industry is rethinking its messaging – rebranding GMOs, influencing regulations, and tapping into behavioural science to shift consumer sentiment.

How Food Companies Are Rebranding GMOs and Gene-Editing

The term “GMO” has become a branding disaster. Decades of fear-based messaging have turned it into a red flag for many consumers, prompting biotech firms to distance themselves from the label altogether. Now, companies and policymakers are rewriting the language of genetic innovation – betting that new terminology will reshape public perception.

The new labels sound less like science and more like sustainability slogans:

- “Precision Breeding” – the UK’s preferred term, positioning gene-edited crops as an extension of traditional breeding rather than genetic modification.

- “Climate-Smart Crops” – a phrase gaining traction, emphasising the role of biotech in reducing agriculture’s environmental footprint.

- “Next-Gen Agriculture” – used by industry giants like Bayer and Syngenta to make gene editing sound more futuristic and consumer-friendly.

But this isn’t just a marketing play – it’s a regulatory strategy. In countries like China and the UK, policymakers are reclassifying CRISPR-edited crops as something separate from GMOs, making them easier to approve and less likely to spark consumer backlash. The distinction matters: if gene editing is seen as “breeding” rather than “modification,” it faces fewer restrictions – and far less public scrutiny.

Corporate Investments in Gene-Edited Foods

The race to secure climate-resilient crops isn’t just happening in labs – it’s now a boardroom priority. Major food corporations are pouring millions into biotech investments, betting that gene-edited foods will protect their supply chains from climate shocks and shifting consumer demands.

- Nestlé is backing CRISPR-edited coffee beans that can survive rising temperatures without losing flavour or yield – an urgent investment as climate change threatens global coffee production.

- Unilever has teamed up with agritech firms to develop gene-edited oilseed crops, positioning gene-editing as a tool to make plant-based foods more sustainable.

- PepsiCo is investing in drought-resistant potato strains, aiming to reduce the environmental footprint of its global snack empire.

These corporate bets aren’t just about innovation – they’re about survival. As extreme weather upends agriculture, food giants are moving to insulate their supply chains before climate disruption hits their bottom line.

Can Branding Change the Narrative?

Rebranding genetically modified organisms (GMOs) can influence public perception, but it doesn’t alter the underlying realities. Behavioural science indicates that consumer trust is built through education and transparency, not just terminology shifts. A 2022 study by the European Food Safety Authority found that consumers were 40% more likely to accept gene-edited foods when provided with clear, science-backed explanations of their benefits.

Dr. Kevin Folta, a plant scientist at the University of Florida, emphasises the importance of clear communication: “Stop using ‘GMO.’ It is imprecise. Everything not arising as a clone is genetically modified from previous forms.”

The future of food isn’t just about innovation – it’s about persuasion. As climate pressures mount and global food demand rises, gaining consumer trust is essential for genetic breakthroughs to reach their full potential. The stakes extend beyond corporate profits; they encompass the future of global food security.

The Future of Climate-Resilient Crops

The future of food is being rewritten – one policy, one investment, and one breakthrough at a time. As climate change threatens global food systems, governments are redrawing the regulatory landscape for genetically modified and gene-edited crops. Some nations are fast-tracking approvals to ensure food security, while others remain trapped in political and public pushback. Meanwhile, agritech startups are seeing an influx of capital, and carbon markets are emerging as unexpected drivers of sustainable agriculture. The question is no longer if biotech crops will play a role in feeding the future, but how quickly they will be embraced.

How Governments Are Handling Biotech Crops

China is breaking its long-standing GMO hesitation – and food security is the reason. In late 2023, the government greenlit commercial planting of gene-edited soybeans and corn, a major policy shift for the world’s largest food importer. Officials have positioned the move as an economic and strategic necessity – designed to cut reliance on foreign seed technology, boost domestic yields, and protect China’s food supply from worsening climate volatility.

India remains deeply divided on biotech crops. While farmers champion genetic innovation as key to improving yields, environmental groups continue to push back against its expansion. The Supreme Court is now weighing a landmark case on GM mustard, a ruling that could set the tone for future biotech approvals. Farmers argue that modified crops are critical to boosting productivity, but critics warn of corporate seed monopolies and environmental fallout. Despite the deadlock, India has already embraced GM cotton – the question is whether food crops will be next.

Post-Brexit, the UK is embracing biotech in a way the EU never did. In 2023, lawmakers fast-tracked the Genetic Technology (Precision Breeding) Act, slashing EU-era restrictions and making Britain a testing ground for gene-edited agriculture. Officials argue that CRISPR crops should not be lumped together with traditional GMOs – a move designed to attract investment in gene-edited wheat, oilseeds, and climate-resilient fruits. With fewer regulatory hurdles, the UK is positioning itself as a biotech leader in Europe.

Southeast Asia is turning to biotech and urban farming to secure its food future. Singapore is leading the charge with its “30 by 30” initiative, investing heavily in vertical farming and gene-edited crops to meet 30% of its nutritional needs domestically by 2030. Indonesia, meanwhile, is channelling capital into agritech startups focused on climate-resilient crops – but policymakers remain wary of fully legalising GMOs. The region’s approach reflects a balancing act between food security and public caution.

Investment Trends in Biotech Agriculture

Biotech investment is no longer a niche bet – it’s a global race. As climate volatility disrupts food production, investors are pouring capital into agricultural biotechnology, betting that genetic innovation will be the key to long-term food security. The global agri-biotech market is projected to hit $104 billion by 2030, fueled by demand for climate-smart crops, precision breeding, and gene-editing breakthroughs.

Venture capital is chasing the next frontier in food tech: gene-editing. Unlike traditional GMOs, CRISPR-edited crops face fewer regulatory hurdles, making them a safer bet for investors. Startups like Tropic Biosciences, Pairwise, and Inari Agriculture have secured major funding rounds, developing crops such as fungus-resistant coffee and nutrient-enhanced leafy greens. The appeal is clear – gene-edited foods promise climate resilience without the regulatory baggage of older biotech crops.

The Role of Carbon Markets in Driving Adoption

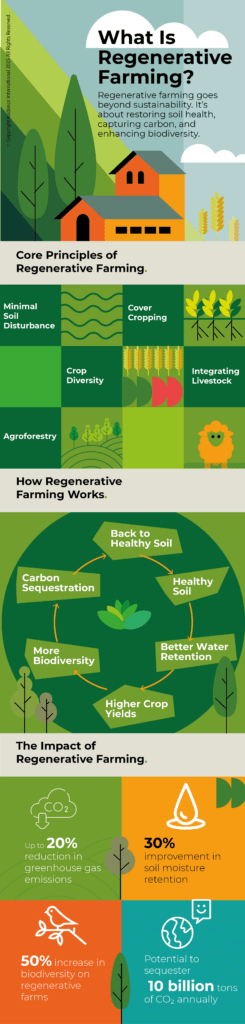

The future of biotech crops could be shaped by an unlikely force: carbon markets. Indonesia and Vietnam are rolling out carbon credit initiatives that reward farmers for adopting regenerative agriculture practices – including biotech crops that boost soil health and reduce chemical inputs. If these incentives take off, farmers could be financially rewarded for planting gene-edited crops that sequester carbon, use less water, or cut fertilizer reliance. This shift could turn biotech adoption into not just an environmental decision, but an economic one.

Biotech crops are no longer just a scientific breakthrough – they are becoming an economic and political necessity. The intersection of government policy, venture capital, and sustainability incentives is redefining agriculture, with gene-edited crops at the centre of the debate. While regulatory fights continue, one thing is clear: the success of biotech crops won’t be decided in labs – it will be decided by farmers, investors, and consumers.

The Race Between Innovation and Acceptance

Climate change isn’t waiting for regulatory approvals or consumer sentiment to catch up. Extreme weather is already reducing global crop yields, disrupting supply chains, and putting food security at risk in regions dependent on staple crops like wheat, rice, and corn. Scientists are engineering solutions, policymakers are reshaping regulations, and agribusinesses are scaling up climate-resilient crops – but none of it matters if regulatory roadblocks and consumer hesitancy delay adoption.

Some nations are moving forward. China and the UK are accelerating approvals for gene-edited crops, while India and Southeast Asia remain caught between the urgency of food security and deep-rooted public hesitation. The industry has rebranded, investors are funnelling billions into biotech, and breakthroughs have produced crops that can withstand extreme heat, require less water, and resist disease.

For climate-resilient crops to reach their potential, three critical shifts must take place:

- Public education must dismantle outdated GMO fears – moving beyond decades-old misconceptions and clearly explaining how modern gene editing differs.

- Companies must change how they communicate biotech benefits – focusing on sustainability and nutrition rather than technical jargon that alienates consumers.

- Regulators must find a balance between public trust and innovation – streamlining approvals without ignoring consumer concerns.

The future of food security won’t be decided in labs – it will be decided in grocery aisles, political chambers, and consumer conversations. The race between scientific progress and public acceptance will determine whether climate-resilient crops become a global necessity – or a solution that came too late.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director