In 2005, Nintendo was teetering on irrelevance in the UK. Once a dominant force, the gaming giant had been eclipsed by Sony’s PlayStation and Microsoft’s Xbox, holding a mere 5% market share in a space increasingly dominated by high-powered consoles and competitive gaming. Gaming had become synonymous with young, tech-savvy male audiences – a niche where Nintendo no longer held sway.

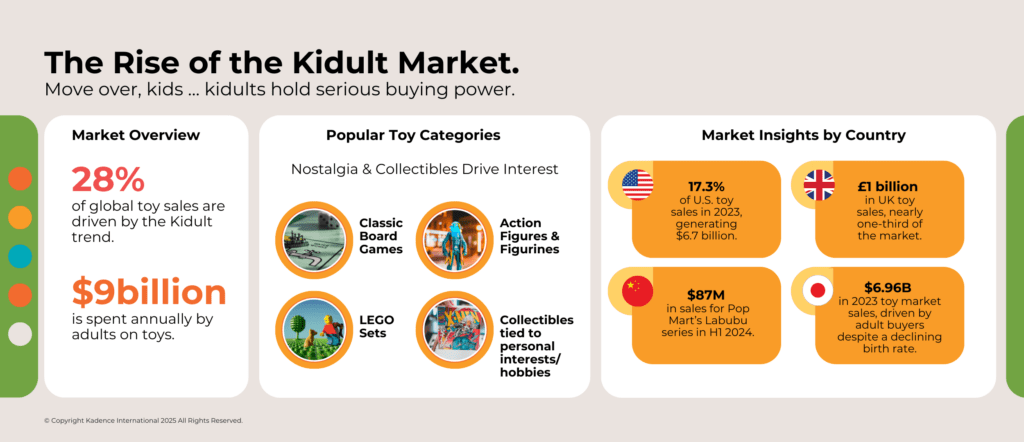

Within two years, Nintendo executed a turnaround that defied industry norms. By 2007, its UK market share had skyrocketed to 80%, driven by a marketing strategy that ignored the industry’s obsession with specs and focused on accessibility, playfulness, and the redefinition of what it meant to be a “gamer.” The Nintendo DS and Wii weren’t just consoles; they were cultural phenomena that expanded the gaming audience beyond teenage boys and esports enthusiasts to parents, professionals, and an emerging market now known as kidults – adults who engage in play-driven, nostalgic, and social entertainment.

This wasn’t just a comeback. It was a masterclass in market expansion, consumer behaviour, and brand reinvention. Nintendo didn’t just take back its position in gaming – it transformed the industry’s entire trajectory. How did they do it? And what lessons can today’s brands learn from this seismic shift?

The Market Landscape Before Nintendo’s Comeback

By the mid-2000s, gaming was a high-stakes, high-performance industry. Sony and Microsoft were in an aggressive race, pushing cutting-edge graphics, processing power, and online multiplayer experiences. The PlayStation 2 was the undisputed king, selling over 155 million units globally, while the Xbox, backed by Microsoft’s deep pockets, had secured a loyal base of hardcore gamers. Nintendo, once the industry’s dominant force, had been relegated to an afterthought.

The problem? The market had narrowed. Gaming had become a battlefield of tech specs and realism, catering to an increasingly insular demographic – young male gamers. The industry had overlooked a fundamental truth: entertainment isn’t just about cutting-edge technology; it’s about accessibility, emotional connection, and cultural relevance.

This was the opportunity Nintendo saw before anyone else. Instead of competing on hardware power, the company pivoted toward a different gaming experience, prioritising intuitive gameplay, social engagement, and an audience that had been ignored for too long.

Nintendo engineered one of the most dramatic turnarounds in business history by rejecting the industry’s fixation on complexity and high-performance specs. Its strategy didn’t just reclaim market share – it reshaped the gaming landscape, expanding the definition of who a gamer could be.

Key Strategies That Fueled Nintendo’s Success

Nintendo’s comeback wasn’t a fluke – it was a deliberate strategy that defied industry norms. While Sony and Microsoft escalated the hardware arms race, Nintendo redefined what gaming could be. Instead of emphasising specs, it broadened its audience and made gaming more intuitive, turning the conversation from power to play.

#1. Expanding the Audience Beyond Gamers

Gaming had long been marketed to young men obsessed with high-speed, high-performance play. Nintendo shattered this mould by targeting demographics the industry had ignored: families, women, and older adults. The company understood gaming wasn’t inherently niche; it had simply been positioned that way.

The strategy was simple but groundbreaking: the barriers stopping non-gamers from picking up a controller. The Wii and Nintendo DS were designed to be intuitive, eliminating the intimidating learning curves of traditional gaming. This wasn’t about mastering complex button combinations or navigating hyper-realistic battlefields; it was about play.

Nintendo’s marketing leaned into this accessibility, positioning gaming as a shared experience rather than a solo, skill-based pursuit. Instead of hyper-stylised action sequences, Nintendo’s ads featured families playing together in living rooms, grandparents competing with grandchildren, and social settings where gaming wasn’t just entertainment; it was connection.

The result? Nintendo didn’t just win back players – it created millions of new ones. This wasn’t just about reclaiming dominance; it was about reshaping the gaming audience entirely.

#2. Leveraging Innovative Gameplay Experiences

Nintendo’s resurgence wasn’t about cutting-edge graphics, faster processors, or blockbuster storytelling. It was built on a simple yet powerful principle of consumer psychology: ease of use. By stripping away complexity, Nintendo made gaming more accessible than ever.

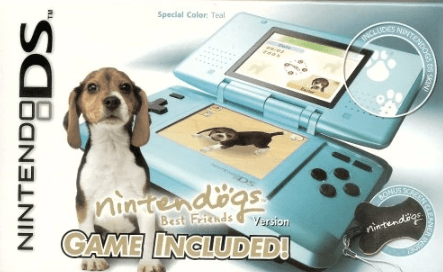

The Nintendo DS: A Touch-Based Revolution

It was built on a simple yet powerful principle of consumer psychology: ease of use. By stripping away complexity, Nintendo made gaming more accessible than ever.

Image Credit: Nintendogs Wiki Fandom

More importantly, Nintendo ensured the software supported this approach. Titles like Brain Age and Nintendogs weren’t designed for traditional gamers – they were built to attract a broader demographic, including older adults and casual players who had never picked up a console before. By moving away from conventional gaming tropes, the DS became a global sensation, selling over 154 million units.

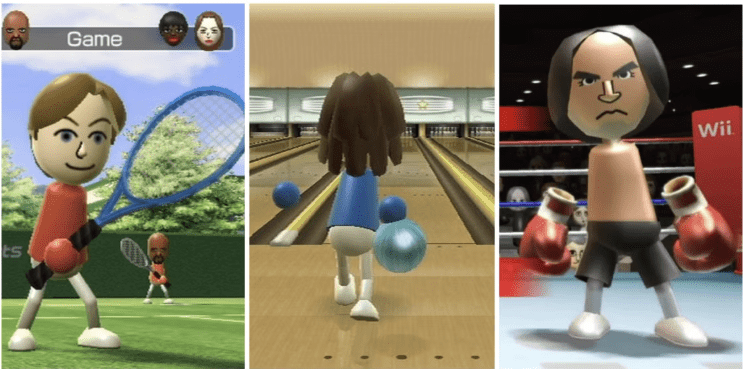

The Wii: Motion-Control Gaming That Redefined Engagement

If the DS lowered the barrier to entry for handheld gaming, the Wii redefined accessibility in home entertainment. Launched in 2006, the Wii introduced motion-sensing controls that eliminated complex button inputs. Players could physically swing, punch, or steer their way through games, making gaming feel more interactive and immersive.

Image Credit: Game Rant

Bundling Wii Sports was a masterstroke. The Wii’s intuitive, motion-based gameplay made it essential for the living room, drawing in families, older adults, and social gamers. By 2007, the Wii had outsold the Xbox 360 and PlayStation 3.

Rather than competing in the high-performance gaming race, Nintendo carved out an entirely new segment – one that prioritised intuitive, inclusive, and social play. The company didn’t just win back market share; it expanded the definition of gaming itself.

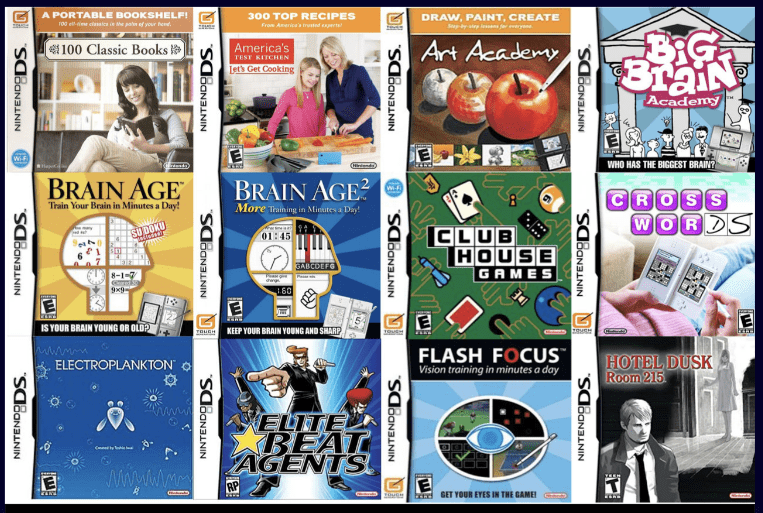

#3. Creating a Software Lineup That Sold Consoles

Nintendo’s success wasn’t just about hardware innovation. The real driver behind the DS and Wii’s dominance was a software strategy that prioritised accessibility, engagement, and repeat playability. While competitors focused on high-budget, graphics-heavy blockbusters, Nintendo leaned into intuitive, universally appealing experiences that turned occasional players into loyal consumers.

The Power of Bundled Games

Few games have matched the cultural impact of Wii Sports. With simple motion controls for tennis, baseball, and bowling, Wii Sports turned gaming into an active, social activity. The result? It became one of the best-selling games of all time.

Similarly, Brain Age for the DS tapped into a new category of users: adults looking for cognitive challenges. Its premise, built around mental exercises and daily training, positioned the DS as a lifestyle product. This pivot expanded Nintendo’s consumer base and set the stage for future mainstream gaming trends.

Franchises That Defined an Era

Beyond bundled titles, Nintendo doubled down on its iconic IPs. Mario Kart DS brought the beloved racing franchise to handheld gamers, while New Super Mario Bros. revitalised classic platforming for a new generation. These titles weren’t just nostalgia-driven – they were strategically designed to leverage Nintendo’s strongest assets while remaining accessible to casual players.

Image Credit: The Gamer

The Wii also saw a boom in motion-driven exclusives. Games like Wii Fit turned the console into a fitness tool, targeting a demographic far beyond traditional gamers. This content diversification ensured Nintendo wasn’t just selling consoles; it was building long-term engagement.

Image Credit: Game Stop

By focusing on intuitive gameplay, evergreen franchises, and software that appealed to untapped markets, Nintendo created a virtuous cycle: every best-selling game drove more console sales, and every console sale expanded the audience for future games. This strategy transformed Nintendo from an industry underdog to a market leader once again.

#4. Making Gaming More Affordable and Accessible

While Sony and Microsoft were engaged in a hardware race, pushing consoles with advanced graphics and premium pricing, Nintendo took a different approach. It focused on affordability, positioning the DS and Wii as low-cost, high-value alternatives that didn’t require a deep investment in gaming culture or expensive accessories. This pricing strategy wasn’t just about undercutting the competition; it was about lowering the barrier to entry and widening the consumer base.

Disrupting the Price War

In 2006, the PlayStation 3 launched at £425 in the UK, while the Xbox 360 ranged from £209 to £279. The Nintendo Wii, by contrast, entered at just £179—an accessible price point that made it an easy choice for families, casual gamers, and first-time buyers long priced out of gaming.

The DS followed a similar model. At launch, it was significantly cheaper than Sony’s handheld PSP, which was marketed as a high-performance portable console with multimedia capabilities. While the PSP struggled to compete with the rise of smartphones in the years ahead, the DS thrived by staying true to its core audience – offering simple, engaging experiences at a price point that felt accessible.

The Cost-to-Value Proposition

Price alone wasn’t enough – Nintendo had to prove value. Bundling Wii Sports gave consumers an instant reason to buy, eliminating the need for additional purchases. The Wii’s motion controls also removed the expense of extra accessories. Meanwhile, the DS thrived on a library of budget-friendly, mass-appeal titles, positioning gaming as an everyday activity rather than a luxury.

This affordability-first strategy had long-term implications. It cultivated a new generation of casual gamers, many of whom might never have considered purchasing a console. More importantly, it reinforced Nintendo’s reputation as the most accessible gaming brand, not just competing for market share but actively expanding the market.

By rejecting the premium-price model and focusing on mass-market adoption, Nintendo proved that success in gaming wasn’t just about hardware specs; it was about making gaming available to everyone.

#5. A Marketing Masterclass in Consumer Engagement

Nintendo’s comeback wasn’t just about hardware, software, or pricing – it was about storytelling. While Sony and Microsoft marketed gaming as a high-performance, immersive experience for dedicated players, Nintendo positioned gaming as something entirely different: a social, intuitive, and universally accessible activity. This shift in messaging was a fundamental repositioning of what gaming meant to consumers.

The Shift from Power to Play

Sony’s PlayStation 3 campaign emphasised its powerful hardware, with cinematic trailers showcasing hyper-realistic graphics and advanced processing power. Microsoft’s Xbox 360 leaned into its online gaming ecosystem, targeting hardcore players with a focus on multiplayer capabilities.

Image Credit: Miscrave

Nintendo went in the opposite direction. It didn’t market specs – it marketed people. Instead of high-adrenaline gameplay, its ads showed families, grandparents, and first-time gamers picking up a Wii remote and playing instantly. The message was clear: gaming wasn’t just for gamers anymore.

Turning Gaming into a Shared Experience

The Wii Would Like to Play became one of the era’s iconic marketing campaigns. Featuring two suit-clad Japanese men introducing the Wii to everyday households, it emphasised invitation over exclusivity. Nintendo wasn’t selling a console; it was selling interaction, laughter, and inclusion.

For the DS, Nintendo leaned into relatability. The Touch Generations campaign targeted non-gamers, featuring celebrities and everyday users engaging with brain-training games, puzzle titles, and social experiences. This wasn’t gaming for the elite; it was gaming for everyone, reinforcing the company’s core strategy of mass accessibility.

Retail Strategy and Experiential Marketing

Beyond traditional advertising, Nintendo excelled at experiential marketing. The company rolled out widespread in-store demo stations, allowing hesitant buyers to try the Wii’s motion controls or experience the DS’s touchscreen before making a purchase. This hands-on approach eliminated scepticism and turned a casual interest into immediate conversion.

Nintendo also capitalised on the rise of social proof. Word-of-mouth marketing skyrocketed as the Wii became a staple in living rooms worldwide. The more people saw their friends and family engaging with Nintendo products, the more likely they were to join in, creating a viral effect that fueled record-breaking sales.

By shifting its marketing from performance-driven specs to emotion-driven engagement, Nintendo didn’t just sell consoles – it sold experiences. In doing so, it reshaped the gaming industry, proving that success wasn’t about catering to the existing market but creating an entirely new one.

#6. The Long-Term Impact on Gaming and Consumer Behavior

Nintendo’s strategy didn’t just reclaim market share – it redefined gaming itself. It shifted perceptions of who a “gamer” could be and expanded what gaming could offer. The ripple effects went beyond Nintendo, reshaping the industry and consumer expectations for years.

Mainstreaming Casual and Social Gaming

Before the Wii and DS, gaming was a niche hobby dominated by young men. Nintendo shattered that perception, proving gaming could be inclusive, social, and effortless. The runaway success of Wii Sports, Brain Age, and Nintendogs sparked demand for intuitive, accessible gameplay – paving the way for mobile gaming’s rise.

Nintendo inadvertently set the stage for the mobile gaming revolution by lowering the entry barrier and emphasising fun over complexity. The App Store, launched in 2008, followed the same principles: games that were simple to learn, easy to access, and designed for mass appeal. Today, the global mobile gaming market generates more revenue than console and PC gaming combined, a shift that can be traced back to Nintendo’s strategy of broadening the gaming audience.

The Legacy of Motion Controls and Interactive Gaming

Initially dismissed as a gimmick, the Wii’s motion controls became a blueprint for interactive gaming. Microsoft’s Kinect and Sony’s PlayStation Move were direct responses, chasing the demand Nintendo had created. More significantly, the idea of physical engagement in gaming extended beyond consoles – AR and VR gaming owe much of their mainstream appeal to Nintendo’s early innovations.

Image Credit: Nintendo

Nintendo’s focus on intuitive play also influenced how developers approached game design. Today, user-friendly mechanics and immediate engagement are central to many of the industry’s best-selling titles, from fitness-based games like Ring Fit Adventure to the continued success of Just Dance, a franchise built on motion-based play.

A Blueprint for Market Expansion

Nintendo’s greatest lesson wasn’t reclaiming market share – it was creating new demand. Rather than competing in a saturated market, it identified an untapped audience and built products around them.

This strategy continues to influence modern gaming. The resurgence of retro consoles, the rise of cloud gaming services that prioritise accessibility over hardware power, and even the success of games like Animal Crossing: New Horizons – which attracted a massive non-traditional gaming audience – can all be linked to the blueprint Nintendo established in the mid-2000s.

Nintendo didn’t just revive its brand – it reshaped the gaming industry. By proving that innovation comes from creating trends, not following them, it set a new standard for market disruption. And its influence didn’t stop at gaming.

Nintendo’s resurgence wasn’t just a corporate turnaround; it redefined how entertainment itself was consumed. By shifting gaming from a skill-based pursuit to a social, inclusive experience, it expanded the industry’s reach far beyond its traditional audience. The DS and Wii weren’t just successful consoles; they were cultural phenomena that reshaped consumer behaviour, fueled the rise of casual gaming, and set the stage for today’s interactive entertainment trends.

The takeaway for brands? Market dominance isn’t about competing harder – it’s about expanding the playing field. Nintendo succeeded by challenging assumptions, identifying unmet consumer needs, and making gaming effortless and engaging. It didn’t just reclaim leadership; it shaped the future of digital entertainment for decades.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director