Veterinary care is undergoing a transformation that few outside the pet industry have fully registered. Quietly, and with surprising speed, it is becoming one of the most innovative frontiers in healthcare delivery – spurred not by institutions or regulators, but by consumer behaviour.

The catalyst was COVID-19. As lockdowns confined millions to their homes, pet adoption surged worldwide. Between 2020 and 2022, more than 23 million American households acquired a new pet, according to the ASPCA. The UK saw a 20% increase in pet ownership during the same period, while markets like Singapore, Indonesia, and Thailand reported double-digit growth in first-time pet ownership, particularly among urban millennials and Gen Z. Today, nearly 60% of households in Southeast Asia’s major cities own at least one pet.

But what followed the adoption boom was something more profound: a redefinition of what pet care should look like. In a world of same-day grocery delivery, wearable glucose monitors, and always-on digital banking, pet owners began demanding the same immediacy, visibility, and personalisation from veterinary services. Convenience became table stakes; transparency became non-negotiable. And traditional clinics – often booked weeks out, with variable pricing and limited hours – found themselves out of sync with rising expectations.

Into this gap stepped a new breed of service: subscription-based, digital-first veterinary platforms. These companies don’t just offer reactive care – they promise continuous access, proactive advice, and predictable costs. Enabled by mobile technology and fueled by a consumer base fluent in subscriptions – from fitness to food to finance – these platforms are not only meeting demand, but redefining it.

This isn’t a Western phenomenon alone. Across Southeast Asia, mobile-native consumers are bypassing legacy systems entirely, engaging with vet care the way they engage with mobility, entertainment, and finance – via app, on demand, and often as part of a bundled service.

What’s emerging is not an add-on to the veterinary industry – it’s a parallel infrastructure. Subscription-based pet care is changing not just how services are delivered, but how they’re valued, experienced, and expected. The shift is quiet, but its implications are structural, global, and irreversible.

The Perfect Storm Behind the Shift

The rise of subscription-based, digital-first veterinary care didn’t happen in a vacuum. It was the product of mounting structural strain in the veterinary industry, colliding with a generational realignment in how consumers engage with health and wellness. What’s happening now is less a trend than a correction – one shaped by workforce shortages, behavioural shifts, and evolving definitions of convenience.

At the heart of this transformation is a growing imbalance between supply and demand. In the United States, the American Veterinary Medical Association projects a shortfall of nearly 15,000 veterinarians by 2030. In the UK, the British Veterinary Association has sounded the alarm over staffing shortages exacerbated by Brexit and post-pandemic burnout. Across Southeast Asia, where veterinary infrastructure has long lagged behind growing pet ownership, access to licensed professionals remains patchy – especially outside major cities.

The result is a system under pressure: overbooked clinics, rising costs, and long wait times for even routine care. These inefficiencies are increasingly incompatible with a consumer base accustomed to real-time digital access in nearly every other domain of life.

That base is also changing. Millennials and Gen Z now account for the majority of pet owners in many countries. In the US, 76% of Gen Z and 71% of millennials own pets, according to a 2023 report by Packaged Facts. These generations have grown up with mobile-first services, expect subscription-based billing, and value transparency over tradition. They’re less loyal to institutions, more loyal to user experience.

But the shift isn’t purely generational – it’s behavioural. Consumers are no longer looking to engage with veterinary services only when something goes wrong. They want ongoing access, reassurance, and preventative care for pets as part of a broader wellness lifestyle. In this model, a once-episodic service – one that was reactive by design – is being reimagined as a continuous relationship.

The demand for immediacy is also driving pricing innovation. Traditional clinics often operate on a fee-for-service basis with little predictability for clients. Subscription models offer a clear alternative: fixed monthly pricing, bundled services, and easy cancellation. It’s a format consumers understand intuitively – one that reduces friction and increases perceived value, even when the actual services may overlap with those offered by brick-and-mortar practices.

These forces – professional shortages, digital behaviour, rising expectations – have created a perfect storm. But it is consumers, not companies, who are setting the pace of change. Their demand for continuity, control, and convenience is rewriting the rules of engagement in pet care. Traditional models are being redefined not by what they lack, but by what they can no longer offer at scale.

The Rise of Subscription-Based Vet Care

If the traditional veterinary model is under strain, subscription-based platforms are capitalising on the gap, not just by digitising care, but by reframing what care means altogether.

At the centre of this shift is a new breed of veterinary service providers offering care plans that emphasise access, continuity, and convenience. Unlike conventional clinics, which are often bound by geographic reach, hours of operation, and one-off appointment models, these platforms offer a digital front door to veterinary support – always open, always responsive.

In the United States, startups like Fuzzy and Pawp have led the charge. Fuzzy offers members 24/7 live vet chat, medication delivery, and access to care plans for chronic conditions – all through a monthly subscription that ranges from $20 to $40. Pawp, which launched in 2020, delivers flat-fee emergency fund access and unlimited telehealth consults for under $25 per month. These companies are less interested in replacing brick-and-mortar clinics and more focused on becoming the first – and frequent – point of contact. Their services are designed around reassurance, convenience, and wellness, rather than surgical procedures or complex diagnostics.

In the UK, Joii Pet Care has gained traction by offering video consults and symptom checkers targeted at affordability and access. Developed by a team of experienced vets and tech entrepreneurs, the app aims to fill care gaps, particularly for lower-income households or those living in rural areas where local clinics are sparse. With prices starting under £25 per consultation or bundled into wellness plans, Joii represents a different approach: one rooted in cost democratisation without sacrificing clinical oversight.

Across Southeast Asia, where veterinary infrastructure varies widely, digital-first models are leapfrogging outdated systems. In cities like Jakarta, Bangkok, and Manila, startups are building integrated ecosystems that combine e-commerce, on-demand consults, vaccination reminders, and home diagnostics – all accessible via mobile app. In these markets, where smartphone penetration is high and traditional vet coverage is limited, the subscription model isn’t just disruptive – it’s foundational.

What all these models share is a fundamental redefinition of veterinary care as a service layer, not a physical location. This service is anchored in several common features:

- Always-on access: 24/7 chat and video support, eliminating the need to wait for clinic hours.

- Tiered pricing: Monthly plans that bundle consults, medications, supplements, or diagnostic tests.

- Proactive care: Wellness tracking, behaviour coaching, and early intervention, rather than reactive treatment.

- Integrated delivery: Some platforms even include food, flea treatments, or insurance coverage – shifting from care to full-lifecycle pet management.

From a business standpoint, the subscription model offers strong appeal: predictable recurring revenue, high engagement, and greater lifetime value per customer. For consumers, the model reduces decision fatigue. Instead of weighing every vet call against cost or necessity, pet owners can access care fluidly, often leading to earlier interventions and stronger long-term outcomes.

Crucially, the value isn’t just in the care provided – it’s in the perception of partnership. These platforms don’t operate like service providers; they position themselves as guides, helping owners navigate an increasingly complex pet wellness landscape. This relationship-first framing plays especially well with younger consumers, who prioritise trust and transparency in brand interaction.

Subscription-based vet care isn’t about replacing traditional clinics. It’s about meeting the unmet needs those clinics were never designed to solve – ongoing reassurance, flexible support, and access untethered from geography or schedule. And in doing so, these platforms are setting new benchmarks for what modern pet healthcare looks like, not just in the West, but in digital-first economies around the world.

Regional Perspectives in Transformation

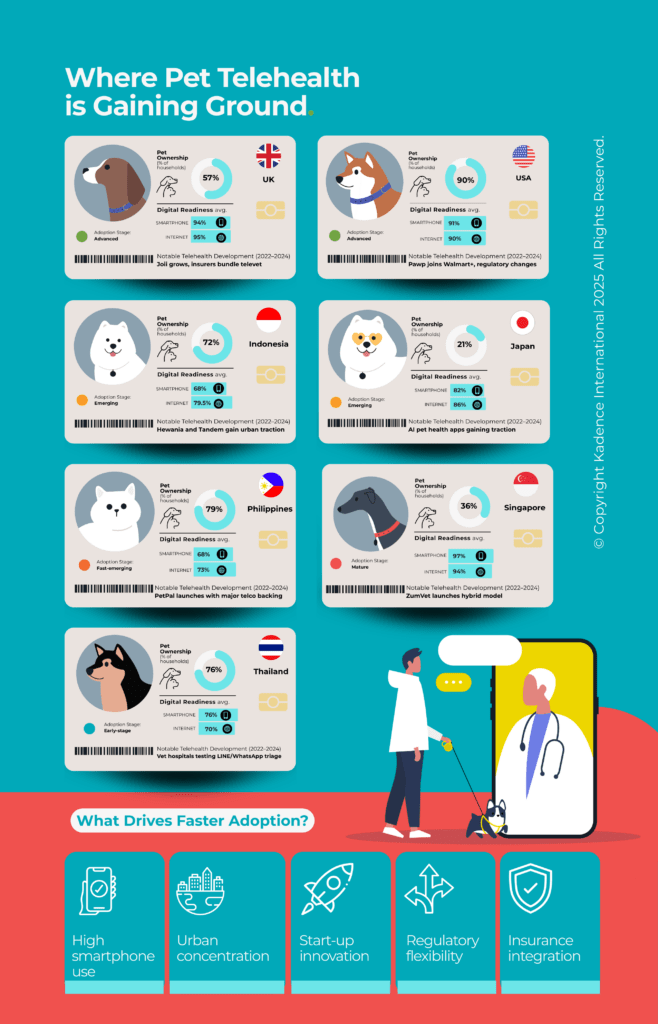

While the shift to digital-first, subscription-based veterinary care is global in momentum, its expression varies significantly by region. Regulation, consumer behaviour, infrastructure, and healthcare norms all influence how the transformation unfolds – and where it gains traction fastest.

United States: Infrastructure Meets Expectation

The US remains the most mature market for pet telehealth, fueled by high rates of pet ownership, established digital payment infrastructure, and a consumer base accustomed to subscriptions across lifestyle categories. Companies like Fuzzy, Pawp, and Dutch have rapidly scaled, supported by favourable funding environments and growing regulatory flexibility.

The American Veterinary Medical Association has gradually updated telemedicine guidelines to reflect new realities, allowing licensed vets to establish a veterinary-client-patient relationship (VCPR) remotely in some states. This flexibility has given startups room to innovate while enabling hybrid models that bridge virtual triage and in-person escalation.

Consumer readiness has also played a role. With 97% of US households owning a smartphone and nearly 80% of millennials identifying as pet parents, mobile-based care isn’t a leap – it’s a natural extension of how health, finance, and lifestyle are already managed.

United Kingdom: Bridging Gaps with Affordability

In the UK, the rise of digital veterinary services has followed a different path – less about convenience, more about access and affordability. NHS-like expectations of care spill into pet ownership culture, where cost sensitivity often leads to delayed treatment or skipped appointments.

Joii and FirstVet have gained traction by offering consults at fixed, low prices, targeting underserved households and rural regions. These services are often paired with employer benefits or pet insurance providers, forming integrated care bundles that mirror human healthcare delivery.

Regulation is catching up, but remains a barrier in some respects. The Royal College of Veterinary Surgeons (RCVS) still requires an in-person relationship to prescribe most medications, limiting the scope of pure-play digital models. Still, the appetite for innovation is evident, especially among younger consumers facing cost-of-living pressures and limited clinic access.

Southeast Asia: Mobile-First and Rapidly Scaling

In Southeast Asia, subscription-based pet care is not just a convenience – it’s becoming foundational. In high-density cities like Jakarta, Bangkok, and Ho Chi Minh City, veterinary infrastructure hasn’t kept pace with urban pet ownership. Clinics are often understaffed or geographically uneven, while demand for care is growing sharply among younger, mobile-first consumers.

Here, digital platforms are leapfrogging legacy systems, integrating consults, treatment reminders, product delivery, and even vaccination records into a single app. The model resembles fintech and telemedicine rollouts in the region: rapid, mobile-led, and often driven by startups with regional or pan-Asian ambitions.

Unlike in the West, where subscription models compete with entrenched systems, Southeast Asia’s innovators are building the baseline infrastructure from the ground up. For many new pet owners in the region, a subscription-based vet app isn’t a supplement – it’s the only vet they’ve ever known.

Brand Spotlight: Pawp

Image credit: Pawp

Few companies have captured the shift in pet care delivery as clearly as Pawp. Launched in 2019, the US-based startup built its model around a simple idea: pet owners want immediate access to expert care without unpredictable costs. For a monthly fee of around $24, subscribers receive unlimited 24/7 access to licensed veterinarians via chat or video, along with an annual $3,000 emergency fund that covers life-threatening situations.

It’s not insurance, and it’s not a replacement for in-person care. Instead, Pawp positions itself as the first point of contact – triaging concerns, offering advice, and filling the gap between full-service clinics and reactive emergency visits. The service is especially appealing to urban renters, multi-pet households, and younger owners accustomed to managing health, banking, and food delivery through their phones.

Adoption accelerated during the pandemic, as pet ownership hit record highs and consumers became more comfortable with telehealth. By 2022, Pawp had expanded nationwide. But its biggest leap came in 2023 when Walmart integrated the service into its Walmart+ membership. For millions of members, a vet became one tap away, included in their monthly subscription. That partnership wasn’t just a distribution win – it marked a cultural shift, signalling that veterinary access, like streaming or grocery delivery, could be bundled into everyday life.

Pawp’s model reflects a broader recalibration of how pet owners think about care. The unlimited access reduces the threshold for engagement – owners no longer hesitate over whether a question is “worth” asking. Instead, they ask more, earlier, and often. This changes the rhythm of care, encouraging prevention over reaction and making the pet-health relationship feel continuous rather than episodic.

While competitors have emerged, few match Pawp’s combination of on-demand triage and financial safety net. The company has also moved into employer benefits and financial services, appearing in bundled perks from credit cards and HR platforms. For traditional clinics, this model doesn’t displace in-person care – but it does rewire when, how, and why pet owners seek help.

What Pawp proves is that subscription care isn’t just a pricing structure – it’s a behaviour model. And for millions of pet owners, it’s quickly becoming the default.

Traditional Clinics at a Crossroads

The rise of subscription-based, digital-first platforms presents traditional veterinary practices with a pivotal question: resist, retreat, or reconfigure?

For decades, veterinary care has been defined by brick-and-mortar clinics. The model was straightforward – appointments, procedures, prescriptions. But this model was never designed for today’s expectations: 24/7 access, real-time answers, preventative guidance, and fixed-cost transparency. As new entrants deliver on these demands digitally, traditional clinics are being forced to confront their own structural limitations.

Some view the trend as a threat to their clinical authority and client relationships. But framing this evolution as competition misses the larger opportunity. In truth, these models don’t replace what clinics do – they fill the spaces in between. And for practices that embrace this reality, digital platforms offer not a threat but a strategic partner.

Hybrid care is emerging as a viable solution. Clinics that incorporate virtual consults – either independently or through collaboration with subscription providers – can triage non-emergency cases more efficiently, free up in-clinic capacity, and reduce staff burnout. This is especially critical as workforce shortages continue to mount. By adding a digital layer, clinics can serve more patients without diluting the quality of care.

The integration opportunity extends further. Clinics that lean into wellness plans, recurring product bundles, or asynchronous follow-ups are finding new ways to generate revenue, build loyalty, and align with how modern pet owners think. The shift from transactional care to relational care – something digital-first platforms do exceptionally well – can be mirrored within physical practices through smarter use of CRM systems, automated reminders, and bundled service pricing.

However, cultural shifts may prove more challenging than technological ones. Pricing transparency, a cornerstone of the subscription model, forces clinics to re-evaluate the traditional ambiguity around fees. Similarly, expectations around always-on access mean that practices must reconsider staffing models, triage protocols, and customer service norms.

Still, the alternative is stagnation. Pet owners will increasingly gravitate toward models that give them more control, clarity, and connection. If clinics don’t evolve in parallel, they risk becoming not obsolete, but peripheral – consulted only in crisis, instead of trusted across the care journey.

The path forward for traditional veterinary care isn’t defensive – it’s adaptive. The future belongs not to those who replicate digital models, but to those who integrate them with the irreplaceable expertise of in-person care.

What Subscription Care Reveals About Consumer Psychology

The growth of subscription-based veterinary care cannot be explained by technology alone. At its core lies a deeper psychological shift: the redefinition of care from a transactional act to an ongoing relationship – one that is emotional, preventative, and embedded in daily life.

Pet owners are no longer engaging with veterinary services purely out of necessity. They are engaging out of responsibility and routine, adopting the behaviours they’ve internalised from human wellness – preventative check-ups, continuous monitoring, and personalised guidance – and projecting them onto their animals. This is not sentimentality; it’s behavioural logic. Pets are increasingly viewed not as dependents, but as extensions of the self. Caring for them is seen as a reflection of competence, compassion, and control.

Subscription models tap directly into this psychological orientation. The fixed monthly fee does more than spread out cost – it reduces decision friction. Owners no longer have to weigh whether a behaviour warrants a $90 consult. They can simply ask. This freedom from hesitation leads to greater engagement, earlier intervention, and – crucially – higher customer satisfaction.

The format itself matters. Subscriptions create a psychological contract: a sense that care is ongoing, not contingent. This fosters trust and encourages owners to interact with the service even when nothing seems urgent. As usage increases, so does perceived value – making cancellations less likely and loyalty more resilient, even in times of economic pressure.

This model also aligns with modern consumers’ preference for predictability over spontaneity, especially among Gen Z and millennials. These cohorts are more likely to use budgeting apps, mental health platforms, and fitness subscriptions than previous generations. In this landscape, paying monthly for a responsive, wellness-oriented vet service doesn’t feel like an expense. It feels like a responsible default.

The emotional context is equally significant. Pet health triggers the same anxiety as human health, often without the institutional support systems or insurance coverage. Subscription care offers not just medical advice, but peace of mind – a buffer against uncertainty that is worth paying for, even if it’s never used.

What we’re witnessing is not just a new way to deliver veterinary services. It’s a new way to frame value, build trust, and establish relevance in the lives of modern pet owners – anchored as much in psychology as in medicine.

From Reactive to Relationship-Based Care

The next frontier in pet healthcare will not be built solely on digital access – it will be defined by intelligence, personalisation, and integration. Subscription models have laid the foundation. What comes next is an ecosystem where care is continuous, contextual, and increasingly predictive.

Already, we’re seeing early signals. AI-enabled symptom checkers and triage bots are improving accuracy and efficiency in first-line responses, particularly in high-volume markets like the US and UK. Wearables are moving beyond step tracking, offering real-time insights into sleep quality, heart rate variability, and behavioural anomalies – data that can trigger interventions before a clinical symptom emerges. And at-home diagnostics, from microbiome testing to genetic screening, are making it possible to detect risk factors earlier than ever before.

As these tools mature, the role of the veterinarian will evolve. Less gatekeeper, more guide. Less episodic expert, more integrated partner. Pet care will mirror the best of modern human healthcare: digitally enabled, insight-driven, and co-managed by both professional and consumer. The brands and clinics that succeed will be those that understand not just what services to offer, but how to build lasting relevance in a world of empowered pet parents.

In this landscape, market research becomes more essential – not less. Understanding the emotional, cultural, and behavioural drivers behind pet care decisions is critical to navigating what’s next. Data alone can reveal what consumers are buying; insight reveals why – and what they’ll demand next. Whether it’s segmenting how Gen Z in Bangkok approaches preventative pet care, or tracking the adoption curve of tele-vet platforms among suburban households in Manchester, the businesses that win will be those that treat insight as strategy, not a sidebar.

The future of veterinary care is not about digitising the past. It’s about reshaping the relationship between pet, owner, and provider. What began as a convenience – subscriptions, on-demand chat, symptom checkers – is becoming an expectation. The logic of episodic care is giving way to a relationship economy, where value is measured not just in outcomes, but in consistency, confidence, and care continuity.

Veterinary practices, platforms, and brands alike face a choice. Compete on service, or compete on understanding. In an age of intelligent pet wellness, the latter will shape the next generation of care.