In a trade hall packed with natural food startups and plant-based hopefuls, the mushroom drinks were among the first to sell out. Odyssey’s lion’s mane “cold brew” disappeared before lunch. Popadelics’ truffle-dusted shiitake chips were gone by midday. And when the Natural Products Expo West wrapped for the year, trend watchers were left with one clear takeaway: mushrooms have stepped into the spotlight.

What was once a fringe ingredient, used mainly in traditional medicine or tucked inside a risotto, is now breaking into every aisle of the supermarket. In the past year, US retail sales of foods and drinks featuring “super mushrooms” hit 642 million dollars, rising nearly 20 per cent according to SPINS, a retail data provider specialising in natural and wellness products. Mushroom-based teas and ready-to-drink coffees surged 250 percent. Even kombucha brands have started adding lion’s mane and chaga, with that segment growing 71 percent year-on-year.

For many shoppers, the appeal is simple. These products promise benefits like focus and energy without the sugar highs or stimulant crashes. Once limited to wellness circles, mushrooms are now part of the grocery routine. They’re showing up in coffee replacements, snack packs, and evening wind-down drinks. What started as a fringe supplement is becoming a habit.

From Folk Remedy to Modern Shelf

Long before they appeared in energy drinks and snack aisles, mushrooms were prized in ancient medicine. Reishi was known as the “mushroom of immortality” in China. In Siberia, chaga was brewed to withstand winter. Even Ötzi the Iceman carried medicinal fungi over 5,000 years ago.

These weren’t culinary choices. They were tools for stamina, clarity, and resilience. Today’s mushroom boom draws from those roots—but trades folklore for sleek packaging and science-backed positioning.

Lion’s mane is now sold for memory. Cordyceps for stamina. Reishi for sleep. Some of the science is still emerging. Yet global momentum is clear. In one year, functional mushroom supplements brought in over 396 million dollars in the US alone, according to the Nutrition Business Journal.

What was once foraged is now formulated. Mushrooms are no longer a footnote in wellness. They’re becoming fixtures in grocery carts and morning routines.

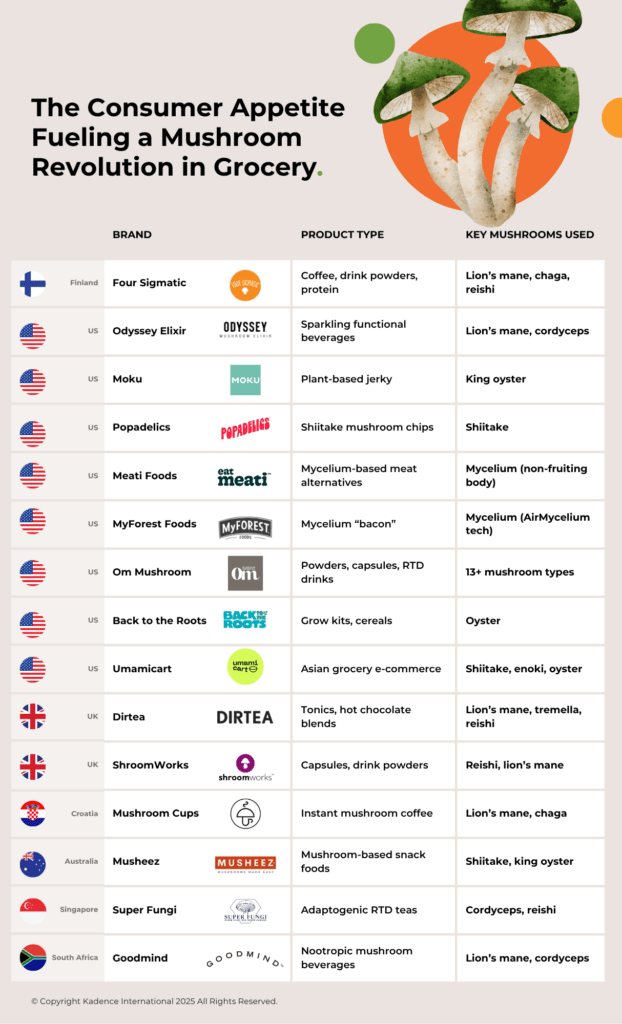

The Brands Leading the Charge

Momentum in the mushroom category is not driven by a single breakout product but by a wave of innovation across beverages, snacks, supplements, and alternative proteins. This is not a health food aisle phenomenon. It is happening at scale, across national chains and direct-to-consumer platforms, with products designed to meet shoppers where they are.

In Finland, Four Sigmatic was among the first to position mushrooms as an everyday wellness tool. The company, founded by a group of foragers and biohackers, built an early following through niche communities. Today, its products are carried in over 7,000 stores across the United States, including Target, Whole Foods, Sprouts, and Walmart. Sales have surpassed 200 million dollars. Its lion’s mane coffee sachets, reishi hot cacao blends, and adaptogenic protein powders are no longer sold on novelty. They are merchandised on functionality, with new packaging focused on outcomes like “Think,” “Calm,” and “Defend.”

Odyssey Elixir, based in Los Angeles, has taken a more caffeinated path. The company produces sparkling beverages infused with lion’s mane and cordyceps, positioned as a clean energy alternative for younger consumers who are moving away from sugary sodas and synthetic ingredients. In 2023, Odyssey sold nearly 10 million cans and secured 6.3 million dollars in venture funding. Retail presence expanded rapidly, reaching over 6,000 stores, including CVS, 7-Eleven, and Publix. The brand’s founder, Scott Frohman, recalls early rejections from buyers. When Publix passed on the pitch, it was data from competitors that changed their minds and brought the brand onto shelves a few months later.

Across categories, these brands are responding to a spectrum of consumer priorities—mental focus, stress relief, indulgent snacking, and sustainable protein. Mushrooms provide a format flexible enough to meet all of them, whether brewed, blended, or jerky-dried.

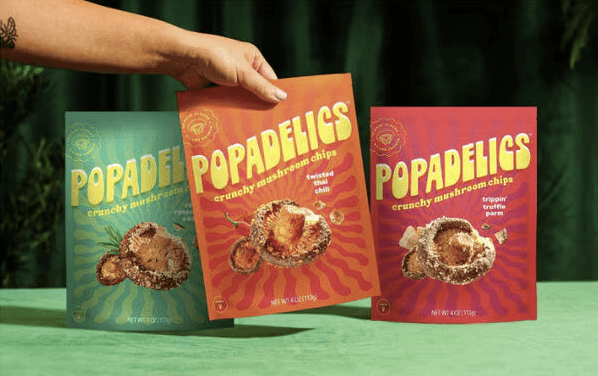

In the snack aisle, Popadelics has turned shiitake mushrooms into a conversation starter. The brand launched through lifestyle marketing, placing its products in fashion boutiques and music festivals before entering grocery retail. By mid-2023, it had secured national distribution through Whole Foods. Some flavours remain backordered, a reflection of both novelty appeal and genuine demand.

Further up the supply chain, companies like Meati Foods are taking a different approach. Instead of using mushroom fruiting bodies, Meati grows mycelium, the root-like structure of fungi, as a base for alternative meat. Its steaks and cutlets are now sold in more than 7,000 stores. With more than 350 million dollars in investment and a 100,000-square-foot production facility in Colorado, the company is positioned as a contender in the race to scale sustainable protein.

These brands are not riding a single trend. They are building around a spectrum of consumer priorities, from mental focus and stress relief to indulgence and sustainable protein. Mushrooms offer a versatile base. Whether brewed, blended, baked, or dried into jerky, they are being used to create products that feel both innovative and familiar, crafted for mass retail and everyday use.

Science or Speculation

The popularity of functional mushrooms has grown faster than the body of evidence behind them. For every shopper who adds lion’s mane to their coffee for focus or chaga to a smoothie for immunity, there is still a lingering question of whether the benefits hold up under scientific scrutiny.

Research has made some progress. Lion’s mane has shown promise in small clinical studies related to cognitive support and nerve regeneration. One 2020 trial in Japan found that daily supplementation improved mild cognitive impairment among older adults. Other mushrooms have drawn interest for their immune-modulating compounds, particularly beta-glucans. In Japan, lentinan from shiitake and PSK from turkey tail are already used as adjuvant cancer therapies. These applications, however, remain outside the scope of conventional Western diets.

Image credit: Moku

In the United States, regulators have taken a cautious approach. The Food and Drug Administration has issued warning letters to brands making disease-related claims. Terms like “supports immunity” or “promotes mental clarity” are generally permitted. Anything more specific invites enforcement. This became clear in late 2024, when the agency declared Amanita muscaria, the hallucinogenic mushroom often found in “legal trip” candies and microdose gummies, as not generally recognised as safe. That designation removed the product from the food market, highlighting how quickly the line can shift between innovation and violation.

While most functional mushroom brands operate within approved boundaries, the category still lacks standardisation. There is little consistency in how extracts are processed, how doses are measured, or how active compounds are verified. This variability makes it difficult for researchers to compare outcomes, and for consumers to understand what they are buying. Experts like Dr. Julie Daoust, Chief Science Officer at M2 Ingredients, say that the future of the category will depend on clarity. “Modern wellness consumers are becoming increasingly educated,” she notes. “They want simplified products that are supported by data.”

Until more robust trials are conducted, much of the appeal will rest on experience and belief. That does not necessarily diminish the impact. In many cases, consumers are not expecting mushrooms to treat illness. They are reaching for products that feel better in the body and align with broader shifts toward clean energy, natural focus, and proactive health. For now, mushrooms sit in that quiet space between proven and promising, sold not as cure-alls, but as tools for daily performance.

Who Is Buying and Why

Functional mushrooms are no longer confined to fringe wellness circles. Today, their customer base spans from college students searching for natural focus to middle-aged parents replacing energy drinks with lion’s mane coffee. What connects them is not a demographic profile, but a shared appetite for clean-label function and the idea that food should do more than fill.

A national survey by the Nutrition Business Journal in 2024 found that 37 percent of Americans use foods or beverages enhanced with functional mushrooms. Another 27 percent report taking mushroom-based supplements. Usage is highest among Gen Z and millennials, but the interest cuts across age groups. These are not isolated early adopters. They are mainstream consumers with a growing awareness of terms like adaptogen and nootropic, many of them learning through TikTok reels or Amazon reviews rather than clinical trials.

Within that broader pool, motivations vary. Gen Z buyers are often looking for energy and focus. They are replacing sugar-heavy drinks with sparkling mushroom elixirs like Odyssey or swapping coffee for Four Sigmatic sachets that offer mental clarity without the caffeine crash. Amazon reported a 47 percent year-on-year increase in searches for adaptogens, a signal that functional terms are resonating with digital-native shoppers.

Millennials, meanwhile, are turning to mushrooms for stress support and immune resilience. The pandemic reshaped health priorities, and fungi-based products now offer a gentle, daily form of reinforcement. Reishi teas and chaga lattes are positioned as alternatives to wine or melatonin, especially for young parents navigating burnout. Familiar formats like snacks, broths, and chocolate blends continue to drive adoption.

The older end of the market is growing too. Interest in cognitive health and natural anti-inflammatory solutions is drawing Gen X and Boomers into the category. Many are less influenced by brand aesthetics and more persuaded by mainstream media coverage or endorsements from integrative doctors. When Lifeway Foods, best known for kefir, launched a mushroom beverage line in 2024, it was positioned for this segment with a focus on wellness benefits rather than trendy packaging.

These consumer groups are distinct, but the unifying thread is trust. People want to feel that what they are buying is real, purposeful, and rooted in something beyond marketing. That is part of why mushrooms, with their history in traditional medicine and visible whole-food forms, are outpacing some of the synthetic functional trends of the past decade.

The traction isn’t lost on grocers and investors. NielsenIQ reports that mushroom-containing grocery products generated over 3.4 billion dollars in US sales last year. Performance-focused segments led the charge, with sports-oriented mushroom products growing more than 30 percent. For a category that only recently stepped out of the supplement aisle, these numbers point to long-term viability—and a new kind of strategic relevance across the food and beverage industry.

As the category matures, consumer expectations are rising. Shoppers are examining ingredient sourcing, evaluating dosage, and learning to read labels more precisely. What began as a novelty has become part of the weekly grocery routine. Mushrooms are no longer just ingredients. They signal something deeper, carrying emotional meaning and delivering real benefits like focus, calm, or stamina.

The Retail Shift and Supply Chain Pressure

The popularity of mushroom-based products has not just reshaped consumer preferences. It has also forced retailers and suppliers to rethink how they categorize, source, and scale a once-afterthought food group.

In grocery stores across the United States, mushrooms have expanded beyond the produce section and supplement aisle. Retailers are building wellness-focused sets, grouping lion’s mane coffees, reishi teas, and chaga powders alongside probiotics and adaptogens. At Whole Foods, end caps now feature mushroom snacks next to CBD seltzers. Target, Walmart, CVS, and even 7-Eleven have integrated mushroom drinks into mainstream shelving. The placement is not just trend-based. It reflects strong sales and consumer pull.

This retail expansion is creating real pressure upstream. Demand for mushroom ingredients now exceeds what many producers can deliver. Lion’s mane, sought for its effects on focus and memory, grows slowly and resists easy cultivation. Cordyceps requires tightly controlled light and temperature conditions. Chaga, most commonly wild-harvested from birch trees in cold climates, can take years to reach maturity. For suppliers, this creates a bottleneck.

Image credit: Popadelics

Some companies are responding with vertical integration and tech-enabled growing systems. MyForest Foods operates a mycelium farm in New York and recently expanded to Canada, using fermentation and climate control to grow slabs of mushroom root for its alt-protein products. Meati Foods has built one of the largest mycelium production facilities in North America, capable of delivering the volume required for mass grocery distribution. These are not small experiments. Meati has received more than 350 million dollars in investment, and MyForest is scaling its AirMycelium platform to meet growing demand from CPG partners.

Yet even these systems are feeling strain. Popadelics, the mushroom chip brand now stocked in Whole Foods nationwide, has announced product backorders due to sourcing limits. As the category grows, more brands are competing for a limited supply of high-quality extracts. The result is a market where product development timelines are stretching, and price volatility is beginning to emerge.

Retailers are staying committed. Sales justify the shelf space, and consumers continue to respond to new formats and claims. But behind the merchandising, the category is in flux. Mushrooms are no longer confined to niche shelves. As they scale into commodity status, they bring new challenges in pricing, sourcing, and traceability.

Image credit Odyssey Elixir

The Fungi Future in CPG

Once a wellness niche, mushrooms have become one of the most dynamic shifts in packaged food. They tap into a rare combination: performance, familiarity, and freshness of format. As this momentum builds, the question is no longer whether functional mushrooms will remain relevant, but how far they might spread.

Across grocery aisles, mushrooms now carry the kind of meaning once reserved for probiotics or protein powders. These products are more than just ingredients. They’ve become symbols of focus, energy, and resilience. That shift moves them from fad to fixture. And mushrooms are showing signs of exactly that shift—embedded in daily routines, no longer riding novelty alone.

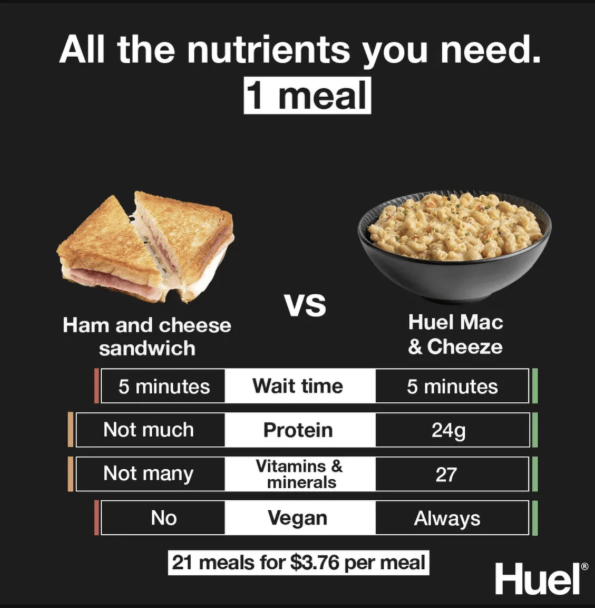

That shift has implications for how brands develop products and tell stories. Mushroom ingredients are already moving into formats far beyond coffee and jerky. Companies are testing fortified cereals, protein bars, and baby snacks. Lifeway Foods launched a mushroom-enhanced kefir line aimed at immune support. Alt-protein brands like Meati and MyForest are pitching fungi not as meat substitutes, but as a standalone category with its own identity. Even koji, a culinary mould used in fermented foods, is being reimagined as a flavour-forward ingredient for sauces, vegan charcuterie, and marinades.

This diversification reflects a deeper change in consumer behaviour. Shoppers are no longer driven solely by the desire for less – less sugar, meat, or caffeine. They are also seeking more. More utility, more focus, more resilience built into the rituals of daily life. Mushrooms, with their blend of medicinal history and modern formatting, speak to that shift. They align with a cultural moment focused on performance without pills and natural function without sacrifice.

What comes next is likely a wave of acquisitions and standardisation. Large CPG companies are watching closely. Some, like Danone and Constellation Brands, have already invested in adjacent wellness categories. Others are expected to move soon. As the category scales, we will see greater pressure for consistency, potency, and proof. That will mean clearer labelling, stronger supply chain traceability, and, inevitably, more clinical research. It may also mean a shakeout, as the market distinguishes between products that deliver and those that simply follow.

The fundamentals remain strong. This is a category built on tangible ingredients, measurable interest, and repeatable consumer habits. It has grown quietly, through everyday formats like coffee and snacks, not through Instagram hype. That subtle momentum may be its biggest strength. Functional mushrooms are not trying to disrupt. They are trying to last.

In a marketplace flooded with fleeting claims, mushrooms are offering something different: daily utility, steady results, and emotional resonance. They are not promising transformation. They are becoming habit. For CPG giants and startup founders alike, the question is no longer if mushrooms will lead. It is whether the rest of the aisle is ready to follow.

Understand What Today’s Consumers Really Want

From flavour innovation to functional benefits, consumer expectations are shifting fast. Our research helps CPG and food and beverage brands uncover the insights behind purchase decisions—so you can create products that resonate and endure. Kadence International is your partner in making smarter, evidence-based moves in a changing market. Submit a brief to start your project.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director