Healthcare, at its core, revolves around people. From intricate surgeries to innovative health tech, the ultimate goal remains constant: improving patient outcomes. Understanding the myriad perspectives of patients and providers is central to achieving this.

Enter focus groups. More than mere conversation circles, focus groups in healthcare have become essential feedback tools that drive change.

Understanding the Significance of Focus Groups in Healthcare

Focus groups comprise select individuals representing specific demographics, brought together to deliberate on designated topics. Within healthcare, they’re more than just discussions—they’re symposiums of lived experiences, professional insights, and potential solutions.

The Expanding Role in Healthcare

Cracking the Patient Experience: More than just gauging satisfaction, focus groups examine patients’ emotional journeys, pinpointing precise moments of unease, joy, or confusion during their healthcare experiences.

Shaping Medical Innovations: As tech pushes the boundaries of medicine, these groups serve as critical sounding boards. They relay potential user needs and unvoiced concerns, ensuring innovations are both groundbreaking and grounded in reality.

Informing Health Policies: As policies lay the framework for practice, focus group insights ensure these frameworks resonate with real-world needs and challenges.

Diving Deeper into the Pros and Cons

Advantages of using focus groups in a healthcare setting:

- A Spectrum of Views: A well-conducted focus group offers a kaleidoscope of perspectives, often uncovering nuances missed in larger surveys.

- Interactive Feedback Loop: Real-time conversations allow for spontaneous questions, generating richer data.

- Revelation of Uncharted Concerns: These groups can spotlight issues entirely off researchers’ radar, paving the way for preemptive solutions.

Disadvantages of using focus groups for healthcare products and services:

- Qualitative versus Quantitative: Focus groups give depth, not breadth. They reveal the ‘why’ but may not always represent the majority sentiment.

- Dominance Bias: The loudest voices might overshadow subtler, equally vital inputs.

- Resource Intensity: From recruitment to analysis, focus groups demand time, expertise, and tools.

Methodology, Tools and Techniques

Strategic Recruitment: Leveraging digital platforms or specialised patient databases can ensure a diverse participant mix.

Comprehensive Recording: Advanced audio and video equipment capture every nuance for richer patient experience analysis.

Expert Transcription: Professional services can translate discussions into data-ready formats.

Sophisticated Data Analytics: With tools like NVivo, qualitative data becomes actionable insights.

Embracing Digital Evolution: Platforms like Webex or Google Meet now facilitate virtual focus groups, erasing geographical boundaries and logistical hiccups.

Examples of Focus Group questions for healthcare services

Given the broad spectrum of the healthcare field, here is a blend of open-ended and closed questions that can be adapted across various healthcare contexts:

Open-ended Questions:

Understanding Patient Experience: “Can you walk us through your last visit to our facility? What stood out to you the most?”

Identifying Pain Points: “What challenges or inconveniences have you encountered while accessing our healthcare services?”

Treatment and Follow-up: “Describe how you felt about the communication and guidance you received post-treatment. Were there areas you wish had been addressed differently?”

Digital Health Experience: “How has your experience been using our online patient portal or telehealth services? What improvements would you suggest?”

Closed Questions:

Closed questions can yield direct, quantifiable responses, while open-ended ones allow patients to share more comprehensive insights, making them a rich source of qualitative feedback. Both are crucial for refining healthcare delivery. Here are some examples of closed questions:

Facility & Staff Evaluation: “On a scale of 1-10, how would you rate the cleanliness and ambience of our facility during your last visit?”

Appointment Scheduling: “Was the process of scheduling your last appointment straightforward and convenient? (Yes/No)”

Professional Interaction: “Did our medical staff explain the procedures and treatments in a manner easy for you to understand? (Yes/No/Somewhat)”

Privacy Concerns: “Do you feel your personal and medical information is kept confidential with us? (Yes/No)”

Exploring Mental Healthcare: Insights from European Adults with Lived Experiences

Background

Mental well-being is fundamental to society, and while the World Health Organisation (WHO) underscores pillars like availability, accessibility, quality, and acceptability of healthcare, there’s a noticeable gap in high-quality mental healthcare for many Europeans. Tapping into the perspectives of those with firsthand experiences can yield deeper insights. This study aimed to collate the experiences of adult Europeans navigating mental healthcare.

Methodology:

The study engaged 50 participants from various European countries with diverse mental health challenges. Their experiences spanned both private and public sectors, covering inpatient and outpatient care. These participants were grouped for focus group interviews. All sessions, totalling seven, were meticulously audio-recorded and transcribed. A comprehensive thematic analysis led to the identification of five major themes, further divided into 13 subthemes.

Key Findings:

The Quest for Assistance:

- Recognising when professional intervention is needed.

- Confusion about where to turn for aid.

- The critical nature of timely assistance.

The Waiting Game: Assessment & Treatment:

- Feelings related to being given priority or lack thereof.

- Emotions of feeling forgotten during extended referral processes.

Treatment: A Mosaic of Needs:

- The role of medication and dedicated professionals.

- Collaboration and consensus on treatment routes.

The Pillars of Care: Consistency and Dignity:

- The undeniable value of consistent care is rooted in empathy.

- The need for a respectful care environment.

Roadmap to Refinement:

- Simplifying and enhancing care access points.

- Amplifying mental health awareness.

- Recognising patients as unique individuals with untapped potential.

This study offers a profound, user-centred lens into the world of mental healthcare in Europe, suggesting pathways to better, more compassionate care.

Final Thoughts

The healthcare universe is expansive, with every innovation, policy, or procedure having profound ripple effects. Focus groups serve as invaluable touchpoints, grounding these ripples in the reality of patient experience. As health standards evolve, the nuanced feedback from such groups ensures that change remains not just technologically advanced but deeply human-centric.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

With retail shelves brimming with products promising plumper lips, fewer wrinkles, and flawless skin, the global health, beauty, and wellness market is on track to reach an estimated seven trillion dollars. And beauty consumers are not holding back. Consumers worldwide are scouring retail and digital shelves to find legacy brands and start-ups. Everything has changed, from beauty products to how they are marketed to even the end user.

Wellness and self-care are at centre stage, and the beauty and personal care industry is experiencing a profound shift towards sustainability, ethical sourcing, and self-care rituals that help destress. These shifts reflect a broader cultural movement where individuals prioritise external beauty and inner well-being. With a conscious investment in self-care, consumers seek products that facilitate a deeper connection with themselves, marking a transformative shift in the industry.

While beauty consumer is ready to open their wallets to look and feel good, they all have unique values and behaviours. So, how do beauty brands target their consumers?

The good news is with the growth of digital media, targeting the right people is easier than ever —but to do that effectively, brands need to understand different brand personas clearly.

How Beauty Personas Help Brands Understand What Their Customers Want

A consumer persona is a detailed profile representing a specific segment of a brand’s target audience. It embodies demographic information, behavioural characteristics, motivations, and pain points, giving brands a vivid depiction of their customers and their desires.

When beauty brands understand and craft these detailed personas, they can better align their product offerings with the unique needs of each consumer segment, providing personalised solutions that resonate more profoundly with their target audience.

Understanding consumer behaviour, buying habits, and preferences is key to staying competitive in the ever-evolving beauty industry. Different types of buyers each come with their unique expectations, wants, and needs. In this post, we will uncover the personas of eight distinct types of beauty buyers to help beauty brands navigate this multifaceted market.

From values and priorities to buying habits and preferences, each type of beauty buyer presents a unique opportunity for brands to resonate on a deeper level, helping brands better connect with these segments.

Segment 1 – Conscious Consumer

Overview

Conscious Consumers represent a growing segment in the beauty industry. Their buying behaviour is strongly influenced by environmental sustainability, ethical sourcing, and social responsibility in their beauty purchases. Their focus extends beyond personal benefit; they often scrutinise labels for eco-friendly ingredients and are willing to pay a premium for products that align with their values.

Values and Priorities

- Environmental Sustainability: Conscious Consumers actively seek products with minimal environmental impact. They value and support brands that practice responsible sourcing and manufacturing. They are often willing to invest more in organic, natural ingredients harvested sustainably.

- Ethical Integrity: This includes a commitment to cruelty-free testing, fair wages, and social justice within the company’s supply chain. They seek transparency and honesty in the products they buy.

- Transparency: Full disclosure of ingredients, sourcing, and corporate practices is vital to Conscious Consumers. They appreciate brands that are open about their values, supply chain, and manufacturing practices.

Product Preferences

- Natural and Organic Ingredients: Emphasis on botanicals, vitamins, and nourishing substances with a low ecological footprint. They favour products that use renewable resources and have a minimal environmental impact.

- Reusable or Recyclable Packaging: A strong preference for minimalistic and recyclable packaging, avoiding single-use plastics and excess materials.

- Cruelty-free Products: Items not tested on animals, certified by reputable agencies, are highly appealing to this segment.

Current Trends and Impact on the Beauty Industry

- Growth of Eco-Friendly Brands: The rising demand for green beauty products has encouraged many brands to reformulate and repackage, driving innovation and new trends within the industry.

- Transparency in Labeling: Brands now offer detailed information about ingredients and their sourcing, increasing consumer trust and loyalty.

- Influence on Other Segments: The principles of the Conscious Consumer are spreading to other segments, broadening the impact on the beauty industry. It is causing ripple effects, forcing the entire industry to reconsider their practices.

Segment 2 – The High-End Hauler

Overview

High-End Haulers are defined by their taste for luxury, exclusive, and often designer beauty products. Quality, prestige, and exclusivity drive their purchasing decisions. They are not just buying products; they are buying a luxurious experience and a symbol of status. High-end haulers are often willing to invest substantially in beauty products, seeking the finest ingredients, elegant packaging, and a brand name that resonates with luxury and success.

Values and Priorities

- Quality Over Quantity: High-end haulers prefer fewer but more premium products. They value the sophistication of formulations, textures, and sensory experiences that luxury products offer.

- Brand Prestige: They often opt for well-known luxury brands that offer a status symbol. The brand’s heritage, story, and reputation can be as important as the product.

- Personalised Experience: Tailored products, personalised recommendations, bespoke packaging, and exceptional customer service are vital to this segment.

Product Preferences

- Designer Brands: High-end haulers are attracted to exclusive brands that signify a certain social status. The allure of limited editions, collaborations with designers, and unique products drive their purchases.

- Innovative Formulations: Cutting-edge technology, rare ingredients, and pioneering techniques that promise unique benefits and superior performance are particularly appealing.

- Luxurious Packaging: Packaging that exudes elegance and exclusivity, often with intricate designs and high-quality materials, is highly valued by this beauty segment.

Current Trends and Impact on the Beauty Industry

- Rise in Niche Luxury Brands: There’s a surge in smaller, niche luxury brands offering bespoke services, exclusive products, and unique brand stories. This has led to a more diverse and vibrant luxury beauty landscape.

- Technology Integration: Virtual try-ons, augmented reality, AI-powered recommendations, and other technological innovations enhance the shopping experience, making it more interactive and personalised.

- Sustainable Luxury: Some high-end brands are incorporating eco-friendly practices and aligning with the values of Conscious Consumers. This trend reflects the growing importance of sustainability, even within the luxury segment.

Segment 3 – The Skinminalist

Overview

Skinminalists embrace a minimalist approach to skincare, focusing on essential, multitasking products that offer efficiency without sacrificing effectiveness. Instead of following a complex, multi-step routine, Skinminalists believe in the ‘less is more’ philosophy. They aim to cut through the noise and focus on what matters, often relying on a few core products that meet all their skin’s needs.

Values and Priorities

- Simplicity: A preference for a simplified routine with fewer products that can still deliver results. They often look for streamlined collections and multi-purpose items.

- Quality Ingredients: For Skinminalists, each product must serve multiple purposes and contain high-quality, effective ingredients. They value formulations that are thoughtful and intentional.

- Transparency: Understanding what each product contains and why is vital for Skinminalists. They often research and educate themselves about ingredients and look for brands that share their philosophy.

Product Preferences

- Multitasking Products: Items that can cleanse, hydrate, and treat simultaneously are appealing, as they simplify the routine and reduce clutter.

- Clean Formulations: Preference for products free from unnecessary additives, fragrances, and fillers. They look for straightforward, effective formulations.

- Efficiency: Products that offer quick, visible results with minimal effort. Time-saving solutions are key for this segment.

Current Trends and Impact on the Beauty Industry

- The decline of 10-Step Routines: As a direct counter to elaborate multi-step routines, the skinminalist approach is gaining traction. It represents a shift towards mindful consumption and thoughtful beauty practices.

- Rise of Indie Brands: Smaller brands focusing on transparent, minimalist products are gaining popularity. Their approach resonates with the skinminalist philosophy, and they often build a strong community around these values.

- Alignment with Conscious Consumer Values: There’s a noticeable overlap with the values of Conscious Consumers, especially in terms of sustainability and ingredient integrity.

Segment 4 – DIY Diva

Overview

DIY Divas represent a creative and resourceful segment in the beauty industry. These individuals prefer making beauty products, often using natural ingredients in their kitchens. Whether it’s creating facial masks, body scrubs, or hair treatments, DIY Divas enjoy the process of crafting personalised solutions. They value the authenticity, customisation, and empowerment of creating their beauty essentials.

Values and Priorities

- Creativity: DIY Divas enjoy experimenting and creating. They enjoy mixing, measuring, and crafting products tailored to their needs.

- Independence: They love controlling what goes into their products, ensuring they know every ingredient.

- Economic and Environmental Consideration: DIY often means cost savings and reduced packaging, aligning with eco-friendly practices.

Product Preferences

- Natural Ingredients: DIY Divas often turn to natural, easily accessible ingredients such as honey, oats, essential oils, and herbs.

- Customisable Solutions: Products tailored to individual preferences, skin types, and specific concerns are highly appealing.

- Do-it-Yourself Kits: Some brands offer DIY kits with all the necessary ingredients and instructions, which is particularly appealing to this segment.

Current Trends and Impact on the Beauty Industry

- Rise of DIY Recipes and Tutorials: Social media platforms are flooded with DIY beauty tutorials, recipes, and inspiration, fostering a community of like-minded individuals.

- Brands Offering DIY Solutions: Recognising this trend, some brands have started offering DIY kits, ingredients, and guidance, bridging the gap between traditional retail and DIY.

- Sustainability and Waste Reduction: The DIY approach often reduces packaging and waste, contributing positively to environmental sustainability.

Segment 5 – Wellness Warrior

Overview

Wellness Warriors view beauty through the lens of overall wellness and holistic health. For them, beauty is not just skin-deep; it’s intertwined with mental, physical, and emotional well-being. They often seek products that contribute to their overall wellness, such as aromatherapy oils, wellness supplements, and products infused with calming or energising ingredients.

Values and Priorities

- Holistic Approach: Wellness Warriors see beauty as part of a broader wellness landscape. They often integrate their beauty routine with their daily health practices, looking for products that nourish the body, mind, and soul.

- Mindful Consumption: They approach beauty with mindfulness, considering how products feel, smell, and contribute to their well-being.

- Natural and Healing Ingredients: They are often drawn to ingredients that have traditional healing properties, such as herbs, essential oils, and botanical extracts.

Product Preferences

- Therapeutic Products: Items that offer more than aesthetic benefits, such as stress relief, relaxation, or energy boosting, appeal to Wellness Warriors.

- Nutritional Supplements: Beauty supplements that support skin, hair, and nail health from within align with the holistic approach of this segment.

- Mindful Brands: Brands emphasising wellness, mindfulness, and holistic health often resonate with Wellness Warriors.

Current Trends and Impact on the Beauty Industry

- Rise of Beauty Wellness: Fusing beauty with wellness practices has given birth to a new industry subset focusing on overall well-being. This includes products like face masks with aromatherapy benefits or body lotions infused with calming herbs.

- Integration with Other Wellness Practices: Beauty brands collaborate with wellness experts, offering products that align with yoga, meditation, or other holistic practices.

- Sustainability and Ethical Consideration: Often, Wellness Warriors align with the Conscious Consumer segment, seeking ethically sourced and environmentally friendly products.

Segment 6 – Savvy Shopper

Overview

Savvy Shoppers are characterised by their smart, budget-conscious approach to purchasing beauty products. They hunt for deals, compare prices, read reviews, and often know where to find the best value. They are not driven by brand loyalty but are motivated to find quality products within their budget. Their decisions are often informed, well-researched, and rational.

Values and Priorities

- Cost-Effectiveness: Price plays a significant role, but Savvy Beauty Shoppers are not just looking for cheap products. They want quality items at a reasonable price, providing real value for money.

- Informed Decisions: They often research, read reviews, and compare options. Knowledge is power for this segment, and they usually make well-informed choices.

- Flexibility: Brand loyalty is less critical for this segment. They are open to trying new brands and products if they offer better value or fit their needs.

Product Preferences

- Affordable Quality Products: Savvy Shoppers look for excellent quality products without breaking the bank. They are often drawn to drugstore brands that deliver results at affordable prices.

- Multi-Benefit Products: Items that provide multiple benefits or can serve various purposes are attractive, as they offer greater value.

- Subscription and Bundling Offers: Many Savvy Shoppers take advantage of subscription services or bundle offers that provide savings and convenience.

Current Trends and Impact on the Beauty Industry

- Rise of Direct-to-Consumer Brands: Many affordable, quality brands bypass traditional retail channels, offering better pricing to Savvy Shoppers.

- Influence of Online Reviews: The vast availability of online reviews and beauty blogs is crucial in guiding Savvy Shoppers’ decisions.

- Use of Technology: Price comparison apps, deal websites, and online shopping have become essential tools for this segment, allowing them to find the best deals quickly.

Segment 7- Beautopian

Overview

Beautopians represent a growing and vibrant segment within the beauty industry. For these individuals, beauty goes beyond a mere routine; it’s an integral part of their lifestyle. They view beauty as a path to wellness and joy, often sharing their beauty experiences and discoveries on social media. Mostly comprised of the younger generations like Gen Z and Millennials, Beautopians are enthusiastic about quick-result products and minimal downtime treatments. Though females dominate this segment, there’s a notable increase in male participation.

Values and Priorities

- Beauty as a Lifestyle: Beauty is not a chore or an obligation but a joyful pursuit. It’s intertwined with daily life and contributes to overall happiness and well-being.

- Instant Gratification: The need for quick and visible results is essential. Products or treatments that provide immediate effects are particularly attractive to Beautopians.

- Social Sharing: This segment commonly shares beauty journeys, routines, and successes on social platforms. It creates a sense of community and connection with like-minded individuals.

- Inclusivity and Diversity: While mostly female-oriented, the Beautopian community is beginning to include more male influencers, reflecting a more inclusive and diverse understanding of beauty.

Product Preferences

- Fast-Acting Products: Items that offer immediate results, whether a face mask that instantly brightens or a serum that quickly hydrates, are appealing to Beautopians.

- Innovative Treatments: Open to aesthetic treatments with minimal downtime like PICO laser, Beautopians seek innovations that align with their fast-paced lifestyles.

- Social Media-Friendly Packaging: Products that look good on Instagram or TikTok might be more attractive, as they complement the social-sharing aspect of the Beautopian lifestyle.

Current Trends and Impact on the Beauty Industry

- Rise of Skinfluencers: The increase in beauty influencers, especially male skinfluencers, has helped shape new perceptions of beauty and opened doors for more inclusive product lines.

- Demand for Quick Solutions: The need for instant gratification is driving innovation in product development, with a focus on formulas that provide immediate results.

- Integration of Technology: This segment’s connection between beauty and social media leads to more tech-savvy marketing strategies, such as AR try-ons or virtual beauty consultations.

Segment 8: Non-Conformist Revolutionary

Overview

Non-conformist revolutionaries signify a dynamic shift within the beauty industry. Traditional norms or expectations do not bind these individuals. They see beauty as a platform for self-expression, revolution, and challenging societal conventions.

Attracting a broad age range, especially younger cohorts, is characterised by their bold choices, eco-conscious mindset, and refusal to fit into a one-size-fits-all mould. Gender fluidity is prominent in this group, and they don’t define beauty based on gender but on authenticity and individuality.

Values and Priorities

- Rebellion as Expression: Beauty becomes a tool to challenge societal norms and stereotypes, celebrating uniqueness and difference.

- Eco-consciousness: With an awareness of the planet’s fragility, they prioritise sustainable and eco-friendly products, advocating for a cleaner beauty industry.

- Fluid Beauty: Rejecting gender-based boundaries, they appreciate beauty products made for everyone, regardless of gender.

- Authentic Narratives: Honest brand stories and transparency are critical. They are more likely to support genuine brands and not just marketing a facade.

Product Preferences

- Eco-Friendly Packaging: Sustainable materials, refillable options, and minimal waste are the order of the day. They prefer brands that take a clear stand on reducing environmental impact.

- Bold and Edgy Products: From vibrant hair dyes to unconventional makeup shades, they seek products that help them stand out.

- Gender-Neutral Options: They gravitate towards brands that don’t categorise products by gender, making beauty accessible for everyone.

- Transparent Ingredients: Knowing what’s inside their beauty products is crucial. Clean and cruelty-free formulations have a higher appeal.

Current Trends and Impact on the Beauty Industry

- Rise of Eco-Brands: As the demand for sustainable products grows, brands adopt eco-friendly product formulation and packaging practices.

- Blurry Gender Lines: The traditional division of “men’s” and “women’s” products is diminishing. Brands are now launching gender-neutral lines to cater to the Non-Conformist Revolutionary.

- Shift in Beauty Narratives: Marketing campaigns are becoming more inclusive, focusing on individuality and rejecting the conventional notions of beauty.

- Embracing Raw Beauty: Brands increasingly promote unedited and unfiltered beauty, celebrating scars, freckles, and other “imperfections” as beautiful.

Final Thoughts

Understanding consumer segments in the beauty industry is necessary for today’s highly competitive and ever-evolving beauty market. As illustrated by the eight distinct segments and their respective personas, consumer behaviour in the beauty space is multifaceted and complex. A diverse range of values, preferences, and influences shapes it.

These segments, however, are not isolated entities. They often overlap and intersect, and individuals may identify with multiple segments depending on their unique circumstances and evolving needs. As such, these personas serve as flexible guides rather than rigid classifications.

With the new age of personalised marketing, a deep understanding of these segments enables brands to craft tailored messages that resonate with their target audiences, foster brand loyalty, and drive consumer action. It’s about seeing consumers as individuals with unique needs and aspirations and addressing these with empathy, authenticity, and respect.

Moreover, as societal values and consumer awareness evolve, new segments will likely emerge, and existing ones will further diversify. Sustainability, ethical sourcing, inclusivity, and digital influence are already reshaping the consumer landscape, pushing brands to innovate and adapt. As we navigate this exciting trajectory, ongoing market research will be crucial in staying attuned to these shifts and ahead in the game.

Ultimately, every consumer has a story, which is part of your brand’s narrative. By listening to these stories, understanding these personas, and responding meaningfully, your brand becomes a part of their story. This symbiotic relationship is the essence of successful branding in the beauty industry – and beyond.

Want to download the detailed personas of your beauty consumers? Get our full guide here.

The United Kingdom, often depicted as a homogenised tapestry of afternoon tea and red buses, is a labyrinth of complexities that can confound even the most seasoned marketers. To the uninitiated, it’s easy to fall into the trap of seeing the UK as a monolithic entity, particularly when so many international perceptions are shaped by London’s towering influence. Yet, beneath the canopy of its collective identity lies a medley of regions, each with its distinct cultural heartbeat and consumer behaviour.

Foreign brands seeking to penetrate this market often discover that what thrives in Manchester might falter in Cardiff, and what resonates in Belfast may not necessarily translate in Edinburgh. As globalisation tugs on the threads of local identities, it has never been more pressing for brands to understand the intricate dance of regionalism that defines the UK.

The UK: A Mosaic of Identities

Venture beyond the capital’s bustling streets, and you’ll find a nation teeming with rich histories, vibrant traditions, and – crucially for marketers – distinct consumer habits.

Let’s begin with the broader picture. The United Kingdom is not merely one country; it’s a union of four: England, Scotland, Wales, and Northern Ireland. According to the Office for National Statistics, as of the last census, England housed approximately 84% of the UK’s population, with Scotland accounting for 8%, Wales around 5%, and Northern Ireland close to 3%. Yet, despite these disparities in population, each country has cultivated its own identity, traditions, and consumer patterns.

England, while the most populated, varies significantly within its own boundaries. The cosmopolitan desires of London’s population, boasting a GDP per capita of 56,431 British pounds as of 2021, often differ significantly from the more industrious North or the coastal South.

In Scotland, there’s a profound sense of national pride. A study by VisitScotland showed that over 60% of Scottish consumers preferred buying local products, a number that spikes during key cultural events and holidays.

Wales, on the other hand, retains a robust commitment to its linguistic heritage. Brands such as Lloyds Bank have acknowledged this by offering services in both English and Welsh, addressing the fact that over 870,000 people, or 29% of the Welsh population, can speak the Welsh language, according to the Welsh Language Commissioner’s office.

Then there’s Northern Ireland, a region with its own unique set of socio-political dynamics. Brands seeking to appeal here must understand that consumer choices often intersect with deeper cultural and historical narratives.

And we’re just scratching the surface. Dive deeper into the individual counties of these nations – from Cornwall’s coastal towns to the Scottish Highlands – and the tapestry grows even more intricate. For instance, Oxford’s average salary in 2022 stood at about £37,000, surpassing the UK’s average, hinting at a more affluent consumer base.

The takeaway? A single, blanket strategy for the UK is not just simplistic; it’s commercially naive. Each region, each country, has its own pulse, its own desires, and its own buying triggers. The question then isn’t whether to localise your approach but how.

Consumer Trends Across the UK: Navigating Unified and Divergent Waters

If there’s one certainty about the UK, it’s that you’ll find as many unifying threads as you will divergences. As marketers, understanding these shared trends while paying heed to regional specialities is paramount. Let’s embark on a whirlwind tour of what binds and what differentiates.

Unified Trends:

Across the UK, certain tendencies bridge the gaps between regions. Digital consumption, for instance, is ubiquitous. According to Ofcom’s latest report, 96% of households in the UK have internet access, and a staggering 88% of adults use smartphones. This digital integration has seen the e-commerce sector skyrocket, with the UK boasting the most advanced e-commerce market in Europe. In 2023, the country expects to have nearly 60 million e-commerce users — leaving only a minority of the population as non-digital buyers. As such, e-commerce has undeniably become the norm for shoppers everywhere in the UK, with the extensive online shopping industry influencing UK consumers daily.

Moreover, a shared interest in sustainability is blooming. Two-thirds of UK consumers say they’ve changed their behaviour to be more sustainable. From packaging to product sourcing, the green shift is palpable and imperative to address.

Regional Specialties:

Despite these shared trends, diving deeper into regional waters unveils distinct currents.

Take food preferences, for example. A YouGov survey found that while 68% of English consumers opt for tea as their go-to brew, in Scotland, it’s a closer contest, with coffee garnering a 48% preference. Or consider fashion, where regions like London and Manchester are more receptive to high-end brands, while areas like the West Midlands show a higher inclination for value-for-money retail, as per the UK’s Consumer Spending Report in 2020.

Local festivals also play a role in consumer trends. St. David’s Day in Wales sees a surge in the sale of traditional Welsh products, while Scotland’s Hogmanay is not just a New Year’s celebration but a catalyst for various sectors, from food and beverage to tourism.

Relevance in Resonance:

While these insights might seem like data points in isolation, they are, in reality, the keys to unlocking genuine consumer resonance. A brand’s ability to navigate these unified and divergent waters will determine its success in the dynamic UK market. Whether launching a digital campaign or positioning a product aligned with regional preferences, marketers are tasked with finding the balance between the general and the specific. The landscape may be intricate, but therein lies its charm – and opportunity.

Common Misconceptions about the UK Market: The Peril of Over-Simplification

In marketing, stereotypes can be a double-edged sword. While they can offer an easy route to comprehend a foreign market quickly, they can just as swiftly mislead, resulting in branding blunders or marketing misfires. With its rich tapestry of regional identities and international prominence, the UK has been subject to numerous such misconceptions. Let’s debunk a few.

The London-centric View:

With its iconic skyline and global reputation, London often becomes the default lens through which the UK is viewed. However, equating London’s preferences to the entirety of the UK’s is a gross oversight. Consider the fact that London houses only about 13% of the UK’s population. Moreover, consumers in cities like Birmingham or Manchester have distinct shopping habits and brand loyalties compared to London.

Stereotyping Regions:

From the stoic Scot to the passionate Welsh, regional stereotypes abound. But marketers would do well to tread carefully here. For instance, the notion that all Scots are frugal is debunked by data from the Scottish Household Survey, which highlighted their propensity for luxury goods in certain regions. Similarly, pigeonholing Welsh consumers as primarily rural overlooks the dynamic urban centres like Cardiff, which, according to the Welsh Government statistics, has seen a 12% growth in retail businesses in the last five years.

Over-generalisation of Buying Power:

It’s an age-old myth that the South of England, compared to the North, has uniformly higher buying power. While areas like London and Oxfordshire might boast higher average incomes, cities in the North, such as Leeds or Newcastle, have seen significant economic growth, with the latter experiencing a 5.5% rise in its GDP in 2020.

The UK: One Size Doesn’t Fit All:

Navigating the UK market demands a keen understanding that its regions are as varied in consumer behaviour as they are in culture and history. Misconceptions can not only hurt a brand’s image but can also translate to significant financial losses. As the adage goes, “assume” makes an “ass” out of “u” and “me.” In the intricate dance of the UK’s consumerism, leading with knowledge, not assumption, is vital.

Implications for Marketing and Market Research: Crafting a Symphony from Regional Notes

Armed with the knowledge that the UK is a medley of regions, each humming its own tune, marketers are faced with the daunting yet exhilarating task of orchestrating a symphony that resonates universally and acknowledges these unique melodies. Here’s the maestro’s guide to achieving just that.

Localising Strategies:

The efficacy of a message often lies in its relevance. Brands like McDonald’s have brilliantly tailored their menus and marketing to resonate with regional preferences, introducing the likes of the ‘Bacon Roll’ in England and the ‘Haggis & Turnip Pie’ in Scotland during special promotions. This regional adaptation is no mere marketing gimmick; according to a Nielsen report, products tailored to local tastes have a 50% higher chance of market success in the UK.

Regional Test Markets:

Using specific regions as testbeds can offer invaluable insights. For instance, a product aimed at urban, cosmopolitan audiences might first be introduced in cities like London or Manchester.

Cultural Sensitivity:

Brands must tread the delicate balance of local authenticity without veering into cultural appropriation or insensitivity. The UK’s Advertising Standards Authority reported that culturally insensitive ads saw a 60% higher negative engagement rate. Thus, the mantra is simple: appreciate, don’t appropriate.

The Digital-Physical Balance:

While the digital realm is a dominant force, the physical world still holds significant sway. Brands must, therefore, weave a strategy that seamlessly integrates both.

Consumer Feedback Loops:

With the dynamic nature of consumer preferences, establishing robust feedback mechanisms is non-negotiable. According to a report by Trustpilot, 89% of UK consumers read reviews before making a purchase, emphasising the critical role of consumer voices in shaping brand perceptions and strategies.

Embracing the UK’s Diversity:

Marketers must see the UK not as a challenge but as an opportunity. The diversity offers a playground to craft nuanced, engaging, and effective strategies. However, the crux lies in the research depth, the cultural appreciation, and the agility to adapt. The UK’s consumer landscape isn’t a puzzle to solve but a narrative to co-write, one region at a time.

Case Studies: Insights from the Trenches

When navigating UK’s consumer market, real-world examples offer a goldmine of insights. Here, we present both ends of the spectrum: brands that flourished through astute understanding and those that faltered, providing valuable lessons for future endeavours.

Success Stories:

- Cadbury’s Dairy Milk: To resonate with regional tastes, Cadbury launched its ‘Tastes Like Home’ campaign. Celebrating local flavours, they introduced limited-edition bars like the ‘English Breakfast’ for London and the ‘Welsh Cake’ for Wales. The campaign was a smashing success, with Cadbury seeing a 14% surge in sales in these regions.

- HSBC’s ‘We are not an Island’ Campaign: This banking giant crafted a campaign celebrating the UK’s rich internationalism. From “We are not an island. We are home to Jodrell Bank” for Manchester to “We are not an island. We are part of something far, far bigger” for the UK, these region-specific ads underlined the UK’s global yet intensely local essence. This campaign was lauded for its profound cultural understanding and resulted in a significant uptick in brand sentiment.

- Lush’s Regional Stores: Recognising that what works in London doesn’t necessarily work in Cardiff or Edinburgh, Lush tailored their store layouts, product ranges, and even scent profiles to cater to regional preferences. The strategy bore fruit, with Lush reporting region-specific stores outperforming their generic counterparts by 23% in 2020.

Cautionary Tales:

- Starbucks’ Gaelic Gaffe: To embrace local culture, Starbucks introduced a Gaelic version of its name in Scotland. However, the translation was botched, leading to ridicule on social media. This error not only impacted the brand’s image briefly but also underscored the importance of meticulous research.

- Pepsi’s ‘Come Alive!’ Campaign in Wales: Pepsi’s infamous global tagline, ‘Come Alive with Pepsi,’ translated in Welsh, meant ‘Pepsi brings your ancestors back from the grave.’ This translation error in the 1960s caused a stir and provided a valuable lesson on the importance of cultural and linguistic nuance.

- Nike’s ‘Londoner’ Ad: While Nike intended to celebrate London’s diversity, it inadvertently ruffled feathers in other regions. Critics felt it overshadowed the rich tapestry of athleticism and culture in other parts of the UK. Though the ad was a hit in London, it underscored the risk of regional exclusion.

These case studies underline the pivotal role of understanding in marketing. Success isn’t just about catchy taglines or grand visuals; it’s about respecting, appreciating, and, most importantly, understanding the complex regional nuances of the UK’s diverse consumer landscape.

Practical Tips for Foreign Brands: Mastering the UK’s Multifaceted Marketplace

Diving into the UK’s consumer market is akin to exploring an intricately woven tapestry, where every thread has its tale and every knot has its nuance. For foreign brands aiming to thrive, not merely survive, here’s a practical playbook tailored from lessons both bitter and sweet.

Engage Local Experts:

“When in Rome, do as the Romans do.” This old adage holds profound wisdom. The regional intricacies of the UK are best understood by those who live in them every day.

- Insider Knowledge: Local agencies deeply understand cultural nuances, regional preferences, and consumer behaviour. According to a report by the Market Research Society, campaigns moulded by local insights in the UK had a 35% higher success rate than generic campaigns.

- Avoiding Pitfalls: Navigating potential cultural minefields becomes easier with local expertise. They can flag potential missteps, ensuring the brand resonates with authenticity rather than appropriation.

- Tailored Strategies: A local expert can help customise campaigns to echo the distinct voice of each region, enhancing consumer connection and engagement.

Continuous Learning:

The UK’s consumer landscape is in perpetual motion, moulded by evolving trends, shifting demographics, and global influences.

- Stay Updated: Annual or bi-annual market research isn’t enough. Brands need to stay attuned to the pulse of the market continually. A British Market Research Association report revealed that brands with quarterly or monthly market check-ins enjoyed a 28% higher brand loyalty score in the UK.

- Feedback Channels: Direct consumer feedback, be it through reviews, surveys, or social media interactions, can offer invaluable real-time insights. This ongoing dialogue ensures the brand remains relevant and responsive.

Embracing Digital:

Digital is not just a platform in the UK; it’s a culture. Understanding this digital landscape is paramount.

- E-Commerce Nuances: The UK’s e-commerce sector is robust, with a projected growth rate of 7% annually as per a 2021 eMarketer report. But the game-changer? Personalisation. Brands that tailor online shopping experiences based on regional preferences witness higher conversion rates.

- Regional Social Media Preferences: Platforms like Facebook and Instagram have pan-UK popularity, but certain regions show distinct preferences. For instance, Snapchat sees higher engagement in urban areas like London, while community-driven platforms like Nextdoor are gaining traction in suburban and rural regions.

- Digital Partnerships: Collaborating with local digital influencers or platforms can amplify brand reach. These partnerships, rooted in trust and authenticity, can help brands effectively tap into established regional audiences.

In essence, the UK is not a market to be ‘cracked’ but a narrative to be co-authored. The journey demands respect, adaptability, and an insatiable thirst for understanding. This might not be the easiest market for foreign brands, but with the right approach, it can certainly be one of the most rewarding.

Final Thoughts: The Symphony of Success in the UK’s Market

In the theatre of global markets, the UK stands out not as a singular act but as a multitude of stories, voices, and emotions that intertwine to form a rich narrative. This very diversity and depth make the UK market both daunting and dazzling.

The lure of the UK’s consumer landscape isn’t merely in its purchasing power or digital prowess. It’s in the laughter that echoes in a pub in Belfast, the quiet contemplation in a bookshop in Edinburgh, the bustling energy of a London market, and the age-old traditions upheld in the Welsh countryside. Each story, each emotion presents an opportunity – a chance to connect, to resonate, and to weave a brand’s tale into the fabric of the UK’s legacy.

The real reward for any brand entering this realm isn’t just monetary success. It’s the privilege of being part of a culture that is as diverse as it is deep, as traditional as it is transformative. Yes, the challenges are many – but so are the rewards.

Brands that approach the UK with an open heart and a keen ear will find more than just a market. They’ll discover a world teeming with stories waiting to be told and retold. It’s not about merely selling a product; it’s about creating memories, forging bonds, and leaving an indelible mark.

For those ready to listen, learn, and love, the UK doesn’t just offer a consumer base. It presents a canvas – vast, varied, and vibrant. And on this canvas, with the right strokes of understanding, respect, and innovation, brands can paint masterpieces that endure.

In this pursuit, remember: It’s not about conquering the UK market. It’s about becoming a cherished chapter in its grand, ongoing saga.

Unlock the UK Market with Kadence International

Navigating the UK’s intricate consumer landscape can be overwhelming. But with Kadence International by your side, you’re not journeying alone. Our London office, entrenched in the heart of this vibrant market, offers a fusion of global insights and local expertise.

From deep-diving into regional nuances to crafting campaigns that resonate, our team at Kadence London is dedicated to illuminating the pathways of success for your brand in the UK. Why go it alone when you can have a seasoned partner guiding you at every step?

Ready to make your mark in the UK? Connect with Kadence International today and let our London team be the compass to your brand’s success story.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Have you ever wondered why we, as consumers, make certain choices and decisions? Why do we feel compelled to buy that new gadget or indulge in a luxurious experience? It’s fascinating how our behaviour as consumers are driven by a complex interplay of factors deeply rooted in the intricate workings of our minds.

Understanding the psychology behind consumer behaviour is paramount for brands seeking to connect with their target audience on a deeper level. By delving into the consumer mindset, we can unlock valuable insights that pave the way for effective marketing strategies and campaigns.

From Bartering to Clicking: Tracing the Evolution of Consumerism

As we trace the historical evolution of consumerism, it becomes evident that consumer behavior is not static. It is shaped by societal, economic, and technological changes, reflecting the dynamic nature of our relationship with products and services.

- Barter and Trade: In ancient times, consumerism revolved around simple bartering systems where goods and services were exchanged directly.

- Industrial Revolution: The advent of the Industrial Revolution in the 18th century transformed consumerism. Mass production led to an abundance of products, making them more accessible to the general population.

- Rise of Advertising: The late 19th and early 20th centuries saw the emergence of advertising as a powerful tool to influence consumer behaviour. The shift from informative to persuasive messaging marked a significant turning point.

- Post-World War II Boom: The post-World War II era witnessed an unprecedented rise in consumerism, fueled by economic growth and the desire for a better quality of life.

- Shifting Societal Values: In the 1960s and ’70s, consumer behaviour underwent a transformation as social movements and changing values influenced purchasing decisions. Environmental concerns and ethical considerations began to shape consumer choices.

- Technological Revolution: The advent of the internet and digital technology in the late 20th century revolutionised consumerism again. E-commerce, social media, and personalised advertising opened new avenues for reaching and engaging consumers.

The Driving Forces Behind Consumer Choices

Consumer behaviour lies at the core of successful marketing strategies. Marketers can tailor their approaches to effectively reach their target audience by understanding what drives consumers to make certain choices.

Consumer behaviour encompasses individuals’ actions, motivations, and processes when selecting, purchasing, and using products or services. It is a multidimensional field that integrates elements of psychology, sociology, and economics to understand why consumers behave the way they do.

Brands can create targeted strategies that resonate with their audience by analyzing motivations, emotions, social influence, and cognitive biases, increasing brand loyalty and business success.

Understanding consumer behaviour requires a comprehensive exploration of these psychological factors:

Motivations: Consumer choices are often driven by underlying motivations such as the need for status, belongingness, self-expression, or convenience. According to a study by Harvard Business Review, emotional motivators are twice as powerful as rational motivators in driving consumer decision-making.

Emotions: Emotions significantly influence consumer behaviour, impacting brand perception and purchase decisions. Research by the Journal of Consumer Research suggests that positive emotions increase the likelihood of purchase, while negative emotions can lead to avoidance. Effective advertising campaigns often evoke specific emotions, such as joy, nostalgia, or fear, to create a connection with consumers.

Social influence: Consumers are influenced by the people around them, including family, friends, and online communities. According to research, 92% of consumers trust recommendations from friends and family over other forms of advertising. Social proof and influencer marketing capitalise on the power of social influence to shape consumer behaviour.

Cognitive biases: Consumers are subject to cognitive biases, mental shortcuts that impact decision-making processes. The anchoring effect, for instance, shows how consumers’ perception of price is influenced by the initial price point they encounter.

From Diverse Threads to Unified Strategies: The Art of Consumer Segmentation

Consumer segmentation is the process of dividing a target market into distinct groups based on shared characteristics, behaviours, and preferences. Market research plays a vital role in identifying and understanding these segments, enabling marketers to tailor their strategies to meet each group’s specific needs and desires.

How market research identifies different consumer groups:

- Demographics: Market research helps identify segments based on demographic factors such as age, gender, income, education, and occupation. Demographic segmentation allows for more precise targeting, ensuring marketing efforts reach the right audience.

- Psychographics: By delving into consumers’ values, beliefs, interests, and lifestyle choices, market research uncovers psychographic segments. An article published in the Journal of Consumer Psychology suggests that psychographic segmentation can uncover deeper motivations and provide insights into purchasing behaviour.

- Behaviours: Market research analyzes consumer behaviours such as purchasing frequency, brand loyalty, and media consumption patterns to identify segments.

Consumer segmentation is like a kaleidoscope that reveals the intricate patterns within your target market. It empowers brands to move beyond a one-size-fits-all approach.

By understanding the diverse threads that compose their target market, brands can weave tailored strategies that speak directly to each segment’s unique needs and aspirations. With this targeted approach, companies can unlock new levels of customer engagement, loyalty, and business success.

Illuminating Consumer Behavior: The Fusion of Psychology and Market Research

Brands can harness the power of psychological principles and techniques to delve deeper into the intricacies of consumer behavior, providing invaluable insights for crafting effective marketing strategies.

For example, the field of neuromarketing combines neuroscience and marketing to understand how consumers’ brains respond to marketing stimuli. Techniques such as EEG and fMRI can measure brain activity, revealing emotional and cognitive responses.

Researchers can uncover subconscious preferences and reactions by tracking where consumers look, how long they focus on specific elements, and their visual attention patterns. According to a recent study, eye-tracking research revealed that consumers’ attention is highly influenced by packaging design, with specific areas attracting the most visual focus.

Brands can unlock more profound insights into consumer behaviour by integrating psychological research methods, understanding consumer motivations, and leveraging behavioural economics concepts. These insights fuel the development of effective marketing strategies, creating powerful connections between brands and their target audience. For example:

- Maslow’s Hierarchy of Needs: A survey by GlobalWebIndex revealed that 42% of respondents were more likely to purchase from brands that align with their values and beliefs. Maslow’s psychological framework suggests that individuals have a hierarchy of needs, from basic physiological to self-actualisation. Market researchers can align their strategies with these needs to resonate with consumers. A survey by GlobalWebIndex revealed that 42% of respondents were more likely to purchase from brands that align with their values and beliefs.

- Loss aversion: The tendency to strongly prefer avoiding losses over acquiring gains. Research by the Journal of Marketing demonstrated that framing a marketing message with loss aversion can significantly increase consumer response rates. Marketers can leverage this by highlighting potential losses consumers might experience if they do not choose their product or service.

- Endowment effect: A study published in the Journal of Consumer Research revealed that consumers are willing to pay more for products they perceive as their own or unique. This cognitive bias refers to the tendency for individuals to assign a higher value to items they already possess. Market researchers can use this insight to create scarcity or exclusivity, driving consumer demand.

Beneath the Surface: The Power of Emotional Drivers in Consumer Behavior

Emotions, desires, aspirations, and subconscious influence consumer behaviour to drive action. Understanding these emotional drivers is essential for marketers seeking to forge meaningful connections with their target audience.

Understanding and leveraging emotional drivers through market research empowers marketers to connect with consumers on a deeper emotional level. By evoking the right emotions, aligning with desires and aspirations, and employing compelling storytelling, brands can create memorable experiences that resonate, forge strong emotional connections, and drive consumer loyalty.

The Role of Desires and Aspirations

Consumer desires encompass the longing for experiences, products, or lifestyles that fulfil their deepest wishes or cravings. Market research techniques like in-depth interviews or focus groups enable researchers to uncover consumers’ desires by probing their aspirations and uncovering what they truly yearn for.

Consumers aspire to certain identities, values, or social statuses that align with their self-concept and desired image. Market research can employ techniques like surveys or ethnographic research to uncover consumers’ aspirations, providing insights into how brands can position themselves to resonate with these aspirations.

The Influence of Emotional Triggers

Emotional triggers are stimuli that evoke emotional responses in consumers, influencing their purchase decisions and brand perceptions. Market research techniques such as emotional response measurements, including facial expression analysis or self-reporting, can help identify and analyze emotional triggers.

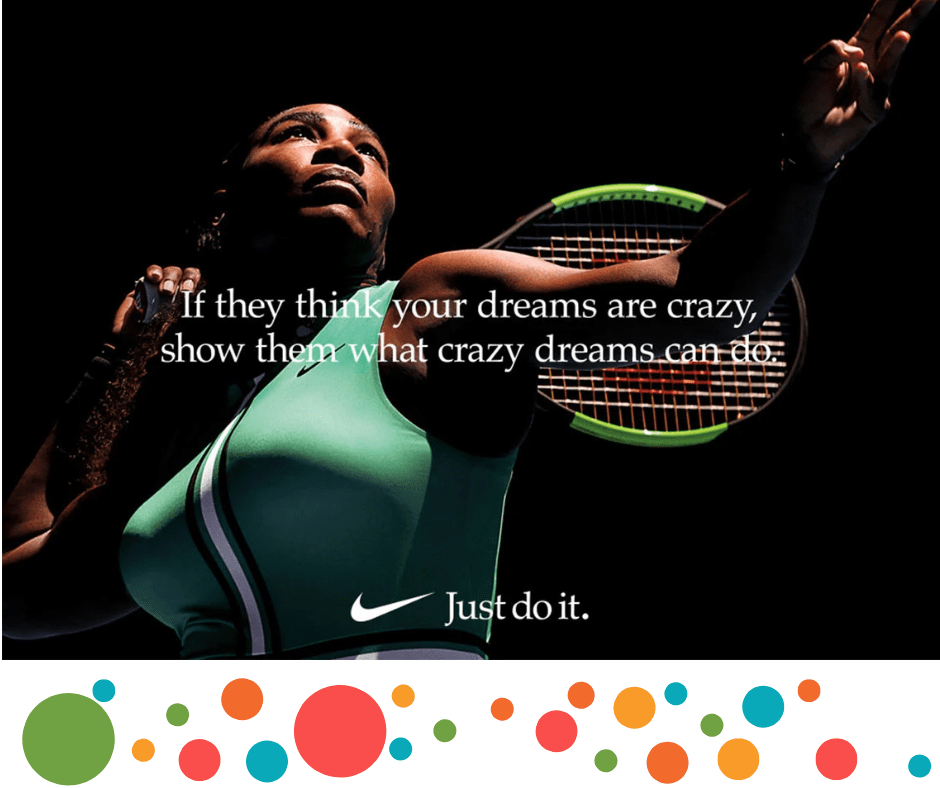

A study conducted by Neuro-Insight revealed that storytelling ads generated a 9% increase in emotional intensity and a 26% boost in long-term memory encoding. Brands that effectively employ storytelling tap into consumers’ emotions, creating narratives that resonate deeply with their audience.

Collaborating with influencers who evoke specific emotions can create powerful connections with consumers. A survey by Mediakix found that 80% of marketers perceived influencer marketing as effective, mainly due to its ability to foster emotional connections with target audiences.

Market research is crucial in uncovering the emotional drivers that shape consumer behavior. For example:

In-depth interviews: Open-ended interviews allow researchers to explore consumers’ emotional connections, experiences, and perceptions in detail. By delving into consumers’ narratives and stories, market researchers can identify the emotional triggers that drive their purchasing decisions.

Online sentiment analysis: Analyzing social media conversations and online reviews provides insights into consumers’ emotional responses and sentiments towards brands and products. Companies that monitor online sentiment gain valuable information to fine-tune their marketing strategies and improve their brand perception.

From Deliberation to Purchase: Decoding the Consumer Decision-Making Process

Understanding the consumer decision-making process is paramount for marketers seeking to guide and influence consumers on their path to purchase. Let’s explore the stages of awareness, consideration, and purchase and uncover how market research can inform strategies to connect with consumers at each step effectively.

Awareness Stage:

- Consumer behaviour at this stage involves recognising a need or desire for a product or service.

- Market research techniques like surveys or online analytics help identify consumer pain points and unmet needs, laying the foundation for strategic marketing initiatives.

- A study by Think With Google found that 48% of consumers start their purchase journey with a search engine, underscoring the importance of understanding their initial awareness needs.

Consideration Stage:

- Consumers actively seek information and evaluate options to fulfil their needs.

- Market research methods such as focus groups or customer feedback surveys provide valuable insights into consumers’ preferences, perceptions, and decision-making criteria.

- Research by McKinsey reveals that consumers engage with an average of 10.4 sources of information during their consideration process, emphasising the need for comprehensive market research.

Purchase Stage:

- Consumers make the final decision and execute the purchase.

- Market research informs marketing strategies to influence consumers at this stage through effective messaging, competitive pricing, and convenient purchasing options.

- According to a study by Deloitte, 80% of consumers are influenced by discounts or promotions during their purchase decision-making process.

Embracing Consumer Psychology for a Purposeful Future

Through the intricacies of consumer behaviour and the power of market research, it becomes evident that understanding the consumer mindset is not merely a means for driving sales but an opportunity to build meaningful connections and shape a purposeful future.

The consumer landscape is ever-evolving, influenced by societal shifts, technological advancements, and changing values. To navigate this landscape successfully, brands must continuously adapt, innovate, and align their strategies with ethical considerations.

Consumer psychology unveils the hidden motivations, desires, and emotions that drive our decisions. It reminds us that consumers are not merely data points or target audiences but individuals with unique needs, aspirations, and values. By embracing this understanding, we can move beyond transactional relationships and foster connections that resonate deeply with consumers.

Market research acts as a compass, guiding us on this journey. It empowers us to gather insights, uncover trends, and make informed decisions that shape marketing strategies. It enables us to understand the nuances of consumer behaviour, embrace personalisation, and craft experiences that genuinely resonate with our audience.

The psychology of consumerism is a fascinating realm that continuously unfolds. By exploring the consumer mindset, leveraging market research, and embracing future trends, we embark on a transformative journey of connecting with consumers in profound and meaningful ways.

Are you ready to unlock the power of consumer insights and drive impactful marketing strategies? Whether you need to dive deep into consumer behaviour, uncover emerging trends, or gain a competitive edge in the marketplace, our team of experienced researchers is here to guide you. With our expertise in designing and executing comprehensive market research studies, we can help you make informed decisions that propel your business forward. Reach out to us today.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

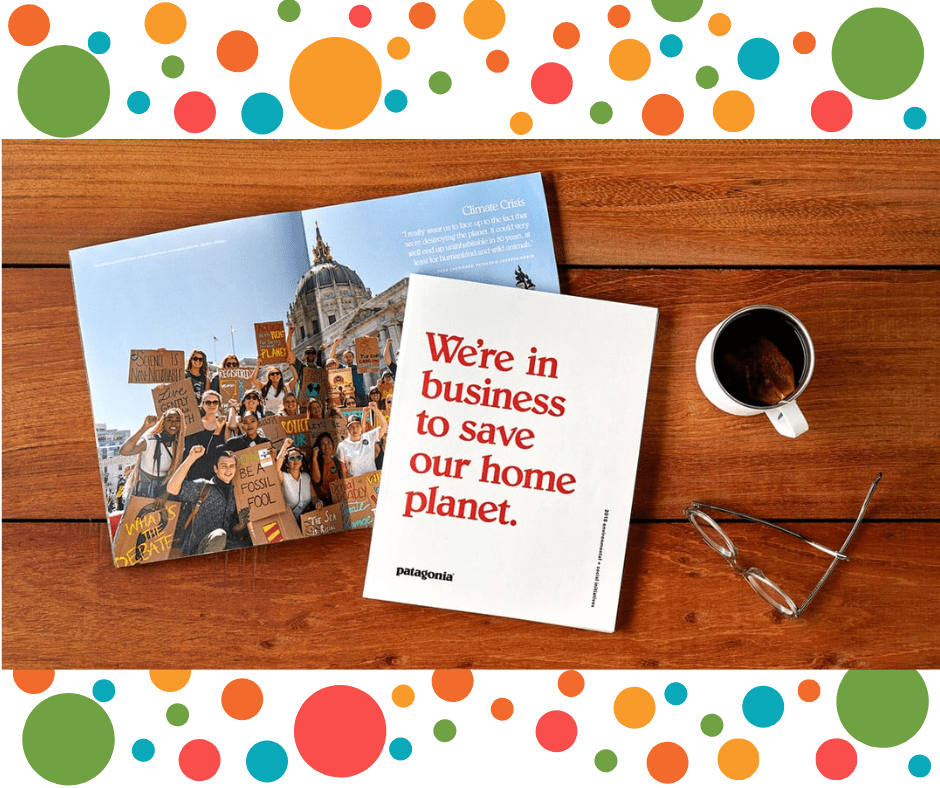

Environmental consciousness has taken centre stage as a pressing global concern. People from all walks of life are adopting behaviour changes and actively seeking ways to protect the environment.

From reducing carbon footprints to embracing renewable energy sources, individuals are increasingly aware of the need to address climate change and preserve the planet for future generations.

This growing importance of environmental consciousness presents a unique market opportunity for brands: the Conscious Nonconsumer segment.

The Conscious Nonconsumer segment comprises a significant portion of the consumer market. These individuals have made personal changes in their habits, embracing sustainable practices in various aspects of their lives. However, they have yet to connect sustainability directly with their purchasing decisions. Despite their environmentally conscious lifestyles, they may not actively seek out sustainable products or consider sustainability factors when making buying choices.

For brands, this represents an untapped growth potential. By targeting the Conscious Nonconsumer segment, companies can tap into a vast market of individuals already inclined towards sustainable practices. By understanding their values and behaviours, brands can strategically position themselves to bridge the gap between conscious living and conscious consumption.

The Rise of Environmental Concerns and Conscious Nonconsumers

The global concern about climate change has reached unprecedented levels in recent years, influencing consumer behaviour across various industries. As the scientific consensus on the urgency of addressing climate change has grown, individuals have become increasingly aware of the environmental challenges we face and the need for collective action. This heightened awareness has led to a significant shift in consumer preferences and has given rise to the emergence of the Conscious Nonconsumer segment.

Climate change is a pressing issue that affects the entire planet. Statistics reveal the alarming prevalence and severity of climate-related events, fueling consumer concern. For instance, extreme weather events such as hurricanes, floods, and wildfires have become more frequent and intense. Rising global temperatures, melting glaciers, and sea-level rise are also clear indicators of the environmental crisis we face. These events and their tangible impacts on communities have heightened public awareness and generated a sense of urgency to address climate change.

Consumer concern regarding climate change has grown parallel with the increase in climate-related events. Studies have shown that many consumers now prioritise sustainability and environmental impact when making purchasing decisions. This shift in consumer behaviour has created an opportunity for brands to engage with environmentally conscious individuals actively seeking ways to contribute to a sustainable future.

One specific segment that has emerged from this shift is the Conscious Nonconsumer. These individuals have adopted environmentally friendly practices in their daily lives, embracing sustainability in various aspects such as energy consumption, waste reduction, and transportation. However, when it comes to their purchasing decisions, they have not fully connected sustainability with their choices. This segment represents a considerable portion of the consumer market, comprising individuals already committed to environmentally conscious living but who have yet to extend their sustainability practices to their buying habits.

Also read: “How Brands Appeal to the Eco-conscious Traveler.”

The Conscious Nonconsumer segment is characterised by individuals who are aware of environmental issues and make efforts to minimise their ecological footprint. They actively participate in activities such as recycling, conserving energy, and supporting local environmental initiatives. However, their purchasing decisions are often influenced by other factors, such as price, convenience, and product quality, rather than explicitly considering the environmental impact of the products they buy.

Recognising the presence of Conscious Nonconsumers is essential for brands seeking to tap into this market opportunity. By understanding the values and behaviours of this segment, brands can develop targeted strategies that bridge the gap between conscious living and conscious consumption. By providing sustainable options and effectively communicating the environmental benefits of their products, brands can engage with Conscious Nonconsumers and encourage them to align their purchasing decisions with their environmental values.

Unveiling the Conscious Nonconsumer Segment

To effectively target and engage with the Conscious Nonconsumer segment, it is crucial to understand their distinct characteristics and behaviours. However, placing them within the broader context of other consumer segments is also essential. By examining the various consumer segments, we can gain insights into the unique qualities of Conscious Nonconsumers and their potential as a target market. The following breakdown provides an overview of the different consumer segments:

Climate change deniers: This segment comprises individuals who either deny or downplay the existence and impact of climate change. They may reject scientific consensus and are less likely to prioritise sustainability in their decision-making process. Climate change deniers often resist changes in their habits or behaviours that would contribute to environmental protection.

Consumers of habit: Consumers of habit adhere to long-established routines and purchasing patterns without much consideration for sustainability. They are less likely to actively seek out sustainable alternatives and may prioritise convenience and familiarity over environmental impact.

Curious consumers: Curious consumers have begun to explore and show interest in sustainability but may not have fully integrated it into their everyday lives. They are open to trying sustainable products and practices but may need more information and guidance to make informed decisions.

Conscious nonconsumers: The Conscious Nonconsumer segment represents individuals who have embraced sustainability in their lifestyle habits but have yet to extend this mindset to their purchasing decisions. They actively engage in eco-friendly practices such as recycling, conserving energy, and reducing waste. However, they may not prioritise sustainability factors when buying products, potentially due to a lack of awareness, information, or readily available sustainable options.

Conscious consumers: Conscious consumers are individuals who actively seek out and prioritise sustainable products and practices. They carefully consider the environmental impact of their purchasing decisions and actively support brands that align with their values. They are knowledgeable about sustainability and seek transparency and authenticity in the products they choose.

Among these segments, the Conscious Nonconsumer segment stands out as a significant market opportunity. These individuals have taken steps towards sustainable living, demonstrating their environmental consciousness and willingness to make positive changes. However, they have yet to fully connect sustainability with their purchasing decisions.

Identifying Barriers to Purchasing

To effectively target the Conscious Nonconsumer segment and encourage them to make sustainable purchasing decisions, it is crucial to understand the barriers that currently prevent them from doing so. By addressing these barriers, brands can create a more conducive environment for Conscious Nonconsumers to engage with sustainable products.

Lack of consideration for sustainability while shopping

One significant barrier Conscious Nonconsumers faces is the lack of explicit consideration for sustainability factors while shopping. Although they exhibit environmental consciousness in other aspects of their lives, sustainability may not be a primary driver in their purchasing decisions.

Other factors like price, convenience, and product quality often take precedence. This may be due to a lack of awareness about sustainable alternatives or a perceived disconnect between sustainability and the products available.

Difficulties in making informed purchasing decisions due to a knowledge gap

Conscious Nonconsumers may encounter difficulties in making informed purchasing decisions due to a knowledge gap regarding sustainable options. They may not have access to comprehensive and reliable information about the environmental impact of products, making it challenging to identify sustainable choices.

Furthermore, the lack of standardised labelling and certification systems can complicate decision-making. Without clear guidance and accessible information, Conscious Nonconsumers may struggle to navigate the marketplace and make sustainable choices.

Price as an obstacle and challenges in finding sustainable products

Price often is a significant obstacle for Conscious Nonconsumers when considering sustainable products. Sustainable alternatives may sometimes be perceived as more expensive than conventional options. This price disparity can discourage Conscious Nonconsumers from actively seeking sustainable alternatives, especially if they perceive sustainability as an added financial burden.

Additionally, finding reliable and easily accessible sustainable products can pose a challenge. Limited availability, lack of awareness about sustainable brands, and difficulties distinguishing genuine sustainable products from “greenwashing” can hinder Conscious Nonconsumers in their quest for sustainable options.

Strategies to Reach Conscious Nonconsumers

To effectively capture the Conscious Nonconsumer market, brands and retailers must implement actionable strategies that resonate with this segment’s values and behaviours. By simplifying decision-making processes, integrating environmental, social, and governance (ESG) features into existing factors, and evolving brands to align with sustainability, companies can successfully engage Conscious Nonconsumers.

Simplify decision-making by highlighting specific, measurable ESG features.

Brands should prioritise transparency and provide clear, concise information about their products’ environmental and social impact. By highlighting specific, measurable ESG features, such as carbon footprint, water usage, ethical sourcing, or labour practices, brands can educate consumers and guide their choices. This information should be easily accessible through product labelling, websites, or mobile applications, enabling Conscious Nonconsumers to make informed purchasing decisions aligned with their values.

Integrate ESG into existing factors considered in purchasing decisions.

To overcome the lack of consideration for sustainability, brands should integrate ESG factors into existing decision-making criteria. For example, brands can also emphasise their sustainable attributes when promoting a product’s quality, durability, or performance. By showcasing how sustainability enhances the overall value and benefits of the product, brands can effectively capture the attention of Conscious Nonconsumers. This integration allows sustainability to become an inherent part of the decision-making process.

Evolve existing brands through packaging design and product adaptation.

Brands can evolve their existing products by innovating packaging design and adapting product formats or ingredients to align with sustainability. Eco-friendly packaging options, such as using recycled materials or reducing excess packaging, can convey a strong message of sustainability. Brands can also explore product adaptations to minimise environmental impact, such as transitioning to renewable or biodegradable ingredients. By incorporating these changes, brands demonstrate their commitment to sustainability and cater to the preferences of Conscious Nonconsumers.

Collaborate with sustainable influencers and organisations.

Brands can leverage the influence of sustainable influencers and collaborate with environmental organisations to amplify their messaging and reach Conscious Nonconsumers. Partnering with influencers who align with sustainability values and have a dedicated following of environmentally conscious individuals can significantly enhance brand visibility and credibility. Collaborating with reputable organisations focused on sustainability can foster trust and authenticity among Conscious Nonconsumers.

Engage in educational initiatives and community involvement.

Brands should invest in educational initiatives to raise awareness about sustainability and empower Conscious Nonconsumers. This can include hosting workshops, webinars, or events that provide information and practical tips for sustainable living. Additionally, community involvement in environmental initiatives and partnerships with local sustainability organisations can demonstrate a brand’s commitment to making a positive impact beyond its products.

Overcoming Challenges and Achieving Growth

To successfully capture the Conscious Nonconsumer market, brands and retailers must overcome challenges and address the preferences of this segment. By effectively addressing these factors, brands can achieve profitable growth by convincing Conscious Nonconsumers to change their buying habits.

Emphasise the importance of viable and easily accessible sustainable options.

One key aspect of targeting Conscious Nonconsumers is to offer viable and easily accessible sustainable options. Brands should strive to provide a diverse range of sustainable products that meet the needs and preferences of this segment. This includes ensuring availability in retail stores and online platforms and effectively communicating these products’ environmental benefits. By making sustainable options convenient and readily available, brands can encourage Conscious Nonconsumers to embrace sustainable choices in their everyday lives.

Cater to affordability and value-for-money propositions.