In just a few years, mobile-first smart surveys have revolutionised market research — making it easier for brands to uncover consumer trends in real-time. Gone are the days of door-to-door and mailed questionnaires; we’ve transitioned to online polls and mobile-first smart surveys. This evolution mirrors the shift in consumer behavior, with over 5.31 billion unique mobile phone users worldwide.

Mobile-first smart surveys emerge in response to the growing demand for real-time, actionable consumer insights.

Mobile-first smart surveys are designed with the mobile user in mind, ensuring surveys are easily accessible on smartphones and tablets. This approach prioritises the mobile experience, leveraging responsive design and intuitive interfaces to increase participation rates.

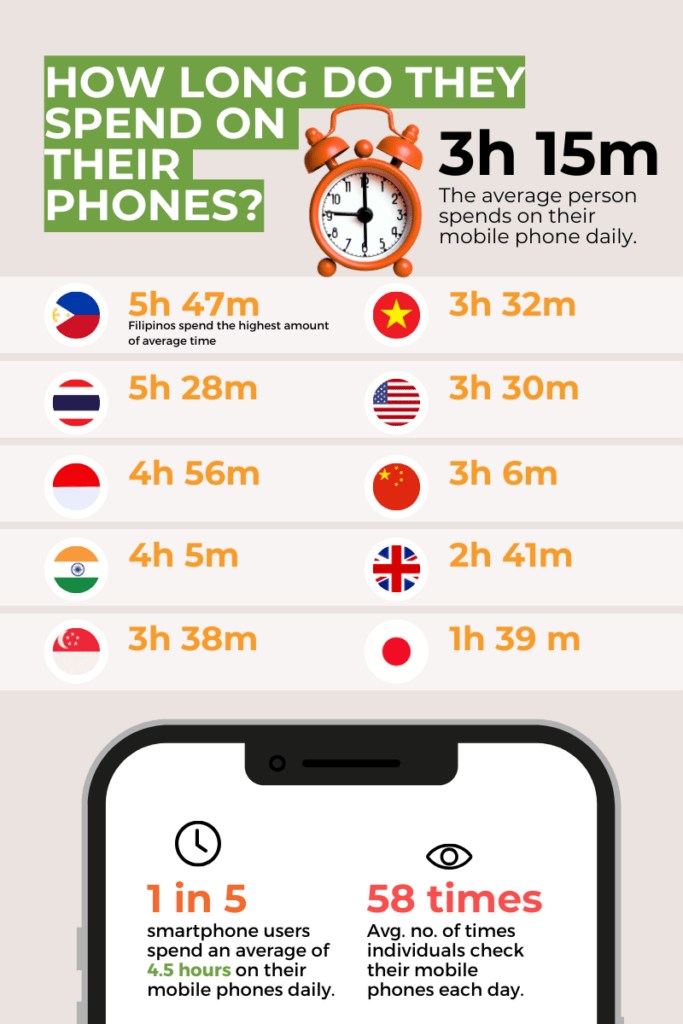

According to recent data, the average person spends 3 hours and 15 minutes on their mobile phone daily. And 1 in 5 smartphone users spend an average of 4.5 hours on their phones daily. At 5 hours and 47 minutes, Filipinos spend the highest amount of average time on their phones each day. So, the potential for engagement is immense.

Mobile-first surveys tap into this potential, allowing brands to gather insights in real-time from a broad and diverse demographic.

The importance of real-time consumer trends has been magnified in today’s fast-paced market. Brands that can quickly adapt to changing consumer preferences gain a competitive edge. Traditional market research methods, while still valuable, often need to catch up, delivering insights that are sometimes outdated by the time they’re analysed. In contrast, mobile-first smart surveys offer immediacy. They enable companies to make informed decisions swiftly, adjusting to market dynamics as they unfold. This agility is crucial at a time when consumer preferences can change overnight, driven by viral trends on social media or shifts in the global economy.

The evolution of mobile-first smart surveys reflects a broader shift in market research toward more agile, real-time methodologies. This transition is not merely about adopting new technologies but about recognising and responding to the changing ways in which people communicate and consume information. As brands seek deeper insights into consumer behavior, mobile-first smart surveys have become a pivotal tool in their strategic arsenal, offering a lens into the preferences and opinions of a highly mobile, constantly connected global population.

Mobile-first smart surveys are defined by their primary focus on optimising the survey experience for mobile devices. This approach acknowledges the primary role smartphones play in our daily lives, designing surveys that are not only accessible but also engaging for users on small screens. These surveys are built from the ground up, featuring responsive design, concise content, and interactive elements that use mobile device’s unique capabilities.

Critical characteristics of Mobile First Smart Surveys include:

- Responsive Design: Layouts adjust fluidly across different screen sizes and orientations, ensuring readability and ease of interaction, whether on a phone, tablet, or desktop.

- Concise Content: Questions are designed to be short, respecting the user’s time and attention span on mobile devices.

- Touch-Friendly Interfaces: Large buttons and sliders facilitate easy interaction, even on the tiniest screens.

- Location-Based Features: Utilising GPS technology to offer questions relevant to the user’s current location, enhancing the relevance and immediacy of the data collected.

- Multimedia Integration: The ability to incorporate images, videos, and voice recordings into surveys, leveraging the multimedia capabilities of modern smartphones.

Image credit: Forsta

The technology powering Mobile First Smart Surveys goes beyond simple design adjustments. Artificial Intelligence (AI) plays a crucial role in analysing open-ended responses and predictive analytics, helping to identify trends and insights from the data collected. Machine learning algorithms can also personalise surveys based on the respondent’s previous answers, making the survey experience more relevant and engaging.

Advantages of Mobile First Surveys

The shift toward Mobile First Smart Surveys reflects mature digital consumer behaviours. By leveraging the latest responsive design and AI technology, these surveys offer a powerful tool for brands seeking to understand and engage with their audience.

Mobile First Smart Surveys have ushered in a new era of market research characterised by enhanced accessibility, real-time insights, higher engagement, and cost savings. These advantages position mobile-first methodologies as a pivotal tool for companies aiming to stay ahead of the competition.

- Accessibility and Reach

The mobile-first approach significantly expands the potential pool of respondents. With over 90% of the global internet population using mobile devices to go online, as reported by Statista, surveys optimised for these devices are more likely to be accessed and completed. This democratisation of access allows brands to gather data from a broader demographic spectrum, including hard-to-reach populations such as younger demographics, lower-income groups, and residents of developing countries who may rely exclusively on mobile devices for internet access.

- Real-time Data Collection

One of the most significant advantages of Mobile First Smart Surveys is the capacity for real-time data collection. This immediacy allows brands to capture and analyse consumer feedback as events unfold, providing a dynamic view of market trends and consumer sentiments. This capability is crucial for responding to fast-changing market conditions and can be the difference between capitalising on a trend and missing the boat. In contrast, with their longer collection and analysis phases, traditional survey methods can lag, offering less timely insights and, therefore, potentially less valuable.

- Improved User Engagement

Mobile-friendly designs play a crucial role in increasing survey completion rates. The intuitive interfaces, touch-friendly navigation, and concise content tailored for mobile users significantly improve the user experience. This focus on user-centric design reduces survey abandonment rates and ensures higher-quality data, as respondents are more likely to provide thoughtful and accurate answers when the survey experience is engaging and straightforward.

- Cost-effectiveness

From a cost perspective, Mobile First Smart Surveys offer clear advantages over traditional methods. The digital nature of these surveys eliminates the need for physical materials, postage, and manual data entry, significantly reducing operational costs. Additionally, the speed and efficiency of data collection and analysis mean that insights are generated faster, allowing brands to act on them more quickly. This can lead to more efficient allocation of resources and better ROI on market research investments.

The scalability of mobile surveys—where the marginal cost of adding another respondent is virtually zero—means that brands can collect data from a larger sample without a proportional increase in cost. This scalability, combined with the broad reach and real-time capabilities of mobile-first surveys, offers an unparalleled opportunity to gather market insights cost-effectively.

Implementing Mobile First Smart Surveys requires a strategic approach, from designing to selecting platforms and ensuring data quality and privacy. Adhering to best practices in each area ensures the collection of high-quality data and the protection of respondents’ information.

When compared with traditional survey methods, Mobile First Smart Surveys offer several advantages:

- Higher Engagement Rates: The mobile-optimised design and interactive elements lead to higher completion rates than desktop-centric surveys.

- Broader Reach: With most internet users accessing the web via mobile devices, mobile-first surveys can reach a broader and more diverse audience.

- Real-time Insights: The immediacy of mobile internet allows for the collection and analysis of data in real-time, providing brands with timely insights.

- Cost Efficiency: Digital distribution reduces the logistical costs of paper-based surveys or face-to-face interviews.

In contrast, traditional survey methods often struggle with lower response rates due to their lack of optimisation for mobile use. They may also miss out on the younger demographics who predominantly use smartphones for internet access. Additionally, traditional methods can be slower and more expensive to deploy, particularly when reaching a geographically dispersed audience.

Implementing Mobile First Smart Surveys

Designing Mobile-First Surveys: Best Practices

Implementing Mobile First Smart Surveys with attention to detail—thoughtful design, selection of the right tools, and rigorous data quality and privacy measures—can significantly enhance the effectiveness of your market research efforts.

Question Design: A good survey design is important. Questions should be concise and straightforward to accommodate the shorter attention spans and smaller screens of mobile users. Use simple language and avoid complex question types that may be difficult to navigate on a mobile device.

Length: Mobile surveys should be short to respect the user’s time and prevent survey fatigue. A good rule of thumb is to keep the survey completion time under 5 minutes. This ensures higher completion rates and more accurate responses.

Interface: The survey interface should be responsive and adjust seamlessly across different devices and screen sizes. Use large, easily clickable buttons, and ensure that text is readable without zooming. Incorporating elements like sliders or touch-responsive scales can enhance the user experience.

Ensuring Data Quality and Privacy

Validating Responses: Implement measures to ensure the authenticity and accuracy of responses. This can include CAPTCHA verification to prevent bot submissions, consistency checks for contradictory answers, and logic paths that adjust questions based on previous responses to gather more precise data.

Protecting Respondent Data: Adhere to data protection regulations such as GDPR or CCPA, depending on your location and the location of your respondents. This includes obtaining consent to collect data, ensuring data is encrypted and securely stored, and allowing respondents to remain anonymous.

Data Quality Checks: Regularly review data for patterns that indicate low-quality responses, such as straight-lining (selecting the same response for all questions) or speed-through (completing the survey too quickly to have read the questions). These checks help maintain the integrity of the data collected.

Overcoming Screen Size Limitations

Challenge: The smaller screens of mobile devices limit the amount of information that can be displayed simultaneously, potentially complicating the presentation of complex questions or answer options.

Solutions:

- Design and Formatting: Utilise responsive design that automatically adjusts content layout based on the device’s screen size. Simplify survey design by breaking down complex questions into multiple, easier-to-navigate screens.

- Visual Aids: Incorporate visual elements such as icons and sliders that are easier to interact with on small screens, reducing the reliance on text-heavy inputs.

- Progressive Disclosure: Implement a technique where only the necessary information is displayed initially, with additional details available on demand. This keeps the interface clean and reduces the cognitive load on respondents.

Ensuring Accessibility and Inclusivity

Challenge: Ensuring that surveys are accessible to all users, including those with disabilities, can be particularly challenging on mobile platforms where navigation and interaction differ significantly from desktop environments.

Solutions:

- Adherence to Web Content Accessibility Guidelines (WCAG): Design surveys that comply with WCAG standards, ensuring they are navigable and usable for people with various disabilities.

- Voice Input and Screen Readers: Optimise surveys for compatibility with voice input software and screen readers, allowing users with visual impairments or limited mobility to participate fully.

- Diverse Language Options: Offer surveys in multiple languages to cater to non-English speakers, increasing the inclusivity of the research.

Dealing with Mobile-Specific Distractions

Challenge: Mobile users are often on the go or multitasking, making it difficult to maintain their attention throughout the survey.

Solutions:

- Engagement Techniques: Incorporate interactive elements such as swipe actions or tap-based responses that leverage the mobile interface to keep users engaged.

- Gamification: Introduce gamification elements, such as points, levels, or badges, to motivate respondents to complete the survey.

- Timely Reminders: Send push notifications or SMS reminders to participants, encouraging them to complete the survey at their convenience. Ensure these communications respect the user’s time and are not overly intrusive.

By addressing these challenges with specific, targeted solutions, organisations can enhance the effectiveness of their Mobile First Smart Surveys. Overcoming screen size limitations with thoughtful design, ensuring accessibility and inclusivity, and countering mobile-specific distractions with engagement strategies are critical steps in harnessing the full potential of mobile surveys.

These approaches improve the quality of data collected and ensure a positive and inclusive experience for all respondents.

How to avoid common pitfalls of Mobile First Surveys

While Mobile First Smart Surveys have been transformative for many brands, offering deep insights into consumer behavior and preferences, brands can avoid common pitfalls. We can identify best practices and common traps by examining successful deployments, providing valuable lessons for organisations looking to leverage this approach.

Here are common lessons learned from mistakes made by other companies.

Avoiding Over-surveying:

One common pitfall is the temptation to overuse mobile surveys due to their ease and cost-effectiveness. A consumer goods company found that frequent survey requests led to declining response rates and survey fatigue among their target audience. The lesson learned was respecting the respondents’ time and attention and focusing on fewer, more targeted surveys to maintain engagement and data quality.

Ensure Data Privacy:

Many companies have faced backlash when a poorly secured mobile survey leads to privacy concerns among participants. Robust data protection measures, including encryption and clear consent protocols, are vital for any survey. Ensuring privacy protects respondents and preserves the integrity and reputation of the research effort.

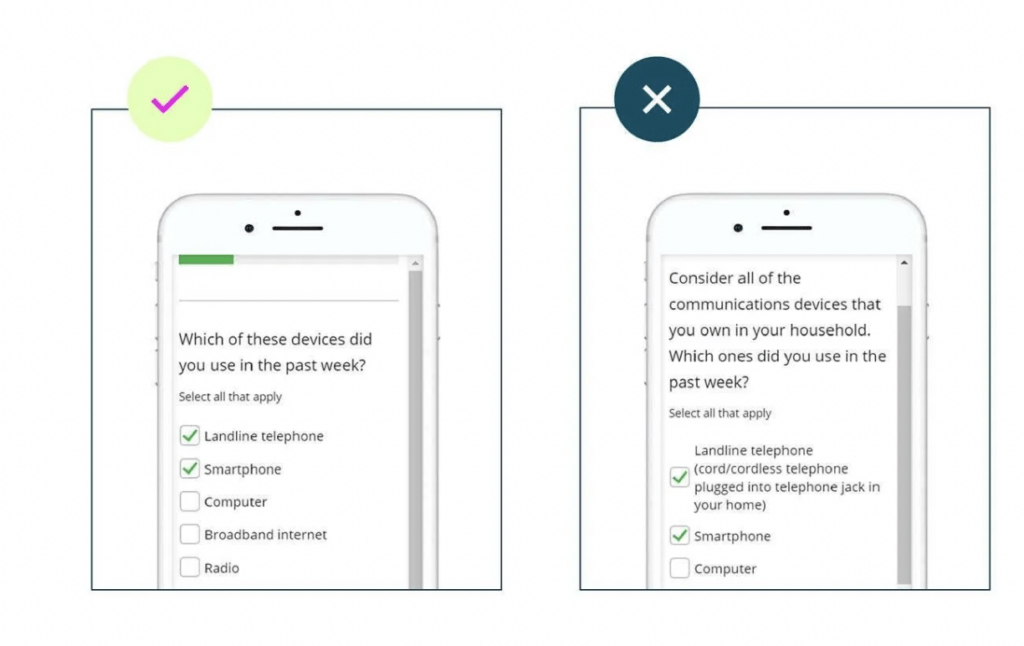

Design for Mobile Limitations:

A common mistake is simply adapting desktop surveys for mobile use without considering mobile devices’ unique limitations and opportunities. For instance, if a brand uses a lengthy desktop version of a survey on mobile, it will lead to poor completion rates. By redesigning the survey specifically for mobile, with shorter, more interactive questions, brands will see a dramatic increase in participation. This highlights the necessity of designing with the mobile experience in mind from the outset.

Tips for Designing Effective Mobile-First Surveys

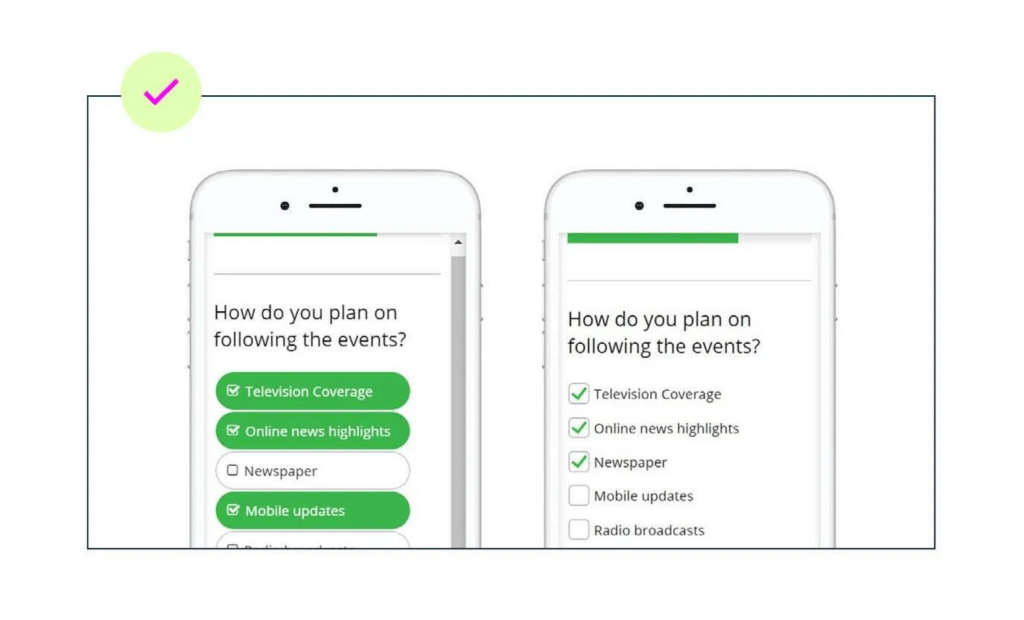

Simplify the User Interface: Ensure your survey interface is clean, intuitive, and easy to navigate on a mobile device. Minimise the need for scrolling and use touch-friendly elements like dropdowns and sliders to enhance the user experience.

Image Credit: Forsta

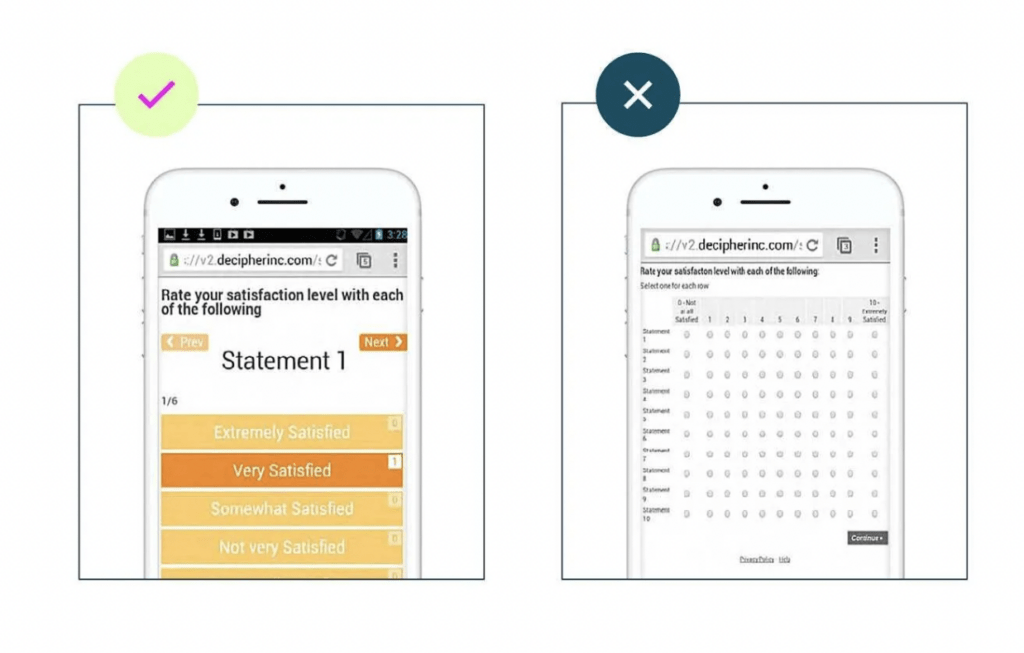

Optimise Question Design: Craft questions that are concise and to the point. Avoid jargon or complex language that might confuse respondents. Each question should serve a clear purpose in meeting your survey objectives.

Image Credit: Forsta

Test Across Devices: Before launching your survey, test it on various devices and screen sizes to ensure consistent performance. This helps identify and rectify any issues hindering the user experience or skew your data.

Strategies for Maximising Response Rates and Quality of Data

Personalise the Invitation: Customising the survey invitation can make respondents feel valued and increase the likelihood of participation. Use the respondent’s name and explain the survey’s purpose, emphasising the importance of their feedback.

Offer Incentives: Incentives can significantly boost response rates. Choose appropriate incentives for your audience, whether it’s access to exclusive content, discount codes, or entry into a prize draw.

Limit Survey Length: Keep your survey as short as possible while collecting the necessary data. Communicate the estimated completion time upfront to set expectations and reduce dropout rates.

Keeping up with Mobile Technology trends

Continuous Learning: Stay informed about the latest developments in mobile technology and survey methodology. Follow industry blogs, attend webinars, and participate in relevant forums or conferences.

Experiment with New Features: Be bold and test new survey features or technologies as they become available. Whether incorporating AR elements or utilising AI for dynamic question paths, experimenting can keep your surveys engaging and provide richer insights.

Gather Feedback on the Survey Experience: Regularly solicit feedback from respondents about their survey experience. This can provide valuable insights into improving your surveys and staying aligned with user expectations.

By embracing these best practices, market researchers can design mobile-first surveys that engage respondents and yield high-quality data. Keeping pace with mobile technology trends ensures that your surveys remain relevant and effective, enabling you to capture the insights needed to drive informed business decisions and stay ahead of the curve.

Market research technology will continue to evolve, driven by advances in mobile technology, AI, and machine learning. These innovations promise to make surveys more engaging, accessible, and insightful, transforming vast quantities of data into actionable intelligence. However, the core principles of effective market research remain unchanged: understanding your audience, asking the right questions, and listening to the feedback.

As we embrace the transformative power of Mobile First Smart Surveys, we must recognise this approach’s global reach and applicability. At Kadence International, with our presence in the US, UK, and Asia, we’ve witnessed firsthand the universal appeal and effectiveness of mobile-first strategies across diverse geographies. This widespread adoption shows the global shift toward mobile-centric consumer behavior, highlighting the importance of mobile-first methodologies in capturing real-time, actionable insights across different markets and cultures.

Our extensive experience across these regions positions us uniquely to understand the nuances and specific needs of brands operating in a globalised market. The trend toward mobile-first is a global movement, with consumers increasingly relying on mobile devices for everyday needs. This universal shift presents challenges and opportunities for brands looking to engage with their audience more deeply.

At Kadence, we leverage our strong foothold in Asia and our global presence to offer unparalleled insights into consumer behavior and market trends. Our expertise in mobile-first research methodologies enables us to provide our clients with the data and analysis needed to make informed decisions, tailor their offerings, and stay ahead in their respective industries.

Contact us if you want to harness the power of Mobile First Smart Surveys and gain a competitive edge in the global market. Learn how our expertise and global reach can help unlock new opportunities and drive your company forward. Whether you’re looking to expand in Asia, the US, the UK, or beyond, Kadence is your partner.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director