In recent years, home ownership in the Philippines has experienced a significant shift. Millennials are now emerging as important players in the real estate market. Over the past five years, home ownership among these younger generations has increased by 20%, a notable rise that has captured the attention of both policymakers and real estate developers. The pandemic made people realise the importance of having a roof above their heads that gives them a sense of security and stability.

According to the PSA survey, homeownership is rising in the Philippines, with over 60% of families owning their homes. So, understanding the generational trends and behaviours driving the Philippine real estate market is crucial.

Millennials bring different priorities and preferences to the market than previous generations. These differences can influence everything from the type of properties in demand to the features that buyers are looking for.

While Filipino Gen Z workers have varied perspectives on financial security and future planning, many are still unsure of homeownership. Some prefer living in their parent’s house or obtaining independence by renting to save for other priorities.

According to a survey by PhilCare, a leading HMO company, many in this demographic feel their earnings are sufficient for retirement and enjoying activities like travel and leisure. Despite this optimism, young professionals frequently lack confidence in managing unexpected expenses. Homeownership is often viewed as an unattainable goal rather than a realistic aspiration.

By analysing these shifts, we can gain valuable insights into the future of real estate in the Philippines. This analysis can help policymakers create more effective housing policies, and developers design properties that meet the needs and desires of young buyers. The goal is to ensure that the market evolves to support these new home buyers and foster sustainable growth in the real estate sector.

Current Landscape of Home Ownership in the Philippines

Overview of the Philippine Real Estate Market

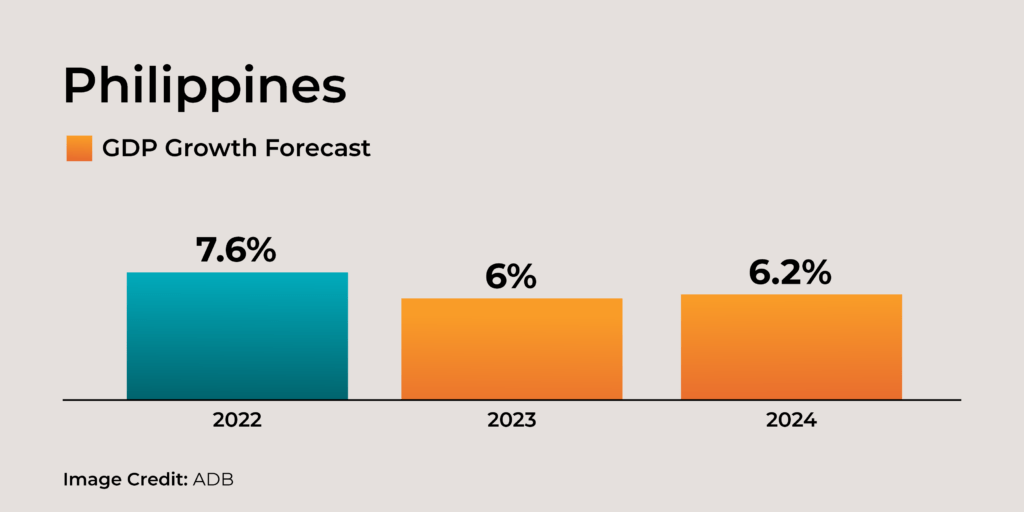

- Economic Growth: According to the Asian Development Bank, the Philippines is forecasted to grow by 6.2% in 2024, driven by a robust service recovery and sustained domestic demand.

- Growing Middle Class: The government targets achieving an upper middle income from the lower middle status within 1-2 years under the World Bank’s classification. This signifies the growing number of middle-class people with more disposable income.

- Urbanisation: According to the PSA census, 54% of Filipinos live in urban areas, and the urban population is increasing by 2.8% annually. As rapid urbanisation continues, more people are moving to cities, hoping for better job opportunities, education, and lifestyles, leading to a higher demand for urban housing.

- Culture: Many Filipinos dream of home ownership, a sign of success and stability. Renting is shunned and considered “a waste of money,” but it is still an option for those in the cities.

- Real Estate Development: Significant investments in residential, commercial, and mixed-use developments are ongoing, particularly in metropolitan areas like Metro Manila, Cebu, and Davao.

- Foreign Investment: The inflow of foreign capital into the real estate sector has been substantial, further boosting market growth.

According to the Philippine Housing and Urban Development Statistics (PHUDS), homeownership among Millennials (ages 26-41) and Gen Z (ages 10-25) has increased by 20% over the past five years.

Filipino Millennials and Their Attitudes Toward Real Estate

- According to the Laguna Journal of Multidisciplinary Research, an estimated 47.% of over 66 million Filipino workers are millennials.

- Roughly 30% of the real estate platform Lamudi’s users are Filipino millennials between 25 and 34.

- Most Filipino millennials are free of college debts, increasing their savings rate and spending power.

- Not only do young Filipinos see homeownership as a goal towards stability, independence, and security, but they also see it as an investment, a tangible asset that can generate wealth over time, and a status symbol, something to be proud of until their later years.

Factors Driving Home Ownership Among Millennials and Gen Z

Economic Factors: Income Growth, Affordability, and Financial PlanningIncome Growth: According to the Asian Development Bank, the Philippine economy is expected to grow by 6.2% in 2024, supported by rising domestic demand and a recovery in services, particularly tourism . This economic growth has led to higher disposable incomes, allowing more Millennials and Gen Z individuals to consider home ownership.

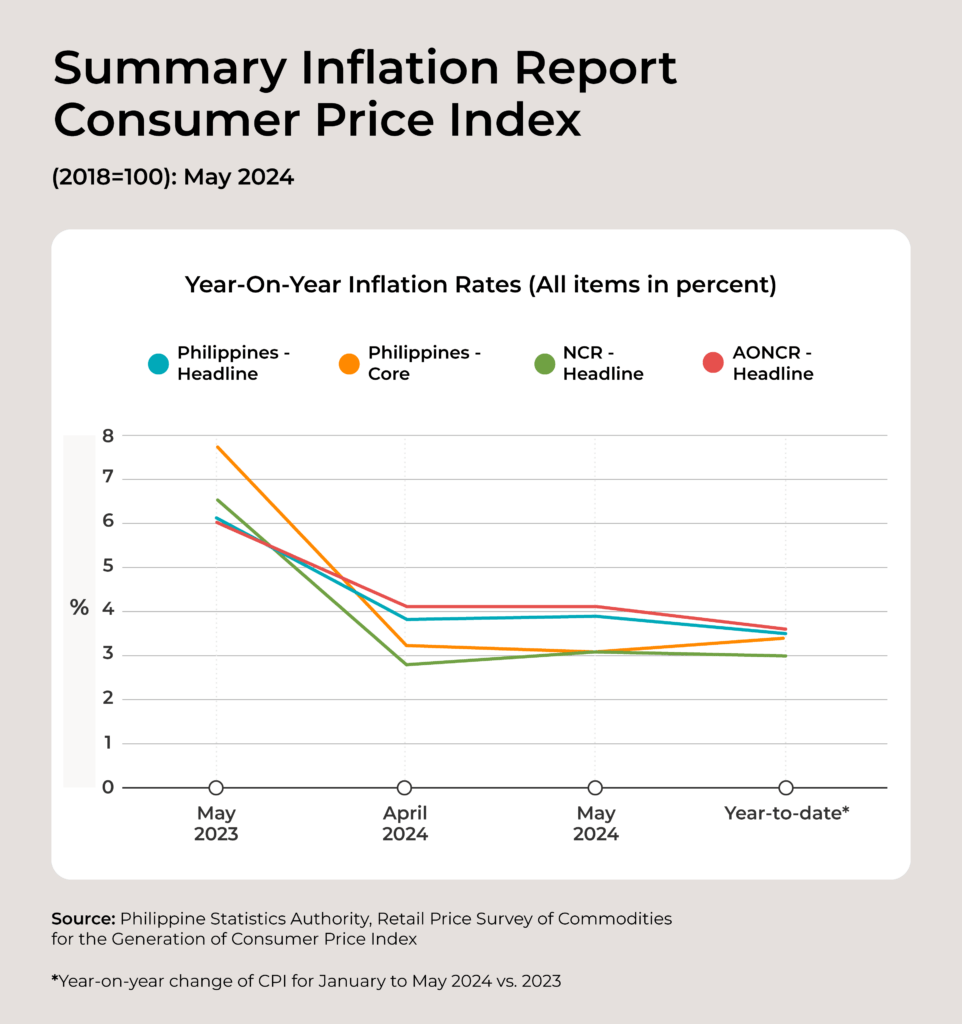

Affordability: As the inflation pressure is expected to average 4.0% this year , according to the Philippine Statistics Authority, many young Filipinos are finding ways to manage their finances better and are looking for more affordable alternatives. Government housing agencies, developers, and banks offer homes with flexible terms, lower interest rates, and deals to make homeownership more affordable. Entry-level housing and studio-type condos are gaining popularity among single or younger households.

Financial Planning: Financial literacy programs and the proliferation of online financial tools have empowered younger generations to plan and save more effectively for home purchases.

Social and Cultural Influences: Changing Family Structures and Priorities

- Family Structures: Millennials and Gen Z have shifted toward nuclear families and single-person households, increasing demand for housing that accommodates smaller family units. The average household size decreased from 4.6 persons per household in 2010 to 4.1 in 2020.

- Priorities: Younger generations prioritise convenience and lifestyle over traditional home ownership values. This has influenced their preference for urban living, closer to work and amenities, and for properties with modern features.

- Influence of Social Media: According to Global Digital Report 2024, the Philippines is one of the biggest social media consumers, with 73.4% of Filipinos using at least one, which creates a strong influence in shaping market perceptions. Many successful influencers in their 20s release video tours of their dream homes, and young followers aspire to do so, too.

Technological Advancements: Online Real Estate Platforms and Virtual Tours

- Online Platforms: The rise of online real estate platforms has made it easier for young buyers to explore, compare, and purchase properties without visiting physical locations. Platforms such as Lamudi and Property24 have become popular among these generations.

- Virtual Tours: Adopting virtual reality (VR) and 360-degree tours allows potential buyers to view properties remotely, increasing their confidence in purchasing decisions. These technologies have significantly reduced the time and effort required to find and buy a home.

Government Policies and Incentives: Housing Loans and Subsidies and Infrastructure Development

- Housing Loans: The government has introduced various loan programs to make homeownership more accessible. For example, the Pag-IBIG Fund offers affordable housing loans with low interest rates and flexible payment terms.

- Subsidies: Government subsidies are also available for first-time home buyers. These can cover a portion of the down payment or reduce the overall cost of the property. These incentives attract young buyers who may not have substantial savings.

- Infrastructures: The current administration aims to continue focusing on infrastructure development. New roads, highways, airports, and railways create more convenient ways to access urban areas, opening opportunities to develop and expand the suburbs and their real estate.

Preferences and Behaviors of Young Real Estate Buyers

Location Preferences: Urban vs. Suburban Living

Urban Living:

- Convenience: Millennials and Gen Z favour urban locations because they are close to work, educational institutions, and amenities such as shopping centres, restaurants, and entertainment venues.

- Connectivity: Urban areas often provide better public transportation options, which is a significant consideration for younger buyers who may prioritise sustainable living and reduced commuting times.

- Lifestyle: The vibrant lifestyle, cultural activities, and social opportunities available in urban centres are attractive to younger generations who value experiences and convenience.

Suburban Living:

- Affordability: While urban living is preferred, rising property prices in city centres drive some Millennials and Gen Z to consider suburban areas where property prices are generally lower.

- Space: Suburban properties often offer more space, which is appealing for those starting families or seeking a quieter environment.

Property Types: Condos, Townhouses, and Single-Family Homes

Condos:

- Popularity: Condominiums are highly popular among young buyers due to their affordability, convenience, and amenities. They provide a lock-and-leave lifestyle that suits the busy schedules of Millennials and Gen Z. Over 15% of all page views for condominiums on Lamudi are from the 25-34 age bracket. The 25-34 millennial age bracket remains the condo market’s most significant lead share contributor.

- Amenities: Many condos come with amenities such as gyms, pools, and communal spaces, which add to their appeal.

- Convenience: Condos offer access to many amenities and nearby malls, supermarkets, and other places people visit daily. The additional tasks of home repair and maintenance are much lower compared to other types.

Townhouses:

- Compromise: Townhouses offer a middle ground between condos and single-family homes, providing more space than a condo while being more affordable than a single-family home.

- Community: They often come with community amenities and shared spaces, fostering a sense of community among residents.

Single-Family Homes:

- Long-Term Goal: Single-family homes are less popular among younger buyers due to higher costs, but they remain a long-term goal for many. They offer more privacy and space, ideal for those planning to start or expand their families.

Key Features and Amenities: Sustainability, Smart Home Technology, and Community Spaces

Role of Technology in Shaping the Future of Real Estate Transactions

| Technology | Impact |

| Online Platforms | Simplifies property search, price comparison, and virtual tours for buyers. |

| Virtual Reality | Provides immersive property tours, enhancing buyer confidence and decision-making. |

| Blockchain | Ensures secure and transparent transactions, reducing fraud and increasing trust. |

| Data Analytics | Helps understand market trends, buyer preferences, and property values. |

Sustainability:

Source: From our study on Global Sustainability, published in The Green Brand report.

- Eco-Friendly Homes: Millennials and Gen Z prioritise sustainability in their living spaces. They highly value energy-efficient appliances, green building materials, and sustainable practices in property management.

- Environmental Impact: The awareness of environmental impact influences their purchasing decisions, with many willing to pay a premium for eco-friendly features.

Smart Home Technology:

- Tech Integration: The integration of smart home technology is a significant draw for younger buyers. Features such as smart thermostats, security systems, and lighting control systems enhance convenience and efficiency.

- Future-Ready Homes: Properties equipped with the latest technology are considered future-proof, offering long-term benefits and convenience.

Community Spaces:

- Social Interaction: Community spaces such as lounges, rooftops, and co-working areas provide opportunities for social interaction and networking, which are important for the lifestyle of younger generations.

- Lifestyle Amenities: Access to amenities like gyms, parks, and recreational areas within the community enhances the living experience and adds value to the property.

Financing and Purchasing Behavior: Down Payments, Mortgage Choices, and Financial Literacy

Down Payments:

- Challenges: Saving for a down payment remains a significant hurdle for many young buyers. High living costs can make it difficult to accumulate the necessary funds. Some developers offer flexible downpayment terms or deals, but this causes a higher attrition rate.

- Assistance Programs: Many use government assistance programs and lower down payment options to enter the housing market.

Mortgage Choices:

- Flexible Options: Millennials and Gen Z favour flexible mortgage options that allow for lower initial payments and the possibility of refinancing. Variable-rate mortgages and first-time buyer incentives are popular choices.

- Online Tools: It is common for people to use online mortgage calculators and financial planning tools, which help them compare options and make informed decisions.

Financial Literacy:

- Education and Awareness: There is a growing emphasis on financial literacy among younger generations. Access to information through online resources, financial advisors, and educational programs helps them navigate the complexities of buying a home.

- Budget Management: Financial literacy programs have improved their ability to manage budgets, save effectively, and plan for long-term financial goals, making homeownership more attainable.

Implications of Younger Buyers for the Real Estate Market

| Impact | What it means |

| Increased Demand | Higher interest in homeownership among Millennials drives demand. |

| Property Pricing | Increased demand leads to higher property prices, especially in urban areas. |

| Market Saturation | Potential stabilisation of prices in some areas due to market saturation. |

Impact on Property Demand and Pricing

- Increased Demand: The growing interest in homeownership among Millennials and Gen Z has increased demand for residential properties, particularly in urban areas. This demand will continue rising as more young people enter the housing market.

- Property Pricing: With higher demand, property prices in urban centres have significantly increased. The price rise is particularly notable in cities like Metro Manila, Cebu, and Davao, which have the highest influx of young buyers. This trend has made affordability a critical issue for many first-time buyers.

- Market Saturation: In some areas, the market is approaching saturation, which could stabilise prices over time. However, the current trend points toward increased property values, driven by sustained demand from younger generations.

Shifts in Real Estate Development: Design, Construction, and Marketing Strategies

Shifts in Real Estate Development

| Area | Description |

| Design | Focus on modern aesthetics, sustainable design, and integration of green building practices. |

| Construction | Incorporation of smart technology, flexible spaces, and eco-friendly materials. |

| Marketing | Emphasis on digital marketing, social media engagement, and virtual property tours. |

Design:

- Modern Aesthetics: Developers are increasingly focusing on modern design elements that appeal to the aesthetic preferences of Millennials and Gen Z. Open floor plans, minimalist designs, and the incorporation of natural light are becoming standard features.

- Sustainable Design: There has been a significant shift toward sustainable building practices. These include using eco-friendly materials, energy-efficient systems and designs that minimise environmental impact.

Construction:

- Smart Technology Integration: New constructions are integrating smart home technologies from the ground up. This includes automated lighting, heating systems, security features, and connectivity options catering to younger buyers’ tech-savvy nature.

- Flexible Spaces: Developers are creating flexible living spaces that can adapt to different needs, such as remote work, entertainment, and family life. This adaptability is crucial in meeting the diverse demands of younger homeowners.

Marketing Strategies:

- Digital Marketing: Digital marketing strategies are paramount in reaching younger buyers. Social media, virtual tours, and targeted online advertisements are key tools for engaging this demographic.

- Experiential Marketing: Developers employ experiential marketing techniques, such as hosting virtual open houses and interactive property tours, to provide a comprehensive buying experience without needing physical visits.

Role of Technology in Shaping the Future of Real Estate Transactions

- Online Platforms: The proliferation of online real estate platforms has revolutionised how properties are listed, viewed, and purchased. Websites and apps like Lamudi, Property24, and others offer comprehensive tools for property search, price comparison, and virtual tours, making the buying process more accessible and efficient. Millennials between the ages of 25 and 34 accounted for 36.8% of sessions, 64.7% of page views, and 36.1% of leads on a real estate platform, according to Lamudi. Another study by Clever found they are 20% less likely to use a real estate agent to find homes than boomers.

- Virtual Reality: VR in real estate transactions is becoming increasingly common. These technologies allow potential buyers to take immersive virtual tours of properties, providing a realistic sense of the space without being physically present.

- Blockchain and Smart Contracts: Blockchain technology is starting to play a role in real estate transactions by providing secure and transparent ways to handle contracts and property records. Smart contracts can automate and streamline the buying process, reducing the risk of fraud and ensuring all parties meet their obligations.

Data Analytics: Advanced data analytics tools are used to understand better market trends, buyer preferences, and property values. This data-driven approach helps developers and real estate agents make informed decisions and tailor their offerings to meet market demand.

Policy Recommendations for Supporting Young Home Buyers

Policy Recommendations for Supporting Young Home Buyers

| Policy Area | Description |

| Affordable Housing | Implement zoning reforms, simplify regulations, and provide financial support. |

| Sustainable Development | Promote green certifications, renewable energy incentives, and mixed-income housing. |

| Financial Education | Integrate financial literacy into school curricula and provide online resources. |

| Public-Private Partnerships | Encourage joint ventures and incentivise private investment in affordable housing. |

Enhancing Access to Affordable Housing: Policy Reforms and Financial Support

Policy Reforms:

- Zoning Laws: Implementing flexible zoning laws that allow for higher-density housing can increase the availability of affordable units in urban areas. This can help accommodate the growing demand from younger buyers who prefer city living.

- Regulatory Simplification: Streamlining the regulatory process for property development can reduce construction costs and, subsequently, the price of housing. Simplified procedures can encourage more developers to invest in affordable housing projects.

Financial Support:

- Subsidies and Grants: Providing subsidies or grants to first-time home buyers can significantly lower the barrier to entry. Programs like the Pag-IBIG Fund offer affordable housing loans with low interest rates and flexible payment terms, making it easier for young buyers to secure financing.

- Tax Incentives: Offering tax incentives to buyers and developers can promote the construction and purchase of affordable housing. These incentives can include property tax reductions, deductions for mortgage interest, and credits for sustainable building practices.

Promoting Sustainable and Inclusive Development

Sustainable Building Practices:

- Green Certifications: Encouraging green building certifications like LEED or BERDE can promote sustainable development. These certifications ensure that buildings are energy-efficient, environmentally friendly, and provide a healthier living environment.

- Renewable Energy Incentives: Offering incentives for incorporating renewable energy sources, like solar panels, in new developments can reduce homeowners’ long-term energy costs and contribute to environmental sustainability.

Inclusive Development:

- Mixed-Income Housing: Developing mixed-income housing projects can ensure that affordable housing is integrated with market-rate housing, fostering diverse and inclusive communities. This approach can prevent the socioeconomic segregation often accompanying affordable housing initiatives.

- Universal Design: Implementing universal design principles that cater to all individuals, including those with disabilities, can ensure that housing developments are inclusive and accessible to everyone.

Strengthening Financial Education and Literacy Programs

Educational Programs:

- School Curricula: Integrating financial literacy into school curricula can equip young people with the knowledge and skills to manage their finances effectively. This includes understanding mortgages, interest rates, and the home-buying process.

- Community Workshops: Hosting community workshops and seminars on financial planning and home ownership can provide prospective buyers with practical guidance. These workshops can be organised by local governments, NGOs, or financial institutions.

Online Resources:

- Financial Tools: Developing and promoting online financial tools like budgeting apps and mortgage calculators can help young buyers plan their finances and make informed home-purchasing decisions.

- Information Portals: Creating centralised information portals that provide comprehensive resources on home buying, financial planning, and available support programs can improve access to vital information.

Encouraging Public-Private Partnerships for Housing Projects

Collaborative Initiatives:

- Joint Ventures: Encouraging joint ventures between the government and private developers can leverage the strengths of both sectors to deliver affordable housing projects. These partnerships can combine public funding with private expertise and efficiency.

- Incentive Programs: Establishing incentive programs that reward private developers for participating in affordable housing projects can stimulate investment. Incentives can include tax breaks, fast-tracked planning approvals, and subsidies for construction costs.

Community Involvement:

- Stakeholder Engagement: Involving community stakeholders in the planning and development process ensures that housing projects meet the needs and preferences of the intended beneficiaries. This can include public consultations, surveys, and collaborative design workshops.

- Long-Term Partnerships: Building long-term partnerships between the public and private sectors can ensure the sustainability and ongoing success of affordable housing initiatives. These partnerships can focus on continuous improvement, maintenance, and community support services.

Case Studies and Success Stories

Greenfield District in Mandaluyong, Philippines

Image Credit: Greenfield Development Corporation Facebook page

Background

Greenfield District is a mixed-use development in Mandaluyong City, Metro Manila. It aims to attract young professionals and families looking for sustainable and convenient urban living options.

Approach/Strategy

The development integrates residential, commercial, and recreational spaces, emphasising sustainability and modern amenities. Greenfield District’s marketing campaigns focused on its eco-friendly design, walkability, and proximity to business hubs. They also highlighted the availability of green spaces and community-oriented features.

Outcomes

Greenfield District has become popular among Millennials and Gen Z, who prioritise sustainability and convenience. The project’s success is evidenced by high occupancy rates and positive feedback from residents who appreciate the blend of urban living with green, open spaces. The district serves as a model for integrating sustainability and modern urban design to meet the needs of younger generations.

ArthaLand Century Pacific Tower

Image Credit: Edge Buildings

Background

Located in Bonifacio Global City (BGC), Taguig, the ArthaLand Century Pacific Tower is a premier sustainable office and residential building. The project targets environmentally conscious Millennials and Gen Z professionals.

Approach/Strategy

The building is designed with state-of-the-art green technologies, achieving LEED Platinum certification for its eco-friendly construction and operations. Marketing efforts highlighted the building’s energy efficiency, smart home technologies, and modern amenities. ArthaLand also engaged in digital marketing campaigns to reach tech-savvy young buyers.

Outcomes

The ArthaLand Century Pacific Tower has attracted numerous young professionals who value sustainability and innovation in their living and working spaces. The project’s success is reflected in its high occupancy and recognition as one of the leading green buildings in the Philippines. It demonstrates the effectiveness of combining green technologies with strategic marketing to appeal to younger demographics.

Final Thoughts on the Future of Home Ownership Among Millennials and Gen Z in the Philippines

The future of homeownership among Millennials and Gen Z in the Philippines appears promising, driven by a combination of economic growth, technological advancements, and changing social dynamics. This demographic shift reshapes the real estate market, presenting opportunities and challenges for developers, policymakers, and other stakeholders.

The increasing homeownership rates among Millennials and Gen Z signal a transformative period for the Philippine real estate market. Developers, policymakers, and financial institutions can create a supportive and dynamic real estate environment by understanding and responding to these generations’ unique preferences and behaviours. This proactive approach will meet young buyers’ needs and drive sustainable growth and innovation in the industry for years.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director