Download the summary of our latest report

The automotive industry has a clear, shared vision of a dramatically transformed future with electronic vehicles, autonomous vehicles, connected cars, shared ownership, and subscriptions. But are consumers ready to transition just yet? The pandemic has changed how much people travel, and this leaves us with the big question: how will the economic damage caused by COVID impact the car industry?

To further understand where consumers stand and what economic recovery looks like for the automotive industry —one of the hardest hit by the pandemic —we looked at five significant trends. We explored what’s at stake for each of these five trends, evaluated the rate of progress, and put the spotlight on innovative brands and solutions leading the way.

- Post-COVID caution: A battered industry navigates massive uncertainty.

- Plugged In: The electronic vehicle revolution is happening but still powered by subsidies.

- In Control: Artificial Intelligence is enhancing, not replacing, human driving abilities.

- Connected Vehicles

- Older Drivers, Younger Drivers

Download the full report and read the summary of the top 5 trends shaping the future of the automotive industry, with a spotlight on the brands that are capitalising on these trends with their cutting-edge innovative solutions.

#1 Post-COVID caution: A battered industry navigates massive uncertainty.

According to analysts, Jato Dynamics, global new car sales fell by over 12% in 2020, that’s around twice the drop recorded in IEA figures for the worst year of the last financial crisis (2007-2008).

While this drop was only 2% in China, the automotive industry felt a heavy blow globally. France, Germany, the UK, and Brazil saw declines of over 20%.

Consumer behaviour changed dramatically, and while new car sales declined due to the pandemic, the automobile aftermarket flourished as people tried to preserve their existing vehicles. Consumers started putting off purchases of luxury cars, hybrids, and EVs.

The early COVID-19 spread brought with it a new innovative trend —virtual showrooms, whereby consumers could move all or at least some part of their car buying experience online. In many parts of the world, COVID restrictions will become a part of life indefinitely, and therefore, this trend is here to stay.

Learn more about how the pandemic has reshaped the automotive industry here by downloading our free report.

#2 Plugged In: The electronic vehicle revolution is happening but still powered by subsidies.

As with much of the electronic vehicle (EV) revolution, subsidies and regulation may be needed for mass EV adoption.

In Norway, subsidies and tax breaks make the cost of an EV virtually identical to that of a non-electric car. 74% of the new cars sold in Norway are EVs, whereas it’s just 2% in the US. In the USA and China, EV sales plateaued when subsidies were reduced or phased out.

In 2021, US President Joe Biden took a step toward cutting greenhouse gas emissions signing an executive order aimed at making half of all new vehicles sold in 2030 electric, a move made with backing from the biggest US automakers.

Amazon is started testing electric delivery vans in 2021. The vehicles were developed in partnership with start-up Rivian, which raised $8 billion from investors, including Amazon through its $2 billion Climate Pledge Fund. The fund includes an agreement to purchase 100,000 electric vehicles from the start-up as part of its ambitious push to make Amazon’s fleet run entirely on renewable energy. Each van has a range of 150 miles per charge.

Before consumers join the EV revolution, they want to know there is a plan for infrastructure for charging stations.

A Deloitte study showed that consumers were putting off plans to buy EVs due to price and driving range. With ranges for EVs now often well over 400km, that is taken care of, but there needs to be a visible EV infrastructure in terms of charging stations. Therefore, at the moment, innovators need to tackle the two most critical factors —price and infrastructure.

Wireless charging stations are an essential solution. Although the technology exists, firms don’t want to build the infrastructure without enough cars; and manufacturers don’t want to create more expensive wireless options without that infrastructure.

Learn more about how Electronic Vehicles or EVs are perceived and the challenges ahead here by downloading our free report.

#3 In Control: Artificial Intelligence is enhancing, not replacing, human driving abilities.

Even though Tesla has made huge strides with its self-driving cars, the adoption is still slow due to consumer trust issues.

Moreover, driverless cars pose problems —of AI, of laws and ethics, and public perception.

In this scenario, autonomous vehicles with Driver Assistance Systems are becoming the norm in many markets.

The ultra-high-end Cadillac Escalade Platinum, launched in Summer 2021, is the first vehicle to boast GM’s Super Cruise technology. The vehicle handles your highway driving for you on major mapped roads. However, your car monitors you and will warn you if you stop paying attention to the road for more than five seconds before switching back to manual.

AI is set to become more prevalent in vehicles, learn more about the challenges for these enhancements here.

#4 Connected Vehicles

So far, automotive and infrastructure innovation has happened chiefly at the individual car level. However, traffic jams and rush hours occur at a network level when all those individual cars interact.

We see a change in this direction as businesses and transportation planners recognize the idea of the “mobility ecosystem” —where software platforms can connect, manage and mitigate network-level inefficiencies between transport services and their users.

Navigation apps showing real-time traffic data are already being used widely. We also see more adoption of smart speed limits and smart traffic light systems.

The next generation of connected vehicles goes deeper and broader with tools that allow bikes or mobility scooters to connect to the same systems cars use. Connected vehicles also make fleet management —of buses or utility vehicles, more efficient.

What are the implications for individual drivers? For the mobility ecosystem to work, each car requires a digital identity. They do, however, present the issue of privacy.

Your car’s digital identity can also be linked to your own distinct identity as a driver, which makes the car more secure with keyless entry using facial or voice recognition and biometric sensors.

Our innovation spotlight is on Foxconn, the Chinese manufacturing giant which makes the iPhone. Foxconn is developing an EV platform that any brand can use to bring vehicles to market —in the same way as the Android phone platform. Foxconn bets that the real differentiator in the future EV market won’t be looks or performance; it’ll be the array of connected features and AI capabilities they possess.

A connected mobility ecosystem is one of the trends emerging in the transportation and automotive industry. Download our report to discover more about this emerging trend.

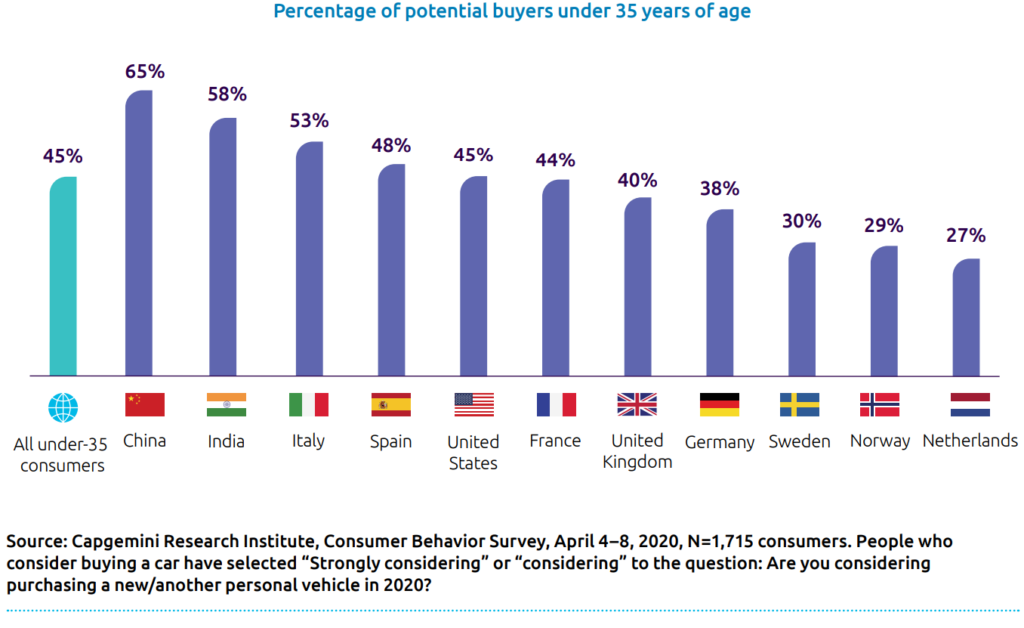

#5 Older Drivers, Younger Drivers

The automotive trends influenced by the ageing population and the changing expectations of Gen Z are creating significant changes. For older people, AI can help extend their driving lifetime. For the young, the big question is whether ownership will decline in favour of sharing and subscription mobility.

Late Millennial and Gen Z consumers are a post-ownership generation —they prefer renting to buying houses or vehicles. Car manufacturers have been trying to introduce the idea of Mobility-as-a-Service solutions, which replaces car ownership with car-sharing or subscription-based offers at a lower cost.

However, while Mobility-as-a-Service has had some successes in the bikes and e-Scooter sectors, especially in busy cities, it’s been tougher ask for cars.

Overall, we see a shift away from the brand to features and capabilities.

If you need more detailed information to help make decisions for your organisation or brand, download the full report here.

To learn more, download the full report: Automotive Trends For 2022

To learn more about how these trends, download the full report. Alternatively if you’d like to speak to us to understand more about how these trends are playing out in your market, get in touch.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director