The beauty industry is constantly evolving and growing, with global sales projected to reach $716 billion by 2025. However, in this crowded and competitive market, it is becoming increasingly challenging for brands to stand out and capture the attention of their target audience.

Did you know that 75% of consumers expect personalized experiences from beauty brands? To provide personalized experiences and create effective marketing strategies, brands in this space must understand the consumer behavior of their target audience.

Demographics

Understanding the demographics of the beauty and cosmetics consumer is essential for product marketing managers to create effective campaigns and products that resonate with their target audience. Over the years, the demographics of the beauty industry have evolved significantly, with changes in age, gender, and socioeconomic backgrounds.

Traditionally, the beauty industry was primarily marketed towards women, but in recent years, there has been a shift towards inclusivity and diversity, with many brands now targeting men, non-binary individuals, and individuals of all ages and ethnicities.

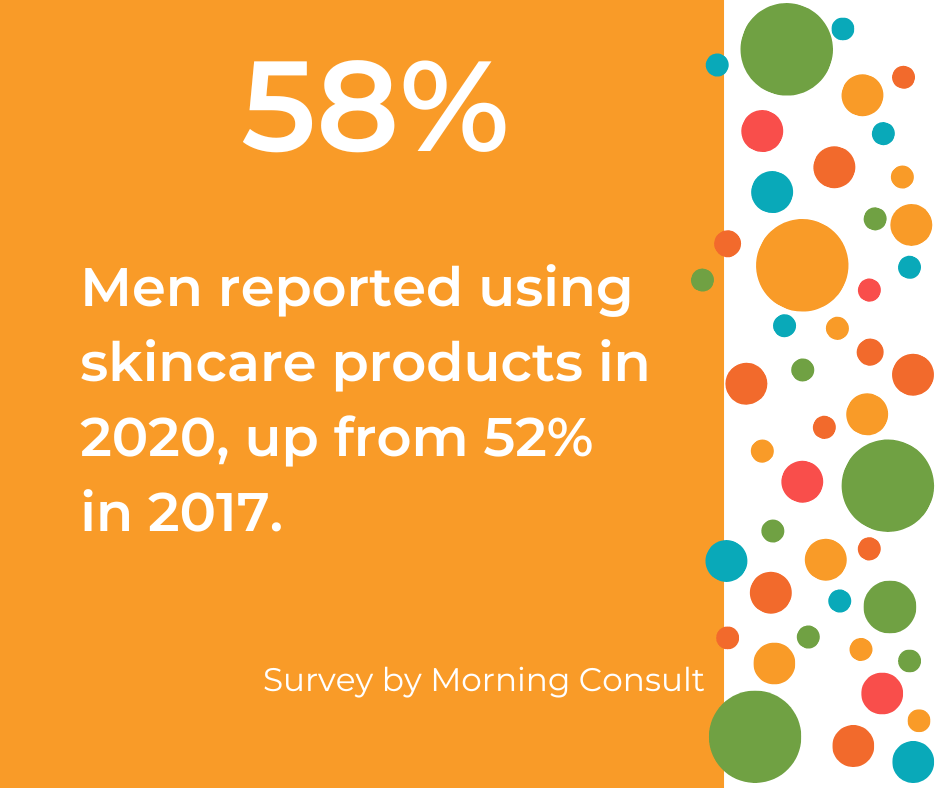

According to a report by Euromonitor International, in 2020, the global beauty and personal care market saw a 6.5% increase in male grooming products, and 60% of men reported using skincare products daily. This trend is expected to continue in the coming years, with more men becoming interested in grooming and personal care.

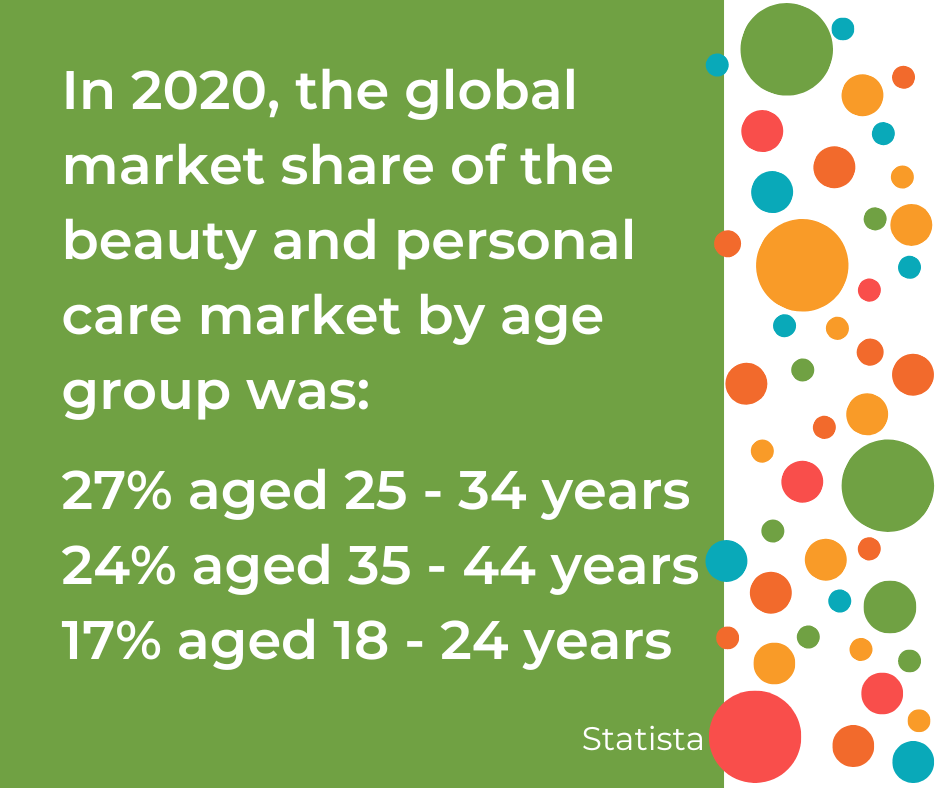

In terms of age, the beauty industry targets a wide range of age groups. The younger generation, especially millennials and Gen Z, have been particularly influential in driving trends and shaping the industry. This demographic is more likely to be influenced by social media and celebrity endorsements and is more open to trying new products and experimenting with different looks.

Socioeconomic background also plays a role in consumer behavior in the beauty industry. High-end luxury brands tend to target a more affluent audience, while drugstore brands aim to be more accessible to consumers on a budget.

Psychographics

In addition to demographics, understanding the psychographics of your target audience is essential for product marketing managers in the beauty industry. Psychographics refers to consumers’ attitudes, values, and beliefs and how these factors influence their purchasing decisions.

For example, some consumers may prioritize sustainability and ethical sourcing when choosing beauty products, while others may prioritize convenience and affordability. Some consumers may be loyal to a particular brand or product, while others may be more open to trying new products and experimenting with different looks.

To better understand the psychographics of your target audience, it can be helpful to conduct market research, such as surveys or focus groups, to gather insights into their preferences and purchasing habits. Social media can also be a valuable tool for understanding the attitudes and values of your target audience, as it provides a platform for consumers to share their opinions and engage with brands.

Once you have a better understanding of the psychographics of your target audience, you can tailor your marketing strategies and products to meet their specific needs and preferences. For example, if sustainability is essential to your target audience, you could focus on using eco-friendly packaging and ingredients in your products. If convenience is a priority, you could develop products that are easy to use on-the-go.

Consumer Behavior Models

Exploring different consumer behavior models can be helpful to better understand the consumer behavior of your target audience in the beauty industry. These models provide a framework for understanding consumers’ purchasing decisions and can help brands develop effective marketing strategies.

- Traditional Marketing Funnel: This model is a widely used framework for understanding the customer journey. It consists of four stages: awareness, interest, decision, and action. At each stage, consumers have different needs and requirements, and it is the job of product marketing managers to provide the right information and support to move them through the funnel toward a purchase.

- Customer Decision-Making Process: This model is a more in-depth framework that focuses on the internal thought processes of consumers. It consists of five stages: problem recognition, information search, evaluation of alternatives, purchase decision, and post-purchase evaluation. This model highlights the importance of understanding the needs and preferences of consumers at each stage of the decision-making process.

- Consumer Adoption Process: The consumer adoption process model focuses on how consumers adopt new products. It comprises five stages: awareness, interest, evaluation, trial, and adoption. This model benefits brands introducing new products to the market, as it helps them understand the factors that influence consumers’ adoption of new products.

By understanding these different consumer behavior models, product marketing managers can tailor their marketing strategies to better meet the needs and preferences of their target audience at each stage of the customer journey.

For example, suppose a brand is launching a new product. In that case, the consumer adoption process model can be used to develop a targeted marketing campaign that focuses on building awareness, generating interest, and encouraging product trialing.

Understanding the different consumer behavior models is crucial for brands in the cosmetics and beauty industries to develop effective marketing strategies that resonate with their target audience. These models provide a framework for understanding the customer journey and can be used to create targeted campaigns that meet the needs and preferences of consumers at each stage of the decision-making process.

Purchase Decision Factors

To better understand the consumer behavior of your target audience in the beauty industry, it is essential to identify the key factors that influence their purchase decisions. Some of the factors that can influence purchase decisions in the beauty industry include:

- Brand Loyalty: Brand loyalty is a significant factor in the beauty industry. Consumers often develop strong attachments to specific brands and are more likely to purchase products from those brands. This can be influenced by factors such as product quality, brand reputation, and the consumers’ emotional connection to a particular brand.

- Price Sensitivity: Price is another significant factor in consumer purchase decisions in the beauty industry. Consumers may be willing to pay a premium for high-end luxury products but also look for affordable options that provide value for money. Price sensitivity can be influenced by factors such as the consumer’s budget, the product’s perceived value, and the market’s competition.

- Product Quality: Product quality is a crucial factor in the beauty industry. Consumers expect high-quality products that deliver on their promises and provide the desired results. Quality can be influenced by factors such as the ingredients used, the manufacturing process, and the testing and certification of the product.

- Social Influence: Social influence can also significantly influence consumer purchase decisions in the beauty industry. Consumers may be influenced by the recommendations of friends and family, as well as social media influencers and celebrities. This can be particularly important for younger generations, who are more likely to be influenced by social media.

By understanding these key purchase decision factors, brands can develop marketing strategies and products that meet the needs and preferences of their target audience.

For example, if brand loyalty is a significant factor for the target audience, the marketing strategy could focus on building emotional connections and highlighting the brand’s reputation and heritage.

Consumer Segmentation

Consumer segmentation divides consumers into groups based on shared characteristics, such as demographics, psychographics, and behaviors. This approach allows brands to understand their target audience better and develop products and campaigns that meet their specific needs and preferences.

In the beauty, personal care, and cosmetics industries, consumer segmentation can be beneficial due to the wide range of products and needs of different consumers. Some examples of different consumer segments within the beauty industry include:

- Age-Based Segmentation: This segmentation approach targets consumers based on their age groups, such as millennials, Gen Z, or Baby Boomers. Each age group may have different needs and preferences regarding beauty products, and marketers can tailor their products and campaigns to meet those specific needs. For example, younger consumers may be more interested in social media and influencer marketing, while older consumers may prefer traditional advertising.

- Gender-Based Segmentation: While the beauty industry has traditionally targeted women, there has been a shift towards gender-neutral and inclusive marketing in recent years. Gender-based segmentation can help marketers develop products and campaigns that speak to the specific needs and preferences of different gender identities.

- Skin Type-Based Segmentation: Consumers may have different skin types, such as dry, oily, or combination. Products can be tailored to meet the specific needs of each skin type, such as developing products for oily skin that focus on reducing shine and controlling oil production.

By understanding the needs and preferences of different consumer segments, brands can develop targeted products and campaigns that resonate with their target audience. For example, if a brand targets younger consumers, it could focus on developing products that are Instagrammable and easily shared on social media. Alternatively, if a brand targets consumers with specific skin concerns, it could develop products that address those concerns, such as anti-aging products for mature skin.

Consumer segmentation is a valuable tool for product marketing managers in the beauty industry to understand their target audience better and develop products and campaigns that meet their specific needs and preferences. By tailoring their marketing strategies and products to different consumer segments, product marketing managers can increase the effectiveness of their campaigns and better connect with their target audience.

Trends in the Beauty Industry

The beauty industry constantly evolves, and brands must stay current with the latest trends and developments. Here are some of the current trends in the beauty industry:

- Clean Beauty: Clean beauty refers to products made with non-toxic, natural ingredients free from harmful chemicals. Consumers are becoming increasingly concerned about the ingredients in their beauty products and are looking for products that are better for their health and the environment. This trend is influencing consumer behavior and driving demand for clean beauty products.

- Sustainability: Sustainability is becoming a top priority for consumers in the beauty industry. Consumers are looking for products that are produced in an environmentally-friendly way and packaged in sustainable materials. This trend drives innovation in product development and packaging and encourages companies to adopt more sustainable practices throughout their operations.

- Inclusivity: Inclusivity is a growing trend in the beauty industry, with consumers looking for products that cater to a diverse range of skin tones, hair textures, and gender identities. This trend drives increased representation and diversity in advertising and product development and encourages companies to be more inclusive in their messaging and branding.

Brands can adapt to these trends by developing products and campaigns that align with consumer values and preferences. For example, a brand could create a line of clean beauty products that use natural ingredients and are free from harmful chemicals. They could also focus on sustainability by using eco-friendly packaging and reducing their carbon footprint. Additionally, they could incorporate inclusivity into their marketing strategies by featuring a diverse range of models in their advertising and offering products that cater to a diverse range of skin tones and hair textures.

Staying up-to-date with the latest trends in the beauty industry is crucial for product marketing managers to develop effective marketing strategies that resonate with their target audience. By adapting to trends such as clean beauty, sustainability, and inclusivity, product marketing managers can create products and campaigns that meet the needs and preferences of their consumers and drive demand for their brands.

Case Studies

To better understand effective product marketing campaigns in the beauty industry, analyzing successful campaigns and understanding why they effectively reached their target audience can be helpful. Here are some examples of successful product marketing campaigns in the beauty industry:

Dove Beauty Case Study

Dove is a brand synonymous with inclusivity and body positivity in the beauty industry. In 2004, Dove launched its “Real Beauty” campaign, which quickly became one of the most iconic marketing campaigns in the industry.

The “Real Beauty” campaign focused on celebrating the natural beauty of women of all ages, sizes, and skin tones. The campaign featured real women in their advertisements rather than professional models or actresses. The campaign also included a series of viral videos that challenged traditional beauty standards and encouraged women to embrace their natural beauty.

The campaign was a huge success, generating millions of views and sparking a conversation about beauty standards and representation in the media. Here are some reasons why the campaign was so effective:

- Catering to consumer values: The “Real Beauty” campaign was successful because it focused on consumer values, such as inclusivity, authenticity, and body positivity. The campaign resonated with consumers tired of seeing unrealistic beauty standards in the media and looking for brands that celebrated diversity and real beauty.

- Using social media to build a following: Dove leveraged social media to connect with its target audience and build a loyal following. The campaign included a website and social media channels that encouraged women to share their stories and photos, creating a community of women who were united by the campaign’s message.

- Differentiating from competitors: Dove differentiated itself by taking a bold stance on inclusivity and body positivity. The campaign challenged traditional beauty standards and celebrated the natural beauty of women of all ages, sizes, and skin tones. This differentiated Dove from other beauty brands focused on promoting unrealistic beauty standards.

The “Real Beauty” campaign was not without its critics, however. Some criticized the campaign for promoting Dove products as a solution to low self-esteem and body image issues. Others argued that Dove was still promoting a narrow definition of beauty, despite its message of inclusivity.

Despite these criticisms, the “Real Beauty” campaign remains an iconic example of effective marketing in the beauty industry. The campaign was successful because it resonated with consumers on a deeper level by focusing on values and emotions rather than just selling products. The campaign also had a lasting impact on the industry, sparking a conversation about beauty standards and representation that continues to this day.

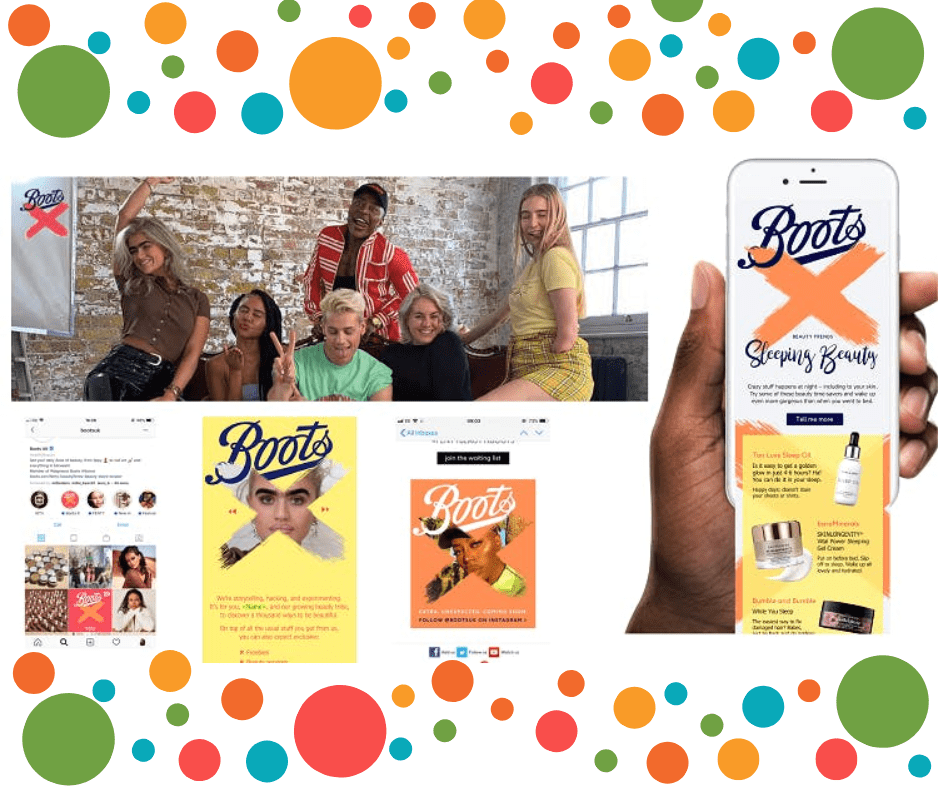

Boots Case Study

Boots is a leading health and beauty retailer in the UK that offers a wide range of products, from skincare to makeup to fragrance. The brand has successfully differentiated itself by providing diverse products and catering to consumers of all ages and backgrounds. Here are some reasons why Boots has been successful in the beauty industry:

- Segmentation: One of the keys to Boots’ success is its segmentation strategy. The brand offers a wide range of products that cater to consumers of all ages and backgrounds, from teens to seniors and from luxury to budget. This segmentation strategy allows the brand to appeal to a broad range of consumers and meet the specific needs of each segment.

- Branding: Boots has built a strong brand reputation over the years by focusing on quality and affordability. The brand is known for its commitment to customer service and has won numerous awards for its loyalty program. This strong branding has helped to build a loyal following of consumers who trust the brand and continue to shop at Boots for their health and beauty needs.

- Product Development: Boots has also been successful in the beauty industry by focusing on product development. The brand offers diverse products, from branded products to exclusive partnerships with other brands. Boots also has a strong focus on innovation, with a dedicated team constantly researching and developing new products to meet the changing needs of consumers.

- Digital Strategy: Boots has also been successful in the beauty industry by leveraging its digital channels to connect with consumers. The brand has a strong online presence, a website offering a wide range of products and services, and an active social media presence. Boots also offers a range of digital tools and services, such as its “Virtual Beauty Counter,” which allows consumers to get personalized beauty advice online.

Overall, Boots’ success in the beauty industry can be attributed to its strong segmentation strategy, branding, product development, and digital strategy. By catering to a broad range of consumers and offering a diverse range of products, Boots has built a loyal following of customers who trust the brand and continue to shop at Boots for their health and beauty needs. Additionally, by leveraging digital channels to connect with consumers and offer innovative products and services, Boots has been able to stay ahead of the curve in the highly competitive beauty industry.

Lotus Herbals Case Study

Lotus Herbals is a popular Indian beauty brand specializing in using natural and herbal ingredients. The brand has successfully differentiated itself by focusing on affordable yet high-quality products accessible to a wide range of consumers. Here are some reasons why Lotus Herbals has been successful in the beauty industry:

- Natural and Herbal Ingredients: Lotus Herbals has differentiated itself from its competitors by focusing on natural and herbal ingredients. The brand strongly focuses on sustainability and uses environmentally-friendly practices in its production processes. This focus on natural and sustainable ingredients has helped the brand build a loyal following of consumers looking for safe and eco-friendly beauty products.

- Accessibility and Affordability: Another key to Lotus Herbals’ success has been its focus on accessibility and affordability. The brand offers a wide range of products at an affordable price point, making it accessible to a wide range of consumers. This has helped the brand to build a large customer base and compete with larger, more established brands in the Indian beauty market.

- Innovative Products: Lotus Herbals has also been successful in the beauty industry by focusing on innovation. The brand has a dedicated research and development team that is constantly researching and developing new products to meet the changing needs of consumers. This focus on innovation has helped the brand to stay ahead of the curve and differentiate itself from its competitors.

- Marketing Strategy: Lotus Herbals has also been successful in the beauty industry by leveraging its marketing channels to connect with consumers. The brand has a strong online presence, with a website that offers a wide range of products and services, as well as an active social media presence. The brand also partners with influencers and celebrities to promote its products and build brand awareness.

Overall, Lotus Herbals’ success in the beauty industry can be attributed to its focus on natural and sustainable ingredients, accessibility and affordability, innovative products, and marketing strategy. By catering to a wide range of consumers and offering affordable yet high-quality products, Lotus Herbals has built a loyal following of customers who trust the brand and continue to purchase its products. Additionally, by leveraging its marketing channels to connect with consumers and promote its products, Lotus Herbals has been able to stay ahead of the curve in the highly competitive Indian beauty market.

SK-II Case Study

SK-II is a luxury skincare brand known for its innovative and high-quality products. The brand has successfully differentiated itself by using natural ingredients, such as Pitera, in its products. Here are some reasons why SK-II has been successful in the beauty industry:

- Product Innovation: One of the keys to SK-II’s success has been its focus on product innovation. The brand is known for using Pitera, a natural ingredient derived from yeast fermentation, in its products. This innovative ingredient has become synonymous with the brand and has helped to differentiate SK-II from its competitors.

- Luxury Branding: SK-II has also been successful in the beauty industry by leveraging its luxury branding to connect with consumers. The brand has a strong focus on quality and premium products. It has successfully marketed itself as a high-end brand offering its customers a luxurious and exclusive experience.

- Digital Marketing: SK-II has also been successful in the beauty industry by leveraging digital marketing channels to connect with consumers. The brand has a strong online presence, a website offering a wide range of products and services, and an active social media presence. SK-II also partners with influencers and celebrities to promote its products and build brand awareness.

- Emotional Connection: SK-II has also been successful in the beauty industry by building an emotional connection with its customers. The brand strongly focuses on empowering women and has launched several campaigns that focus on issues related to women’s empowerment, such as its #ChangeDestiny campaign. This emotional connection has helped to build a loyal following of consumers who feel strongly connected to the brand.

Overall, SK-II’s success in the beauty industry can be attributed to its focus on product innovation, luxury branding, digital marketing, and emotional connection. By leveraging its unique ingredient, Pitera, and focusing on luxury branding and premium products, SK-II has been able to differentiate itself from its competitors and build a loyal following of consumers. Additionally, by leveraging digital marketing channels and building an emotional connection with its customers, SK-II has stayed ahead of the curve in the highly competitive beauty industry.

In conclusion, understanding consumer behavior is essential for product marketing managers in the beauty industry. By understanding the demographics and psychographics of their target audience, brands can create more effective marketing strategies and better tailor their products to meet the needs of their customers.

Additionally, by understanding consumer behavior models, purchase decision factors, and consumer segmentation, companies can better target their audience and create more effective marketing campaigns.

Lastly, by staying up-to-date on current trends in the beauty industry and analyzing successful case studies, brands can adapt their strategies to meet the changing needs and preferences of the market.

Key Takeaways:

- Understand the demographics and psychographics of your target audience

- Use consumer behavior models to understand your audience better

- Identify key purchase decision factors that influence consumer behavior in the beauty industry

- Use consumer segmentation to target your audience better

- Stay up-to-date on current trends in the beauty industry

- Analyze successful case studies to adapt your marketing strategies and product offerings.

Want to learn more about the latest beauty, cosmetics, and personal care trends? Download our report About Face here

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director