Understanding how to calculate market size is a critical step in evaluating whether your product can succeed or whether you’re investing in an untested and potentially unprofitable niche.

Accurate market size calculation is crucial to business success. This foundational element of market size analysis enables senior leaders to navigate complex market conditions and make informed strategic decisions. Understanding how to calculate potential market size is especially important when entering a new market or launching a product. Without solid data, companies may misallocate resources and overestimate demand.

Robust market size analysis, grounded in data, offers brands a strategic edge. By studying consumer demand, market trends, and competitor positioning, companies can identify market gaps and avoid strategic missteps. This is particularly important in global market sizing, where economic factors and purchasing behaviors vary regionally.

To stay competitive, brands must move beyond static estimates. Using AI-driven predictive models and real-time data tools transforms traditional market size calculation into a dynamic, responsive strategy. These tools help adapt to changing consumer behavior and regional conditions.

What is Market Size?

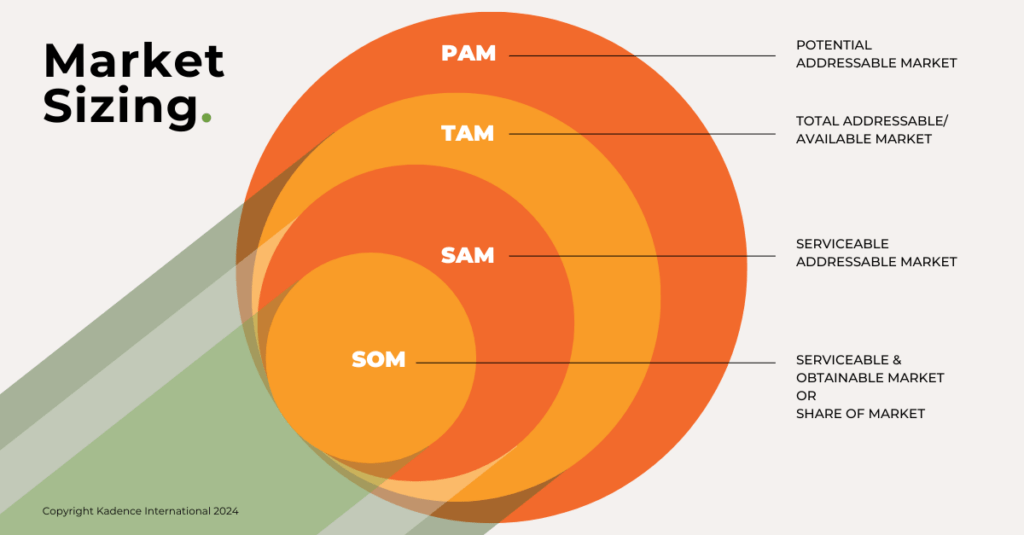

Market size refers to the total potential revenue or sales volume a business can achieve within a specific market. Understanding market size calculation involves breaking it down into two key components:

Total Addressable Market (TAM): The overall demand for your product or service across all potential customers.

Serviceable Available Market (SAM): The share of the TAM that your business can realistically serve based on your capabilities, competitors, and market access.

While TAM gives a high-level view, SAM provides a practical foundation for more targeted market size analysis.

Why Market Size Matters for Businesses

Understanding market size is essential for companies because it underpins goal setting, strategic planning, and risk assessment. Whether you’re launching a new product or entering unfamiliar territory, market size analysis provides critical insight into demand levels and helps inform product development, marketing allocation, and long-term strategy.

For example:

- Product Launches: Calculating market size before launch ensures you’re meeting sufficient demand. Market sizing methods help identify promising segments and avoid over-investment in saturated or declining categories.

- Market Entry Strategies: When entering a new region, market size calculation clarifies opportunity scale. It enables you to design entry plans informed by economic conditions, consumer preferences, and regional competition.

- Resource Allocation: Accurate market size estimates allow for smarter budget and resource distribution. This improves ROI by ensuring marketing and operations focus on the most viable market opportunities.

Hypothetical Example: The EV Market in the Philippines

Let’s consider a hypothetical example of market size analysis: A major global automotive brand plans to enter the electric vehicle market in the Philippines. To estimate potential revenue, the company calculates market size using both TAM and SAM. This includes evaluating urban growth, middle-class expansion, and government support for electric mobility. Market size calculation here is the foundation for evaluating commercial viability.

With insights from this market size analysis, the company focuses its entry strategy on high-opportunity urban centers for EV adoption. Targeted resource allocation—including partnerships for charging infrastructure—supports a stronger foothold in sustainable transportation, backed by precise market sizing methods.

Key Approaches to Calculating Market Size

Effective market size calculation relies on a mix of traditional methods and modern AI-driven approaches. These market sizing methods help businesses better understand potential demand and adapt to global shifts. Below, we explore key approaches used in advanced market size analysis today.

Top-Down Approach for Market Sizing

The top-down method of market sizing begins with high-level industry data—like government reports or global market estimates—and then narrows the focus to your specific target market. This market size calculation technique is useful for gauging overall potential, though it can sometimes miss local behaviors or niche demand.

AI Forecasting Models:

Modern AI forecasting tools elevate top-down market size analysis by layering in predictive analytics. These models process historical market data, competitor trends, and consumer sentiment to improve the accuracy of market size projections and future demand forecasts.

Example Scenario:

Our earlier example—the global automaker entering the EV market in the Philippines—might begin with a top-down market size calculation based on the $500 billion global EV market. By applying AI-based market sizing methods, they refine this estimate using local variables like infrastructure, preferences, and policy incentives. This dynamic market size analysis enables more responsive, localized strategy planning.

Bottom-Up Approach to Determine Market Size

The bottom-up approach to market size calculation starts at the ground level—relying on local sales data, consumer interviews, and behavioral surveys. This method offers precise, actionable insights and is especially useful for detailed market size analysis within specific segments or regions.

Predictive Analytics for Consumer Behavior:

Machine learning–driven predictive analytics enhances bottom-up market size analysis by revealing future purchasing trends based on past behavior. These tools allow businesses to scale their market size calculations with greater speed and accuracy than traditional survey methods alone.

Example Scenario:

A company exploring the plant-based food market in Japan could use real-time consumer surveys and AI-driven behavior analysis to uncover key consumption trends. These insights enhance the accuracy of market size calculations and support data-led product development aligned with emerging demand for organic and eco-friendly options.

Hybrid Approach to Market Sizing

The hybrid approach to market sizing combines top-down and bottom-up methods to provide a holistic market size analysis. By merging broad industry data with localized research, this method delivers a more complete and context-aware understanding of potential market value.

Scenario Analysis:

Scenario analysis is a vital part of advanced market size analysis. It enables businesses to model future outcomes based on changing conditions—like economic slowdowns or shifting consumer behaviors—producing a range of market size forecasts rather than relying on a static figure. This approach increases agility and reduces risk in strategic planning.

Example Scenario:

Consider a beauty brand entering China’s $60 billion beauty industry. By applying both top-down and bottom-up market sizing methods—backed by consumer surveys and market size analysis—the brand can model how variables like regulatory shifts or rising demand for cruelty-free products will shape future opportunity. Scenario analysis helps ensure the strategy is adaptive and resilient.

Steps to Calculate Potential Market Size

Accurate market size calculation depends on strong data, strategic foresight, and modern tools. These next four steps outline a structured market sizing method that senior leaders can apply to generate actionable insights and improve global market size estimates.

Step 1: Define Your Target Market with AI and Predictive Modeling

Step one in any effective market size calculation is defining your target audience. With predictive modeling, machine learning can segment audiences using real-time data and historical behavior, making your market size analysis more accurate and responsive to shifting demand.

For instance, in Japan, using AI to analyze the purchasing patterns of senior grocery buyers could reveal untapped market segments or emerging preferences, such as increased demand for organic products among older consumers.

Step 2: Analyze Market Demand Using Real-Time Data

Market size analysis based on static data can quickly become outdated. Using real-time data sources—such as digital transactions, social media behavior, or mobile app usage—gives businesses a dynamic and current view of market demand, leading to more accurate market size calculations.

Example Scenario:

In Vietnam’s fast-fashion market, brands can use real-time e-commerce data and social listening tools to improve their market size analysis. By tracking how consumers engage with fashion content online, companies can predict demand shifts, refine product offerings, and update their market size calculations with more precision.

Step 3: Identify Competitors and Leverage Competitive Intelligence

Accurate market size calculation requires more than just competitor lists—it demands active competitive intelligence. By tracking pricing, product innovation, and customer retention, businesses strengthen their market size estimates with real-world context and up-to-date intelligence.

AI-Powered Competitor Analysis:

AI-driven competitor analysis tools offer real-time alerts on new product launches, pricing shifts, and changing customer sentiment. This supports more responsive market size analysis, helping brands adapt their strategies and refine projections as competitive conditions evolve.

Example Scenario:

In Singapore’s online gaming industry, market size analysis supported by AI-based competitor tracking can reveal gaps in consumer engagement. For new entrants, this approach helps uncover underserved niches, refine positioning, and estimate market potential with greater accuracy.

Step 4: Estimate Market Value with Dynamic Forecasting Models

Traditional market sizing methods often rely on static revenue projections. In contrast, dynamic forecasting models allow brands to perform real-time market size calculations that reflect actual consumer behavior and evolving economic conditions, delivering more accurate results.

Example Scenario:

In India’s digital payments sector, market size calculation powered by AI can analyze banking access, transaction trends, and digital literacy. These models help companies forecast adoption rates, identify growth opportunities, and scale effectively based on real-time insights and evolving user behaviors.

Common Challenges in Calculating Market Size (and How to Overcome Them)

Senior decision-makers and market researchers often encounter complex hurdles during market size calculation. Fortunately, these challenges can be addressed with the right market sizing methods, tools, and a proactive research approach:

- Data Limitations: In market size analysis, data gaps can hinder accuracy. Leveraging AI and machine learning helps fill these gaps, generate forecasts, and continuously refine datasets with real-time information, enhancing the precision of your market size calculations.

- Rapidly Changing Conditions: To ensure robust market size calculations amidst fluctuating demand and economic shifts, invest in scenario analysis. This approach allows businesses to prepare for various future scenarios, maintaining agility in their market size analysis.

- Regional Differences: Incorporate localized AI-driven models into your market sizing methods to account for cultural, regulatory, and economic variations across regions, ensuring more accurate market size analysis.

- Overestimating TAM: Employ AI to dissect the Total Addressable Market (TAM) into realistic segments, facilitating more precise market size calculations and identifying truly serviceable and attainable market portions.

Actionable Recommendations for Market Leaders

Accurate market size calculation is an ongoing process requiring data-driven insights, predictive analytics, and strategic foresight. Implementing effective market sizing methods ensures that businesses can adapt to evolving market dynamics and maintain a competitive edge.

Leverage AI and Predictive Analytics

Integrate AI-driven tools into your market research strategy to dynamically analyze data, predict trends, and continuously refine market size calculations. Machine learning algorithms enable real-time tracking of consumer behavior, enhancing the accuracy of your market size analysis, particularly in fast-evolving sectors like technology and healthcare.

Tip: Enhance traditional market size calculations with AI by integrating real-time data, predictive analytics, and automated updates. This approach leads to more dynamic and precise market size analysis, enabling businesses to anticipate how emerging technologies might influence sectors like digital payments or shifting consumer behaviors in fast-fashion markets.

Apply Tailored Strategies for Specific Industries and Regions

Tailor your market size calculations to the specific characteristics of each industry and region. Employing appropriate market sizing methods ensures that factors like cultural nuances, economic conditions, and regulatory frameworks are accurately reflected, providing a more precise market size analysis across sectors such as technology, healthcare, and retail.

Tips for Tailoring Market Size Calculations:

- Industry-Specific: For global brands conducting market size analysis, regional adaptation is critical. Segment your market sizing methods to reflect local consumer preferences, cultural nuances, and regulatory conditions. For instance, in India’s digital payments sector, a mobile-first approach is essential, while in the UK beauty market, demand for cruelty-free and sustainable products must shape market size calculations

- Regional Adaptation: For global companies, segment market analysis by region and factor in local consumer preferences, regulatory conditions, and cultural nuances. For example, a mobile-first strategy may be essential in the digital payments space in India, while sustainability and cruelty-free preferences may shape the beauty market in the UK.

- Focus on Serviceable Market Segments for Realistic Growth: Overestimating the Total Addressable Market (TAM) can result in unrealistic projections. Instead, market leaders should center their market size analysis on the Serviceable Available Market (SAM) and Serviceable Obtainable Market (SOM)—the most realistic and competitive segments to target in any market size calculation.

Tips for Targeting Serviceable Markets:

- Narrow Market Segments: Identify narrow market segments that align with your brand’s strengths and competitive positioning. Use detailed customer personas, combined with market size analysis and AI-driven behavioral data, to focus your efforts on high-potential groups during your market sizing process.

- Assess Market Entry Barriers: Assess competitive pressures, pricing models, and regulatory challenges to determine how much of the SAM is truly attainable. A strong market size calculation should account for these barriers. For example, companies entering the digital payments market must evaluate adoption rates and infrastructure maturity as part of their market size analysis.

- Adopt Scenario Analysis for Greater Flexibility: Markets evolve quickly, and effective market size analysis requires agile strategies. Scenario analysis enables business leaders to model multiple outcomes—economic shifts, policy changes, or new technologies—providing a range of potential market size estimates and reducing overreliance on static projections. Tip: As part of your market size analysis, model a variety of projections—like how a recession might affect demand or how innovation could open up new market segments. This flexibility supports smarter market sizing methods and helps brands remain competitive as dynamics shift.

- Leverage Continuous Market Research for Agile Decision-Making: One-time market size calculations are no longer enough in fast-moving markets. Continuous market research and real-time market size analysis help brands stay agile, react to consumer behavior shifts, and capture new opportunities as they arise.

Tips for Continuous Research:

- Adopt Real-Time Data Tools: To improve the accuracy of market size analysis, adopt tools for ongoing data collection and real-time analysis. Digital analytics platforms, AI-powered social listening, and automated surveys help track evolving consumer behavior and deliver continuous insights for more dynamic market size calculations.

- Periodic Market Size Reviews: Schedule regular market size reviews to ensure your analysis reflects real-world changes. Periodic updates to your market size calculation, informed by dynamic forecasting models, enable brands to pivot in response to market shifts, regulatory updates, or economic disruptions.

- Collaborate Across Departments for a Holistic View: Effective market size analysis requires input from more than just marketing or strategy teams. By involving sales, finance, product development, and operations, businesses gain a 360-degree view of market potential. This cross-functional collaboration improves both the accuracy and strategic impact of your market size calculations.

Tips for Cross-Department Collaboration:

- Engage Sales Teams: Sales teams are on the front lines of customer interaction, making their input essential to market size analysis. Their observations on buyer behavior, demand shifts, and saturation levels help validate market size estimates and make forecasts more grounded in current conditions.

- Collaborate with Finance: Partnering with finance ensures your market size calculation aligns with broader revenue planning. Financial analysts can help refine your market sizing assumptions and ensure growth projections are financially viable and aligned with business performance indicators.

- Prioritize Data-Driven Decision-Making: Accurate market size analysis depends on a strong foundation of reliable data. Senior leaders should base strategic decisions on predictive analytics and documented trends, not assumptions. This data-driven approach to market sizing helps minimize resource misallocation and enables rapid strategic adjustments when conditions change.

Tips for Data-Driven Decision-Making:

- Use Multiple Data Sources: Use a blend of primary research, secondary sources, internal sales records, and AI-driven analytics to enhance your market size calculation. A multi-source strategy provides a broader, more reliable foundation for understanding true market potential.

- Validate Assumptions Continuously: Market size analysis is only as strong as the assumptions behind it. Continuously validate those assumptions using competitor intelligence, updated industry benchmarks, and customer feedback. This ensures that your market size estimate remains current and actionable as conditions evolve.

FAQS about Market Size Analysis

1. How to do market size analysis?

Market size analysis involves estimating the total revenue or units that can be generated within a specific market. This includes identifying the target audience, calculating total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM). Market size analysis helps businesses understand potential demand and guides investment decisions.

2. What are the 5 strategies that will determine the market size?

The five main strategies for determining market size are:

- Top-down analysis using industry reports

- Bottom-up analysis based on sales data and projections

- Value theory using perceived customer value

- Comparative benchmarking with similar products or markets

- Demand-side estimation through surveys or market research

Each method offers a different lens to calculate potential market size and evaluate market opportunities.

3. What is an example of market size?

A simple example of market size: if there are 10 million potential users of a product, and each user is likely to spend $100 per year, the total market size is $1 billion annually. This estimate helps businesses assess whether the market is large enough to justify entry or expansion.

4. What is the market size in marketing analysis?

In marketing analysis, market size refers to the total volume of sales or revenue a product or service can achieve within a specific market. Understanding market size is a foundational step in building go-to-market strategies, forecasting growth, and prioritizing customer segments.

5. What are the common methods used for market size calculation?

Common methods for market size calculation include top-down analysis, bottom-up analysis, and hybrid approaches. These techniques rely on secondary research, internal sales data, customer surveys, and industry benchmarks to estimate how large a market is and how much of it a company can realistically capture.

Refine Your Market Size Strategy and Stay Ahead of the Curve

Calculating market size is no longer a static, one-time task—it’s a dynamic process that requires continuous data updates, advanced forecasting models, and AI-driven insights. Market size analysis, when done right, gives brands a strategic edge in identifying high-growth segments, planning expansion, and allocating resources more effectively.

For senior leaders and marketing strategists, investing in accurate market size calculation is essential for navigating volatile conditions, spotting opportunities early, and sustaining long-term growth.

Now is the time to sharpen your approach. At Kadence International, we specialize in helping brands conduct rigorous, data-backed market sizing tailored to local and global markets. Whether you’re entering a new region or refining your product strategy, we offer the research expertise and predictive tools you need to lead with confidence.

Partner with Kadence and turn your market size analysis into a competitive advantage. Reach out today to discover how our market research services can support your next strategic move.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director