Food prices in Japan have surged since 2022, shifting consumer habits in ways that brands cannot afford to ignore. A nationwide study by our sister company, CMG Inc., reveals the extent of this shift, showing how inflation influences where, what, and how often people buy groceries.

Japanese consumers have long prioritized quality and brand loyalty, often paying a premium for fresh, locally sourced ingredients. However, inflation is shifting these behaviors. Our study shows that more shoppers seek discounts, adjust grocery lists, and change stores to cope with rising costs.

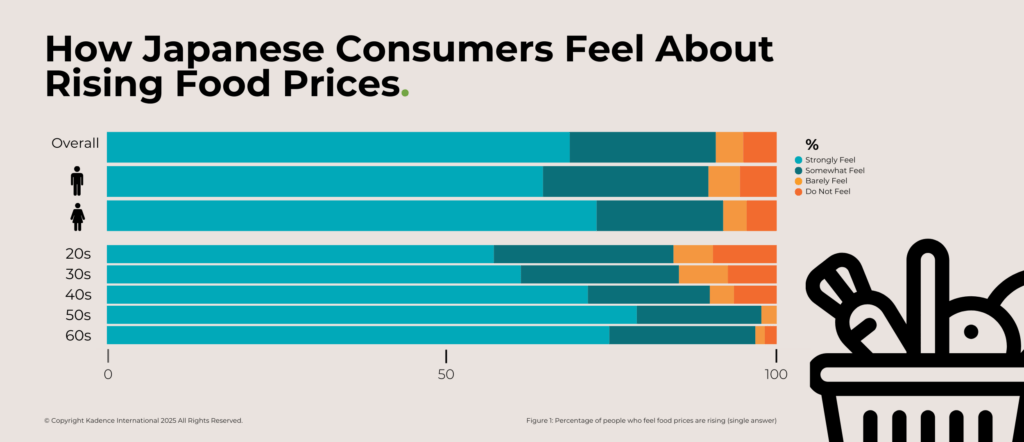

Our study of Japanese consumers aged 20 to 69 found that 90% feel the strain of rising food costs, with 70% experiencing it intensely. Prices for essential staples like rice, leafy greens, and eggs have surged, pushing shoppers toward lower-cost alternatives, bulk buying, and store-switching strategies.

Households are adjusting by choosing cheaper alternatives, relying on discounts, and carefully planning purchases to minimize costs. The findings reveal how inflation shapes the Japanese food market today and how brands must adapt to meet shifting consumer priorities.

Japanese consumers feel the weight of rising food prices

Inflation is hitting middle-aged consumers the hardest. Women and those aged 40 to 60 report the most strain as they juggle rising grocery bills alongside housing, childcare, and utility costs.

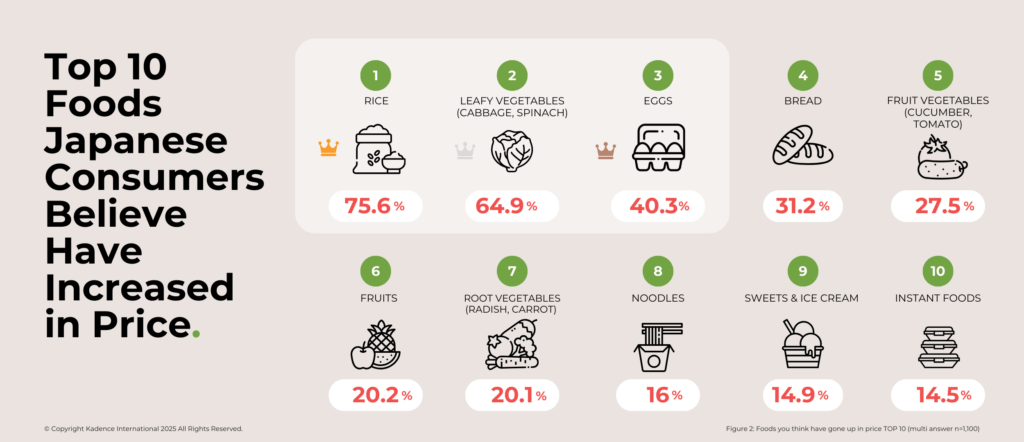

Rice tops the list, with three-quarters of respondents saying its cost has risen. Leafy vegetables, eggs, and fruits are among the most frequently cited items experiencing price hikes. The rising costs of these essentials are pushing consumers to reconsider their grocery lists, with many shifting to more affordable alternatives or cutting back on certain items altogether.

Consumer sentiment suggests inflation is not just a financial strain but an ongoing source of anxiety. Many households are adjusting broader spending patterns, cutting back on dining out and non-essential purchases as they prioritize their grocery budgets. This heightened sense of caution underscores the urgency for brands to meet evolving needs with adaptable solutions.

Implications for Brands

As inflation shapes consumer habits, brands operating in the food industry must rethink their strategies. Price sensitivity is now a dominant force in purchasing decisions, making affordability and value essential selling points. Companies that rely on staple food products may need to introduce smaller pack sizes, bulk discounts, or subscription-based models to maintain customer loyalty.

This shift presents an opportunity for brands that offer alternatives to high-cost staples. The surge in demand for lower-cost items like bean sprouts and tofu suggests that consumers are willing to make substitutions. Positioning these products as smart, affordable choices through targeted marketing and in-store promotions could help brands capture market share.

Retailers and food manufacturers must also recognize that Japanese consumers actively seek ways to save. Loyalty programs, digital coupons, and promotional bundles could play a more significant role in purchasing decisions as shoppers become more selective about where they spend their money. Companies that can balance pricing strategies with perceived value will be best positioned to navigate the evolving food market in Japan.

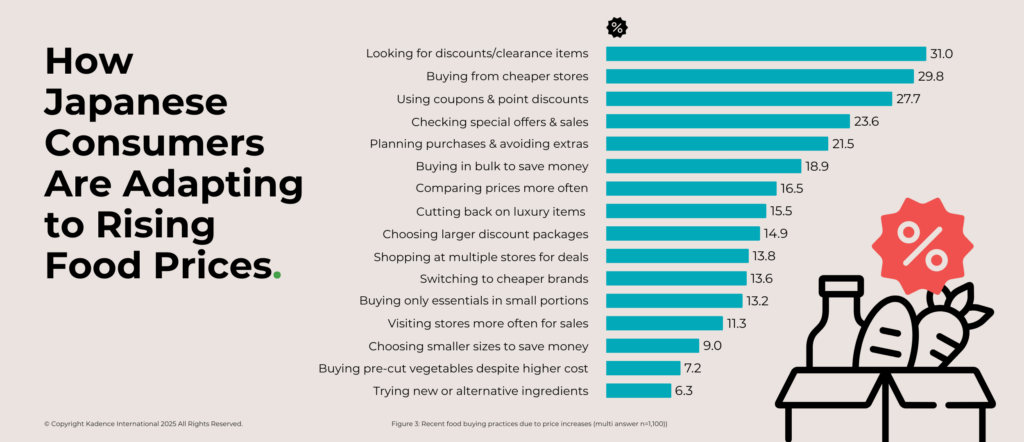

How Consumers Are Changing Their Shopping Habits

As prices climb, Japanese consumers are becoming more strategic. Nearly 30% are actively hunting for clearance deals, while an equal share is switching supermarkets in search of lower prices. Discount chains and bulk retailers see increased foot traffic as shoppers shift from premium stores to budget-friendly alternatives.

Beyond price-driven decisions, shoppers are becoming more disciplined in their purchasing habits. Many are researching deals in advance, planning their shopping lists, and buying only what is necessary. This shift suggests that impulse buying is declining, making it harder for brands to capture spontaneous purchases. Instead, consumers approach grocery shopping with a calculated mindset, weighing every purchase against cost and necessity.

Digital engagement is also playing an increasing role in consumer decisions. More shoppers use online price comparison tools, retailer apps, and e-commerce platforms to track discounts and find the best deals. Brands that integrate their promotions seamlessly into these digital channels will have a greater chance of influencing purchase decisions early on.

However, in-store promotions and point-based rewards in Japan remain highly influential, offering brands an alternative way to engage cost-conscious consumers. Brands that integrate their promotions seamlessly into digital and physical retail channels will have a greater chance of influencing purchase decisions before consumers even enter a store.

Implications for Brands

With price-conscious behavior shaping the market, brands must adapt their pricing and promotional strategies. Offering flexible discounts and personalized promotions could help retain customers who might otherwise trade down to lower-cost alternatives. Brands traditionally relying on premium positioning may need to consider budget-friendly variations or value packs to stay competitive.

A prime example of a brand adapting to shifting consumer behavior is Nissin Foods, the maker of Cup Noodles. The company has introduced new flavors and healthier options for health-conscious consumers while maintaining affordability. Its focus on sustainability through eco-friendly packaging and responsible sourcing has also helped sustain consumer loyalty despite economic challenges.

Retailers also need to rethink in-store and digital promotions. Placing high-demand items in visible areas, bundling products at competitive prices, and integrating discount offers into mobile shopping apps can help maintain customer engagement. As shoppers become more deliberate, brands must ensure they are part of the decision-making process before consumers reach the checkout counter.

What are people buying less and more often?

Rice, snacks, and cabbage are the top three foods that people buy less of due to price increases.

Rising prices are forcing consumers to rethink where they shop and what they buy. The survey reveals a clear pattern – high-cost staples are being purchased less frequently, while affordable alternatives are gaining traction. Since 2021, Japan has experienced a significant surge in rice prices. In 2023, the average selling price for a 60-kilogram bag of rice was approximately ¥15,310 (about $139 USD). By January 2025, this price escalated to ¥25,927, a 69% increase from the previous year. This equates to roughly $171 USD.

At the same time, lower-cost and versatile food items are seeing an uptick in sales. Bean sprouts and tofu, known for their affordability and adaptability in Japanese cuisine, are among the top foods people buy more often. Bread, another relatively inexpensive staple, has also gained popularity. The trend suggests consumers prioritize foods that offer more servings, opting for ingredients that stretch further and provide better value.

Implications for Brands

Understanding these shifts is critical for food manufacturers and retailers. Brands in high-cost categories need to rethink how they position their products. Offering smaller portion sizes, value packs, or price promotions could help retain consumers considering cutting back. For brands selling products that are growing in demand, this is a moment to strengthen their market position. Highlighting the versatility, nutritional benefits, and affordability of products like tofu and bean sprouts can reinforce their appeal in price-sensitive times.

Retailers should also adapt by ensuring budget-friendly items are well-stocked and prominently displayed. Promotional strategies should focus on cost-effective meal solutions, helping consumers maximize their grocery budgets. As inflation influences purchasing decisions, brands that align their offerings with consumer priorities will be best positioned to maintain loyalty and sales.

How Japan’s food inflation compares to the West

Rice isn’t just a staple in Japan—it’s a cultural cornerstone and an economic indicator. Unlike many Western nations where grains are heavily imported, Japan produces most of its rice domestically, meaning price fluctuations reflect deeper economic shifts. This inflation trend mirrors similar surges in other staple foods worldwide, such as wheat in the U.S. and soybeans in China.

Food prices are rising worldwide, but the impact varies from country to country. While Japan is seeing sharp increases in staples like rice, vegetables, and eggs, the US and the UK markets are grappling with their inflation-driven shifts in consumer behavior. In Western markets, dairy products, meat, and processed foods have been among the most affected categories, driving consumers toward discount grocery chains, bulk buying, and private-label alternatives.

In the US, shoppers increasingly turn to wholesale retailers and discount supermarkets to cut costs. Many are switching from brand-name products to store-brand alternatives, with major retailers reporting a surge in private-label sales. Coupon usage once thought to be in decline, has made a strong comeback, mainly through digital platforms and loyalty apps. In the UK, where food inflation and the cost of living have been a persistent challenge, many households are scaling back on meat purchases and opting for frozen or tinned foods as a cost-saving measure.

Despite regional differences, the global trend is clear – consumers are becoming more intentional about how and where they spend their grocery budgets. The shift toward discount-driven shopping, meal planning, and strategic purchasing decisions redefines how food brands and retailers operate across markets.

While Japan sees a shift toward staples like tofu and bean sprouts, the US and UK consumer shifts lean toward private labels and bulk buying, highlighting different approaches to cost savings.

Implications for Brands

Brands must recognize that price sensitivity is no longer confined to specific regions. Inflation-driven purchasing habits are reshaping consumer expectations on a global scale. Affordability and value have become key decision-making factors, making it essential for brands to rethink their pricing and promotional strategies.

Companies that traditionally cater to premium or discretionary food categories may need to introduce flexible pricing structures, offering economy-sized packaging or subscription models to retain budget-conscious shoppers. Meanwhile, brands positioned in lower-cost categories have a unique opportunity to strengthen their appeal, emphasizing the affordability and versatility of their products.

Japan’s beef bowl industry thrives despite multiple price hikes due to rising costs. Zensho Holdings, the parent company of Sukiya, a Japanese restaurant chain that serves gyudon (beef bowls), curry, and other dishes, has reported strong profit growth and increased customer numbers, highlighting how strategic pricing and strong brand equity can sustain demand even in inflationary times. This resilience reflects Japan’s unique consumer behavior, where quality and convenience often precede purely cost-cutting measures.

Retailers, particularly those in markets where discount shopping is on the rise, should focus on making savings more accessible. Digital loyalty programs, targeted promotions, and clear communication around price advantages will be critical in maintaining consumer trust and engagement in a price-sensitive environment.

How brands can adapt to a cost-conscious market

Food inflation is not just reshaping consumer habits but redefining how brands must approach pricing, marketing, and product development. As shoppers prioritize affordability and shift toward lower-cost alternatives, companies must take a proactive approach to remain relevant in a rapidly changing market.

One of the most immediate strategies for brands is pricing flexibility. Offering a range of product sizes at different price points can help cater to varying consumer budgets. Smaller packaging options can attract shoppers looking to control their spending, while bulk discounts can appeal to those who prefer to stock up when prices are favorable. Subscription models that provide cost savings over time may also help retain customer loyalty, particularly for staple goods.

Product positioning is equally important. Brands that once relied on premium pricing must now justify their value through differentiation. Messaging focusing on nutritional benefits, sustainability, or versatility can encourage consumers to keep buying products even if prices increase. For brands in high-growth categories like tofu and bean sprouts, reinforcing affordability and multiple-use meal applications can strengthen market share.

Retailers have a crucial role to play in guiding purchasing decisions. Strategic in-store placements, meal-planning promotions, and digital tools that showcase the best value options can help shoppers navigate rising prices. Supermarkets that integrate personalized discounts, loyalty rewards, and digital coupons into their customer experience will be better positioned to retain price-sensitive consumers.

The brands that succeed in an inflationary market will listen to consumers, adapt to shifting priorities, and offer tangible value beyond price alone. As economic conditions continue to shape spending behavior, remaining flexible and responsive will define long-term brand resilience.

Turning Challenges Into Opportunities

Rising food prices are forcing consumers to rethink their purchasing decisions, but they are also creating new opportunities for brands willing to adapt. The shift toward cost-conscious shopping is not a temporary adjustment; it reflects a more profound change in consumer behavior likely to persist even if inflation stabilizes. Brands that recognize these shifts and respond strategically will retain their customer base and strengthen their market position in the long run.

Innovation will be key for companies in high-cost categories. Reformulating products to be cost-effective without compromising quality, offering flexible portion sizes, and introducing alternative ingredients can help brands navigate price sensitivity. For companies in growing categories, reinforcing the value of their products through effective messaging and promotions will be essential to sustaining momentum.

Digital engagement is also becoming more critical. Consumers increasingly rely on price-comparison tools, e-commerce discounts, and loyalty programs to make informed purchasing decisions. Brands that invest in personalized marketing, mobile-based promotions, and transparent pricing strategies will be better positioned to build long-term trust with their audience.

Food inflation is reshaping the competitive landscape, but it must not be a setback. Companies that approach this challenge with flexibility, creativity, and consumer-first thinking can turn market uncertainty into a moment of strategic growth.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director