Singapore’s cuisine vibrantly reflects its rich multicultural heritage, offering an irresistible blend that captivates the palates of locals and visitors. From hawker centers serving local delights like Hainanese chicken rice to high-end restaurants offering innovative fusion cuisine, the island nation has something to satisfy every palate. But beneath the surface of this culinary diversity, a significant shift is underway in how Singaporeans choose their food.

Over the last decade, a transformation in consumer preferences has begun to reshape the culinary terrain. Today’s diners are increasingly health-conscious, environmentally aware, and eager to explore global flavors, pushing the food and beverage sector toward a delicious new era. This change isn’t just a fleeting trend. A seismic shift is challenging food and beverage brands to evolve or risk being left behind. The stakes are high, but so are the opportunities. By understanding and embracing this new wave of consumer priorities—such as plant-based diets, sustainable practices, and technological innovations in food—brands can stay relevant and thrive. Understanding these evolving trends is about keeping pace, driving forward, and crafting strategies that align with modern values and tastes.

Adaptability and innovation are the ingredients for future success in Singapore’s food and beverage sector.

Rise of Health-Conscious Eating

Over the years, Singapore’s Government and the public have focused more on promoting and adopting healthier lifestyles. They have done this through national initiatives like the Health Promotion Board’s (HPB) Healthier Choice Symbol and the Singapore Food Agency’s (SFA) Nutritional Labelling. The HPB’s Healthier Dining Programme (HDP) also helps consumers identify healthier dishes on menus and storefronts through visual identifiers. This is also reflected in retail data showing increased demand for lower-sugar drinks, wholegrain rice, and wholegrain bread.

According to a survey by the Health Promotion Board, 60% of Singaporeans reported making a conscious effort to choose healthier food options.

This shift is particularly pronounced among younger consumers, who are more likely to seek nutritious and wholesome meals. For instance, the rise of salad bars like SaladStop! and Grain Traders highlights the growing appetite for fresh, customizable, and health-oriented dining options.

The demand for plant-based alternatives is also gaining momentum. Brands like Impossible Foods and Beyond Meat have made significant inroads into the Singaporean market, with local brands like Tindle and Karana joining the fray. This trend isn’t just limited to restaurants; supermarkets are also stocking up on a wider variety of plant-based products, catering to the increasing number of flexitarians —those who primarily eat plant-based but occasionally consume meat.

Another aspect of this health-conscious movement is the popularity of organic food. Farmers’ markets and organic grocery stores like Little Farms and SuperNature have become more prevalent, offering consumers access to organic produce and products. This shift toward organic is not just about personal health but also reflects a broader concern for the environment and sustainable farming practices.

For F&B brands, this means rethinking menus and product offerings to cater to health-conscious consumers. Restaurants offering detailed nutritional information and highlighting healthier options will likely attract more patrons. Similarly, food producers and retailers emphasizing the health benefits and quality of their ingredients can tap into this growing market segment.

The rise of health-conscious eating in Singapore underscores the importance of understanding and adapting to changing consumer preferences. As more people prioritize their health and well-being, the F&B sector must respond with innovative and appealing options that meet these new demands.

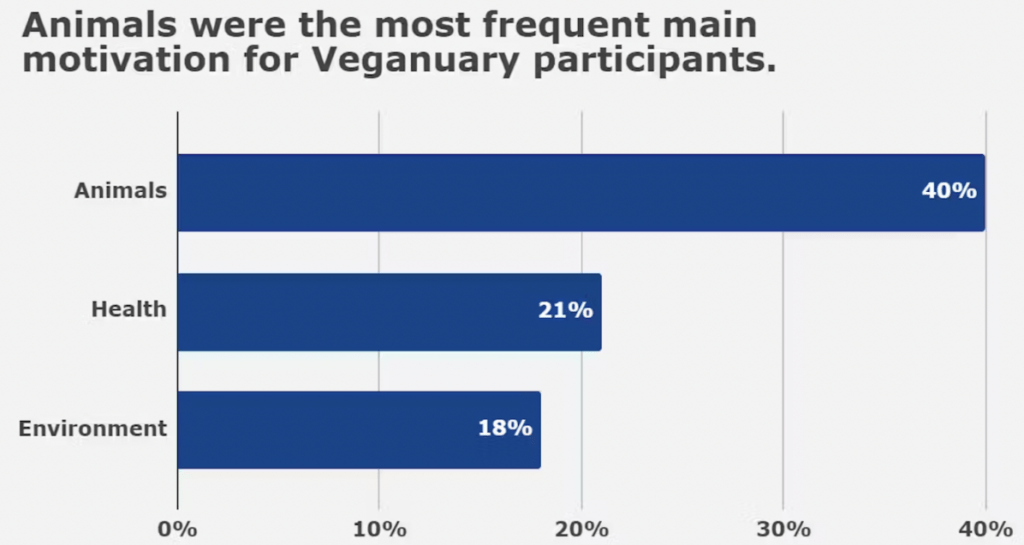

Surge in Plant-Based Alternatives

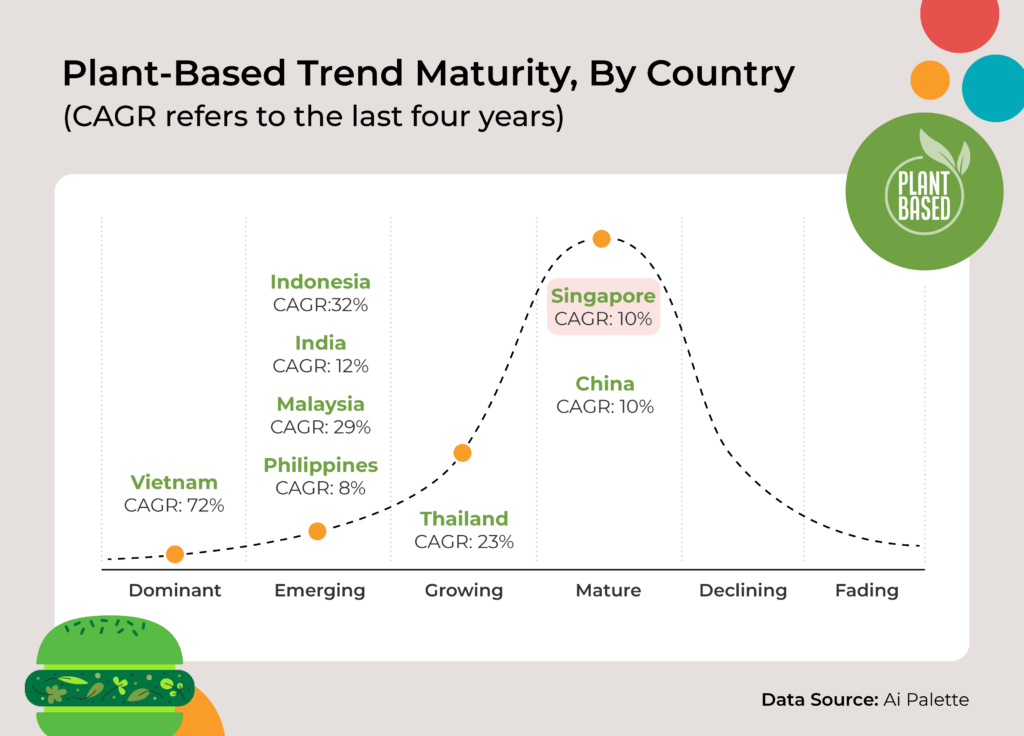

The surge in plant-based alternatives is reshaping food in Singapore, reflecting a global trend toward more sustainable and health-conscious eating. This shift is evident in consumer demand and the growing number of businesses entering the plant-based market.

According to a 2023 Euromonitor International report, Singapore’s plant-based food market is projected to grow at an annual rate of 7.2% over the next five years. This growth is driven by increasing consumer awareness about the health benefits of plant-based diets and the environmental impact of meat consumption.

International brands like Impossible Foods and Beyond Meat are leading the charge, making significant inroads into Singapore’s restaurants and supermarkets. Local startups are also making their mark. Tindle, a Singaporean company producing plant-based chicken, has gained traction with its products featured in numerous restaurants nationwide. Similarly, Karana, which creates plant-based pork from jackfruit, has become popular among consumers and chefs looking to incorporate sustainable ingredients into their menus.

The success of these brands reflects a broader trend: the growing acceptance and popularity of plant-based foods among Singaporeans. This trend isn’t just about ethical or environmental concerns; it’s also about taste and innovation. Many plant-based products are now designed to closely mimic the taste and texture of meat, making them appealing to a wider audience, including those who do not identify as vegetarians or vegans.

Restaurants and food service providers respond to this demand by expanding their plant-based offerings. Major chains like Burger King and KFC have introduced plant-based options, while high-end restaurants incorporate sophisticated dishes catering to discerning palates. This diversification attracts new customers and positions these brands as forward-thinking and responsive to consumer trends.

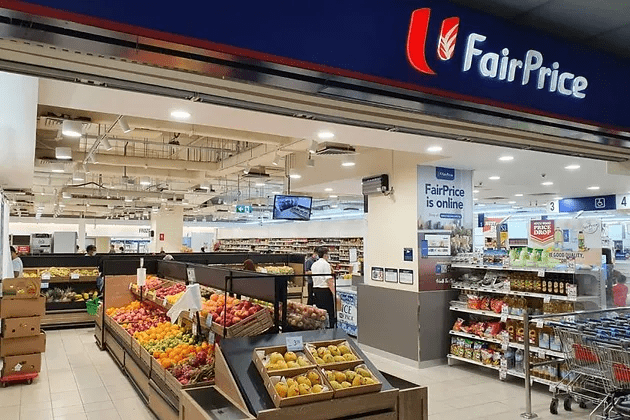

Supermarkets are also crucial to the plant-based boom. Chains like FairPrice and Cold Storage stock a wider variety of plant-based products, from dairy alternatives to ready-to-eat meals. This increased availability makes it easier for consumers to incorporate plant-based foods into their daily lives.

The surge in plant-based alternatives presents significant opportunities for the F&B sector in Singapore. Brands that embrace this trend can attract health-conscious and environmentally aware consumers, positioning themselves at the forefront of a growing market. By offering innovative and appealing plant-based options, the F&B sector can meet the evolving tastes of Singaporeans and drive future growth.

Impact of Technology on Food Choices

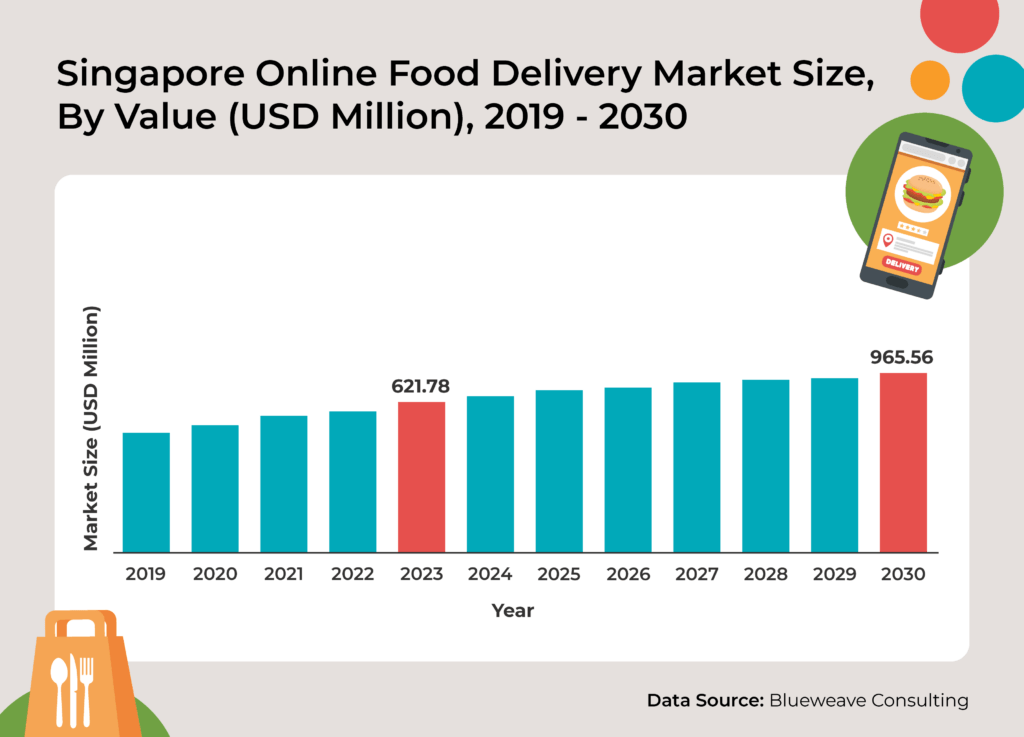

Technology is transforming how Singaporeans choose and consume food, bringing convenience and innovation to the forefront of the F&B sector. From food delivery apps to online grocery shopping, digital advancements are reshaping consumer behavior and expectations.

Food delivery services have become a staple in Singapore’s urban lifestyle. Apps like GrabFood, Deliveroo, and Foodpanda have revolutionized how people access their favorite meals, offering a wide range of options at their fingertips. A survey by Statista in 2023 found that over 70% of Singaporeans use food delivery services at least once a month. This shift has increased the convenience for consumers, provided restaurants with new revenue streams, and expanded their customer base beyond physical locations.

Online grocery shopping is another area where technology is making a significant impact. With platforms like RedMart, NTUC FairPrice Online, and Amazon Fresh, consumers can easily browse, purchase, and have groceries delivered to their doorstep. This growth is expected to continue as consumers appreciate the convenience and time savings offered by these services.

Social media also plays a crucial role in shaping food choices. Platforms like Instagram, TikTok, and Facebook influence dining trends and consumer preferences through food influencers, viral recipes, and restaurant reviews.

A 2023 survey by Rakuten Insight revealed that 60% of Singaporeans discovered new food products or restaurants through social media.

This digital word-of-mouth marketing has become a powerful tool for F&B brands to attract and engage customers.

In addition to these consumer-facing technologies, the emergence of food tech startups is driving innovation within the F&B sector. Companies like Shiok Meats, which produces lab-grown seafood, and Sustenir Agriculture, an urban farming venture, are pushing the boundaries of food production and sustainability. These innovations address food security and environmental concerns and cater to the growing demand for novel and sustainable food options.

Adopting advanced technologies, such as AI and big data analytics, is also transforming the operational aspects of the F&B sector. Restaurants and food service providers leverage these tools to optimize supply chains, reduce food waste, and enhance customer experiences. For example, AI-driven platforms can analyze customer preferences and predict demand, enabling brands to tailor their offerings effectively.

Sustainability and Ethical Eating

The growing emphasis on sustainability and ethical eating significantly influences food choices in Singapore. Consumers are increasingly aware of their food’s environmental and social impact, leading to a shift towards more responsible consumption patterns.

Source: Kadence International’s Global Sustainability Report, The Green Brand

Increasing Consumer Awareness

- Environmental Impact: A 2023 survey by the Singapore Environment Council found that 65% of Singaporeans are concerned about the environmental impact of their food choices. This awareness is driving demand for sustainably sourced and produced food.

- Sustainable Practices: Consumers are looking for brands prioritizing sustainable practices, such as reducing carbon footprints, minimizing food waste, and using eco-friendly packaging.

Demand for Locally Sourced Food

- Urban Farming: Urban farming initiatives, like those by Edible Garden City, are gaining popularity. These farms provide fresh, locally grown produce, reducing the carbon footprint associated with long-distance transportation.

- Support for Local Producers: Consumers are increasingly supporting local farmers and producers. This trend is evident in farmers’ markets’ rise and local produce availability in supermarkets.

Ethical Considerations in Food Consumption

- Fair Trade: Products with fair trade certification are becoming more popular as consumers seek to ensure that their purchases support fair wages and working conditions for producers.

- Animal Welfare: There is growing concern about animal welfare, leading to increased demand for ethically sourced meat and dairy products. Companies like The Fishwives and Sasha’s Fine Foods offer ethically sourced options that cater to this market.

Sustainable Dining Options

- Plant-Based Menus: Many restaurants are expanding their plant-based menu options to cater to environmentally conscious diners. For example, restaurants like The Living Café and Whole Earth focus on plant-based, organic, and sustainable ingredients.

- Zero-Waste Initiatives: Some establishments are adopting zero-waste practices, such as using whole ingredients, composting, and minimizing single-use plastics. These initiatives resonate with consumers who prioritize sustainability.

For instance, Kampung Durian, a farm-to-table concept, offers locally sourced, sustainable durian and other produce. Their approach reduces food miles and supports local agriculture. Online food delivery service Grain emphasizes healthy, sustainable meals. Grain’s commitment to using sustainably sourced ingredients and eco-friendly packaging has made it a favorite among health-conscious and environmentally aware consumers.

Influence of Global Cuisines

Singapore’s food scene has always been a melting pot of diverse culinary influences, reflecting the city-state’s multicultural heritage. In recent years, the influence of global cuisines has intensified, reshaping local dining preferences and offering new opportunities for the F&B sector.

Integration of Global Flavors

- Cultural Fusion: Singaporeans have a penchant for experimenting with food. This openness to new flavors has led to a rise in fusion cuisine, blending traditional Singaporean dishes with international elements. For instance, the popular Laksa Pasta combines local laksa flavors with Italian pasta.

- Popularity of International Food Trends: Food trends such as Korean BBQ, Japanese ramen, and Mexican tacos have a strong following in Singapore. Restaurants like Kko Kko Nara (Korean) and Guzman y Gomez (Mexican) are examples of international eateries thriving in the local market.

Influence of Food Tourism

- Exposure to Global Cuisines: Singaporeans’ love for travel translates into a curiosity for international foods. As people travel more, they bring back a taste for global cuisines, driving demand for authentic international dining experiences.

- Immigrant Influence: The diverse expatriate community in Singapore also plays a role in introducing and popularizing their native cuisines. This dynamic has led to the flourishing of various ethnic restaurants, such as Italian bistros and Middle Eastern eateries. Violet Oon is a restaurant that offers a unique blend of Peranakan flavors with Western techniques, creating a fusion that appeals to locals and tourists. Nouri a Michelin-starred restaurant known for its “crossroads cooking” philosophy, blending global flavors and techniques to create unique dishes.

Adoption of Global Food Practices

- Street Food Evolution: Inspired by street food cultures from cities like Bangkok, Tokyo, and New York, Singapore’s street food scene is evolving. New-age hawker stalls are incorporating international influences while maintaining local roots.

- Global Culinary Techniques: Chefs in Singapore are increasingly adopting international culinary techniques, such as sous-vide cooking and molecular gastronomy, to elevate traditional dishes.

Impact on Local Cuisine

- Reinventing Traditional Dishes: The fusion of global cuisines with local ingredients is reinventing traditional dishes. This trend preserves cultural heritage and keeps it relevant to modern palates.

- Broadening Palates: The influx of global cuisines has broadened the palates of Singaporeans, making them more adventurous eaters. This openness creates opportunities for F&B brands to introduce innovative and diverse menu offerings.

Convenience and Ready-to-Eat Meals

In urban Singapore, convenience is a key driver of food choices. The growing demand for ready-to-eat meals and convenient dining options is reshaping the F&B sector, catering to the busy lifestyles of modern consumers.

Growth of the Convenience Food Sector

- Busy Lifestyles: With long working hours and a fast-paced lifestyle, Singaporeans increasingly seek convenient meal solutions. According to a recent survey, 45% of Singaporeans purchase ready-to-eat meals at least once a week.

- Single-Person Households: The rise in single-person households also contributes to the demand for convenient food options. These consumers often prefer quick and easy meals over cooking elaborate dishes.

Popularity of Ready-to-Eat and Meal Kit Services

- Ready-to-Eat Meals: Supermarkets and convenience stores are expanding their range of ready-to-eat meals, offering everything from traditional Asian dishes to Western favorites. Brands like 7-Eleven and Cheers have seen significant growth in this segment.

- Meal Kit Services: Brands like HelloFresh and The Hungry Chef are capitalizing on the trend for convenience by offering meal kits that provide all the ingredients and instructions needed to prepare a meal at home. These kits save meal planning and grocery shopping time, appealing to busy professionals.

For instance, YOLO is a healthy fast-food chain that provides nutritious, ready-to-eat meals for on-the-go consumers. Their offerings include salads, grain bowls, and wraps, making healthy eating accessible and convenient.

Impact on Traditional Dining

- Takeaway and Delivery Services: The rise of food delivery platforms like GrabFood and Deliveroo has made it easier for consumers to enjoy restaurant-quality meals at home or on the go. This trend has led many traditional restaurants to develop takeaway and delivery-friendly menus.

- Cloud Kitchens: The concept of cloud kitchens, which operate solely for delivery services without a physical dine-in space, is gaining traction. This model allows businesses to reduce overhead costs while meeting the demand for convenient dining options.

Innovation in Convenience Food

- Smart Vending Machines: Innovative vending machines offering fresh, ready-to-eat meals are appearing in strategic locations across Singapore. Brands like Shake Salad provide healthy meals through vending machines in offices and residential areas.

- Packaging Innovations: Sustainable and functional packaging is becoming a priority for ready-to-eat meal providers. Packaging innovations enhance convenience and address environmental concerns, appealing to eco-conscious consumers.

Impact of Demographic Changes

Singapore’s diverse and dynamic population is significantly influencing food choices. Demographic shifts, including an aging population, the influence of younger consumers, and the presence of a large expatriate community, are all shaping the F&B sector.

Influence of Younger Consumers

- Health and Wellness: Younger consumers are driving the demand for healthier food options. According to a survey, 70% of Singapore millennials prefer food promoting health and wellness.

- Tech-Savvy Preferences: This demographic is more inclined to use technology for food-related decisions, from ordering meals through apps to discovering new restaurants on social media platforms like Instagram and TikTok.

Preferences of Expatriates and Multicultural Communities

- Global Cuisine Demand: According to the Ministry of Manpower, Singapore’s significant expatriate population, comprising around 29% of the total population, has diverse culinary preferences. This demand for international cuisines is evident in the variety of ethnic restaurants thriving in Singapore.

- Cultural Festivals and Food: The presence of multicultural communities also means that food festivals and cultural celebrations influence food trends. Events like Deepavali, Hari Raya, and Christmas see a surge in demand for specific foods, offering opportunities for F&B brands to cater to these cultural preferences.

Aging Population and Dietary Needs

- Nutritional Requirements: As Singapore’s population ages, there is a growing demand for food products that cater to older adults’ dietary needs. The Ministry of Health projects that by 2030, one in four Singaporeans will be aged 65 and above, driving the need for nutrient-dense, easy-to-digest foods.

- Functional Foods: Foods fortified with vitamins, minerals, and other nutrients that support health and wellness are becoming more popular. Companies like Brands and Eu Yan Sang, known for their health supplements and traditional Chinese medicine, are tapping into this market by offering functional food products.

A great example is The Soup Spoon, a restaurant chain that offers nutrient-rich soups catering to the health-conscious and aging population. Their menu includes options that are easy to consume and nutritious, appealing to older adults. British retailer Marks & Spencer provides a range of ready-to-eat meals and grocery items that cater to the diverse tastes of expatriates and health-conscious consumers. Their offerings include international cuisines and health-focused products.

Adapting to Demographic Changes

- Menu Customization: F&B brands are increasingly customizing their menus to cater to the diverse tastes and dietary requirements of different demographic groups. Offering options that appeal to younger, health-conscious consumers and nutrient-rich foods for older adults is becoming a standard practice.

- Inclusive Marketing: Effective marketing strategies that resonate with different demographic groups are essential. This includes targeted advertising on social media for younger consumers and informative campaigns about health benefits for older adults.

Innovations in the F&B Sector

Innovation is a key driver of growth and competitiveness in Singapore’s F&B sector. From adopting advanced technologies to developing new food products, brands continuously evolve to meet changing consumer demands and stay ahead of the curve.

Development of New Food Products

- Alternative Proteins: The rise of alternative proteins is one of the most significant innovations in the F&B sector. Brands like Shiok Meats, which produces lab-grown seafood, and Next Gen Foods, known for its plant-based chicken brand Tindle, are pioneering this space. These products cater to health-conscious and environmentally aware consumers, offering sustainable alternatives to traditional meat.

- Functional Foods and Beverages: The demand for functional foods and beverages that provide health benefits beyond basic nutrition is growing. Examples include fortified snacks, probiotic drinks, and foods enriched with vitamins and minerals. Brands like F&N and Yakult lead the way with innovative products catering to health-conscious consumers.

Adoption of Advanced Technologies

- AI and Big Data: AI and big data analytics are transforming the F&B industry. These technologies help brands optimize supply chains, reduce food waste, and enhance customer experiences. For instance, AI-driven platforms can analyze customer preferences and predict demand, allowing restaurants to tailor their offerings more effectively.

- Automation and Robotics: Automation is increasingly being adopted to improve efficiency and reduce labor costs. Automated kitchens, robotic chefs, and self-service kiosks are becoming more common in Singapore. These innovations streamline operations and enhance the dining experience by reducing wait times and ensuring consistent food quality.

Sustainability Innovations

- Eco-Friendly Packaging: The push towards sustainability has led to innovations in packaging. Companies are exploring biodegradable, compostable, and reusable packaging options to reduce environmental impact. For example, SaladStop! uses eco-friendly packaging from renewable resources, aligning with its commitment to sustainability.

- Waste Reduction Technologies: Technologies that minimize food waste are gaining traction. Solutions like Winnow, which uses AI to track and reduce food waste in commercial kitchens, are helping businesses become more sustainable. These technologies enable restaurants to make informed decisions about portion sizes and menu planning by analyzing food waste patterns.

The fast-food giant Burger King has introduced plant-based versions of its classic menu items, such as the Impossible Whopper, to cater to the growing demand for alternative proteins. This move has attracted health-conscious consumers and positioned the brand as a leader in innovation. Sustenir Agriculture, an urban farming company, uses vertical farming techniques to grow fresh produce in controlled environments. Their approach reduces the carbon footprint associated with traditional agriculture and provides Singaporeans with locally grown, sustainable food options.

Embracing Innovation for Growth

- Collaborations and Partnerships: Many F&B businesses partner with tech startups and research institutions to drive innovation. These collaborations foster the development of new products and technologies that can revolutionize the industry.

- Consumer Education: It is crucial to educate consumers about the benefits of innovative products and sustainable practices. Effective communication strategies, such as transparency about sourcing and production methods, can build trust and drive the adoption of new food products.

Singapore’s F&B sector is transforming significantly, driven by changing food choices and consumer preferences. The future of Singapore’s F&B sector looks promising, with opportunities for growth and innovation. Brands that stay attuned to evolving consumer preferences and embrace technological advancements will thrive. The continued focus on sustainability and ethical practices will meet consumer demands and contribute to a more responsible and resilient food system.

Adapting to these trends requires agility and a willingness to innovate. By offering diverse and appealing food options, leveraging technology, and prioritizing sustainability, F&B brands can position themselves for success in a competitive market. As Singaporeans’ food choices continue to evolve, the F&B sector must remain responsive and forward-thinking to cater to the dynamic tastes of its consumers.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director