Behind the oat milk in your latte lies a billion-dollar revolution. Data is now shaping everything we consume, from coffee beans to compostable cups, as brands race to redefine food for a tech-driven world.

Across the globe, food and beverage companies are no longer relying on gut instinct to shape their strategies. Every decision—from flavor profiles and packaging to sourcing and distribution—is informed by data, allowing brands to respond to trends, reduce waste, and innovate at unprecedented speeds. But behind every bite or sip lies an intricate web of insights, where numbers tell stories that shape the future of food.

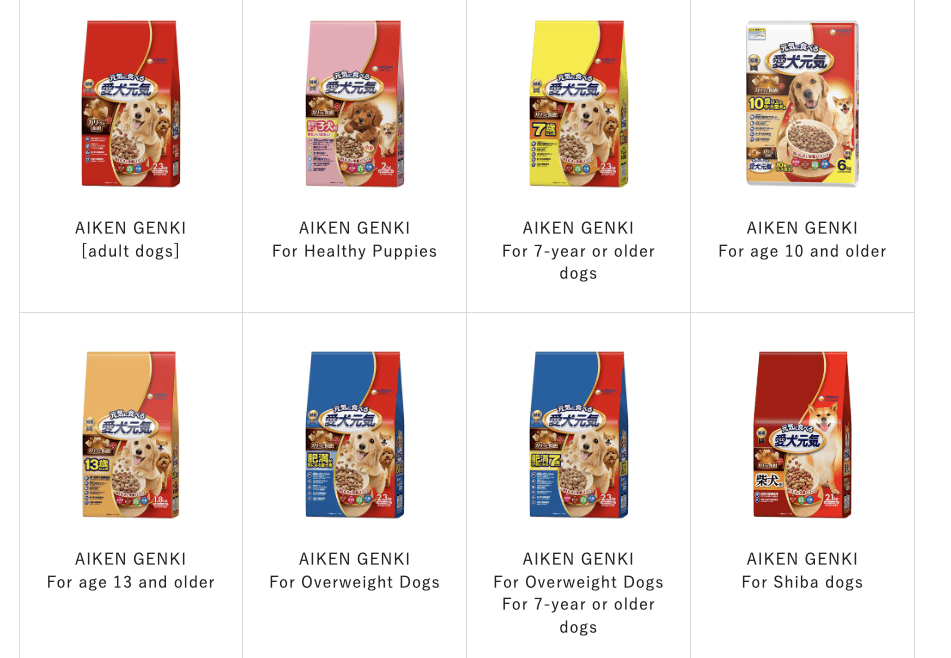

The Role of Market Research in Innovation

The future of food isn’t just a matter of taste; it’s a high-stakes battle to predict consumer desires in real-time. Market research has moved from gut instinct to a data-powered engine, driving decisions that can make or break billion-dollar brands.

Case Study: Oatly – Redefining Plant-Based Dairy

Image Credit: US Campaign

Background: In Sweden in the 1990s, Oatly became a niche producer of oat-based dairy alternatives. For years, the company’s growth was steady but unspectacular as it competed against established players in the plant-based market, including almond and soy milk producers. By the 2010s, as climate awareness grew, so did demand for sustainable food options—and Oatly seized the moment.

Two things were happening simultaneously. First, consumers were now increasingly choosing plant-based products not only for dietary reasons but also to combat climate change. Second, millennials and Gen Z were drawn to brands that authentically communicated transparency and environmental values.

Approach: Oatly developed a data-driven marketing strategy that positioned it as an environmentally conscious disruptor. Campaigns like “Wow No Cow” focused on the environmental benefits of oat milk compared to dairy, while product packaging included simple, bold messaging and clear data about carbon savings. The company also used predictive analytics to forecast demand spikes in specific regions, ensuring its supply chain could scale without delays.

Outcomes: Oatly became synonymous with sustainability in the plant-based category. In the third quarter of 2024, Oatly reported revenue of $208 million, marking a 10% growth from the previous quarter. This contributed to a trailing twelve-month revenue of $813 million, reflecting a 5% year-over-year increase.

Anticipating Trends with Advanced Research Methods

Oatly’s success illustrates how data, when paired with the right tools, can reveal opportunities others miss. Companies today are going beyond traditional surveys, turning to social listening, AI-driven consumer sentiment analysis, and predictive trend modeling to anticipate what consumers will want before they even know it themselves.

Take the rise of functional beverages, for example. Tools like AI algorithms analyze health trends, social media keywords, and regional purchasing behaviors to forecast demand for drinks infused with adaptogens or probiotics. Companies using these methods can reduce development timelines by months, bringing products to market at just the right moment.

Sustainability as an Innovation Driver

Sustainability isn’t just a moral imperative—it’s a consumer demand. Market research shows that eco-consciousness is a key purchase driver across demographics, forcing brands to innovate responsibly.

For forward-thinking companies, this means embedding sustainability into every level of product development. From sourcing ingredients using blockchain for traceability to designing packaging optimized for recyclability, the most innovative brands align environmental goals with consumer expectations.

Optimizing the Supply Chain with Data

Behind every perfectly timed product delivery or consistently stocked supermarket shelf lies a complex, data-driven supply chain. In the food and beverage industry, where freshness is paramount, and waste can mean millions in losses, supply chain optimization has become a critical area for innovation. Advanced tools like predictive analytics, artificial intelligence, and digital twins are transforming how brands manage logistics, reduce costs, and meet evolving consumer expectations.

Case Study: Tesco – Using AI to Reduce Waste and Improve Availability

Image Credit: The Grocer

Background: Tesco, one of the UK’s largest supermarket chains, faced significant challenges with inventory management. Food waste was a major issue, with overstocked items expiring before being sold, while understocked items led to missed sales and disappointed customers.

Strategy: Tesco implemented a machine learning system to forecast demand more accurately. The system analyzed historical sales data, regional consumption patterns, and even external factors like weather and holidays to provide store managers with precise inventory recommendations.

Approach: The company introduced AI-powered tools to monitor real-time inventory levels and automatically adjust supply orders. For example, during heatwaves, the system increased deliveries of barbecue items and ice cream to areas with expected spikes in demand. Tesco also used digital twins, virtual simulations of its supply chain, to test the impact of various logistical changes without disrupting real-world operations.

Outcomes: Tesco achieved a 45% reduction in food waste across its operations, measured against a 2016/17 baseline. At the same time, on-shelf availability improved significantly, enhancing customer satisfaction and loyalty. By pairing advanced analytics with operational adjustments, Tesco demonstrated how a smart supply chain can benefit both profitability and sustainability. The company has set an ambitious target to halve food waste by 2025, five years ahead of the UN’s Sustainable Development Goal 12.3.

Advanced Tools Driving Supply Chain Transformation

- Predictive Analytics for Demand Planning:

By incorporating data from weather patterns, social events, and consumer behavior, brands can forecast demand more precisely than ever. For instance, beverage companies use predictive models to adjust production for seasonal trends, such as spiked demand for bottled water during summer heatwaves. - Digital Twins for Scenario Simulation:

Digital twins allow companies to create a virtual replica of their supply chain, enabling them to test new strategies before implementing them. This helps brands identify potential bottlenecks, improve route planning, and maximize efficiency. - Blockchain for Traceability:

Transparency is becoming a key consumer demand, especially in the food industry. Blockchain technology ensures every step of the supply chain—from sourcing to delivery—is documented and verifiable, boosting trust and accountability.

Adapting Supply Chains for Sustainability

Modern supply chains aren’t just optimized for efficiency—they’re designed to align with environmental goals. By integrating sustainable practices, brands can reduce their carbon footprints while meeting the expectations of eco-conscious consumers.

Example: HelloFresh – Just-in-Time Inventory Management

Meal kit delivery service HelloFresh uses real-time data to align ingredient sourcing with consumer orders. By predicting demand accurately and only ordering what’s needed, the company minimizes food waste and reduces its reliance on large inventories. This approach has allowed HelloFresh to operate more sustainably while cutting costs.

As the food and beverage industry grapples with global challenges like climate change and supply chain disruptions, brands that embrace advanced technologies are emerging as leaders. From Tesco’s AI-powered systems to HelloFresh’s precision sourcing, the message is clear: data isn’t just a tool—it’s the backbone of a modern, resilient supply chain.

Reducing Waste Through Precision

Food waste is one of the most pressing challenges facing the food and beverage industry. One-third of the world’s food is wasted—an environmental and economic catastrophe.

Brands are now turning to AI-driven analytics, smart packaging, and circular economy models to reduce waste at every stage—from production to consumption.

Case Study: HelloFresh – Leveraging Data to Cut Food Waste

Image Credit: Hello Fresh

Background: As a meal kit delivery company, HelloFresh operates in a space where precision is critical. Every ingredient must be perfectly portioned to avoid waste while maintaining freshness and quality. Traditional supply chains often struggle with surplus inventory and spoilage, but HelloFresh aimed to rewrite the playbook with data-driven efficiency.

Strategy: HelloFresh built its operations around just-in-time inventory management. The company analyzed customer order trends, seasonal preferences, and historical purchasing data to forecast how much produce, meat, and other ingredients to source.

Approach: By integrating real-time data into its supply chain, HelloFresh could adjust orders dynamically. For example, if a new recipe gained unexpected popularity, the system would rapidly adjust sourcing schedules, ensuring that ingredients arrived fresh without overstocking. HelloFresh also partnered with local suppliers to shorten lead times and reduce transportation emissions.

Outcomes: By aligning ingredient sourcing with customer orders, HelloFresh has significantly reduced food waste compared to traditional grocery stores. While specific percentages vary, the company’s model inherently leads to less waste due to its pre-portioned ingredients and demand-driven procurement. This achievement improved operational efficiency and became a key selling point for environmentally conscious consumers, reinforcing the brand’s image as a sustainability leader.

Smart Packaging: Extending Shelf Life and Reducing Spoilage

Packaging is another area where waste reduction can have a significant impact. Innovations like IoT-enabled sensors and temperature-sensitive labels are helping brands monitor product freshness and reduce unnecessary disposal.

Example: Mimica – Smart Labels for Freshness Monitoring

Mimica, a UK-based startup, developed smart labels that change texture to indicate a product’s freshness based on temperature exposure. Unlike traditional expiration dates, which often lead to premature disposal, Mimica’s labels provide consumers with accurate, real-time information about spoilage. In pilot programs, using Mimica’s labels reduced dairy product waste by 63%, opening doors for wider adoption across other perishable goods.

The Role of Advanced Technologies in Waste Reduction

- AI-Driven Forecasting:

Predictive analytics helps brands forecast demand accurately, preventing overproduction and spoilage. Example: Tesco’s AI-powered systems optimize inventory to reduce store waste. - Digital Twins for Supply Chain Simulation:

Virtual models allow brands to test new supply chain strategies, identifying inefficiencies before they occur. - IoT-Enabled Sensors:

Smart packaging equipped with IoT sensors provides real-time updates on temperature and freshness, enabling better inventory decisions.

Staying Competitive in an Evolving Market

Agility and innovation are critical to staying relevant in the food and beverage sector. Brands must anticipate consumer preferences, adapt to market disruptions, and align with global trends like sustainability and health-consciousness. Advanced tools like AI-driven predictive analytics, blockchain for transparency, and rapid prototyping enable companies to stay ahead of the curve and build deeper connections with their audiences.

Case Study: Tony’s Chocolonely – Transparency as a Competitive Edge

Image Credit: Latana

Background: In 2005, Tony’s Chocolonely set out to create a slave-free chocolate industry. Competing against well-established brands, the Dutch company needed to differentiate itself while raising awareness of unethical practices in cocoa production.

Strategy: Tony’s positioned itself as the industry’s most transparent player by implementing blockchain technology to track its cocoa supply chain. The company responded to consumer attitudes toward ethical sourcing and tailored its messaging to resonate with socially conscious shoppers.

Approach:

- Tony’s introduced blockchain to verify that every cocoa bean used in its products was sourced ethically, free from child labor or exploitation.

- The company used its packaging as a storytelling medium, with unevenly divided chocolate pieces symbolizing inequality in the supply chain.

- Consumer attitudes guided targeted campaigns that educated consumers on systemic issues in cocoa farming while offering a solution through their purchase choices.

Outcomes: Tony’s achieved strong sales growth in Europe and North America, fueled by its commitment to transparency and ethical sourcing. Beyond financial success, the brand influenced industry giants to adopt more responsible practices, demonstrating that social impact can drive competitive advantage.

Rapid Prototyping and Testing

In an industry where trends emerge and fade quickly, speed-to-market is critical. Advanced analytics and consumer feedback loops now allow brands to develop, test, and refine products faster than ever.

Example: Impossible Foods – Iterating with Data

Impossible Foods, known for its plant-based meat, refines its products using real-time consumer feedback and sensory analysis. Before launching its Impossible Chicken Nuggets, the company conducted multiple rounds of testing with focus groups and food service partners, analyzing taste, texture, and cooking performance. This iterative process allowed Impossible Foods to introduce a product that met consumer expectations and culinary standards.

Leveraging Predictive Analytics for Future Readiness

Predictive analytics helps brands anticipate market shifts, ensuring they stay competitive. By analyzing factors like weather, economic conditions, and purchasing trends, companies can make proactive decisions about inventory, production, and marketing.

Example: Coca-Cola – Predicting Demand in Functional Beverages

Coca-Cola used predictive analytics to enter the functional beverage market, identifying emerging demand for products with probiotics and immunity-boosting ingredients. This approach allowed the company to launch products like Coca-Cola Plus with fiber and expand its portfolio to address consumer health trends. By aligning with data-driven insights, Coca-Cola secured its position in a rapidly growing category.

Blockchain and the Future of Consumer Trust

Blockchain is becoming an essential tool for brands to ensure transparency and authenticity in their supply chains. Consumers increasingly demand proof of ethical sourcing, sustainability, and product integrity.

- For companies like Tony’s Chocolonely, blockchain not only verifies claims but also builds consumer trust by providing accessible, immutable records.

- In the seafood industry, blockchain is being used to certify sustainable fishing practices, providing real-time traceability from ocean to plate.

The Future of Food Lies in Innovation and Data

Staying competitive in the food and beverage market isn’t just about responding to trends; it’s about anticipating them. Advanced technologies like AI, blockchain, and predictive analytics are no longer optional; they’re the foundation for navigating disruptions, building trust, and leading the industry forward.

Data is reshaping every facet of the food industry, from product innovation and supply chains to waste reduction and sustainability. Brands that put data at the center of their strategies are redefining precision and adaptability, delivering products that align with shifting consumer values like eco-consciousness and health.

The stakes couldn’t be higher. Climate change, supply chain volatility, and evolving consumer expectations are rewriting the rules of competition. Brands like Tony’s Chocolonely and Impossible Foods are proving that innovation isn’t just a survival tool—it’s a pathway to leadership.

The future of food isn’t just on your plate; it’s in the data shaping what’s on it. For companies ready to embrace this power, the rewards are limitless. For those who hesitate, irrelevance is the risk they can’t afford to take.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director