Environmental sustainability has emerged as a cornerstone of brand integrity, corporate responsibility, and a growing determinant of bottom-line success.

As public consciousness veers emphatically towards sustainability, the pressure is mounting for brands to respond.

With environmental awareness at its pinnacle, prominent Quick Serve Restaurants or QSRs are unveiling ambitious sustainability goals. For instance, Burger King has envisioned a net-zero emissions target by the year 2050, while Wendy’s has committed to utilizing 100% sustainable materials for its customer-facing food packaging by 2026.

Not trailing behind, Chipotle, an early adopter of sustainability in the QSR world, has outlined a bold objective to slash its carbon emissions by half by the close of this decade.

Such brand announcements reflect a profound shift in operational strategies aligning with the global sustainability ethos.

How are these commitments translating into tangible actions concerning sourcing, packaging, and waste management?

And how is this green transition influencing consumer behavior and brand loyalty in a market where differentiation is key?

The sustainability movement for QSRs is a testament to the broader narrative of ecological consciousness. Traditionally, QSRs, known for their speed and convenience, are now standing at the intersection of experience and sustainability.

The sustainability narrative within QSRs is not novel but has gained momentum recently.

A Seedling of Change: The Initial Foray into Sustainability

The roots of sustainability in QSRs can be traced back to modest beginnings when rudimentary practices such as recycling or energy conservation marked early environmental responsibility efforts.

These early steps, driven more by cost-saving inclinations than environmental altruism, gradually began morphing into more structured and deliberate sustainability strategies.

Over time, as environmental consciousness grew among consumers, pioneering brands started to explore beyond the rudimentary towards more comprehensive and impactful sustainability measures, laying the groundwork for a broader industry-wide awakening.

Evolutionary Strides: Broadening the Sustainability Spectrum

The journey from sporadic green initiatives to integrated sustainable practices has been evolutionary.

Central to this evolution has been incorporating sustainability in sourcing, which burgeoned from merely procuring locally to embracing organic, fair-trade, and plant-based ingredients, marking a significant stride towards a lower carbon footprint.

The eco-journey of QSRs is a narrative of evolution, innovation, and contribution towards a greener future, keeping the essence of convenience and quick service intact.

Concurrently, the packaging standards shifted from single-use, non-biodegradable materials to recyclable, compostable, or biodegradable alternatives.

On the waste management front, the narrative evolved from simple disposal to recycling, composting, and educating consumers on waste segregation, symbolizing a transition from reactive to proactive waste management ethos.

The Consumer Consciousness Crest: Fueling the Sustainable Transition

Amidst the operational green shifts, a parallel narrative of rising consumer awareness and demand has unfolded. Armed with a deeper understanding and concern for environmental issues, the modern consumer began to wield their purchasing power to endorse brands aligning with their eco-values.

The demand for transparency in sourcing, eco-friendly packaging, and robust waste management has transmuted from a soft preference to a pronounced expectation.

The rise in consumer eco-consciousness has accelerated this sustainable transition, making it a competitive advantage, and, for QSRs today, it is a brand differentiator as important as taste and convenience.

The symbiotic relationship between evolving sustainable practices within QSRs and the escalating consumer demand for environmentally responsible dining experiences narrates a story of transformation. It demonstrates how heightened consumer awareness can propel industries to recalibrate their operational strategies, enabling a cycle of continuous improvement toward environmental stewardship.

As QSRs continue on this green revolution, they help foster a business environment where profitability coalesces with responsibility.

Sustainable Sourcing in Quick Serve Restaurants

In a world where environmental conscientiousness is no longer a choice but a necessity, the QSR sector is amidst a pivotal transition towards sustainable sourcing.

This aspect of the operation is not merely a superficial attempt to ride the green wave but a robust strategic shift that goes to the core of how QSRs function.

Below, we unravel the importance, practices, and consequential impact of sustainable sourcing, shedding light on how this green vein reshapes the QSR industry.

The Importance of Sustainable Sourcing

Sustainable sourcing is an indispensable pivot towards reducing the environmental footprint of QSR operations. By aligning procurement practices with sustainability principles, QSRs can significantly curb their greenhouse gas emissions, reduce waste, and foster a more responsible consumption ethos.

The process aids in ensuring that the ingredients served across counters every day are not just appetizing but are a symbol of ecological respect and responsibility.

Moreover, sustainable sourcing highlights the broader global objective of achieving the Sustainable Development Goals (SDGs), an agenda aimed at melding the threads of economic growth, social inclusion, and environmental protection.

Green Procurement in Practice

The QSR sector has witnessed the sprouting of innovative sourcing strategies aimed at nurturing an environmentally benign supply chain. Foremost among these is the endeavor to local sourcing, which curtails transportation emissions and galvanizes local economies. For instance, procuring fresh produce from local farmers, thus reducing the carbon footprint associated with long-haul transportation.

The shift toward organic and plant-based ingredients is another remarkable stride. QSRs champion a more natural and less harmful food system by opting for suppliers that shun synthetic pesticides or genetically modified organisms.

Additionally, partnerships with suppliers practicing fair trade and responsible agriculture further underscore the commitment to sustainable sourcing. By endorsing fair wages, ethical labor practices, and environmentally sound farming methods, QSRs are extending their sustainability ethos beyond the immediate boundary of their operations.

Impact on Consumer Choices and Brand Loyalty

The ripple effects of sustainable sourcing transcend the operational sphere, making a discernible imprint on consumer perception and brand loyalty. Today’s consumers, equipped with a heightened awareness of sustainability issues, are increasingly aligning their patronage with brands that reflect their eco-values.

When a QSR articulates its sustainable sourcing practices, it resonates with this growing segment of eco-conscious consumers, fostering a deeper brand connection.

Sustainable sourcing practices are also becoming a key brand differentiator in the cluttered QSR marketplace. By embodying a commitment to environmental stewardship through sustainable sourcing, QSRs are not merely enhancing their societal image but are forging a distinct competitive advantage.

Sustainable sourcing goes beyond corporate responsibility and enters the domain of brand equity, consumer loyalty, and business viability. It’s an emblem of how integral sustainability has become in carving a modern, responsible, and appealing brand persona in the QSR sector, underlining a strategic alignment with evolving global sensibilities and consumer expectations.

As QSRs navigate the green procurement pathway, they are inching closer to a sustainable operational ethos. Still, they also nurture a brand identity that resonates with the zeitgeist of environmental mindfulness prevailing amongst modern consumers.

Sustainable packaging in Quick Serve Restaurants

Amidst the global clamor for environmental responsibility, the QSR sector is progressively turning to sustainable packaging.

This shift transcends environmental compliance and resonates with a broader narrative of corporate responsibility and consumer demand for eco-friendly practices.

The critical need for sustainable packaging emanates from an ecological necessity to reduce waste, particularly plastic, that besieges our environment.

Conventional single-use plastic packaging, long favored by the QSR industry for its convenience and cost-effectiveness, has been identified as a significant contributor to the global plastic pollution crisis.

Sustainable packaging allows QSRs to reduce their environmental footprint substantially, align with regulatory mandates, and respond to the burgeoning consumer demand for environmentally responsible practices. It’s a proactive step towards establishing a brand’s eco-credentials and fostering a culture of environmental mindfulness within the sector.

Sustainable packaging ventures in QSRs

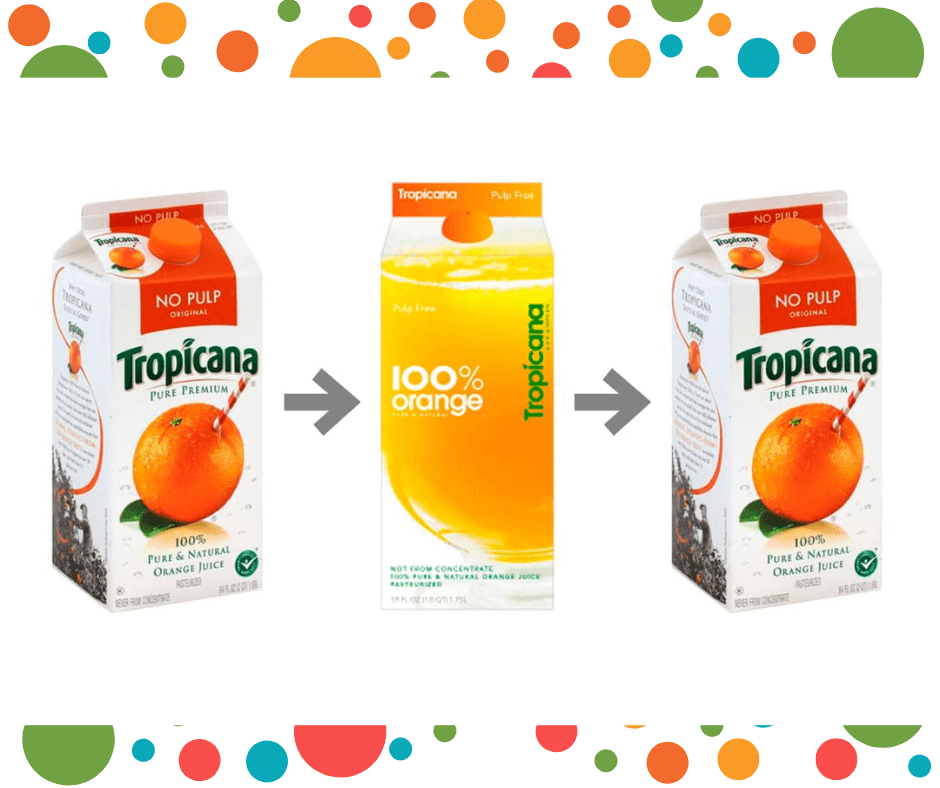

The QSR industry is burgeoning with innovative sustainable packaging solutions, significantly departing from the erstwhile norm of single-use plastic.

Several QSRs champion using recyclable, biodegradable, or compostable materials as a viable and environmentally responsible packaging alternative. For instance, transitioning to plant-based plastics, recycled paper, and other biodegradable materials has seen a notable uptick.

Another laudable venture is the design innovation to minimize material usage without compromising functionality or aesthetic appeal. Some QSRs are also exploring reusable packaging models, encouraging consumers to return the packaging for a discount on their next purchase, thus instigating a reuse cycle.

Impact of eco-friendly packaging on consumer choices

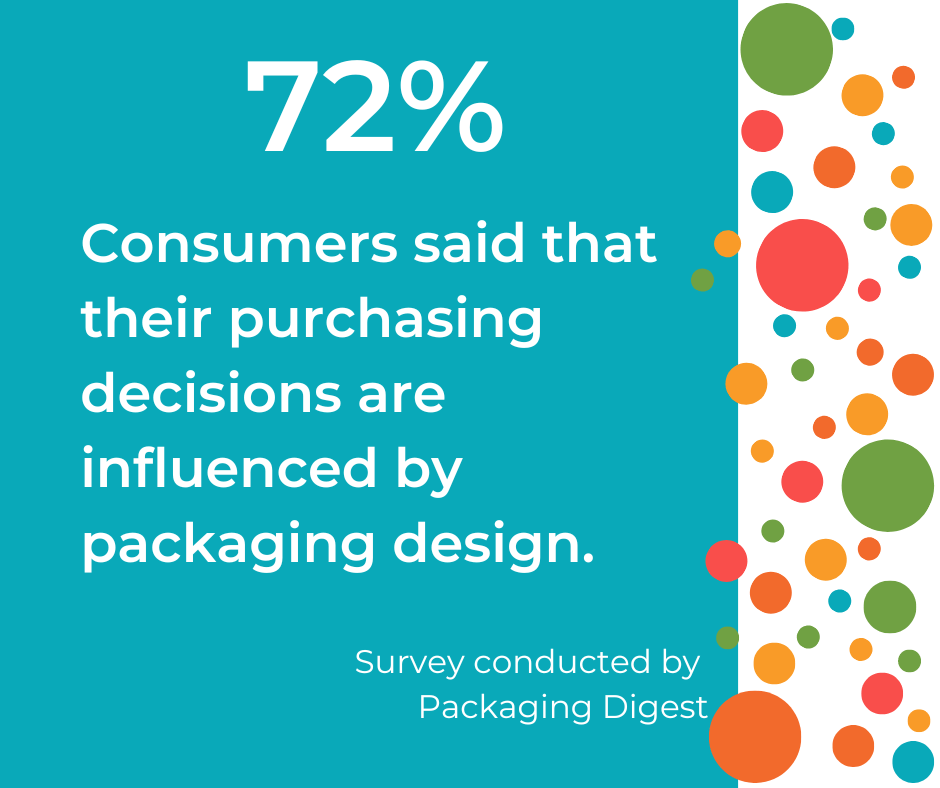

The ripple effects of sustainable packaging are perceptible in altering consumer perception and behavior. Sustainable packaging articulates a brand’s commitment to environmental responsibility, a message that resonates profoundly with a growing cohort of eco-conscious consumers.

The tangible shift towards eco-friendly packaging solutions enhances a brand’s appeal. It engenders a positive behavioral change among consumers, who are increasingly inclined to patronize establishments that echo their environmental values.

The transparent communication of sustainable packaging fosters a deeper trust and brand loyalty, as consumers appreciate the tangible steps taken towards environmental conservation.

Rethinking waste management in Quick Serve Restaurants

The sustainability narrative in the QSR sector is incomplete without a candid discussion on waste management.

The disconcerting visuals of overflowing landfills and marine ecosystems besieged by plastic debris have accentuated the waste dilemma, a significant portion of which is attributed to the F&B industry, including QSRs.

A Waste Quandary: Challenges Pervading the QSR Industry

Predominantly, the heavy reliance on single-use packaging in the QSR sector has led to a surge in plastic waste, an environmental hazard given its non-biodegradable nature. Food waste, another glaring challenge, contributes significantly to landfill overflows and greenhouse gas emissions.

There is also a lack of robust recycling and composting infrastructure, coupled with varying regional regulatory frameworks, which often impede streamlined waste management practices. These challenges highlight the urgent need for reimagined waste management strategies that are both ecologically viable and operationally feasible.

Innovative Solutions in QSRs

The QSR sector is progressively advancing towards innovative waste management solutions that aim to mitigate the environmental repercussions of its operations. Notable among these are waste reduction initiatives, such as portion control and inventory optimization, aimed at minimizing food waste right at the source.

Embracing recycling and composting has seen a significant uptick. QSRs nurture a recycling culture by setting up dedicated recycling stations within outlets and educating consumers on proper waste segregation. Similarly, composting organic waste is being adopted to divert food waste from landfills.

The adoption of circular economy principles, wherein waste is viewed as a resource, is gaining traction. For instance, converting food waste into bioenergy or organic fertilizers embodies a circular approach to waste management, turning a problem into a solution.

The impact of waste management initiatives on the environment and consumer preferences

The positive ramifications of waste management initiatives extend both environmentally and perceptually. Environmentally, effective waste management significantly curtails landfill contributions, reduces greenhouse gas emissions, and fosters resource efficiency.

On the consumer front, the cognizance and appreciation for waste management practices are burgeoning. A visible commitment to reducing waste enhances a brand’s eco-credibility and resonates profoundly with the rising tribe of environmentally mindful consumers. This resonance is a defining factor in consumer preferences and, by extension, brand loyalty.

Case studies of QSR brands committed to reducing their carbon footprint

Pret A Manger: Grab-and-Go

Pret A Manger is leading the charge in environmental responsibility, aiming to reduce carbon emissions and waste in its operations. They’ve initiated using sustainable packaging and have committed to sourcing ingredients sustainably, focusing on animal welfare and organic produce.

The brand has also implemented energy-efficient lighting and equipment in stores, further minimizing its environmental impact. These changes have heightened the brand’s appeal to an ever-increasing base of eco-conscious consumers in the UK and beyond.

Tata Starbucks: Brewing Sustainability

Tata Starbucks, a joint venture between Tata Consumer Products and Starbucks, has pursued sustainability goals in India. They have been moving towards renewable energy sources and investing in energy-efficient equipment, working actively to diminish their carbon footprint.

Tata Starbucks has also initiated water-saving measures and waste reduction strategies, including recycling and composting, that reverberate well with India’s growing environmentally conscious market. These efforts underscore the brand’s commitment to sustainable business practices, thereby enhancing brand perception and loyalty.

Yoshinoya: Sustainable Bowls

Yoshinoya, a major QSR brand in Asia, is another example of progressively adopting sustainable practices to reduce its environmental impact. The brand has initiated measures like using eco-friendly packaging and reducing single-use plastics in its operations.

Additionally, Yoshinoya is working on reducing food waste and implementing energy-saving technologies in its outlets across Asia. The brand’s dedicated sustainability actions are fostering a deeper connection with its Asian consumers, who are increasingly valuing environmental responsibility.

Nando’s: A Flame-Grilled Commitment to Sustainability

With its roots in South Africa and a strong presence in the UK, Nando’s has been committed to sustainability. The brand has been working towards sourcing its energy from renewable sources and has implemented several energy-saving measures in its restaurants.

Nando has also shown commitment to animal welfare and sustainable sourcing of ingredients, resonating well with consumers who are passionate about the provenance of their food. These strategic sustainability initiatives enhance Nando’s brand image and cement its position as a responsible QSR player.

Jollibee: Serving Joy Sustainably

Jollibee, the renowned Filipino QSR brand, is earnestly embracing sustainability. The company is focused on optimizing its operations to be more energy-efficient and is progressively reducing its dependence on non-renewable energy sources.

Jollibee is also concentrating on waste management strategies and has undertaken extensive efforts to reduce the use of plastics in its services. These concerted sustainability endeavors foster loyalty and admiration from its diverse customer base, underlining the brand’s resolve to act responsively towards environmental concerns.

How sustainable practices shape consumer decisions

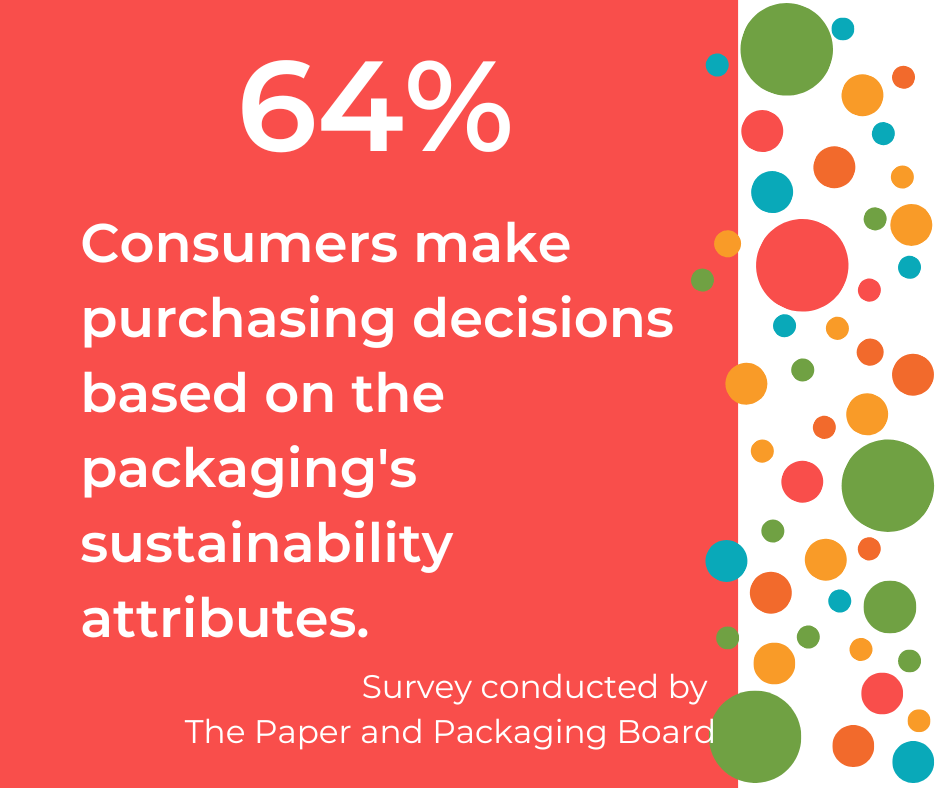

Evidence suggests that contemporary consumers, particularly younger ones, are inclined towards brands that embody environmental stewardship.

For QSRs, adopting sustainable practices is also a strategic maneuver to align with this evolving consumer preference. The decisions encompassing sustainable sourcing, eco-friendly packaging, and waste management initiatives are progressively becoming a barometer of brand appeal and determining where consumers dine.

Beyond greenwashing, sustainability is a pillar of brand loyalty.

Consumers seek genuine commitment and tangible actions toward sustainability, making it a cornerstone for building and retaining brand loyalty.

Brands that communicate their sustainability efforts transparently and continually strive for eco-excellence are perceived as trustworthy and responsible, attributes that engender consumer loyalty.

The importance of Market Research and Surveys for the QSR sector

Market research and consumer surveys provide a rich tapestry of insights into the interplay between sustainability, consumer choices, and brand loyalty in the QSR sector. A slew of studies highlights a willingness among consumers to pay a premium for sustainably sourced and packaged food.

Additionally, brands that are perceived as environmentally responsible enjoy a higher degree of customer loyalty and advocacy, cementing the financial viability of sustainable practices.

A particularly revealing data point is the correlation between the perceived sustainability of a QSR and the likelihood of repeat patronage. Consumers are not just making one-off green choices but forming lasting allegiances with brands that mirror their ecological values.

Challenges and opportunities in embedding sustainability in Quick Serve Restaurants

The journey towards sustainability for QSRs is rife with both hurdles and prospects. While the ecological and ethical imperatives are clear, the pragmatic pathway is often mired in operational, financial, and regulatory challenges.

Yet, within these challenges lie untapped opportunities for innovation, differentiation, and enhanced consumer allegiance.

Challenges faced by QSRs when adopting sustainability choices

- Operational Adaptability: Adapting operations to embrace sustainable practices often requires a significant overhaul of existing processes, which can be both time-consuming and financially demanding.

- Cost Implications: Sustainable sourcing and eco-friendly packaging solutions often come with a higher price tag, posing financial challenges, especially in a sector known for razor-thin margins.

- Regulatory Landscape: The diverse and ever-evolving regulatory landscape concerning environmental practices demands continuous adaptation and compliance, often requiring substantial investment in legal and operational adjustments.

- Consumer Price Sensitivity: While there’s a growing preference for sustainable practices, price sensitivity among consumers remains a concern, especially in economic downturns.

- Supply Chain Complexity: Establishing a sustainable supply chain, especially in a globalized economy, demands rigorous vendor assessment and continuous monitoring to ensure adherence to sustainability standards.

Opportunities for brands unveiling the sustainability spectrum

- Brand Differentiation: Sustainability provides a robust platform for brand differentiation in a highly competitive market. It offers an avenue to showcase a brand’s values, attract eco-conscious consumers, and foster loyalty.

- Market Expansion: Aligning with sustainability opens doors to new market segments and demographic cohorts, particularly among younger, environmentally aware consumers.

- Innovation Drive: The quest for sustainability is a potent catalyst for innovation, propelling the development of eco-friendly packaging solutions, waste management technologies, and energy-efficient operations.

- Long-term Cost Savings: Sustainable practices such as energy efficiency, waste reduction, and sustainable sourcing can yield long-term cost savings, balancing the initial investment required.

- Resilience and Risk Mitigation: Sustainable operations foster resilience by reducing dependency on finite resources and mitigating risks associated with regulatory compliance and reputational damage.

- Investor Appeal: With a surge in responsible investing, sustainability credentials are becoming a key consideration for investors, potentially enhancing a brand’s financial standing and attracting investment.

Final Thoughts

The QSR sector’s sustainability story is a shared script where consumers, industry players, and stakeholders have pivotal roles. As consumers, the power of choice is significant; choosing brands prioritizing sustainability contributes to a larger narrative of positive change. For QSR stakeholders, embedding sustainability is an investment in long-term resilience, brand loyalty, and a thriving consumer base.

The rising tide of consumer advocacy for eco-conscious brands will likely accelerate the sustainability drive, turning it into a norm rather than a niche.

At Kadence, we have worked with some of the world’s most renowned QSR brands, and we can help analyze your current operations thoroughly, offer strategies for sustainable transformation, and assist in navigating the regulatory landscape.

Connect with us at Kadence to explore how your QSR can step into a sustainable future, meeting both the ecological imperatives and the evolving expectations of the modern-day consumer.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director