A Dallas-based Coca-Cola bottler recently undertook a bold initiative, maximizing recycling within its operations and the communities it serves. It aims to reduce its carbon footprint and replenish vital watersheds.

Amazon is similarly reinventing its shipping methods, from downsizing packaging to boosting the use of easily recyclable materials, all for a healthier planet and enhanced customer satisfaction.

Meanwhile, the 2023 Buying Green Survey by Trivium Packaging revealed a telling statistic: 82% of participants are willing to pay more for products housed in eco-friendly packaging.

These unfolding reports and brand commitments highlight a compelling truth—sustainability is an explicit message reverberating through consumer markets and corporate boardrooms —not just a trendy buzzword.

Modern brand packaging has evolved into a multidimensional player in global commerce. It has become a crucial yet often underrated ambassador for brands and commodities worldwide.

Product packaging has many roles. It is a touchpoint communicating a brand’s ethos, a tangible commitment to environmental stewardship, and a key influencer of consumer choices in a marketplace.

Innovative packaging reshapes consumer preferences and recalibrates brand success and market leadership in today’s conscientious consumer environment.

Packaging in its fundamental form shields commodities from damage, contamination, and tampering. Yet, in the global marketplace, where countless products vie for consumer attention, packaging goes beyond its protective function, evolving into a silent salesperson. It beckons from shelves with its colors, design, and imagery, telling a story, evoking emotions, and ultimately, swaying consumer choices.

So, how far does the impact of packaging extend beyond mere aesthetics or functional design?

To understand this, we must delve into the psychology of colors and shapes, the increasing role of technology, and the profound impact of eco-friendly materials and sustainability claims on consumer behavior. Additionally, we will analyze how innovative packaging carves market niches, fortifies brand loyalty, and even mitigates the challenges of e-commerce logistics.

Mind Over Matter: The Psychology of Packaging Appeal

Imagine standing in a wine aisle; your gaze moves from one bottle to another, each in its distinct packaging. Amid the many choices, one label catches your eye—a serene, pastel landscape, evoking a sense of peace. Without tasting a drop, you feel drawn to it. This scenario conveys a fundamental truth: packaging is a dialogue in visual psychology, and every color, shape, and design element is meticulously crafted.

The world of colors and their silent yet persuasive impact is powerful in brand packaging. Color psychology is deeply rooted in human neurology.

Reds invoke urgency and passion, often seen in clearance sales and fast-food industries, while blues evoke trust and security, a favorite among corporate and healthcare brands. Green, a color synonymous with nature, health, and tranquility, is increasingly prevalent in products purporting natural ingredients or eco-friendliness.

According to a study published in the journal Management Decision, perceptions of color can account for up to 85% of the reasons people purchase one product over another.

Yet, there’s more to packaging psychology than color alone. Shapes and design motifs are equally compelling. Angular, sharp designs often communicate a sense of edginess, dynamism, and masculinity, whereas smooth, rounded shapes convey softness, femininity, and comfort.

The renowned theory of “Contour Bias,” which suggests that people generally favor objects with contoured edges over those with sharp angles, often guides the hand of packaging designers aiming for a broad, universal appeal.

The psychology of packaging isn’t solely about appearances but also functionality. The ‘ease of use’ phenomenon, a cornerstone of the classic Simplicity Theory, highlights that humans have an innate preference for easy-to-use and easy-to-understand products.

Packaging that is simple and functional in design—be it a ketchup bottle that rests on its cap or a medicine bottle with a transparent dosing system—resonates with consumers, often tipping the scales in a purchase decision.

A series of studies in the Journal of Consumer Psychology emphasizes that consumers often equate product weight with quality. Heavier packages show richness and luxury, compelling consumers to opt for them despite higher price tags. This tactile psychological cue is critical for premium brands curating an opulent experience.

We live in a world where online reviews and peer recommendations are paramount, and the “Halo Effect” is gaining prominence. Packaging quality profoundly influences initial product judgments. A consumer thrilled by an unboxing experience, triggered by aesthetic and functional delight, is likelier to rate the product positively, even before its actual use.

Understanding Consumer Preferences through Market Research

Market research is indispensable in understanding consumer preferences and guiding packaging design and functionality. Companies gain insights into what consumers value in packaging by conducting surveys, focus groups, and product testing. This process reveals preferences for certain materials, shapes, colors, and even text on the packaging, which can significantly influence buying decisions. For instance, a study might show a preference for minimalist design over complex patterns or eco-friendly materials over traditional plastics.

Packaging and Brand Perception

Market research plays a crucial role in understanding how packaging impacts brand perception. Through consumer feedback, companies learn how different packaging designs are perceived in terms of quality, value, and trustworthiness. This feedback is crucial for new product launches or rebranding efforts, where the packaging can significantly affect the product’s success or failure. For example, market research might reveal that consumers associate sleek, simple packaging with luxury or prefer clear packaging showcasing the product.

Identifying Trends and Innovations

Staying ahead of trends is crucial in today’s dynamic market, and market research is vital in identifying these trends. Market research helps companies stay abreast of innovations in packaging technology, such as smart packaging, biodegradable materials, or unique opening mechanisms. By understanding these trends, brands can innovate and stay competitive. For instance, market research may indicate a growing consumer interest in sustainable packaging solutions, prompting a company to explore biodegradable or recyclable materials.

Tailoring Packaging to Different Demographics

Different demographic groups may have varying preferences and needs when it comes to packaging. Market research helps companies tailor their packaging to these specific groups. For example, younger consumers might be more attracted to vibrant, quirky packaging, while older demographics might prefer more traditional, easy-to-open packaging. Companies can design packaging that appeals to their target audience by understanding these nuances.

Evaluating Packaging Effectiveness

Finally, market research is vital in evaluating the effectiveness of packaging. Post-launch feedback and sales data can provide insights into how well the packaging is received and whether it meets the consumers’ needs. This evaluation can lead to further refinements and improvements in future packaging designs. For example, if a new packaging design leads to increased sales, it indicates effectiveness, while lackluster sales might prompt a reevaluation of the packaging strategy.

Green Is the New Black: The Eco-Friendly Packaging Revolution

Physical aisles and digital shopping platforms have transformed in recent years, with the rising demand for sustainability. Today’s consumer doesn’t just scan a product; they probe into its ethos, discerning the carbon footprint hidden within the packaging.

This shift is reshaping industries and redefining brand loyalties.

The success story of Seed Phytonutrients, a beauty company that propelled itself to fame in the eco-conscious market, is a great example.

Their standout feature? A shower-friendly, compostable paper bottle made from 100% post-consumer recycled paper encases a recyclable plastic liner, using 60% less plastic than traditional bottles.

This became a brand statement, resonating powerfully with consumers and elevating the brand to cult status among sustainable product enthusiasts.

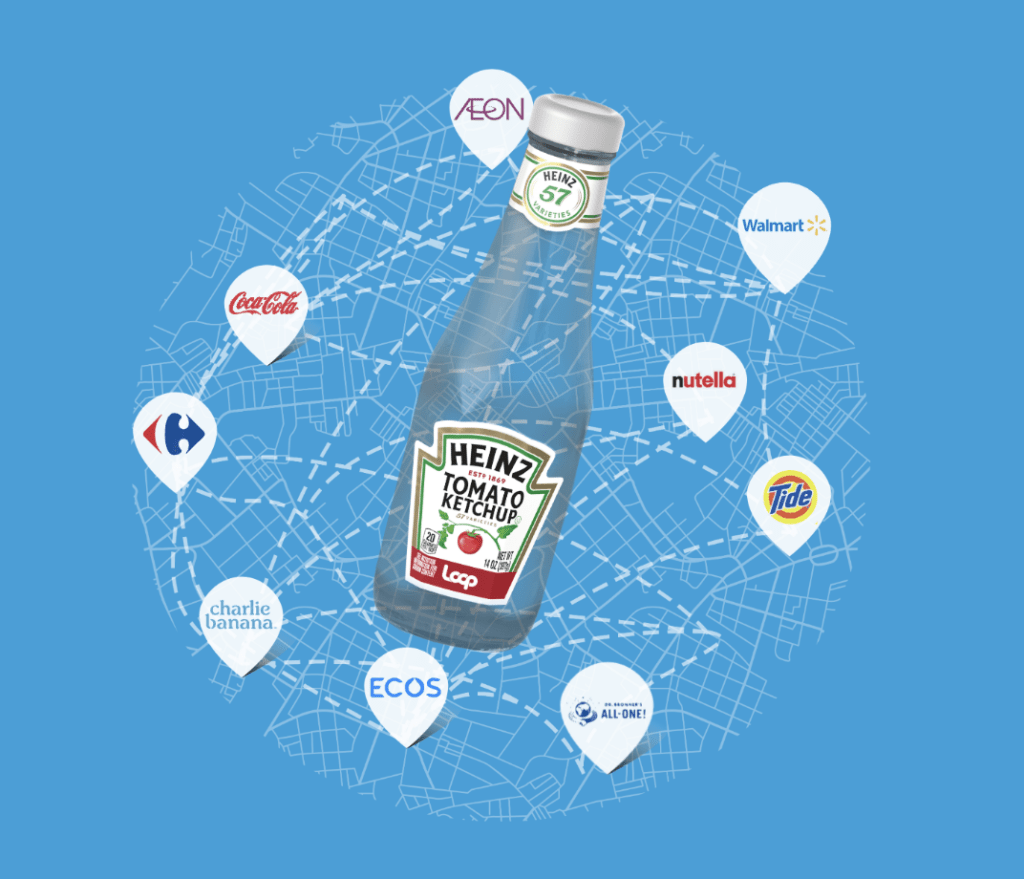

Similarly, Loop is a shopping platform that partners with brands to offer products in durable, reusable packaging. From Haagen-Dazs’ stainless-steel ice cream containers to Crest’s mouthwash in a sleek, returnable glass bottle, Loop is curating a sustainable experience. The outcome? A burgeoning consumer base and an expanding partnership roster with retail giants like Kroger and Ulta.

The drive toward sustainable packaging is a strategic response to evolving consumer demands. According to a Nielsen report, 73% of global consumers say they would definitely or probably change their consumption habits to reduce their environmental impact.

But what catalyzes this loyalty toward eco-conscious packaging? The answer lies in the “Reciprocity Principle” of psychology. When brands demonstrate genuine concern for the planet, consumers respond with loyalty, a sentiment strong enough to sway purchasing decisions.

Sustainable packaging also elevates consumer trust. A Salesforce survey shows that 68% of customers trust companies to act in society’s best interest. This trust translates into economic dividends. A case in point is Patagonia, an outdoor clothing brand that has long embraced environmental activism. Their pledge to repair, reuse, and recycle their products has cultivated profound consumer trust, translating into a fiercely loyal customer base and robust sales, even in economic downturns.

Wrapped Around the World: Packaging Success Stories

United Kingdom: The Triumph of Innocent Drinks

In the beverage market, where countless brands jostle for consumer attention, Innocent Drinks, a UK-based company, has carved a distinctive identity. This brand, renowned for its smoothies and juices, has won shelves and hearts courtesy of its innovative packaging, which marries functionality, aesthetic appeal, and environmental consciousness. This resonates deeply with today’s discerning consumers.

Innocent’s packaging philosophy pivots on simplicity and honesty, mirroring its brand ethos of delivering ‘innocent’ natural, healthy, and transparent products.’ This commitment is evident in their clear, minimalist bottles. The visual appeal is undeniable; the packaging invites you to a healthful experience, even before you’ve twisted the cap. But the magic doesn’t end there. Quirky, playful messages on its packaging create a moment of unexpected joy, a personal connection in the impersonal nature of mass production. With quotes like ‘we love trees’ pasted on the packaging and images of ‘tree huggers,’ Innocent’s packaging ticks the eco-friendly box.

However, its steadfast pledge toward sustainability makes Innocent a packaging innovator. The brand was among the pioneers in the UK to introduce 100% recycled plastic bottles, a bold move when ‘sustainable packaging’ was still a nascent market concept. This wasn’t a silent change; Innocent actively communicated this ecological shift to its consumers, weaving it into its brand narrative of health for the individual and the planet.

According to a YouGov BrandIndex, Innocent Drinks has consistently maintained a high “Buzz score,” a metric that gauges whether consumers have heard anything positive about the brand, emphasizing strong positive consumer reception. The brand’s commitment to sustainable packaging has bolstered its image as an eco-conscious leader and fostered profound trust among consumers, reflected in its market performance despite premium pricing.

Moreover, Innocent’s annual “The Big Knit” campaign, where tiny knitted hats adorn their smoothie bottles, and a portion of the sales proceeds go to charities supporting the elderly, further amplifies their brand image. This ingenious packaging strategy, blending creativity with social responsibility, has skyrocketed sales during the campaign and fortified Innocent’s image as a brand with a heart deeply embedded in community values.

Innocent Drinks is a testament to how innovative packaging can craft an extraordinary success story when aligned with brand ethos, consumer expectations, and social responsibility. The brand’s journey shows that packaging is an interactive platform where brand stories and messaging unfold, consumer identities are mirrored, and societal values are upheld, one bottle at a time.

Brand examples: Who Gives A Crap

This cheekily named brand has revolutionized the once-mundane toilet paper industry with its eco-friendly products wrapped in eye-catching, playful paper, replacing traditional plastic. The brand’s bold colors and fun messages stand out in a product category not known for creativity, generating buzz and making an otherwise dull product Instagram-worthy.

The real genius lies in their commitment to the environment: the toilet paper is made from 100% recycled materials, and 50% of their profits support sanitation projects globally. Consumer reaction? A resounding applause, evidenced by strong sales and a loyal subscriber base, showcasing that responsibility paired with whimsy is a winning formula.

Brand Examples: Ooho’s edible water pods

Picture this —a water container you can eat. Ooho’s edible water pods, encapsulated in a seaweed-based membrane, propose a futuristic alternative to the plastic water bottle.

These bite-sized orbs have piqued consumer curiosity, offering a novel experience that addresses plastic waste. Events and runners at marathons have particularly embraced Ooho, but the broader market uptake is gradual. The challenge lies in altering entrenched consumer habits and scaling production, but the initial excitement suggests a market ready for packaging innovations that push boundaries.

Asia: Where Tradition Meets Innovation

Asia, a vibrant mix of cultures, traditions, and economies, presents packaging trends, each weaving in unique regional stories, consumer preferences, and market sensibilities. Packaging isn’t a one-size-fits-all proposition; it’s a delicate art form balancing global trends with deep-rooted cultural nuances. The brands that flourish here understand that packaging must resonate with the region’s cultural ethos, echoing the consumer’s intrinsic tastes and traditions.

Take, for instance, the success of KitKat in Japan. Nestlé capitalized on the phonetic resemblance between “KitKat” and “Kitto Katsu,” which translates to “surely win” in Japanese, a phrase associated with good luck before exams or significant endeavors. The brand launched diverse flavors reflecting local delicacies — from matcha green tea to sake — with packaging to match, often incorporating elements of Japanese art and cultural motifs. This deep cultural alignment transformed KitKat into a customary student gift and a beloved tourist novelty, driving its market dominance.

Similarly, in South Korea, the Lunar New Year and the mid-autumn festival Chuseok are critical shopping seasons, where gift-giving is a cultural norm. Here, packaging takes a ceremonial role. Products are often presented in elaborate, aesthetically pleasing packages, doubling as gifts without additional wrapping. Brands thriving in this market invest in luxurious, culturally significant packaging designs that resonate with the ceremonial meaning of these festivals.

However, packaging in Asia isn’t just traditional; it’s also technological. The rise of QR codes on packaging in China highlights this trend. These codes, when scanned, provide a wealth of information — from product authenticity to digital user manuals, even augmented reality experiences. This fusion of packaging and technology caters to the Chinese consumer’s tech-savvy nature and demand for product transparency, a critical factor given the prevalence of counterfeit goods in the region.

Brand case study: EcoWare

As India grapples with the plastic waste crisis, EcoWare positions its biodegradable food packaging as a viable solution, aligning with the cultural shift toward sustainability. Their products, made from agricultural waste, cater to a growing demographic that prioritizes environmental impact in their purchasing decisions.

Consumer reception is promising, especially in urban areas with higher eco-awareness. The food industry is also taking note. EcoWare is gaining traction in restaurants, food delivery services, and school canteens, signaling a slow but steady shift in consumer preference and industry standards.

The brand’s packaging incorporates elements familiar to Japanese consumers, enhancing relatability. Their easy-to-handle, ready-to-cook bowls meet urban lifestyle demands, particularly among younger demographics. The result? Persistent brand loyalty is born from taste and a packaging design that resonates culturally and fits seamlessly into modern life.

Sustainability, a global concern, reverberates through Asian markets, albeit with regional variations. In India, for example, edible cutlery and packaging are gaining traction as an eco-friendly alternative and a nostalgic nod to traditional practices like eating on banana leaves. This innovative packaging serves a dual purpose — reducing plastic waste and resonating with a cultural practice familiar to the consumer psyche.

For packaging strategies to succeed in a diverse region like Asia, they must be fluid, adaptable, and culturally aware. They must speak the region’s language in literal script and cultural semiotics, mirroring its traditions, echoing its technological strides, and respecting its environmental sensibilities. Packaging transcends its utilitarian role and becomes a storyteller, a curator of experiences, and a bridge linking global brands with local consumers.

United States: Innovation Meets Conscious Consumption

In the United States, packaging is at a fascinating crossroads. There’s a drive for novelty, convenience, and technological integration, and there’s also a rising tide of environmental responsibility and conscious consumption. This confluence shapes a unique marketplace where packaging innovations and sustainability initiatives aren’t just value-additions but essential components of brand identity and consumer loyalty.

One remarkable instance of packaging ingenuity fused with tech innovation is using smart labels in product packaging. Brands like Jack Daniel’s have employed NFC (Near Field Communication) technology, enabling consumers to engage with products through their smartphones. By tapping the bottle with their device, consumers can access content — from the brand’s legacy to cocktail recipes, even virtual distillery tours. This interactive experience creates a connection between the brand and consumer that’s experiential and engaging.

However, the quest for connectivity and convenience doesn’t overshadow the growing consumer demand for sustainability. The eco-conscious wave isn’t peripheral in the US; it’s at the core of consumer behavior, significantly swaying purchasing decisions. A study by the Hartman Group found that 70% of US consumers consider the environmental friendliness of a product’s packaging when deciding on their purchases. This sentiment is particularly pronounced among Millennials and Gen Z consumers, who are more informed and vocal about environmental issues thanks to digital platforms.

Brands are responding, understanding that sustainability is a market necessity. Take the case of Tide’s Eco-Box, which is a testament to how sustainability can be smartly integrated into packaging design.

The Eco-Box is designed for e-commerce and uses 60% less plastic and 30% less water in its formula. It’s also delivered in a shipping-safe package, eliminating the need for additional boxing or bubble wrap. This design isn’t just environmentally friendly; it’s consumer-centric, considering the convenience of online shoppers who prefer easy-to-manage and storage-efficient packages.

Brand Case study: Seed Phytonutrients

Seed Phytonutrients has carved its niche in the crowded beauty sector with sustainable packaging that doesn’t compromise aesthetic appeal. Their shower-friendly paper bottles, made from 100% post-consumer recycled paper with a post-consumer recycled plastic liner, are a first in the industry.

Consumers have responded enthusiastically due to the brand’s eco-consciousness and holistic approach to beauty and wellness. The packaging reflects the brand’s values, and this authenticity engenders deep loyalty, particularly amidst growing consumer awareness of environmental issues and product ingredients.

Alter Eco

With sustainability at its heart, Alter Eco redefines food packaging with compostable, plastic-free chocolates and truffle wrappers. This innovative approach addresses plastic pollution without sacrificing product quality or packaging design. Consumers, especially eco-conscious ones, are willing to pay a premium for products that align with their values. The success of Alter Eco underscores a critical trend: packaging is no longer an afterthought in the food sector; it’s central to the consumer’s purchasing decision, a direct reflection of their personal and global concerns.

The ripples of this eco-conscious shift are reforming established brand practices. For example, McDonald’s USA announced its commitment to renewable and recyclable packaging materials across all locations by 2025. Such initiatives resonate with consumers, reinforcing brand loyalty through demonstrated responsibility toward shared environmental concerns.

The Future of Packaging in 2024 and beyond

We are witnessing a renaissance in packaging, shaped by the demand for sustainability. This blog post has illuminated the role of packaging in influencing consumer choices and brand success. Now, let’s integrate the five emergent sustainability trends in package design, reflecting the evolving ethos of our times.

Embracing Biodegradable Materials: The urgent need to address plastic pollution has catalyzed the shift toward biodegradable materials in packaging. This trend reflects a deeper consumer demand for products that align with their values of ecological responsibility. Brands like Coca-Cola and Amazon, which are incorporating these materials, are not just adapting to a trend but actively participating in creating a more sustainable future.

Circular Design and Zero-Waste Packaging: The concept of circular design—where products are made to be reused, recycled, or composted—signals a significant shift in how we approach packaging. Zero-waste packaging shows a brand’s commitment to the entire lifecycle of its products. This approach resonates deeply with consumers who are increasingly aware of the environmental impact of their purchasing decisions.

Reducing Packaging Footprint: The trend toward minimizing the packaging footprint addresses the dual challenge of waste reduction and resource efficiency. This trend indicates the future of packaging lies in minimalism and efficiency. Brands that successfully reduce their packaging footprint are likely to find favor with a consumer base that values sustainability as much as product quality.

Eco-Friendly Ink and Labeling: The shift toward eco-friendly inks and labeling is an important trend that speaks to the meticulous attention to detail required in sustainable packaging. This goes beyond the materials used for the package, considering every aspect of the packaging process. It’s a trend that reduces environmental impact and enhances brand reputation as it reflects a comprehensive approach to sustainability.

Emphasis on Consumer Education and Transparency: Perhaps the most crucial trend is the growing emphasis on educating consumers and providing transparency. This trend acknowledges that informed consumers are the key drivers of sustainable practices. By emphasizing education and transparency, brands can build trust and loyalty, forging a deeper connection with their customer base.

As we look towards the future, it is evident that the convergence of these sustainability trends in packaging design is shaping consumer behavior and brand perceptions and redefining the ethos of global commerce.

In this new era, packaging transcends its traditional role, becoming a dynamic interface between the brand and its environmentally conscious consumers. The brands that adeptly navigate these trends integrating them into their packaging strategies, will stand at the forefront of more sustainable and responsible business practices.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director