In Japan, the loudest thing on social media might be silence. While nearly 80% of the population actively uses social platforms, few are broadcasting their lives. They scroll quietly, post sparingly, and conform to cultural expectations of privacy and restraint. This restraint reflects meiwaku—the deeply rooted cultural norm of not drawing attention or causing discomfort, shaping much of Japan’s online behavior.

Cross Marketing Inc., our sister company, recently surveyed 2,500 Japanese users aged 15 to 79 to understand what drives this behavior. The results reveal which platforms dominate, how people engage, and the emotional trade-offs they experience.

While much of the world grapples with platform fatigue, misinformation, and AI-driven feeds, Japan offers a striking counterpoint: a society that embraces social media with intentionality, favoring privacy, restraint, and purpose over performance.

The Platforms Japan Can’t Quit

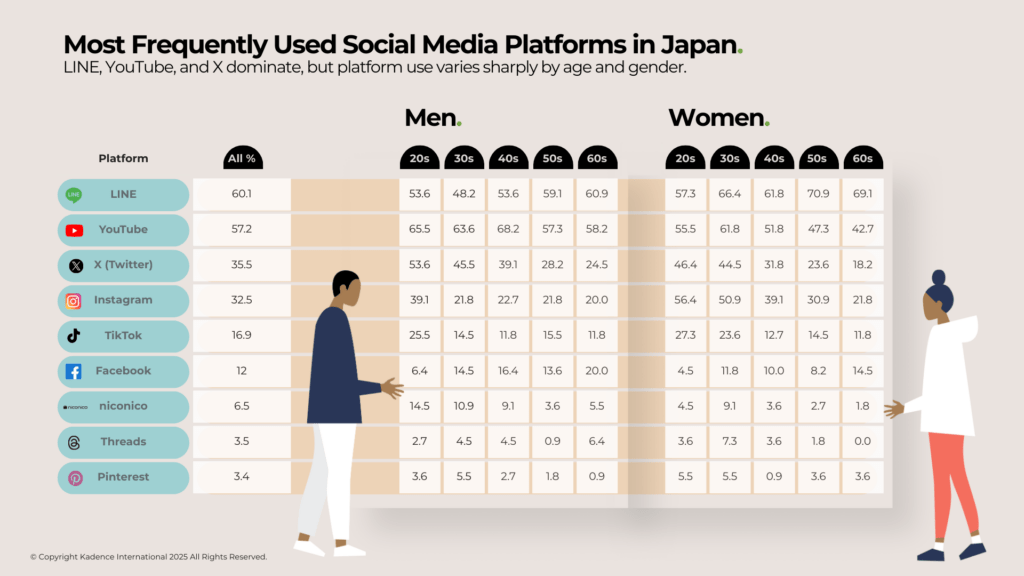

When it comes to social media preferences, Japan diverges sharply from global norms. Japan’s favorite platforms aren’t trendy but practical, private, and safe. Messaging eclipses broadcasting. Entertainment is consumed, not performed. And loyalty runs deep, as platforms that meet emotional and functional needs remain sticky for years.

LINE: Japan’s Digital Backbone

With over 97 million users, LINE isn’t just for messaging; it’s where Japan chats, shops, pays bills, and receives public health alerts. Its all-in-one design made it indispensable during the pandemic and has cemented its role as a daily utility. Unlike WhatsApp, LINE is more than social. It’s essential.

LINE’s dominance is so entrenched that international competitors like WhatsApp and Facebook Messenger never gained meaningful traction. It blends functionality and familiarity, all while honoring the unspoken boundaries of Japan’s social etiquette.

Why TikTok Hasn’t Taken Over

TikTok may dominate Gen Z attention globally, but in Japan, skepticism runs deep. Although TikTok use among Japanese teens has hit 70%, trust lags far behind. Just 11% rely on social media for news, compared to nearly 69% for mass media (The Japan Times). Low trust and privacy concerns continue to limit TikTok’s role as an information source.

Inside Japan’s Social Media Habits

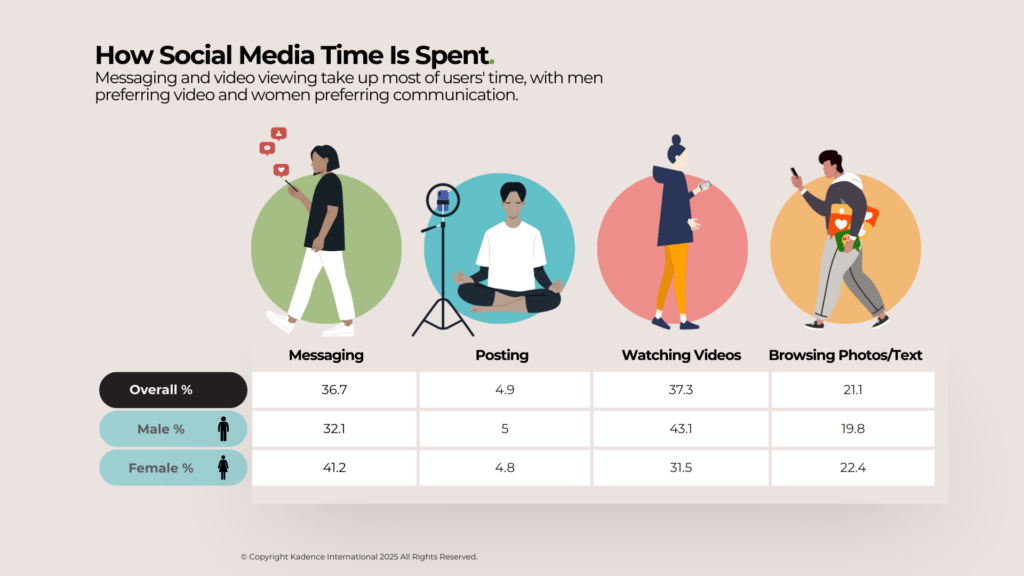

What Japanese users do on social media often says more than what they post—or, more accurately, don’t. Most activity centers on messaging and video consumption, while posting remains marginal. Social feeds here quietly reflect interests, habits, and unspoken social codes.

Gendered patterns add another layer. Women gravitate toward messaging, browsing photos, and reading updates, while men lean more toward video consumption. Yet across all demographics, participation remains largely passive.

Over half of women listed “messaging and story viewing” as their top activity, compared to 44% of men. Conversely, men over-indexed in video consumption by 1.3x.

In Japan, silence isn’t absence. It’s intentional. A social media culture built around watching, not performing, mirrors the broader emphasis on harmony, discretion, and non-disruption. The metrics confirm what many observers already sense: Visibility isn’t the currency here. Attention is.

The Emotional Trade-Offs of Social Media in Japan

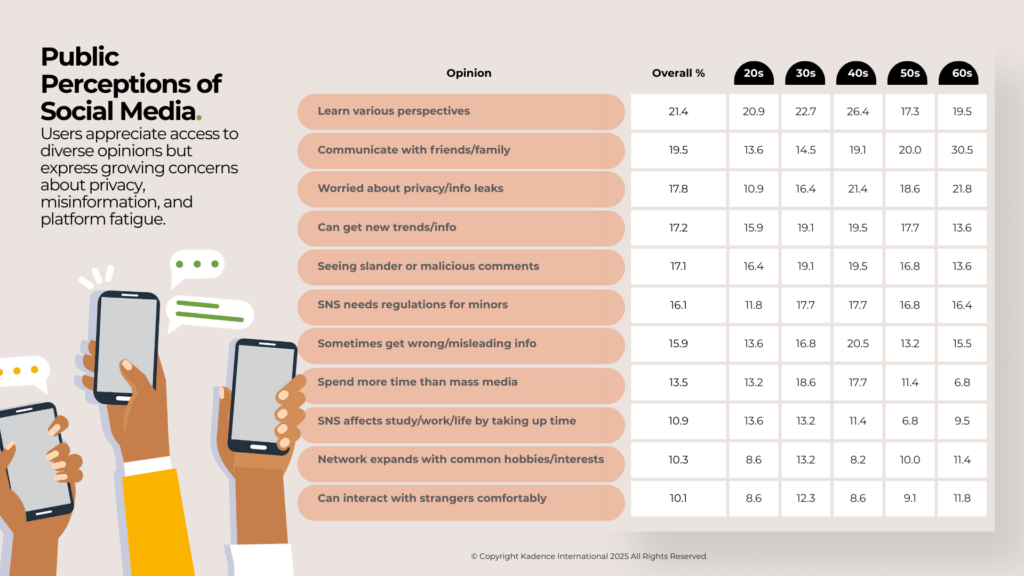

Even as social media becomes routine in Japan, the emotional toll of being ‘always on’ is increasingly visible. Our survey results reveal a core tension: users appreciate the convenience of staying connected but remain uneasy about the psychological and social costs.

This chart reveals a telling split. While over half of respondents cited convenience, such as keeping in touch or staying updated, as a top benefit, nearly 40% pointed to concerns about mental health, misinformation, and interpersonal stress.

Younger users, particularly those in their twenties, describe social media as “exhausting.” The endless scroll of curated lives creates comparison fatigue, fueling anxiety in a culture that prizes composure and conflict avoidance.

Older users are more worried about misinformation. As trust in traditional media drops, social media has become an important but questionable option. This raises issues about what is real, who controls the message, and how reliable the information is. Only 39% of Japanese users trust social media for news, which is one of the lowest rates in the world (Edelman Trust Barometer 2024).

Most users favor closed networks like LINE and Instagram Stories, where sharing is controlled and passive scrolling dominates.

Where Japan Posts — Open vs Closed Platforms

| Platform Type | Common Platforms | Primary Use |

| Closed Networks | LINE, Instagram Stories | Personal updates, private chats |

| Open Platforms | TikTok, X (Twitter), YouTube | Entertainment, fandom, browsing |

Why Avatars Rule in Japan

In Japan, anonymity isn’t evasive—it’s respectful. Many users use avatars or nicknames to uphold meiwaku, the cultural norm of avoiding discomfort or attention. Instagram profiles often feature pets or anime characters instead of personal photos. For brands, this signals a need for subtlety. Campaigns built on emotional safety and soft engagement resonate far more than loud, influencer-driven pushes.

What Is Meiwaku?

In Japanese culture, meiwaku refers to not causing trouble or discomfort to others. It’s a deeply ingrained social principle that governs offline and online behavior. On social media, this translates to minimal self-promotion, controlled sharing, and a preference for anonymity, not because users are hiding, but because they’re being polite.

The Hidden World of Japanese Social Media Fandoms

Japan’s social media landscape isn’t devoid of passion—it’s just quieter. Fandom culture thrives in low-visibility spaces like YouTube comments, anonymous X accounts, and curated playlists. Anime, gaming, idol culture, and DIY content form deep yet discreet communities. Participation here is subtle: likes, silent reposts, and niche hashtags form the backbone of engagement.

For brands, this signals opportunity, but only for those who observe before they speak.

How Japan Looks for Information Online

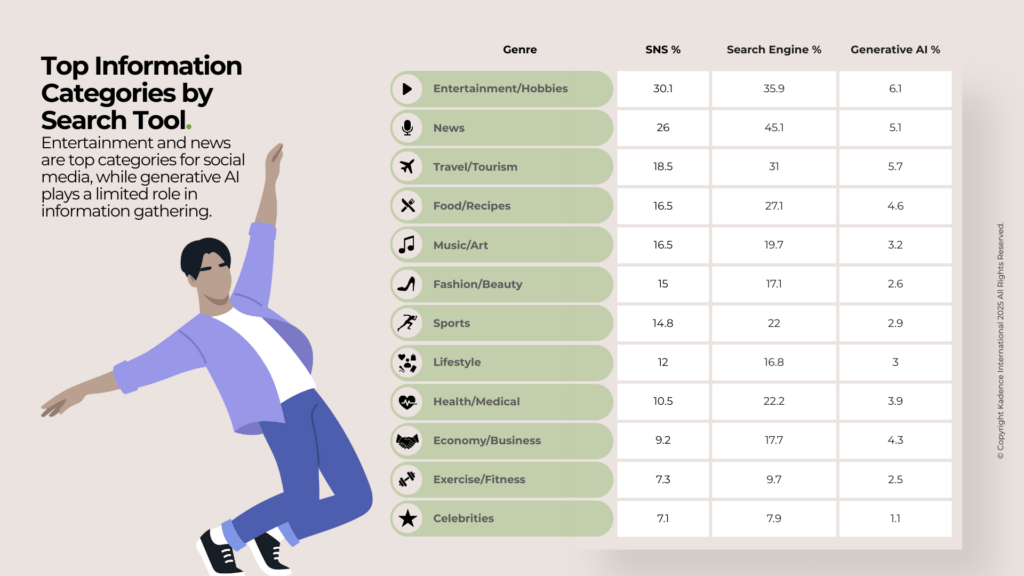

Japanese users are increasingly selective about where they seek truth. Our survey reveals a clear hierarchy based on perceived authority in search behavior.

Search behavior reveals a clear segmentation: Google and Yahoo dominate health, news, and finance. YouTube leads in tutorials, product reviews, and DIY. TikTok and Instagram—favored by younger users—are go-to platforms for fashion, food, and beauty.

This divide isn’t accidental. In Japan, legitimacy and formality are closely linked. Trendy platforms are fine for fashion, but not for facts. According to a 2024 Digital Confidence Index Asia study, 61% of Japanese users verify information they find on social media using a traditional search engine before trusting it.

The takeaway for brands is tactical. Campaigns aiming to inform—particularly around health, education, or finance—must be anchored on platforms with stronger reputational authority. In contrast, discovery-driven content (like recipes, fashion trends, or pop culture) finds greater traction in visually immersive feeds.

How Japan Compares to Other APAC Markets

| Country | Most Used App | Gen Z Trust (news %) | Posting Frequency |

| Japan | LINE | 39% | Low |

| Indonesia | TikTok | 62% | High |

| South Korea | YouTube | 54% | Medium |

| Philippines | 68% | High |

Source: Cross Marketing 2025, Edelman Trust Barometer 2024

Regulation, Trust, and the Rise of Platform Accountability in Japan

Japan is not immune to global concerns around digital trust. In 2023, the country amended its data privacy laws, requiring platforms to disclose how user data is handled and how algorithms shape content. According to NHK, public support for stricter regulation is growing, with 48% in favor. The discomfort centers on opaque algorithms—how feeds are personalized, why content goes viral, and how ads track behavior. While personalization is often welcomed in Western markets, in Japan, it tends to feel intrusive.

What the Future Holds for Social Media in Japan

Japan isn’t rushing toward hyperconnectivity. It’s editing as it goes. Social media use isn’t declining; it’s being redefined. Platforms serve a purpose. Behavior is intentional. Authority must be demonstrated.

For Gen Z in Japan, TikTok is shifting from entertainment to search. With 70% of teens aged 13 to 19 now on the app—a 1.2 times increase from the previous year—it has become the first stop for discovering trends, how-to content, and product reviews. This shift rewires search habits: younger users bypass Google for short-form discovery tailored to their interests.

This rewiring of search behavior among teens suggests a more profound shift in how digital literacy is acquired and who gets to shape it.

In Japan, digital literacy is increasingly shaped by TikTok, YouTube, LINE, and Instagram. Younger users now seek product reviews, tutorials, and trends via short-form video before turning to traditional search. Success means optimizing not just for typed queries, but for platform-specific behaviors—like watch time on YouTube, engagement loops on TikTok, and closed-circle visibility on LINE and Instagram Stories. In Japan’s trust-driven digital culture, success isn’t about going viral. It’s about becoming quietly indispensable through credibility, emotional subtlety, and cultural fluency.

Japan’s generational platform split remains distinct. Older users rely on LINE and YouTube for communication and passive viewing, while younger audiences gravitate toward TikTok and Instagram for exploration and cultural connection.

This measured digital culture may offer a model for other markets. In an era of algorithmic noise, declining trust, and digital burnout, Japan’s selective, restrained approach presents an alternative: one rooted in purpose, privacy, and cultural nuance.

The Road Ahead

To engage Japan’s digital audience, brands must go beyond showing up. Success depends on earning permission through credibility, cultural awareness, and timing. Mistrust runs high. Convenience is non-negotiable. Translation alone isn’t enough, as cultural fluency is essential.

Policy will continue shaping the landscape. Japan’s push for algorithmic transparency and data accountability signals a shift toward platforms prioritizing user well-being over unchecked engagement.

In Japan, the question isn’t “What’s trending?” It’s “What’s trusted?”

That distinction may define the next phase of social media, not just in Japan, but in any market looking to reset the digital contract. In Japan, digital success isn’t about virality but building quiet relevance, one trusted touchpoint at a time.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director