Forever 21 is closing its doors – again. Once the crown jewel of American mall culture, the fast-fashion giant is filing for bankruptcy for the second time in under five years. As shuttered storefronts stretch across the US, its downfall has become more than a brand misstep – a sign that the old fast-fashion model is running out of time.

In its place, a new breed of fashion titans is rising. Shein and Temu, two digital-first platforms with Chinese roots, have turned the industry on its head. Their tools? Artificial intelligence, real-time trend scraping, lightning-fast production, and a hyper-personalized consumer journey. These aren’t just cheap alternatives; they’re smart machines designed for a generation that grew up with TikTok, interactive shopping, and constant trends.

Forever 21’s decline isn’t a singular event. It’s part of a deeper market shift – one where legacy playbooks are being rewritten by code, content, and community. As fashion retail becomes more focused on digital channels, brands that do not change may become outdated and irrelevant.

Forever 21’s Fall Signals a Broken Retail Model

Forever 21’s descent didn’t happen overnight. It was a slow unraveling, a brand once emblematic of youth culture now outpaced by the very consumers it once captivated. At its peak, Forever 21 thrived on trend turnover, sprawling mall spaces, and low prices. But the retail landscape changed, and the brand didn’t.

As digital shopping accelerated and consumer expectations shifted, Forever 21 remained tethered to an outdated model – long production cycles, centralized design decisions, and a heavy reliance on brick-and-mortar foot traffic. Its once-successful approach became a liability. While consumers moved toward immediacy and personalization, the company doubled down on bulk inventory, sluggish turnarounds, and static pricing. It failed to keep pace with the velocity of online trend formation – a pace now dictated not by runways or retail calendars but by social feeds refreshed by the second.

The gap widened as Gen Z entered the market. Raised in an era of choice overload, platform-native shoppers sought brands that moved with them – fluid, responsive, and in sync with their aesthetic sensibilities. Forever 21, by contrast, felt stuck. Its collections lagged behind trends. Its online presence was clunky. It couldn’t deliver the frictionless experience digital-native brands were engineering.

Even attempts at reinvention – rebrands, collaborations, and in-store tech integrations – were often too reactive or off-mark. Market research during this period revealed a steady erosion in brand affinity among younger demographics, who increasingly dismissed mall-based fast fashion as outdated, unoriginal, or environmentally negligent. The retail floors, once buzzing with teens became quieter, the racks fuller, and the margins thinner.

The retail model that once made Forever 21 a sensation has become outdated. And in an industry that now rewards adaptability over legacy, the brand’s decline underscores a critical truth: fashion doesn’t wait.

Shein and Temu Built a Smarter System

While legacy players like Forever 21 struggled to pivot, Shein and Temu were busy rewriting the rules of engagement. What distinguishes them isn’t just speed – it’s the system beneath the surface, a high-velocity engine built on data, automation, and platform-native behavior. These brands aren’t retailers in the traditional sense; they’re algorithmic marketplaces fueled by machine learning, social signals, and a relentless feedback loop between consumer demand and product creation.

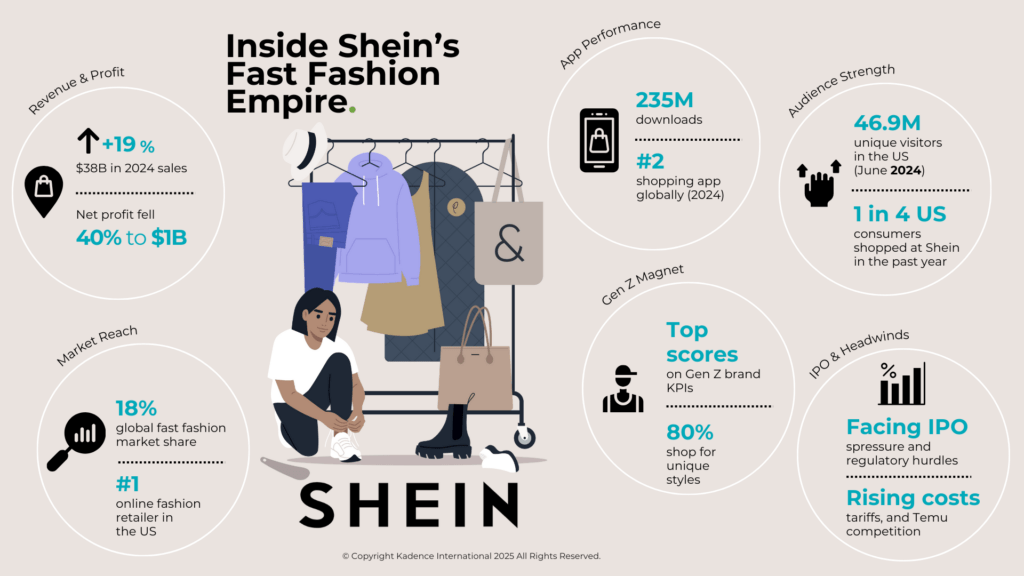

Shein, in particular, operates more like a tech company than a fashion label. Its infrastructure is designed to detect real-time micro-trends, testing new styles in limited batches and scaling only the best performers. Instead of seasonal collections, it drops thousands of SKUs daily – each one a calculated bet based on keyword spikes, user behavior, and social engagement. What used to take legacy brands months now takes Shein days, with entire production cycles compressed into near real-time manufacturing.

Image Credit: Boffin Coders

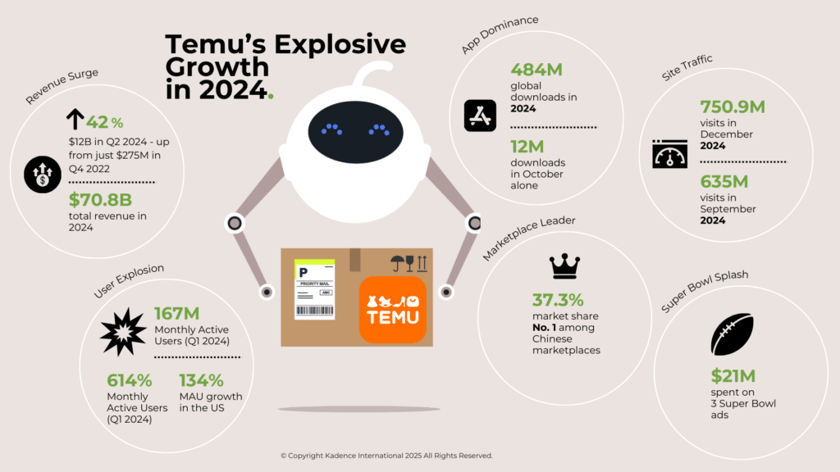

Temu is building dominance on a different front. Backed by the e-commerce powerhouse PDD Holdings, its model leans heavily on gamification and bottom-dollar pricing, turning shopping into a behavioral loop. Discounts are dynamic, product discovery is algorithmically engineered, and the platform’s addictive scroll mimics social media architecture. Rather than chasing trends, Temu floods the feed with hyper-targeted inventory based on browsing data, purchase history, and behavioral nudges. Brand storytelling becomes secondary to price, pace, and personalization in this context.

Image Credit: Tech Crunch

Both companies excel at bypassing traditional gatekeepers. Instead of relying on expensive ad campaigns or celebrity endorsements, they tap into the power of peer-to-peer virality. TikTok hauls, influencer codes, and affiliate campaigns do more than drive traffic – they create a cultural moment, making shopping a social performance. The result is a decentralized and infinitely scalable distribution model.

Where traditional fast fashion brands pushed products, Shein and Temu pull consumers into a constantly evolving loop of discovery, validation, and conversion. It’s a model built not on intuition but on information, a data-centric approach that doesn’t just respond to the market but often predicts it.

Speed and Price Now Come with a Cost

But the same mechanisms fueling this meteoric rise are now drawing intensified scrutiny. As Shein and Temu scale at breakneck speed, regulators, watchdogs, and increasingly vocal consumer groups are beginning to question the true cost of their success. Investigations into labor practices, environmental degradation, and product safety are no longer confined to fringe activism; they’re reaching mainstream legislative agendas in the U.S. and Europe.

To soften criticism, Shein recently launched a resale platform in the U.S., positioning it as a circular fashion solution. Branded as a way for consumers to buy and sell secondhand Shein items, the initiative appears, on the surface, to nod toward sustainability. But industry experts and environmental advocates have been quick to call it out. Critics argue that the move lacks substance, pointing out that reselling ultra-low-quality garments does little to counteract the brand’s core business model – one built on volume, disposability, and micro-trend churn. The resale program, some say, is more about optics than impact.

This tension highlights a bigger issue in the industry. The European Union has suggested tougher rules for transparency in textile imports, and U.S. lawmakers want more oversight on very cheap goods coming in through de minimis loopholes. These regulatory flashpoints are less about fashion and more about accountability – demanding that platforms operating on mass micro-consumption clarify how and where products are made, under what conditions, and at what environmental cost.

At the same time, cultural sentiment is shifting. What was once dismissed as disposable fashion is becoming a reputational risk. High-visibility criticism from sustainability influencers, investigative journalists, and even former brand collaborators is reshaping the narrative around what it means to shop cheap. For a growing subset of consumers, convenience and cost are no longer blind spots; they’re trade-offs weighed against a rising ethical awareness.

Still, the backlash isn’t yet translating into behavioral change at scale. Most consumers prioritize value and speed, even as they express concerns about sustainability. But the growing friction between convenience and conscience is opening a critical window. For competitors, this is a signal: the future of fast fashion won’t just be about how quickly brands can produce – it will hinge on how transparently they can operate in a world that’s starting to ask harder questions.

Retailers Must Rethink the Entire Playbook

The road ahead demands a fundamental shift in how fashion brands think, operate, and communicate. Survival won’t come from marginal tweaks to legacy systems but from a reengineering of retail itself – beginning with the supply chain.

Brands must move beyond cost efficiency and embrace operational intelligence. That means investing in technologies that enable demand sensing, real-time replenishment, and localized micro-manufacturing. Flexibility is no longer optional; it’s the foundation of relevance.

Equally critical is the evolution of pricing strategy. Competing with Shein and Temu on cost alone is a race few can afford to run. Instead, smart pricing – anchored in perceived value, quality assurance, and ethical sourcing – offers a more sustainable path. Consumers may be price-conscious, but they’re also becoming more aware of what pricing signals. Transparency around why a product costs what it does can strengthen trust and justify margins in a way race-to-the-bottom tactics cannot.

The marketing function must also be rebuilt for the algorithmic age. Traditional seasonal campaigns are losing ground to dynamic, always-on storytelling that responds to cultural shifts and consumer moods in real-time. This is where social commerce becomes critical, not as a trend but as infrastructure. Influencers are not just amplifiers; they’re now co-creators, collaborators, and curators of brand identity. Investing in decentralized content strategies, creator partnerships, and community-led design isn’t a nice to have – it’s how brands remain visible in a crowded, scroll-driven marketplace.

Finally, there’s the matter of trust. Authenticity becomes the ultimate differentiator in an ecosystem flooded with low-cost, high-frequency goods. Brands that can demonstrate their values through verifiable action – whether in ESG commitments, labor transparency, or community impact – will carve out a deeper connection with consumers navigating ethics. It’s not about appealing to everyone; it’s about being clear, consistent, and credible in what you stand for.

The Fast Fashion Reckoning Is Already Here

The fast fashion battleground is no longer about who can flood the market with the most products – it’s about who can navigate a volatile consumer landscape with speed, precision, and purpose. Shein and Temu have exposed the vulnerabilities of legacy brands not just by being faster or cheaper but by building systems attuned to cultural momentum, behavioral data, and the economics of digital attention. But their rise also highlights the limits of optimization when values, trust, and transparency are left out of the equation.

The future belongs to brands that can do both – move at the algorithm’s speed while operating with the discipline of long-term stewardship. Fashion is evolving from a product-based business to a platform-based experience, where relevance is won not once but constantly. For incumbents and challengers alike, this moment is not just a test of resilience. It’s a call to rethink what fashion means in a world where everything can be copied, but not everything can connect.

The rules have changed. What remains is the opportunity for those willing to radically rethink their systems as Shein and Temu have and to act before the next store closes.