In India, a financial revolution is quietly taking shape. Over two-thirds of Gen Z and Millennials in India now use neo-banks—digital-only platforms built for a mobile-first world—demonstrating a major shift in youth banking habits.

Data from our study, “Gen Z and Millennials’ Trust in Neo-Banks Across Southeast Asia,” conducted in partnership with PureSpectrum, indicates that convenience and digital services rank highest among the factors influencing bank selection among Indian youth. This preference signals a shift away from traditional banks, where legacy and reputation—a cornerstone for earlier generations—were ranked as the top priority by only 3% of respondents.

Setting the Scene: India’s Youth and Financial Ecosystem

With a median age of 28, India has one of the youngest populations globally. According to United Nations data, Gen Z and Millennials together account for over 50% of the country’s 1.4 billion people. This demographic weight has profound implications for industries across the board, but nowhere is its impact more visible than in banking.

Younger generations’ demand for tech-driven solutions has paved the way for a neo-bank boom. With 750 million internet users and growing smartphone penetration, India’s digital infrastructure provides a solid foundation for this transformation. For many of these young consumers, the appeal of neo-banks lies in their ability to sidestep the inefficiencies associated with traditional banks, including long queues, cumbersome paperwork, and limited operating hours.

Historically, India’s banking sector has been dominated by well-established institutions like the State Bank of India (SBI) and ICICI Bank, whose extensive branch networks were critical for trust and accessibility. However, these legacy systems are now struggling to keep pace with the demands of a digital-first audience. While traditional banks have introduced online services, they often lack the seamless user experience and agility that define neo-banks.

This shift reflects broader global trends but is particularly pronounced in India, where financial innovation is meeting the needs of an increasingly mobile and tech-savvy population. The question is no longer whether neo-banks can compete with traditional institutions but how quickly they can capture market share in a country ripe for digital disruption.

Cultural and Behavioral Insights

India’s youth are redefining banking, favoring innovation and convenience over the legacy markers valued by previous generations. For Gen Z and Millennials, 24/7 accessibility and personalized experiences take precedence. These consumers expect banks to function like their favorite apps: intuitive, always accessible, and personalized.

This cohort values the integration of banking with other digital services, such as wallets, investments, and financial analytics. For instance, many neo-banks provide seamless connections with UPI-based payments and budgeting tools that allow users to track expenses in real time. These features align with the preferences of a generation accustomed to managing their lives digitally.

Traditional banks, with their reliance on physical infrastructure and slower adaptation to technological advances, are increasingly seen as outdated by India’s youth. Legacy and reputation, once cornerstones of trust, no longer hold the same appeal. The generational shift reflects a broader trend: trust is now built through convenience, innovation, and transparency, rather than through long-established institutional histories.

Key Finding #1: Digital-First Banking is the Norm

For India’s youth, banking is no longer tied to physical branches or traditional methods. Research shows 67% of Indian respondents currently use neo-bank services, reflecting a strong shift toward digital-first banking. This trend is driven by convenience, speed, and accessibility—factors that resonate strongly with a generation accustomed to on-demand services.

India’s adoption of neo-banks aligns with a global shift toward digital banking, but the country’s growth trajectory stands out. With India ranking among the largest online populations in the world, affordable smartphones, and low-cost data plans have accelerated this shift, extending digital banking to remote regions.

Another key enabler of this shift has been the Unified Payments Interface (UPI), a government-backed platform that has revolutionized financial transactions. In 2023, UPI processed over 10 billion transactions in a single month, underscoring the scale of its adoption. Neo-banks have seamlessly integrated with UPI, offering users a one-stop solution for payments, savings, and account management, making them a natural choice for digitally native consumers.

Globally, countries like Singapore and South Korea have led the way in digital banking adoption, but India’s unique combination of demographics and infrastructure is positioning it as a leader in this space. Unlike many developed markets, where traditional banks still hold significant sway, India’s younger population is less tied to legacy institutions, giving neo-banks a competitive edge.

This rapid shift is reshaping India’s financial landscape, making digital-first banking not just an option but the norm for millions of young consumers. As neo-banks continue to innovate, their role in India’s economic ecosystem is set to grow even further, challenging traditional banks to adapt or risk obsolescence.

Key Finding #2: What Matters Most to Indian Youth

For India’s young consumers, banking priorities are clear: convenience and digital services rank as the most important factors when selecting a financial institution. According to our study, these attributes consistently outpaced traditional criteria like reputation or customer service, reflecting a generational shift in expectations. Neo-banks, designed for app-first, seamless experiences, have become the go-to choice for Gen Z and Millennials seeking efficient financial tools.

Low fees and attractive interest rates further enhance the appeal of neo-banks. Unlike traditional banks, which often charge maintenance fees or impose minimum balance requirements, many neo-banks offer zero-fee accounts and competitive savings rates. For price-conscious users, these features are game-changers.

Several players have emerged as frontrunners in India’s neo-banking ecosystem, each targeting the youth market with tailored solutions:

- Jupiter: Designed for digital natives, Jupiter offers intuitive money management tools, including personalized expense insights and instant account setup.

- Niyo: Focused on global travelers and professionals, Niyo provides multi-currency accounts, competitive forex rates, and seamless integration with international payment platforms.

- RazorpayX: Catering to freelancers and small businesses, RazorpayX combines traditional banking features with advanced analytics, enabling users to manage cash flow and automate transactions effortlessly.

These neo-banks distinguish themselves by addressing pain points that traditional banks have struggled to resolve. Whether it’s the ability to open an account in minutes or access detailed spending breakdowns at a glance, these features align with the tech-savvy expectations of India’s youth.

By prioritizing innovation and user-centric design, neo-banks are not just meeting the needs of their customers—they are redefining what Indian consumers expect from banking. For the country’s Gen Z and Millennials, convenience is no longer a bonus; it’s a baseline requirement.

Bridging Gaps in Financial Inclusion

Neo-banks are pivotal to India’s digital transformation, driving financial inclusion nationwide. While urban adoption has been swift, neo-banks are increasingly reaching underserved markets in tier-2 and tier-3 cities. According to Statista, smartphone penetration in India is projected to hit 76% by 2025, creating fertile ground for digital-first banking solutions.

Yet, building trust remains a hurdle, especially in regions loyal to traditional banks. Security concerns were cited by more than two-thirds of respondents as a significant barrier, reflecting broader anxieties about data privacy in a country that has seen its share of cyberattacks on financial platforms.

Broader Economic Impact

Neo-banks are not just reshaping how individuals interact with their money—they are also driving financial inclusion across India. Digital-first platforms have significantly reduced the barriers to accessing banking services, especially in tier 2 and tier 3 cities, where traditional bank branches are often sparse. With a smartphone and an internet connection, users in these regions can open accounts, transfer funds, and access savings tools in minutes.

Neo-banks have become indispensable for gig economy workers and small businesses. Platforms like RazorpayX offer features tailored to freelancers and entrepreneurs, such as automated payment systems and cash flow management tools. These innovations enable small-scale enterprises, which often face hurdles with traditional banks, to operate more efficiently and securely.

Government initiatives have played a critical role in fostering this transformation. Programs under Digital India have expanded internet access to rural areas, while open banking frameworks introduced by the Reserve Bank of India (RBI) encourage collaboration between fintech firms and traditional financial institutions. The growth of UPI, which neo-banks heavily rely on, is another testament to how public policy has facilitated financial innovation.

As neo-banks continue to grow, their ability to integrate underserved populations into the formal financial system has broader implications for economic development. By democratizing access to banking, they are not just meeting the needs of India’s youth but also contributing to the country’s long-term economic resilience.

Comparative Lens: How India Stands Out

India’s neo-bank adoption is part of a larger regional trend, but certain factors make its growth trajectory unique. Compared to its Southeast Asian neighbors, India has a distinct mix of demographic advantages, technological infrastructure, and regulatory challenges that shape its neo-banking landscape.

Here’s how India compares with these markets:

| Aspect | India | Singapore | Malaysia | Philippines |

| Neo-Bank Adoption | 67% of respondents use or have used neo-banks | 66%, led by high smartphone penetration | 62%, with strong focus on convenience | 67%, heavily reliant on mobile banking |

| Primary Drivers | Convenience, low fees, and digital services | High trust in digital-first institutions | Affordable fintech services | Customer service and ease of use |

| Challenges | Security concerns and limited service options | Small market size, regulatory clarity | Trust in legacy banks still significant | Lower internet penetration in rural areas |

| Government Role | UPI, Digital India initiatives | Strong fintech ecosystem, MAS support | Public-private collaboration on fintech | Lagging fintech adoption support |

| Demographic Advantage | Young, tech-savvy population | Wealthy, digitally literate population | Balanced mix of urban and rural users | Urban growth driving fintech adoption |

Key Observations:

- Adoption Rates: India matches the Philippines in adoption rates at 67%, despite differences in population size and banking infrastructure.

- Government Support: India’s proactive government initiatives, such as UPI and open banking frameworks, provide a robust foundation for neo-bank growth, unlike the slower regulatory progress seen in the Philippines.

- Challenges and Opportunities: Security concerns are a shared challenge across markets, but India’s vast young population and expanding digital reach give it unmatched potential for neo-bank proliferation.

India’s sheer scale and demographic profile set it apart from its regional counterparts. While Singapore leads in trust and Malaysia excels in convenience-driven adoption, India’s combination of innovation and policy support positions it as a leader in the neo-bank revolution across Southeast Asia.

A Competitive Landscape

The rise of neo-banks has not gone unnoticed by traditional banking giants. Many are now exploring partnerships with fintech companies to remain competitive, while some, like ICICI and HDFC Bank, have launched their own digital offerings to retain their customer base.

Despite these efforts, neo-banks’ lean structures and focus on user experience give them an edge. Their ability to integrate with popular payment platforms, budgeting tools, and investment services makes them particularly appealing to Millennials and Gen Z, who prefer consolidated, intuitive financial ecosystems.

Key Finding #3: Challenges for Neo-Banks in India

Despite their growing popularity, neo-banks in India face significant challenges in their quest for widespread adoption. The most pressing concern is security and trust, cited by 67% of respondents as a barrier to fully embracing digital-only banking. For a population that has historically relied on well-established banks with physical branches, neo-banks must overcome skepticism about the safety of their platforms and the privacy of sensitive financial data.

India’s fintech space has seen its share of high-profile security breaches, which have contributed to these concerns. For instance, in 2022, the personal data of millions of users from a popular digital payment app was reportedly leaked online, raising alarms about the vulnerabilities of digital financial services. Although neo-banks are investing heavily in cybersecurity measures, such incidents make it challenging to build trust, particularly among first-time users.

Another hurdle for neo-banks is their limited service offerings compared to traditional banks. While neo-banks excel in day-to-day financial management—such as payments, savings, and money transfers—they often lack critical features like loans, credit cards, or mortgage options. For many users, these omissions make neo-banks a supplemental rather than primary banking choice.

The regulatory environment also plays a role. Neo-banks in India operate in partnership with traditional banks, as the Reserve Bank of India (RBI) does not currently permit fully independent digital banks. This dependency can limit the scope of services and innovation that neo-banks can provide.

To remain competitive, neo-banks must address these barriers head-on. Enhancing transparency around security protocols, expanding service offerings, and strengthening partnerships with traditional banks are crucial steps toward winning the trust of India’s young consumers. As the market matures, the ability to overcome these challenges will determine whether neo-banks can evolve from niche disruptors to mainstream players in India’s financial ecosystem.

What’s Next for Neo-Banks in India?

The future of neo-banks in India is bright but will require strategic evolution to sustain momentum. One key development will likely be increased partnerships between traditional banks and fintech companies. These collaborations will help neo-banks navigate India’s regulatory landscape, which currently restricts fully independent digital banks. By leveraging the infrastructure and licenses of established banks, neo-banks can expand their reach while addressing compliance requirements.

Security and trust, consistently highlighted as barriers, are also areas ripe for improvement. As neo-banks continue to invest in advanced cybersecurity protocols—including biometric authentication, encryption, and real-time fraud detection—they can reassure customers about the safety of their platforms. Transparent communication about these measures will be essential for building long-term trust.

Expanding service offerings is another critical priority. Neo-banks have primarily focused on payments, savings, and money management, but the next phase will likely include loans, investment products, and credit facilities. These additions will allow neo-banks to transition from supplementary services to full-fledged financial ecosystems, increasing their appeal as primary banking providers.

As smartphone penetration deepens and India’s digital infrastructure improves, neo-banks are also expected to play a greater role in financial inclusion. By innovating to meet the unique needs of rural and underserved communities, these platforms can help bridge the gap between India’s urban and rural economies, fostering equitable growth.

India’s journey toward becoming a global fintech powerhouse is just beginning. With a young, tech-savvy population at the helm, supported by progressive government policies and relentless innovation, the future of banking in India is undoubtedly digital—and it’s already here.

To access our insight summary from our study, click here.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

A tech company buzzes with anticipation over a groundbreaking product idea promising to redefine its market. Behind the scenes, excitement unites teams across departments, from engineering drafting the first blueprints to marketing strategizing the big reveal. There’s a palpable energy as developers discuss potential features, designers brainstorm aesthetics, and sales teams forecast demand.

Nothing energizes organizations more than launching a new product. This exciting phase boosts team morale and shareholder confidence and sharpens the competitive edge of brands, setting them apart in a crowded marketplace.

However, this initial euphoria can be short-lived as the journey from concept to market often encounters hurdles, like products losing focus, teams grappling with burnout, and innovations arriving too late.

So, why do products often miss the mark?

Here are some common pitfalls of New Product Development:

- Lack of Product Uniqueness: A product might lack the distinctiveness to stand out without exploring a comprehensive range of solutions. This risk magnifies when an organization rushes to lock down a concept without considering various perspectives or potential market shifts.

- Shifting Market Realities: A common pitfall is failing to account for market changes or making assumptions about distribution channels. This can lead to a project that starts with a simple concept but ends up burdened with unnecessary features, prolonging development and leading the product astray from its original mission. For instance, a start-up in the sustainable energy sector might begin designing a basic solar panel solution but end up integrating smart technology features that delay the project and dilute its core value proposition.

- Technical Hurdles Overlooked: Overestimating a company’s technical prowess or underestimating the project’s complexity can lead to significant delays. A tech firm developing an advanced AI-driven analytics platform might be stalled by unforeseen technical challenges, lacking the necessary expertise or innovations to proceed as planned.

- Function Misalignment: Discrepancies between different departments’ expectations and capabilities can derail a product’s development. An example is a company designing a revolutionary health tracker that requires cutting-edge manufacturing techniques, which the company’s factories cannot produce at scale or within cost targets.

- Underestimating User Experience Design: Failing to prioritize user experience design can result in a product that’s technically sound but difficult or unpleasant to use. Consider a software company developing a powerful new project management tool that is too complex for the average user, leading to low adoption rates despite its advanced features.

- Neglecting Regulatory Compliance: Overlooking the regulatory requirements specific to the industry can cause significant setbacks or even halt a product launch. A pharmaceutical company developing a new drug might encounter delays if it fails to align its development process with stringent regulatory standards.

Countless new products go nowhere, and all have one root cause: inadequate Market Research.

Launching a product without understanding the target market’s needs and preferences can lead to misaligned product features. For instance, a food and beverage company might launch a new energy drink without realizing its target demographic prefers natural ingredients over synthetic supplements, resulting in poor sales.

While no strategy can eliminate product development uncertainties, thorough planning, grounded in comprehensive market research and cross-functional collaboration, can navigate these complexities more effectively.

Market Research: The Compass of New Product Development

So, amid this whirlwind of new product development activity, one tool ready to guide the brand’s efforts toward success is undoubtedly market research —the unsung hero poised to turn their vision into a market-ready reality.

Market research provides a foundation for decision-making that can mean the difference between a product’s success and failure. It offers insights into what consumers truly want, not just what a company thinks they need. This intelligence informs product design, positioning, and marketing strategies to introduce the product to the market.

It also identifies the size of the opportunity, helping to forecast demand and potential revenue, thereby shaping investment decisions and prioritizing features based on what will deliver the most value to the target audience.

Consider the development of the first smartwatches. Early entries into the market focused primarily on technology enthusiasts, offering features like message notifications, app integrations, and Bluetooth connectivity.

However, market research conducted by a leading technology company revealed a broader potential audience: the health-conscious consumer.

This insight led to a pivotal shift in product development strategies. The next generation of smartwatches incorporated advanced health monitoring features such as heart rate sensors, sleep trackers, and even electrocardiogram (EKG) capabilities.

The result?

A product that resonated deeply with consumers, transcending its original tech-savvy base to reach a broader audience that valued health and wellness. This expanded market appeal led to increased sales, higher market penetration, and the establishment of the smartwatch as a must-have accessory for the health-conscious individual.

When brands understand the consumer’s voice, they can tailor their innovations to meet real, sometimes unarticulated, needs.

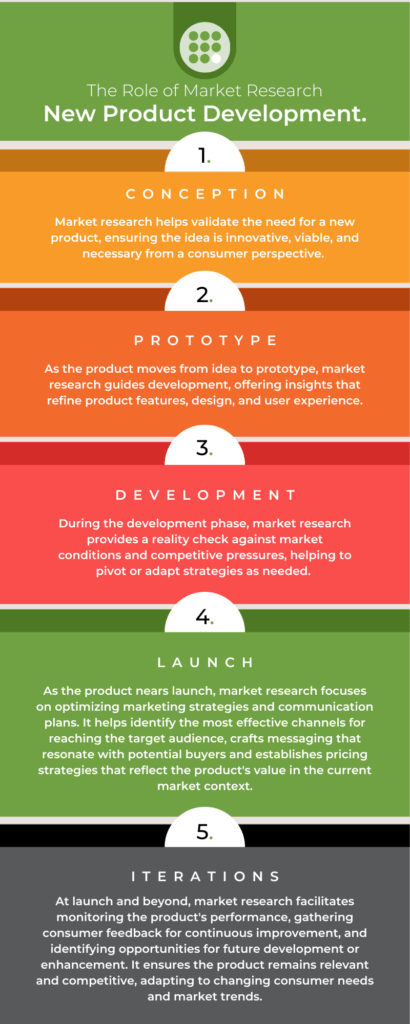

The Scope of Market Research throughout the product lifecycle

Market research permeates every facet of the product development process, from the initial conception of an idea to its launch and market entry.

Critical components of market research in this context include:

- Market Analysis: Understanding the market size, growth, and trends to identify opportunities and challenges.

- Customer Insights: Gathering data on customer demographics, preferences, needs, and buying behaviors to tailor the product accordingly.

- Competitive Intelligence: Analyzing the competitors’ strengths, weaknesses, market positions, and strategies to identify differentiators and market gaps.

- Concept Testing: Evaluating consumer responses to the product concept to validate its appeal and refine its features.

- Pricing Strategy: Assessing the market to set a competitive price that aligns with customer expectations and value perceptions.

- Distribution Channels: Identifying the most effective ways to reach the target market, considering both traditional and digital channels.

- Promotional Strategy: Developing marketing strategies based on insights into customer preferences and behaviors.

Types of Market Research Methodologies Used in New Product Development.

Quantitative and Qualitative Research are two primary market research methodologies in informing new product development. These approaches, distinct in their methods and insights, work in tandem to provide a comprehensive understanding of the market, consumer preferences, and potential product impact.

Quantitative Research is characterized by its ability to gather data that can be quantified and subjected to statistical analysis.

This type of research excels in answering “how many?” and “how much?” questions, providing hard numbers that can inform decisions on market size, consumer demographics, and measurable customer behaviors.

Surveys with closed-ended questions, structured interviews, and secondary data analysis are common methods used to collect quantitative data. The strength of quantitative research lies in its objectivity and the ability to generalize findings across larger populations, making it invaluable for assessing market potential and forecasting demand.

Qualitative Research, on the other hand, delves into the “why” and “how” behind consumer choices and behaviors. It seeks to understand motivations, attitudes, and feelings through in-depth interviews, focus groups, and observation. This type of research is interpretive, providing rich insights into consumer needs, experiences, and preferences that might not be evident through numbers alone.

Qualitative research shines in exploring new concepts, testing product ideas, and uncovering underlying consumer sentiments that can shape product development and positioning.

The role of market research in segmenting customers

Market research helps in identifying various bases for segmenting a market, such as demographics (age, gender, income level), psychographics (lifestyle, values, attitudes), geographic locations, and behavior (purchase habits, usage rates). Companies can uncover patterns and trends that inform how the market can be segmented by analyzing data collected through surveys, focus groups, and other research methods.

For example, a company launching a new fitness app might use market research to discover that its primary audience segments include busy professionals looking for quick workouts, fitness enthusiasts seeking advanced training programs, and beginners needing guidance and motivation. Each of these segments has distinct needs, preferences, and pain points, guiding the app’s feature set, user experience design, and marketing messages.

The role of market research in identifying potential customers

Market research helps not only segment the market but also identify the potential customers within those segments. It provides insights into the characteristics of consumers most likely to purchase the product, their decision-making processes, and the channels through which they can be reached most effectively.

For instance, knowing that busy professionals value efficiency and flexibility, the fitness app company might highlight features such as short, customizable workouts and on-the-go accessibility in its marketing efforts targeting this segment.

The role of market research in analyzing the competition

Market research aids in the identification of direct and indirect competitors, providing a clear picture of the market ecosystem. It involves collecting data on competitors’ product offerings, pricing strategies, distribution channels, marketing tactics, and customer service practices. This information can be gathered through various means, including public records, customer surveys, competitor websites, and social media analysis.

Beyond identifying competitors, market research delves into their performance and strategies. It evaluates their market share, growth trajectories, and the factors driving their success or failure. This analysis helps uncover gaps in the market that the new product can fill, identify areas where competitors are underperforming, and spot emerging trends that could affect competitive dynamics.

Equipped with a thorough understanding of the competitive landscape, companies can strategically position their product to capitalize on market opportunities. Market research informs the development of a unique value proposition (UVP) that differentiates the product from competitors. This differentiation could be based on features, quality, price, customer service, or any combination of factors that resonate with the target audience.

For example, if market research reveals that consumers are dissatisfied with the complexity and user-unfriendliness of existing products in a category, a company could position its new offering as a simpler, more intuitive solution. This positioning directly addresses a gap in the market, appealing to consumers seeking an alternative to the status quo.

How insights from Market Research can inform product differentiation and positioning strategies

Informing Product Differentiation:

Insights from market research pinpoint the areas most valued by consumers and those underserved by current market offerings. For example, suppose research indicates that customers in a particular market seek more environmentally friendly options in a product category dominated by less sustainable choices. In that case, a company can focus on developing a product that uses sustainable materials or practices, addressing a specific consumer need, and differentiating its product from competitors.

Guiding Positioning Strategies:

Market research insights help identify the most compelling way to position a product by understanding the target audience’s values, needs, and perceptions. This can involve emphasizing specific product attributes, benefits, or values that align with the target market’s desires or gaps in the category. For example, if market research reveals a gap in the market for a tech product that combines high performance with user-friendly design for non-tech-savvy users, a company can position its product as the ideal solution for this unmet need, leveraging simplicity and ease of use as key selling points.

Enhancing Competitive Strategy:

Insights from competitive analysis clearly show competitors’ positions and how consumers perceive them. This knowledge allows brands to identify areas of opportunity for differentiation and to develop strategies that leverage their strengths against competitors’ weaknesses. It can also inform decisions on whether to adopt a head-to-head positioning against direct competitors or to find a niche market where the company can dominate.

Tailoring Marketing Communications:

With insights into consumer preferences and competitive positioning, companies can craft targeted marketing messages highlighting their product’s unique benefits and features. This ensures that communications resonate with the intended audience and clearly articulate the product’s unique value proposition, setting it apart from competitors.

How does market research help identify potential risks and challenges in the market?

Market research plays a crucial role in risk mitigation by identifying potential risks and challenges that could impact a new product’s success in the market.

Identifying Market Risks:

Market research helps identify a broad range of risks, including shifts in consumer behavior, emerging competitive threats, regulatory changes, and technological advancements. By keeping a pulse on the market, brands can anticipate changes that might affect the demand for their product or its competitive position. For example, a detailed analysis of market trends might reveal consumers’ growing preference for sustainable products, indicating a risk for products that do not align with environmental values.

Understanding Consumer Sentiments:

Through surveys, social media listening, and other feedback mechanisms, market research gauges consumer sentiments and identifies potential backlash or negative perceptions of a product or brand. This early warning system allows companies to adjust their strategies, messaging, or product features to better align with consumer expectations and avoid potential reputational damage.

Evaluating Competitive Dynamics:

Competitive analysis, a key component of market research, sheds light on the strategies and performance of competitors, helping companies identify risks related to competitive actions. Understanding the competition enables brands to foresee potential market entries by competitors, changes in competitive pricing strategies, or the introduction of substitute products, allowing them to prepare defensive or counter-strategies.

Assessing Regulatory and Compliance Risks:

Market research also plays a vital role in identifying regulatory changes and compliance requirements that could threaten the product’s market entry or expansion. By staying informed about the regulatory environment, companies can ensure their products comply with relevant laws and standards, avoiding costly legal issues and delays.

Testing Market Assumptions:

Concept testing and other research methodologies challenge and validate the assumptions underpinning a product’s development. This critical evaluation can reveal flaws in the product concept, unrealistic market expectations, or misalignments with consumer needs, allowing companies to address these issues before they escalate into more significant risks.

Forecasting Demand and Financial Risks:

Market research helps accurately forecast demand for a new product, a crucial factor in financial planning and risk management. Overestimation of demand can lead to overproduction, excess inventory, and financial strain, while underestimation can result in missed opportunities and an inability to meet market demand. Companies can mitigate financial risks and optimize their supply chain and production strategies through precise demand forecasting.

The role of market research in scenario planning and contingency strategies

Market research is integral to scenario planning and the development of contingency strategies, equipping brands with the foresight and flexibility to navigate future uncertainties and changes in the market landscape. This strategic approach allows organizations to prepare for multiple potential futures, ensuring they can respond swiftly and effectively to various challenges and opportunities that may arise.

Scenario Planning

Scenario planning involves creating detailed narratives about the future based on different assumptions about how current trends, uncertainties, and driving forces could evolve.

Market research provides the empirical foundation for these narratives by offering insights into current market conditions, consumer trends, technological advancements, regulatory environments, and competitive landscapes. By analyzing this data, companies can identify critical variables that might impact their business and construct a range of plausible future scenarios.

For instance, market research might reveal an emerging trend toward eco-conscious consumer behaviors, prompting a company to develop scenarios ranging from mild increases in demand for sustainable products to significant shifts in consumer purchasing patterns favoring green products exclusively. These scenarios enable the company to plan for product innovations, marketing strategies, and supply chain adjustments that align with varying degrees of market demand for sustainability.

Contingency Strategies

Contingency strategies are plans developed to address specific risks or opportunities that might emerge in the future. Market research plays a crucial role in identifying these potential risks and opportunities, allowing companies to devise informed strategies that mitigate threats and capitalize on emerging trends. This process involves understanding the current market, forecasting changes, and assessing their potential impact on the company’s operations, products, and financial health.

Market research can, for example, help a company anticipate potential regulatory changes affecting its industry. Suppose research indicates a likely increase in regulatory scrutiny over product safety standards. In that case, the company can develop contingency plans that include ramping compliance efforts, investing in product innovation to meet new standards, and preparing communication strategies to reassure customers and stakeholders.

Integrating scenario and contingency strategies with overall business planning ensures that market research insights are effectively translated into actionable plans. This integration allows companies to be proactive rather than reactive, setting mechanisms to adapt to market changes quickly. It also supports strategic decision-making by highlighting potential risks and opportunities to consider in the company’s long-term strategy.

The Impact of Market Research on Crafting Effective Marketing Messages and Campaigns

Market research uncovers the emotional and rational drivers behind consumer purchasing decisions, allowing marketers to craft messages that appeal to these motivations.

How Insights into Consumer Behavior and Preferences Guide Marketing Channel Selection and Promotional Tactics

Insights from market research also play a crucial role in selecting the most effective marketing channels and promotional tactics. Understanding where the target audience spends their time, the types of media they consume, and how they prefer to receive information about new products enables companies to allocate their marketing resources more efficiently, choosing channels to reach their audience effectively.

For example, suppose market research indicates that the target demographic for a new fitness app heavily uses social media platforms and engages with influencer content. In that case, the company might prioritize social media marketing and influencer partnerships over traditional advertising channels like TV or print. This strategy ensures that marketing efforts are concentrated where they will have the most impact, increasing visibility and engagement with the target audience.

Additionally, insights into consumer behavior can inform the timing and nature of promotional tactics. For instance, if research shows that potential customers are most receptive to new products at the beginning of the year, a company might time a significant promotional campaign to coincide with New Year’s resolutions, using special offers or trials to encourage adoption.

Feedback Loops and the Role of Market Research in Product Improvement

After a product is launched, the journey of market research does not end but instead enters a new, critical phase. Ongoing market research post-launch is vital for the continuous improvement of the product, ensuring it remains relevant and competitive. This constant research process helps companies capture real-time feedback on how consumers receive the product, identify areas for enhancement, and detect emerging trends that could influence future product iterations.

Integrating customer feedback into product updates and future development cycles is a systematic process that involves several steps. Initially, companies collect feedback through various channels, including direct customer inquiries, online reviews, social media, feedback forms within the product, and user testing sessions. This feedback is then analyzed to identify common themes, patterns, and specific areas for improvement or innovation.

The insights gained from this analysis inform the prioritization of product updates. Critical issues affecting user experience or satisfaction are addressed promptly, while suggestions for new features or enhancements are evaluated for alignment with the product’s strategic direction and market demand. This prioritization ensures that resources are allocated efficiently, focusing on changes impacting customer satisfaction and business objectives.

Integrating customer feedback into the development process often involves cross-functional collaboration between product management, engineering, design, and marketing teams. Regular meetings and feedback loops ensure that customer insights are shared across the organization and that decisions regarding product updates are made with a comprehensive understanding of customer needs.

Once updates are implemented, the cycle continues, with companies seeking feedback on the changes to ensure they have positively impacted the user experience. This iterative process allows constant refinement and adaptation, making the product more robust and competitive.

Example: Software Application Updates

Consider a software company that has launched a project management tool. After launch, ongoing market research and user feedback indicate that while the tool is well-received, users are experiencing difficulties with the mobile app version, particularly its notification system. The company uses this feedback to prioritize an update that improves mobile app notifications, making them more customizable and less intrusive.

The company also identified a request for a new feature that allows integration with third-party calendar apps, a suggestion that came up frequently in user feedback. After evaluating this against the product roadmap and market demand, the company develops this integration, further enhancing the tool’s utility and user satisfaction.

By continually engaging in market research and integrating customer feedback into product updates, the company not only improves its current offering but also lays a solid foundation for future development cycles, ensuring the product remains relevant and continues to meet the evolving needs of its users.

Picking up from where we left off with our tech company’s new product development journey, the initial excitement around their groundbreaking product idea has now been channeled into a series of strategic, informed steps toward realization. The enthusiasm within the company has evolved into a dedicated focus driven by the rich insights gained from their market research. As the product moved from concept to launch, every decision—design tweaks or marketing messages—was backed by data and consumer feedback, ensuring that the final offering met and exceeded customer expectations.

The product launch was just the beginning. Embracing the ethos of continuous improvement, the company remained committed to gathering and acting on customer feedback post-launch. This cycle of feedback and improvement fostered a strong connection with users, who saw their needs and preferences reflected in the product’s evolution.

The tech company’s new product development story shows the power of market research. It demonstrates that success in product development is not just about having a groundbreaking idea but about bringing it to market in a way that resonates with consumers.

Market research is the thread that connects every stage of bringing a new product to market. It ensures that every decision, from conception to launch, is informed, strategic, and aligned with meeting consumer needs and achieving market success.

Step into the world of Karlo Angelo Lazaro, the dynamic Project Manager at Kadence International’s Philippines office. With a career marked by evolution and resilience, Karlo brings a unique blend of experience and passion to market research.

From navigating data analysis to leading groundbreaking projects, his journey shows the transformative power of dedication and curiosity in the ever-evolving field of market research.

Join us as we delve into his insights, challenges, aspirations, and what’s shaping the future of market research in the Philippines.

Can you share what inspired you to pursue a market research career and what has motivated you in this field?

I was a Reconciliation Specialist for J.P. Morgan Chase; the work was repetitive and not stimulating enough to sustain my interest.

Some of my University friends already worked in different Market Research agencies, such as Millward Brown and TNS, so I asked for referrals. I’ve enjoyed learning about their work, how interesting the industry is, and how different it is from banking.

I secured a position in TNS as a Research Associate, which started my Market Research journey. The sheer variety of clients and research methodologies kept me going.

Before Kadence International, you worked in various roles, including Research Executive and Reconciliation Specialist. How did these experiences shape your approach as a Project Manager in market research?

One thing I appreciate about having worked as a Reconciliation Specialist is that it developed my keen eye for detail. There’s no place for mistakes when balancing salary accounts, so there was a real impetus for me to hone my skills. This has served me well as a Project Manager — I can always spot if something is amiss in whatever I’m checking, be it a client deliverable or a simple email.

Rising through the Market Research ranks has made me more empathetic to my Analysts and Researchers. Since I have been in their position before, it has helped me manage them better because I know how long tasks take and the possible bottlenecks they may encounter.

The roles I’ve had before ultimately led me to be a better Market Researcher. I always give my team grace and try to be as understanding as possible, so long as there are no deliberate or egregious mistakes.

What unique challenges and rewards have you encountered while working at Kadence International?

I joined Kadence back in March 2021. Lockdowns were still common, and all research had moved online or via CATI. So, that was quite a unique moment in Market Research, but across all industries.

Upon joining Kadence, I was assigned the World Poll PH 2021 project. It was the first large-scale CATI tracking study I’ve ever handled. It was four waves of N=1000 each, with two waves running concurrently.

We had problems with the output quality of the contracted CATI supplier, so we had to do the calls in-house, meaning we recruited our callers to finish the study. That was quite the challenge for my first CATI project, but I made it work and was rewarded with the client’s continued trust in us for this tracking project.

Could you discuss a particularly memorable or challenging project you managed at Kadence International?

Aside from the World Poll, another critical project I will never forget is my first political survey. The project was called Pundit, and it had several iterations throughout 2021. Initially, it was a one-off set of FGDs, but it developed into multiple qualitative and quantitative projects leading up to a few months before the 2022 Philippine National Elections.

We started this when no official candidacy had been announced yet, so we saw how people reacted and how their sentiments changed throughout the different iterations of Pundit.

One thing to note was that Pundit results were not released publicly, so I’m very proud of this project because our results closely resembled those of publicly released political surveys at the time. This shows that we are capturing the true sentiment of the public.

Another remarkable thing about the project was the fact that this is where Kadence Philippines saw a return to F2F TAPI interviewing, which brought about a different set of challenges like interviewers falling ill due to COVID and local government units refusing to have us conduct surveys in their area due to COVID fears.

We also had to respond quickly to sudden government announcements that could impact our people on the ground, such as possible lockdowns in areas where COVID numbers were up. Pundit was a whirlwind of different issues, but I wouldn’t have traded it for anything else because it was such a fun project to run.

You possess skills in data visualization, critical thinking, and communication. How do these skills play a role in your daily responsibilities?

These skills are helpful when I am training my team members. When we craft proposals or have reports to send out, I get to share my knowledge and experiences with the junior team members. What is the best way to present the findings, what charts should be used, and so on? We’ve also had coaching sessions on proper client communications and how we can influence clients to see things our way. It fills me with joy when my team members can confidently talk with clients and accomplish tasks with little to no supervision on my end.

How has the market research industry evolved, particularly in the Philippines, during your tenure?

When I started, we were still in the thick of the PAPI era, with interviewers lugging multiple printed questionnaires for face-to-face surveys. I remember accompanying an interviewer for a tobacco study where we had a printed showcard of choices. The project was Discrete Choice Modelling (DCM) for a cigarette brand, so we had several choice tasks printed on A3 paper! However, today, one can run a DCM or Conjoint project using tablets or even online.

The Philippines is now in its TAPI and Online Survey era. Gone are the days when researchers and field personnel sifted through sheets of paper to collate a questionnaire.

Then, there is the rise of boutique agencies in the Philippines. As significant research entities buy out and combine into one or the other, boutique agencies introduce new thinking and approaches because they can afford to explore more and create their niche in the industry, as compared to major players.

How have technological advancements influenced your work in market research?

Technology has made work faster and slightly more accessible. From the introduction of tablets and interviewing to automatic encoding and faster data processing, technological advances in market research have greatly helped analyze the results of the studies comprehensively.

It has given us more time for brainstorming sessions and in-depth analysis to make our reports holistic and not rushed. Clients appreciate when we, as researchers, are conscientious; technology has allowed us to do that.

What advice would you give someone just starting their career in market research?

For those starting their Market Research journey, here is some advice for navigating the field.

- Start building on your skills.

- Develop your eye for details. Attention to detail and precision are crucial skills to be a market researcher.

- Learn how to analyze data and develop strong analytical skills. Know which charts are best to use for your data type.

- Improve your written and oral communication. You must develop your communication skills to express study findings confidently and accurately.

- Keep an open and curious mind.

- Always ask questions and be proactive in learning about the industry.

- Cultivate a curious mind and be someone who’s always searching for new ideas.

- Develop expertise, but don’t put yourself in a box.

- Fully grasp the intricacies of a methodology, be it qualitative or quantitative, but don’t be defined by it. Don’t be afraid to branch out of your expertise so you can become a holistic researcher.

- Volunteer for challenging tasks; it will help you when it’s time to venture out to do greater things.

Success comes from a combination of different factors, so one should be adaptable and constantly seeking opportunities for improvement.

What are your professional aspirations or goals in the market research field?

I still haven’t experienced a lot in Market Research, but in the next 5-8 years, I’d like to head the Insights department. I don’t know what industry yet, but that’s the direction I want to head toward.

I would also like to work outside the confines of the Philippines.

How would you describe the culture at Kadence International, and how does it align with your personal values?

Kadence has an open culture, and the people are friendly and helpful. Plus, we’re still on a hybrid work schedule, which adds brownie points to Kadence.

I’m very laid back, so the company culture suits me well. I’m able to express my thoughts without fear of retaliation or not being taken seriously. My style of work fits well with the Kadence ethos.

In what ways do you believe Kadence International’s approach to market research makes a difference for clients and the broader community?

Our approach fosters a sense of kinship with our clients, who trust us. We’ve had successful relationships with clients because we care about their needs. We meet them halfway when it comes to costs and suggest the proper methodologies to answer their business issues.

We don’t shy away from telling them what will work and what won’t; we’re upfront and honest with them about our strengths and limitations. Clients always appreciate honesty.

How do you maintain a healthy work-life balance, especially in a demanding field like market research?

I am not shy about taking a break now and then. Having a long weekend where I laze around and catch up on my reading is essential to maintain my sanity.

I am okay with working long hours, especially if we’re doing fieldwork, but there should always be time for play. I carve out time after stressful projects so I’m refreshed and ready to face different challenges.

Outside of work, what are some hobbies or activities you enjoy?

I like to walk to clear my mind, and it’s my sole form of physical activity. I’m an avid reader and also enjoy web novels. I’m trying to rekindle my book-reading habit, which will be another escape source.

I also watch a lot of reality TV and other shows that are light and where I don’t have to spend much thinking power to follow the story. Lastly, I listen to pop and OPM music to soothe my mind.

Anything else you’d like to add?

I’ll leave you with a quote that stayed with me when I considered applying to graduate school.

“Your career is like a garden. It can hold an assortment of life’s energy that yields a bounty for you. You do not need to grow just one thing in your garden. You do not need to do just one thing in your career.”

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director