Establishing a global brand is complex. Companies looking to expand internationally must contend with significant challenges, including varying consumer behaviours, cultural differences, and economic disparities. These factors make maintaining a consistent brand identity complicated while adapting to local demands. However, the rewards for getting it right are substantial. Brands that successfully navigate these complexities can tap into new markets, increase their global presence, and achieve sustained growth.

Understanding Local Market Dynamics

Successfully expanding into a new market requires more than just introducing an existing product or service to a different audience. This requires a deep understanding of the local environment, where cultural nuances, consumer behaviour, and economic factors are crucial for a brand’s success. Brands that fail to consider these elements often struggle to gain traction because what works in one region may not translate effectively to another.

Take McDonald’s as an example. The fast-food giant’s success in markets like India highlights the importance of adapting to local tastes and preferences. Recognising that much of the population avoids beef, McDonald’s reimagined its menu, introducing vegetarian options like the McAloo Tikki, a potato-based burger that quickly became a local favourite. This adaptation wasn’t a simple change; it resulted from extensive market research that provided insights into local dietary habits, preferences, and cultural sensitivities. By leveraging this in-depth understanding of the Indian market, McDonald’s maintained its brand identity while catering to local tastes, leading to its widespread acceptance and success in the region.

Image credit: McDonald’s blog

Adapting Global Strategy to Regional Needs

Maintaining a global identity while adapting to regional markets is a delicate balancing act. Brands must ensure their core values and messaging remain consistent across all markets. Yet, they must also be flexible enough to meet the specific needs and preferences of local consumers. This balance is crucial for sustaining a coherent brand image while being relevant in diverse regions.

Coca-Cola exemplifies how a global brand can achieve this balance. The company has consistently maintained its brand identity through its iconic logo, packaging, and overarching messaging centred around happiness and togetherness.

However, Coca-Cola also customises its marketing strategies to resonate with local audiences. In Japan, for instance, Coca-Cola introduced a range of products that cater specifically to Japanese tastes, such as green tea-flavoured beverages and smaller, more convenient packaging sizes. The brand also tailored its advertising campaigns to align with local cultural values and traditions, reinforcing its relevance.

This approach allows Coca-Cola to retain its global identity while remaining adaptable to regional preferences. The result is a brand that feels familiar and relevant to consumers worldwide, demonstrating the effectiveness of a flexible global strategy that accommodates local needs.

Image credit: Coca-Cola Japan

Leveraging Technology for Global Reach

Technology is a critical asset for brands aiming to expand their presence globally. Digital platforms, data analytics, and artificial intelligence (AI) offer the tools necessary to understand and engage with consumers across different regions. These technologies allow brands to collect real-time insights, personalise their offerings, and deploy targeted marketing strategies that resonate with diverse audiences.

Netflix exemplifies how technology can drive global success. The streaming service uses data analytics and AI to deeply understand viewer preferences in various markets. By analyzing viewing patterns, Netflix can tailor content recommendations to individual users, making the experience more relevant and engaging for audiences around the world.

Additionally, Netflix’s investment in local content further enhances its appeal in specific regions, demonstrating how technology can be leveraged to achieve global reach and local relevance.

Image Credit: Netflix

Building Brand Trust Across Borders

Building trust is fundamental to a brand’s success, particularly when expanding into new markets. Trust is not just about delivering a quality product; it’s about transparency, adhering to ethical practices, and forging strong local partnerships. Consumers across the globe are increasingly discerning, and they expect brands to act responsibly and authentically, especially when they enter their local markets.

Unilever is a strong example of a brand that has effectively built trust across borders. The company’s commitment to ethical practices and corporate responsibility is evident in its Sustainable Living Plan, which aims to improve health and well-being, reduce environmental impact, and enhance livelihoods worldwide. Unilever has successfully integrated these principles into its operations across different regions, tailoring its initiatives to address local challenges.

For instance, in India, Unilever has partnered with local organisations to promote hygiene and sanitation through its Lifebuoy soap brand. By educating communities about the importance of handwashing, the company not only enhances public health but also strengthens its reputation as a responsible and caring brand. This approach has earned Unilever significant trust and loyalty from consumers in diverse markets, proving that ethical branding and corporate responsibility are crucial to establishing long-term relationships with global audiences.

Image credit: Unilever

Navigating Regulatory and Competitive Landscapes

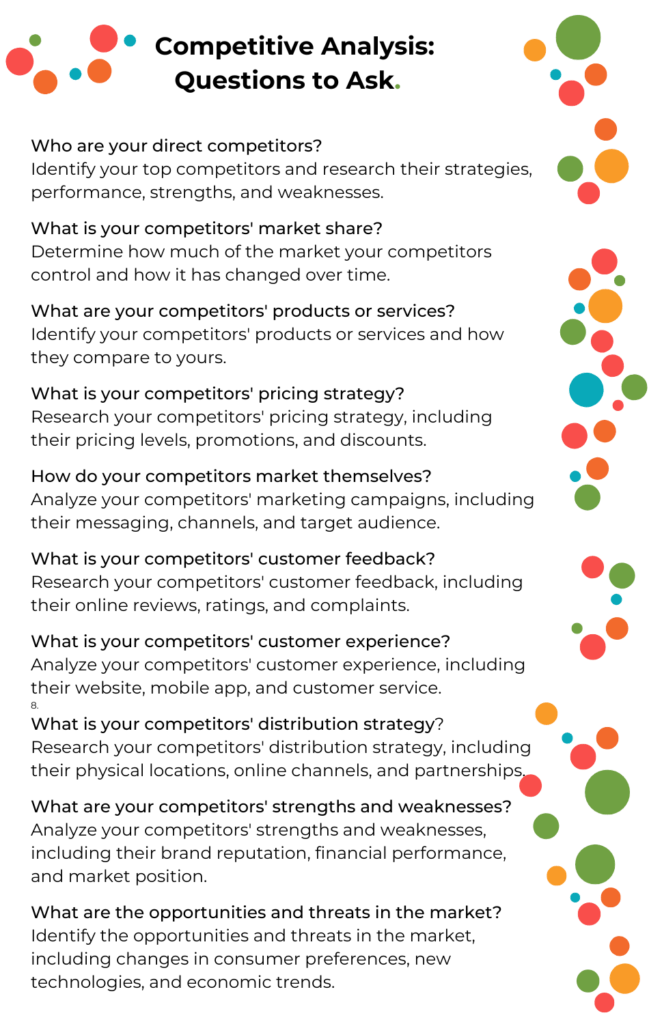

Expanding into new markets often means navigating a complex web of regulations and facing stiff competition from established local players. Regulatory requirements can vary significantly from one country to another, covering areas such as product standards, advertising restrictions, and data privacy laws. For global brands, the ability to adapt to these regulations while maintaining a competitive edge is crucial for success.

Apple’s entry into the Chinese market illustrates how a brand can overcome regulatory challenges to establish a strong presence in a highly competitive environment. China’s strict regulations on data storage, internet censorship, and local partnerships posed significant hurdles for Apple. To comply with Chinese laws, Apple made strategic decisions, such as partnering with local companies like China Mobile and setting up a data centre in China to store user data locally. These moves ensured that Apple met regulatory requirements without compromising its product offerings.

Moreover, Apple’s approach to navigating the competitive landscape in China involved understanding and responding to local consumer preferences. Apple differentiated itself from local competitors by offering localised content and services and developing features tailored to Chinese users. Despite the challenges, Apple’s ability to adapt to the regulatory environment and stay attuned to local market dynamics has allowed it to maintain a strong foothold in one of the world’s most challenging markets.

Image credit: Apple Store China

Common Pitfalls and How to Avoid Them

Expanding into international markets presents numerous opportunities but comes with its share of risks. Many brands make critical mistakes that can hinder their success or even derail their expansion strategy. Understanding these pitfalls and how to avoid them is essential for any brand looking to establish a global presence. Below is a list of common mistakes brands often make during worldwide expansion and practical solutions to navigate these challenges effectively.

Underestimating Cultural Differences

- Conduct thorough cultural research to understand local customs, values, and consumer behaviours.

- Tailor your product offerings, marketing messages, and customer interactions to align with these cultural nuances.

Ignoring Local Competition

- Analyze and understand the competitive landscape in each market.

- Identify major local competitors and their strengths and weaknesses, and adjust your strategy to offer something unique that resonates with local consumers.

Failing to Comply with Local Regulations

- Engage local legal experts to ensure full compliance with local regulations, including product standards, advertising restrictions, and data protection laws.

- Review regulatory changes regularly and adapt quickly to stay compliant.

Inconsistent Brand Messaging

- Develop a flexible yet consistent global strategy that maintains your brand’s core identity while allowing for regional adaptations.

- Ensure all marketing materials and communications align with global standards and local expectations.

Overlooking Supply Chain Challenges

- Plan for logistical challenges specific to each region, including shipping, distribution, and inventory management.

- Establish reliable local partnerships and consider setting up regional hubs to streamline operations.

Inadequate Customer Support

- Provide customer support tailored to the local market, including language preferences and cultural expectations.

- Invest in training local customer service teams to ensure they can address issues effectively and empathetically.

Underestimating the Importance of Local Partnerships

- Cultivate strong relationships with local businesses, distributors, and influencers who can help you navigate the market and build credibility.

- Local partnerships can provide valuable insights and resources that enhance your brand’s market entry and growth.

Rushing the Market Entry

- Take the time to conduct thorough market research and develop a solid entry strategy.

- Avoid rushing into a market without fully understanding the local dynamics, leading to costly mistakes and setbacks.

Neglecting Long-Term Strategy

- Don’t focus solely on short-term gains. Develop a long-term strategy that includes continuous market research, adaptation to evolving consumer needs, and investment in local relationships.

- Regularly revisit and refine your strategy to ensure sustained success.

Case Study Deep Dive: Tesla’s Global Expansion Success Story

Image credit: Tesla

Tesla, Inc. is a prime example of a brand that has successfully navigated the complex landscape of global expansion. From its early days as a niche electric vehicle (EV) manufacturer in the United States to becoming a dominant global force in the automotive industry, Tesla’s journey offers valuable insights into the strategic decisions, challenges, and results that have shaped its international success.

Initial Strategy: Establishing a Strong Foundation

Tesla’s entry into the global market was built on a foundation of innovation and strategic foresight. The company’s initial focus on producing high-performance electric sports cars, such as the Tesla Roadster, helped establish its reputation as a pioneer in EV technology. This positioning attracted early adopters and generated significant media attention, laying the groundwork for Tesla’s future growth.

One of Tesla’s earliest and most critical decisions was its Initial Public Offering (IPO) in 2010. The capital raised through the IPO provided the financial resources necessary to fund the development of additional vehicle models, expand manufacturing capabilities, and begin entering international markets. This move was instrumental in positioning Tesla for global expansion.

Market Entry: Targeting Europe and China

Tesla’s first significant international push came in 2013 with its entry into the European market. The company began selling the Model S in Europe, strategically opening service centres and stores in key cities across the continent. Europe’s strong interest in sustainability and green technology provided a receptive market for Tesla’s vehicles. Tesla invested heavily in building its Supercharger network to further support its European customers, ensuring EV owners had access to reliable charging infrastructure across the region.

China represented another significant milestone in Tesla’s global expansion. Recognising the growing demand for electric vehicles in China, Tesla entered the market in 2015 with the Model S. China’s strict regulations on foreign ownership and data storage posed challenges. However, Tesla navigated these hurdles by forming partnerships with local companies and committing to building a Gigafactory in Shanghai. This strategic move allowed Tesla to localise production, reduce costs, and better serve the Chinese market, quickly becoming one of Tesla’s largest sources of revenue.

Image credit: Business Insider

Overcoming Challenges: Navigating Regulatory Hurdles

Tesla’s global expansion has not been without its challenges. The company has had to navigate various regulatory environments, each with its own set of rules and requirements.

In China, Tesla faced significant hurdles in data localisation and foreign ownership. To comply with local laws, Tesla established a data center in China and became the first foreign automaker to wholly own its factory, thanks to changes in Chinese regulations.

In Europe, Tesla encountered challenges related to manufacturing and logistics. The decision to build Gigafactory Berlin was a direct response to these challenges. By establishing a manufacturing presence in Europe, Tesla could reduce production bottlenecks and streamline the delivery of vehicles to European customers, thereby enhancing its competitiveness in the region.

Results: A Global Automotive Leader

Today, Tesla is a global leader in the automotive industry, with a presence in major markets across North America, Europe, and Asia. The company’s commitment to innovation, sustainability, and strategic market entry has paid off, with Tesla consistently ranking as one of the world’s most valuable automakers.

Tesla’s success in international markets is evident in its sales figures and market share. The company’s ability to localise production through Gigafactories in China and Europe has significantly increased its manufacturing capacity and reduced costs, making its vehicles more accessible to a global audience. Additionally,

Tesla’s continued investment in its Supercharger network and local partnerships has strengthened its brand’s reputation for reliability and customer satisfaction.

Key Takeaways from Tesla’s Global Expansion:

- Strategic Market Entry: Tesla’s careful selection of markets and timing of entry were crucial to its success. The company prioritised regions with strong demand for EVs and supportive regulatory environments.

- Localisation of Production: Tesla could localise production, reduce costs, and meet the specific needs of local markets by building gigafactories in China and Europe.

- Regulatory Compliance: Tesla’s proactive approach to navigating regulatory challenges, such as data localisation in China, ensured its continued growth and success in key markets.

- Innovation and Adaptation: Tesla’s commitment to innovation, from its vehicle technology to its charging infrastructure, has allowed it to stay ahead of competitors and continuously adapt to changing market conditions.

Checklist for International Expansion

Expanding into global markets requires careful planning and execution. Below is a practical checklist to guide brands through the complexities of international expansion:

Conduct Comprehensive Market Research:

- Analyze local consumer behaviours, cultural nuances, and economic conditions.

- Identify the demand for your product or service and understand the competitive landscape.

- Determine the local market’s potential for growth and profitability.

Assess and Adapt to Regulatory Environments:

- Understand and comply with local regulations, including product standards, advertising laws, and data protection policies.

- Engage with local legal and regulatory experts to ensure compliance and mitigate risks.

Develop a Flexible Global Strategy:

- Create a strategy that maintains global brand consistency while allowing for regional adaptations.

- Tailor marketing campaigns, product offerings, and messaging to resonate with local audiences.

Leverage Technology for Localisation:

- Utilise data analytics and AI to gather real-time insights on local consumer preferences.

- Implement digital tools to personalise the customer experience in different markets.

- Ensure your digital platforms are optimised for local languages and cultural contexts.

Build Strong Local Partnerships:

- Collaborate with local businesses, distributors, and influencers to enhance market entry and brand credibility.

- Consider joint ventures or partnerships to navigate local markets more effectively.

Prioritise Ethical Practices and Corporate Responsibility:

- Uphold transparency and ethical practices in all markets to build trust with consumers.

- Engage in corporate social responsibility initiatives that resonate with local communities and reflect your brand values.

Prepare for Operational Challenges:

- Plan for logistics, supply chain management, and distribution networks tailored to local market needs.

- Ensure your customer service and support are equipped to handle regional languages and issues.

Continuously Monitor and Adapt:

- Regularly assess your performance in each market and adjust strategies as needed.

- Stay attuned to global market trends and local developments that may impact your business.

Global Expansion ROI Calculator

The Global Expansion ROI Calculator provides a framework for estimating the financial outcomes of entering new markets, allowing brands to assess the viability of their global strategies. This tool considers factors such as market entry costs, expected revenue, and operational expenses, offering a practical guide to evaluating the potential profitability of international expansion.

Key Components of the ROI Calculation:

- Market Entry Costs:

- Initial Investment: Include costs associated with market research, legal fees, and setting up operations (e.g., offices, supply chains).

- Marketing and Localisation: Factor in the cost of marketing campaigns, localisation of products, and adaptation of branding to fit local tastes and regulations.

- Expected Revenue:

- Sales Projections: Estimate potential revenue based on market size, target audience, and expected market share.

- Pricing Strategy: Consider how local economic conditions and consumer behaviour influence pricing and sales volume.

- Operational Expenses:

- Ongoing Costs: Include expenses related to staffing, logistics, regulatory compliance, and customer service tailored to the local market.

- Technology and Infrastructure: Account for investments in digital platforms, supply chain management, and local partnerships.

Simplified ROI Formula:

- Expected Revenue: Projected income from sales in the new market.

- Operational Expenses: Ongoing costs of running the business in the new market.

- Market Entry Costs: Initial investment required to enter the market.

Conceptual Guide:

- Conduct Thorough Market Research:

- Understand the size of the market, customer demand, and competition.

- Use data to project realistic sales figures and potential market share.

- Estimate Costs Accurately:

- Include all potential costs, both one-time and ongoing, in the calculation.

- Consider possible variations in costs due to local economic conditions or regulatory changes.

- Adjust for Local Variables:

- Tailor your pricing strategy to local consumer expectations and purchasing power.

- Anticipate fluctuations in revenue based on seasonality, economic trends, or political stability.

- Calculate and Compare:

- Use the ROI formula to estimate the potential return from each market.

- Compare these estimates across regions to prioritise markets with the highest potential return.

- Review and Reassess:

- Regularly revisit your calculations as market conditions evolve.

- Adjust strategies based on real-world performance and emerging opportunities or challenges.

Final Thoughts

Expanding internationally is not a one-size-fits-all endeavour; it requires a deep understanding of local markets, the flexibility to adapt strategies, and the strategic use of technology to connect with diverse audiences.

Brands that succeed on the international stage prioritise local insights, ensuring their offerings resonate with cultural nuances and consumer preferences. They balance global consistency with regional relevance, leveraging technology to gather real-time data and personalise their approach. Trust and reputation, built through transparency and ethical practices, are equally crucial as they foster long-lasting consumer relationships across borders.

The critical lesson for brands looking to expand globally is clear: adaptability is key. As markets continue to evolve, brands must remain agile, continuously refining their strategies to meet consumers’ shifting demands and expectations worldwide. Success in global markets isn’t just about entering new regions; it’s about sustaining that presence by staying attuned to each market’s unique challenges and opportunities. Those who can do so will thrive today and be well-positioned for long-term success in an increasingly interconnected world.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing General Manager PR -Internal Communications & Government Affairs

General Manager PR -Internal Communications & Government Affairs Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director