The arrival of Covid-19 has brought with it dramatic changes in food and drink purchase patterns. Shelf-stable food like pasta, rice and canned goods flew off the shelves. Immune system boosting ingredients were top of the shopping list. But which behaviours will stick and what are the longer term food industry trends to watch?

We spoke to consumers in 10 countries, as well as our own internal food and beverage experts to understand the global picture and the local nuances and trends in each market. We wanted to understand how people are eating and drinking in this new normal, and what implications this has for the future.

We’ve summarised the key global and local trends in this blog post but for the full findings, download the report: Understanding the Impact of Covid-19: Food Industry Trends for 2020 and Beyond.

Global food industry trends for 2020 and beyond

The pandemic has improved eating and drinking habits across the world

Over half (53%) of the consumers we spoke to told us that since the onset of the pandemic, what they eat and drink has changed for the better. Some countries like India and Vietnam have seen a big swing towards healthier diets, whereas others like the US, UK and Japan have been more consistent. Overall, very few people (just 6%) believe their diet has changed for the worse.

People are cooking more at home and they’re eating more fresh fruit and vegetables

With more time at home, and health high on the agenda, it’s unsurprising that half of consumers globally (51%) are now cooking more for themselves and their families. This trend is more prevalent in some Asian markets, such as India, China, Thailand and Vietnam, than it is in the US, UK or Japan. But even in this market, consumers have found an innovative workaround to sourcing home-cooked meals. Over the past few months, professional chef / dietician delivery services like Sharedine have boomed in Japan. This is where a personal chef will come to a customer’s house and cook a number of dishes from scratch that can be reheated over the coming days. The service even includes grocery delivery!

At a global level, people are also more conscious of what they eat, with a real focus on fresh produce. Half of consumers globally (51%) tell us they are eating more fresh fruit and vegetables. This is more significant than any other dietary changes, such as eating more grains and nuts (adopted by 29%) or eating more meat-free products or dairy and cheese (practiced by just 16% and 13% respectively).

Health-conscious consumers are looking to boost their immune systems and brands are responding

Even now long after the onset of the pandemic, immune-boosting solutions are still at the top of consumers’ shopping lists. Consumers in markets like India are looking to natural ingredients. But others, like those in Thailand and China are making use of a new range of RTD products that have sprung up to meet this need. The “water plus” category has boomed in Thailand, with brands such as Yanhee Vitamin Water, B’lue, VITADAY Vitamin Water and PH Plus 8.5 Alkaline Water coming to the fore. In China, product launches have included milk with immune globulin, Vitamin C fruit tea and Chinese jujube drinks.

Free report

Which behaviours will stick and which will subside in a world without restrictions?

Download the full report to see where behaviours across a range of categories placed and to learn more about how key behaviours will develop in future.

Download now

Worries about the origin of food are one of the key food industry trends for 2020 and beyond

When asked which of the behaviours they’d adopted in the pandemic that they’d continue in future, being conscious of where the produce I consume originates from for safety / health reasons came out top. We see this reflected in consumer behaviour. Some people in countries like Vietnam and Indonesia have moved away from visiting wet markets, opting instead for mini supermarkets or online solutions. In some markets, there are also significant groups of consumers that are opting to eat more meat-free products, perceived to be less prone to infection. This amounts to 32% of consumers in Vietnam, 28% in India and 23% in China. With these concerns top of mind for many consumers, it’s the brands that prioritise hygiene and safety that will come out on top. We’re already seeing some great examples of this happening, with the help of technology. One example is Haidilao. This hotpot restaurant in Beijing has installed smart robotic arms to prepare and deliver raw meat and fresh vegetables. It’s also introduced technology to track and dispose of food that has passed its expiry date.

Supporting local is a key consideration for many consumers

Across the world people are doing their bit to keep local food and beverage brands afloat. This looks set to continue in future. When asked which of the behaviours they’d adopted in the pandemic that they’d continue, supporting local produce and food and beverage brands came out second highest.

In Japan, this trend has manifested itself in the 応援消費 (Consume To Support) movement. This initiative that went viral, ranking first amongst the top 10 consumer trends in the first half of 2020 according to Rakuten, an online retail giant and Nikkei, a flagship financial newspaper. The term was first created and gained popularity in 2011 when a 3.11 earthquake shook the eastern part of Japan and people showed their support through making purchases from the damaged areas. In the pandemic, we saw a resurgence of this. Consumers purchased from the food and beverage brands hardest hit – farms, manufacturers and restaurants with excess stock – thanks to innovative apps like Pocket Marche and TABETE.

We’ve seen similar movements in other markets. In Indonesia #belidariteman (buy from a friend) was promoted by the Association of Indonesian Young Entrepreneurs (HIPMI) encouraging people to support local. In the Philippines, the traditional value of “Bayanihan” which translates as “spirit of communal unity” has seen Filipinos shopping from local food and beverage brands in these difficult times.

With local being an important purchase consideration for consumers both now and in the future, brands will do well to emphasize their heritage and role in the community going forwards.

Consumers are looking to food and drink as escapism to create occasions at home

As people spend more time at home, there’s a real opportunity for brands to help consumers create special occasions with their loved ones through the power of food and drink. This could be through providing inspiration for at-home events and special recipes for consumers to cook themselves. It could also be achieved by creating products, services and experiences that can be delivered at home. There are some great examples of this emerging around the world. In Singapore, bar and restaurant, Tippling Club, is offering virtual cook-along sessions with its in-house chef. In Hong Kong, Café Earl Grey is delivering restaurant signatures with simple instructions to cook and assemble at home. These dishes are accompanied by an extensive selection of curated wines and bottled cocktails. And in the Philippines, restaurants are delivering uncooked ingredients so that people can cook their favourite dishes at home.

Stay ahead

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

![]()

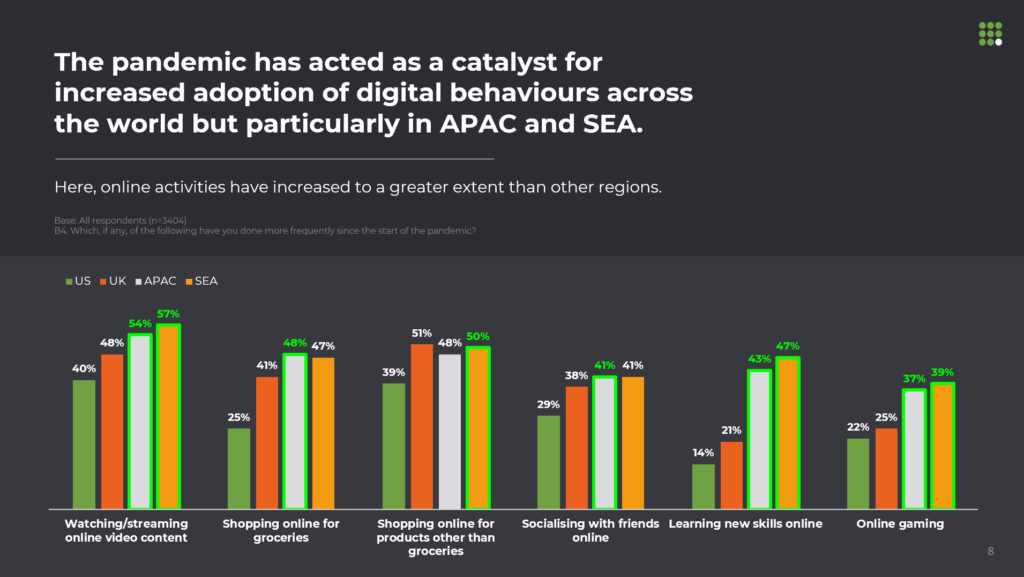

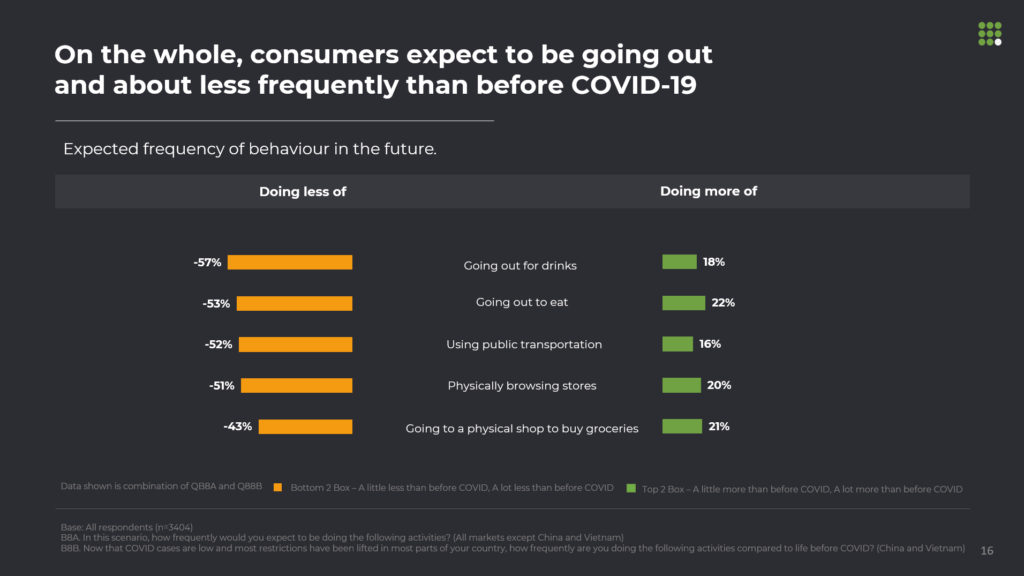

Online shopping is on the rise but this is playing out differently in different markets

Food and beverage brands have had to innovate to survive in the wake of local restrictions. Online has played a critical role in this transformation. Consumers across markets have experienced the benefits of online shopping first hand, accelerating its growth. But this has played out differently in different markets. In Vietnam, ghost kitchens have been set up to meet the growing demand for meal delivery. In Indonesia, a jastip service allows consumers to make and receive orders from local wet markets via WhatsApp. And in the UK, where online grocery is more well established, growing numbers of older customers are moving their grocery shopping online. In 2019, just 8% of over 55s in the UK had bought food and essentials online. This figure has now soared to 25% according to the How Britain Shops Online report.

Country specific food industry trends

Food industry trends in the UK

One of the key global trends we see in the UK is the shift towards supporting local. Office workers in the UK have been encouraged to work from home for the majority of 2020, meaning that food and drink spend has been concentrated closer to home – and we expect to see this continue as working patterns shift as a result of the pandemic. According to Mastercard data, it’s been people shopping and eating out locally, rather than spending money in Central London, that has driven the economic recovery in London. Other key trends in this market include the growing number of silver surfers that are embracing to online grocery shopping as mentioned above and rise of at-home food and drink occasions. As in other markets, brands are anticipating consumers will spend more time at home, and catering to this with services such as online cooking classes and delivery collaborations.

Food industry trends in the US

We expect to see consumers continuing to eat and drink more at home in the US too, as many office workers continue to remotely, and city dwellers flee to the suburbs. Whilst consumers are enjoying cooking at home and planning to do more of it in future, they’re are also ordering more takeout, and looking to meal kit companies for ease and convenience. Attitudes towards health in the US depart from the global trend. Whilst 53% of consumers globally tell us that what they eat or drink has changed for the better, in America only 25% think this is the case. In the US, consumers are viewing health more holistically. Whilst some are looking to food and drink to support physical health, others are using food as a tool to support their mental health, with two thirds of Americans eating more comfort food than before.

Food industry trends in Singapore

Global trends such as the rise of online shopping and a growing focus on health and wellness are reflected in Singapore. In fact, an AIA survey conducted prior to Phase Two of safe reopening found that Singaporeans are allocating the highest portion of their expenses on healthier meal choices. One trend that is more specific to Singapore is the growing importance of sustainability. When it comes to sustainability efforts, Singapore falls behind many other nations in terms of recycling, plastic-use reduction, and food wastage reduction, and this has come into sharper focus as a result of the pandemic, alongside more recent government efforts to achieve a Zero Waste Singapore. In response, we’re starting to see the rise of more sustainable packaging, “ugly” produce and bulk food stores.

Food industry trends in Vietnam

Vietnam has seen big changes in the channels people use for shopping. Online meal delivery has boomed as restaurants have pivoted, and ever more Vietnamese consumers are turning to the mini supermarket, as worries about food safety and origin come to the fore. In line with this, organic food is also growing in popularity, although high prices mean that at present this trend is confined to the middle class.

Food industry trends in China

In China and Hong Kong, global trends around health and eating at home are particularly important, with 86% of Chinese respondents acknowledging their desire to eat at home even after the pandemic ends according to Nielsen. Concerns about food safety are also front of mind, and in response we’re seeing a growing trend towards automation and contactless processes in manufacturing and distribution.

Food industry trends in Thailand

As in Vietnam, meal delivery in Thailand has boomed, accelerating the adoption of online and mobile banking and contactless payment methods. The global trend towards an increasing emphasis on health is evident in Thailand, too with 71% cooking more for themselves and their families and 62% consuming more fresh fruit and vegetables. Many Thai consumers are also looking towards beverages as a way of looking after their health. Drinks containing Vitamin C have seen 47% growth compared

to last year.

Food industry trends in India

Like their counterparts in Thailand, Indian consumers are looking for immune boosting products, but many of the specific trends we see playing out in this market are driven by food safety concerns. As mentioned previously, a significant number of Indian consumers are eating more meat-free food due to worries about infection, and they’re also buying more packaged food. Against this backdrop, street food vendors have had to pivot, elevating their offering, leading to the emergence of gourmet street food.

Food industry trends in Japan

As mentioned above Japanese consumers have been quick to support local brands through the 応援消費 (Consume To Support) movement. This is a trend that we believe will persist in Japan, albeit not as prominently as it does on a global scale. Our research shows that 1 in 4 consumers in the country say they will be more conscious of supporting local produce and food and beverage brands in future, compared to 4 in 10 globally. One emerging trend that is quite specific to Japan is the move towards stocking up on food. In most countries this behaviour peaked at the height of the pandemic and has since subsided but in Japan 41% of consumers plan to ‘stock up’ on essentials rather than buying day-to-day in future and 35% are intending to buy more frozen or tinned produce. This can be explained by looking at the specific experience of the Japanese people. In response to natural disasters like earthquakes, typhoons, flooding and landslides, Japanese consumers are used to having to stock up.

Food industry trends in the Philippines

We see this trend towards bulk buying emerging in the Philippines too, where 48% of consumers say they plan to ‘stock up’ on essentials instead of buying day-to-day. Global trends around eating more healthily are also important in the Philippines, which is significant given that the traditional Filipino diet is higher in total fat, saturated fat, and cholesterol than most Asian diets.

Food industry trends in Indonesia

Trends in Indonesia closely mirror those seen globally. There’s been an uptick in online grocery shopping, with a large proportion of Indonesian grocery shoppers (59%) having used e-commerce sites for this purpose according to a Snapcart survey carried out in May. People have also started to adopt online shopping in new categories, such as OTC, multivitamins / supplements, herbal products, and even RX drugs. Cooking more at home, and supporting local food and drink businesses are also key trends in this market.

To learn more about the food industry trends in each market, download the full report – it’s packed full of facts, stats and examples from each country. Alternatively, if you need further support in understanding changing consumer behaviour in your market, please get in touch with us. We have a wealth of experience in food and beverage, having worked with the likes of Mars, Unilever and Arla, and would be happy to share our expertise.

You might also be interested in

Sales & Marketing

Sales & Marketing Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director