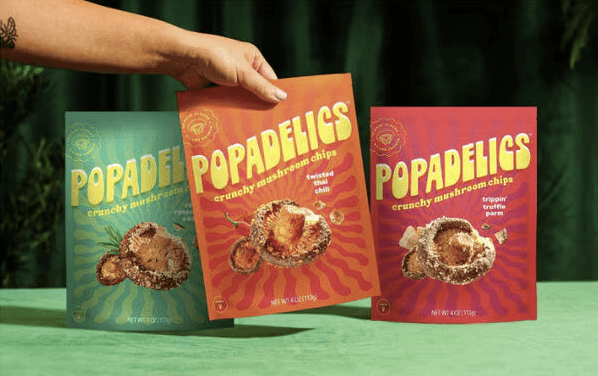

In a trade hall packed with natural food startups and plant-based hopefuls, the mushroom drinks were among the first to sell out. Odyssey’s lion’s mane “cold brew” disappeared before lunch. Popadelics’ truffle-dusted shiitake chips were gone by midday. And when the Natural Products Expo West wrapped for the year, trend watchers were left with one clear takeaway: mushrooms have stepped into the spotlight.

What was once a fringe ingredient, used mainly in traditional medicine or tucked inside a risotto, is now breaking into every aisle of the supermarket. In the past year, US retail sales of foods and drinks featuring “super mushrooms” hit 642 million dollars, rising nearly 20 percent according to SPINS, a retail data provider specializing in natural and wellness products. Mushroom-based teas and ready-to-drink coffees surged 250 percent. Even kombucha brands have started adding lion’s mane and chaga, with that segment growing 71 percent year-on-year.

For many shoppers, the appeal is simple. These products promise benefits like focus and energy without the sugar highs or stimulant crashes. Once limited to wellness circles, mushrooms are now part of the grocery routine. They’re showing up in coffee replacements, snack packs, and evening wind-down drinks. What started as a fringe supplement is becoming a habit.

From Folk Remedy to Modern Shelf

Long before they appeared in energy drinks and snack aisles, mushrooms were prized in ancient medicine. Reishi was known as the “mushroom of immortality” in China. In Siberia, chaga was brewed to withstand winter. Even Ötzi the Iceman carried medicinal fungi over 5,000 years ago.

These weren’t culinary choices. They were tools for stamina, clarity, and resilience. Today’s mushroom boom draws from those roots—but trades folklore for sleek packaging and science-backed positioning.

Lion’s mane is now sold for memory. Cordyceps for stamina. Reishi for sleep. Some of the science is still emerging. Yet global momentum is clear. In one year, functional mushroom supplements brought in over 396 million dollars in the US alone, according to the Nutrition Business Journal.

What was once foraged is now formulated. Mushrooms are no longer a footnote in wellness. They’re becoming fixtures in grocery carts and morning routines.

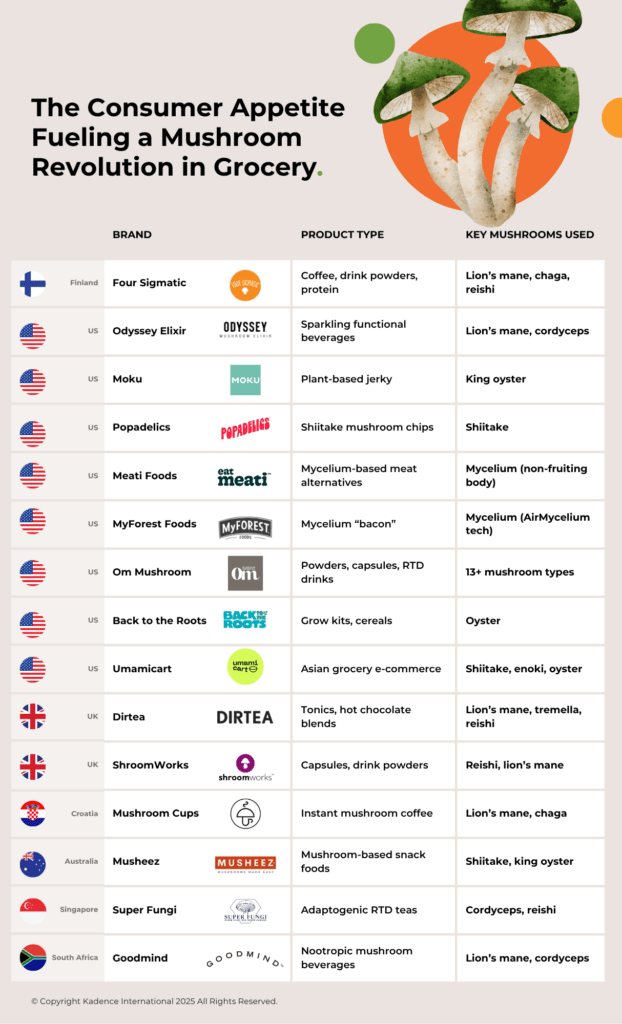

The Brands Leading the Charge

Momentum in the mushroom category is not driven by a single breakout product but by a wave of innovation across beverages, snacks, supplements, and alternative proteins. This is not a health food aisle phenomenon. It is happening at scale, across national chains and direct-to-consumer platforms, with products designed to meet shoppers where they are.

In Finland, Four Sigmatic was among the first to position mushrooms as an everyday wellness tool. The company, founded by a group of foragers and biohackers, built an early following through niche communities. Today, its products are carried in over 7,000 stores across the United States, including Target, Whole Foods, Sprouts, and Walmart. Sales have surpassed 200 million dollars. Its lion’s mane coffee sachets, reishi hot cacao blends, and adaptogenic protein powders are no longer sold on novelty. They are merchandised on functionality, with new packaging focused on outcomes like “Think,” “Calm,” and “Defend.”

Odyssey Elixir, based in Los Angeles, has taken a more caffeinated path. The company produces sparkling beverages infused with lion’s mane and cordyceps, positioned as a clean energy alternative for younger consumers who are moving away from sugary sodas and synthetic ingredients. In 2023, Odyssey sold nearly 10 million cans and secured 6.3 million dollars in venture funding. Retail presence expanded rapidly, reaching over 6,000 stores, including CVS, 7-Eleven, and Publix. The brand’s founder, Scott Frohman, recalls early rejections from buyers. When Publix passed on the pitch, it was data from competitors that changed their minds and brought the brand onto shelves a few months later.

Across categories, these brands are responding to a spectrum of consumer priorities—mental focus, stress relief, indulgent snacking, and sustainable protein. Mushrooms provide a format flexible enough to meet all of them, whether brewed, blended, or jerky-dried.

In the snack aisle, Popadelics has turned shiitake mushrooms into a conversation starter. The brand launched through lifestyle marketing, placing its products in fashion boutiques and music festivals before entering grocery retail. By mid-2023, it had secured national distribution through Whole Foods. Some flavors remain backordered, a reflection of both novelty appeal and genuine demand.

Further up the supply chain, companies like Meati Foods are taking a different approach. Instead of using mushroom fruiting bodies, Meati grows mycelium, the root-like structure of fungi, as a base for alternative meat. Its steaks and cutlets are now sold in more than 7,000 stores. With more than 350 million dollars in investment and a 100,000-square-foot production facility in Colorado, the company is positioned as a contender in the race to scale sustainable protein.

These brands are not riding a single trend. They are building around a spectrum of consumer priorities, from mental focus and stress relief to indulgence and sustainable protein. Mushrooms offer a versatile base. Whether brewed, blended, baked, or dried into jerky, they are being used to create products that feel both innovative and familiar, crafted for mass retail and everyday use.

Science or Speculation

The popularity of functional mushrooms has grown faster than the body of evidence behind them. For every shopper who adds lion’s mane to their coffee for focus or chaga to a smoothie for immunity, there is still a lingering question of whether the benefits hold up under scientific scrutiny.

Research has made some progress. Lion’s mane has shown promise in small clinical studies related to cognitive support and nerve regeneration. One 2020 trial in Japan found that daily supplementation improved mild cognitive impairment among older adults. Other mushrooms have drawn interest for their immune-modulating compounds, particularly beta-glucans. In Japan, lentinan from shiitake and PSK from turkey tail are already used as adjuvant cancer therapies. These applications, however, remain outside the scope of conventional Western diets.

Image credit: Moku

In the United States, regulators have taken a cautious approach. The Food and Drug Administration has issued warning letters to brands making disease-related claims. Terms like “supports immunity” or “promotes mental clarity” are generally permitted. Anything more specific invites enforcement. This became clear in late 2024, when the agency declared Amanita muscaria, the hallucinogenic mushroom often found in “legal trip” candies and microdose gummies, as not generally recognized as safe. That designation removed the product from the food market, highlighting how quickly the line can shift between innovation and violation.

While most functional mushroom brands operate within approved boundaries, the category still lacks standardization. There is little consistency in how extracts are processed, how doses are measured, or how active compounds are verified. This variability makes it difficult for researchers to compare outcomes, and for consumers to understand what they are buying. Experts like Dr. Julie Daoust, Chief Science Officer at M2 Ingredients, say that the future of the category will depend on clarity. “Modern wellness consumers are becoming increasingly educated,” she notes. “They want simplified products that are supported by data.”

Until more robust trials are conducted, much of the appeal will rest on experience and belief. That does not necessarily diminish the impact. In many cases, consumers are not expecting mushrooms to treat illness. They are reaching for products that feel better in the body and align with broader shifts toward clean energy, natural focus, and proactive health. For now, mushrooms sit in that quiet space between proven and promising, sold not as cure-alls, but as tools for daily performance.

Who Is Buying and Why

Functional mushrooms are no longer confined to fringe wellness circles. Today, their customer base spans from college students searching for natural focus to middle-aged parents replacing energy drinks with lion’s mane coffee. What connects them is not a demographic profile, but a shared appetite for clean-label function and the idea that food should do more than fill.

A national survey by the Nutrition Business Journal in 2024 found that 37 percent of Americans use foods or beverages enhanced with functional mushrooms. Another 27 percent report taking mushroom-based supplements. Usage is highest among Gen Z and millennials, but the interest cuts across age groups. These are not isolated early adopters. They are mainstream consumers with a growing awareness of terms like adaptogen and nootropic, many of them learning through TikTok reels or Amazon reviews rather than clinical trials.

Within that broader pool, motivations vary. Gen Z buyers are often looking for energy and focus. They are replacing sugar-heavy drinks with sparkling mushroom elixirs like Odyssey or swapping coffee for Four Sigmatic sachets that offer mental clarity without the caffeine crash. Amazon reported a 47 percent year-on-year increase in searches for adaptogens, a signal that functional terms are resonating with digital-native shoppers.

Millennials, meanwhile, are turning to mushrooms for stress support and immune resilience. The pandemic reshaped health priorities, and fungi-based products now offer a gentle, daily form of reinforcement. Reishi teas and chaga lattes are positioned as alternatives to wine or melatonin, especially for young parents navigating burnout. Familiar formats like snacks, broths, and chocolate blends continue to drive adoption.

The older end of the market is growing too. Interest in cognitive health and natural anti-inflammatory solutions is drawing Gen X and Boomers into the category. Many are less influenced by brand aesthetics and more persuaded by mainstream media coverage or endorsements from integrative doctors. When Lifeway Foods, best known for kefir, launched a mushroom beverage line in 2024, it was positioned for this segment with a focus on wellness benefits rather than trendy packaging.

These consumer groups are distinct, but the unifying thread is trust. People want to feel that what they are buying is real, purposeful, and rooted in something beyond marketing. That is part of why mushrooms, with their history in traditional medicine and visible whole-food forms, are outpacing some of the synthetic functional trends of the past decade.

The traction isn’t lost on grocers and investors. NielsenIQ reports that mushroom-containing grocery products generated over 3.4 billion dollars in US sales last year. Performance-focused segments led the charge, with sports-oriented mushroom products growing more than 30 percent. For a category that only recently stepped out of the supplement aisle, these numbers point to long-term viability—and a new kind of strategic relevance across the food and beverage industry.

As the category matures, consumer expectations are rising. Shoppers are examining ingredient sourcing, evaluating dosage, and learning to read labels more precisely. What began as a novelty has become part of the weekly grocery routine. Mushrooms are no longer just ingredients. They signal something deeper, carrying emotional meaning and delivering real benefits like focus, calm, or stamina.

The Retail Shift and Supply Chain Pressure

The popularity of mushroom-based products has not just reshaped consumer preferences. It has also forced retailers and suppliers to rethink how they categorize, source, and scale a once-afterthought food group.

In grocery stores across the United States, mushrooms have expanded beyond the produce section and supplement aisle. Retailers are building wellness-focused sets, grouping lion’s mane coffees, reishi teas, and chaga powders alongside probiotics and adaptogens. At Whole Foods, end caps now feature mushroom snacks next to CBD seltzers. Target, Walmart, CVS, and even 7-Eleven have integrated mushroom drinks into mainstream shelving. The placement is not just trend-based. It reflects strong sales and consumer pull.

This retail expansion is creating real pressure upstream. Demand for mushroom ingredients now exceeds what many producers can deliver. Lion’s mane, sought for its effects on focus and memory, grows slowly and resists easy cultivation. Cordyceps requires tightly controlled light and temperature conditions. Chaga, most commonly wild-harvested from birch trees in cold climates, can take years to reach maturity. For suppliers, this creates a bottleneck.

Image credit: Popadelics

Some companies are responding with vertical integration and tech-enabled growing systems. MyForest Foods operates a mycelium farm in New York and recently expanded to Canada, using fermentation and climate control to grow slabs of mushroom root for its alt-protein products. Meati Foods has built one of the largest mycelium production facilities in North America, capable of delivering the volume required for mass grocery distribution. These are not small experiments. Meati has received more than 350 million dollars in investment, and MyForest is scaling its AirMycelium platform to meet growing demand from CPG partners.

Yet even these systems are feeling strain. Popadelics, the mushroom chip brand now stocked in Whole Foods nationwide, has announced product backorders due to sourcing limits. As the category grows, more brands are competing for a limited supply of high-quality extracts. The result is a market where product development timelines are stretching, and price volatility is beginning to emerge.

Retailers are staying committed. Sales justify the shelf space, and consumers continue to respond to new formats and claims. But behind the merchandising, the category is in flux. Mushrooms are no longer confined to niche shelves. As they scale into commodity status, they bring new challenges in pricing, sourcing, and traceability.

Image credit Odyssey Elixir

The Fungi Future in CPG

Once a wellness niche, mushrooms have become one of the most dynamic shifts in packaged food. They tap into a rare combination: performance, familiarity, and freshness of format. As this momentum builds, the question is no longer whether functional mushrooms will remain relevant, but how far they might spread.

Across grocery aisles, mushrooms now carry the kind of meaning once reserved for probiotics or protein powders. These products are more than just ingredients. They’ve become symbols of focus, energy, and resilience. That shift moves them from fad to fixture. And mushrooms are showing signs of exactly that shift—embedded in daily routines, no longer riding novelty alone.

That shift has implications for how brands develop products and tell stories. Mushroom ingredients are already moving into formats far beyond coffee and jerky. Companies are testing fortified cereals, protein bars, and baby snacks. Lifeway Foods launched a mushroom-enhanced kefir line aimed at immune support. Alt-protein brands like Meati and MyForest are pitching fungi not as meat substitutes, but as a standalone category with its own identity. Even koji, a culinary mold used in fermented foods, is being reimagined as a flavor-forward ingredient for sauces, vegan charcuterie, and marinades.

This diversification reflects a deeper change in consumer behavior. Shoppers are no longer driven solely by the desire for less – less sugar, meat, or caffeine. They are also seeking more. More utility, more focus, more resilience built into the rituals of daily life. Mushrooms, with their blend of medicinal history and modern formatting, speak to that shift. They align with a cultural moment focused on performance without pills and natural function without sacrifice.

What comes next is likely a wave of acquisition and standardization. Large CPG companies are watching closely. Some, like Danone and Constellation Brands, have already invested in adjacent wellness categories. Others are expected to move soon. As the category scales, we will see greater pressure for consistency, potency, and proof. That will mean clearer labeling, stronger supply chain traceability, and, inevitably, more clinical research. It may also mean a shakeout, as the market distinguishes between products that deliver and those that simply follow.

The fundamentals remain strong. This is a category built on tangible ingredients, measurable interest, and repeatable consumer habits. It has grown quietly, through everyday formats like coffee and snacks, not through Instagram hype. That subtle momentum may be its biggest strength. Functional mushrooms are not trying to disrupt. They are trying to last.

In a marketplace flooded with fleeting claims, mushrooms are offering something different: daily utility, steady results, and emotional resonance. They are not promising transformation. They are becoming habit. For CPG giants and startup founders alike, the question is no longer if mushrooms will lead. It is whether the rest of the aisle is ready to follow.

Understand What Today’s Consumers Really Want

From flavor innovation to functional benefits, consumer expectations are shifting fast. Our research helps CPG and food and beverage brands uncover the insights behind purchase decisions—so you can create products that resonate and endure. Kadence International is your partner in making smarter, evidence-based moves in a changing market. Submit a brief to start your project.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Consumer sentiment in the US took a sharp downturn in the first quarter of 2025, signaling growing anxiety about the economy as inflation fears and geopolitical tensions weigh heavily on households.

The University of Michigan’s consumer-sentiment index dropped to 50.8 in April, down from 57 in March, marking the lowest since June 2022. Inflation expectations surged to a 44-year high of 6.7%, deepening concerns about a potential recession. As fears of stagnant economic growth and rising costs persist, US households are not only deferring big-ticket purchases but are also shifting their spending habits. A 2024 survey by McKinsey found that 57% of consumers plan to postpone purchases of cars, electronics, and home appliances due to economic uncertainty. This behavior reflects a broader shift in consumer priorities, where many opt to save for security rather than indulge in discretionary purchases.

In addition, more consumers are actively reconsidering their brand choices. According to Ipsos, one in four Americans have boycotted a brand in the past year over political or ethical reasons, signaling a more value-driven approach to spending. This trend underscores a more selective approach, with households prioritizing purchases that align with personal values and long-term needs.

The Shift in Spending Behavior Globally

Globally, households are tightening their belts in response to growing financial uncertainty. Consumer confidence has dropped significantly in the US and Europe, as evidenced by rising savings rates. In the US, savings deposits increased by 5.4% in 2024, according to major US banks, while credit card usage declined. Meanwhile, Europe’s savings rate surged to 13.5% in Q4 2024, up from 10.7% in 2023, indicating that consumers are prioritizing savings over spending.

Retail sectors are feeling the impact of this shift. High-ticket purchases, such as luxury goods and cars, are down across key markets as consumers focus on essentials and future security. Reports from the European Central Bank show a marked decline in discretionary spending, echoing similar trends in the US.

While this cautious approach stems from immediate financial strain and long-term economic uncertainty, the shift is expected to shape the global economy in the coming months. Companies that can adapt – offering products aligned with consumer values, health, and sustainability – will be well-positioned to thrive in this evolving market.

Case Study: Frasers Group’s Strategic Store Closures Amid Economic Uncertainty

Image credit: X

Background:

Frasers Group, a major UK retailer owning brands like Sports Direct and House of Fraser, has faced challenges due to declining consumer confidence and increased operational costs. In response, the company has closed several stores, including its flagship, House of Fraser in Bath, which had been operating for over 200 years.

Actions Taken:

Frasers Group has been consolidating its physical retail presence, focusing on high-performing locations and expanding its online offerings. The company has also been investing in its luxury segment, with CEO Michael Murray expressing confidence in a rebound in demand for premium goods.

Outcome:

While facing short-term challenges, Frasers Group aims to strengthen its market position by streamlining operations and capitalizing on the anticipated recovery in luxury retail.

The Impact on Financial Institutions and Retailers

As consumer behavior shifts toward savings and caution, financial institutions and retailers feel the effects. Banks have reported an uptick in deposits, while credit card usage has decreased, signaling a change in how consumers manage their finances in uncertain times.

In the US, savings rates have steadily increased over recent years as consumers prioritize financial security. The Federal Reserve’s 2024 Financial Stability Report shows that household savings rates have remained elevated, with a marked preference for more liquid assets. This shift in consumer behavior is attributed to ongoing economic uncertainties and the rising cost of living. Meanwhile, credit card debt, though still growing, has been growing at a slower pace compared to the previous year, with the Federal Reserve noting in its 2024 Report on Household Debt and Credit that credit card balances increased by 6.4% in 2023, slower than previous years’ growth. This suggests consumers are becoming more cautious with discretionary spending, opting to save more and use credit less.

Retailers are adjusting to these changing dynamics. For many brands, especially those in luxury and non-essential goods markets, the slowdown in spending has forced a reevaluation of strategies. High-end brands, which have long relied on the discretionary spending of affluent consumers, are facing challenges as more shoppers scale back on big-ticket purchases.

On the other hand, retailers in the wellness, health, and essential goods sectors benefit from this shift. A January 2024 McKinsey & Company report highlights that 56% of Gen Z consumers in the US consider fitness and wellness a “very high priority,” reflecting a continued commitment to spending on health-related products and services. McKinsey estimates that the global wellness market, valued at over $1.8 trillion, continues to grow at 5-10% annually, with significant demand for wellness products in emerging markets.

For financial institutions, the challenge lies in balancing the growing demand for savings accounts and low-risk investments with the need to provide consumer credit options. As fewer people rely on credit cards, many banks are exploring alternative forms of credit, such as buy now, pay later (BNPL) services, which allow consumers to make purchases without accumulating high-interest debt. While BNPL services have gained popularity, there are concerns about their long-term sustainability and the potential for increased consumer debt.

Ultimately, the growing trend toward saving and cautious spending drives significant shifts in the financial services and retail sectors. Companies that can adapt to these changes – offering value, flexibility, and products aligned with consumers’ evolving needs – will be well-positioned to thrive in the coming months.

How Brands are Adapting Strategies in Response to Consumer Behavior Shifts

In response to the evolving consumer market, companies are implementing various strategies to align with changing preferences and economic conditions:

- Enhanced Digital Engagement: Retailers use digital platforms to offer personalized shopping experiences. This includes leveraging data analytics to understand consumer behavior and tailoring marketing efforts accordingly.

- Flexible Pricing and Promotions: Companies are introducing flexible pricing models and targeted promotions to address price sensitivity. This approach aims to maintain customer loyalty while accommodating budget-conscious consumers.

- Product Innovation and Diversification: Brands diversify their offerings to meet consumers’ evolving demands. This includes introducing new product lines that align with current trends, such as wellness-focused or sustainable products.

The Road Ahead: Implications for Economic Growth

The trend toward saving and cautious spending presents a complex economic landscape. While rising savings rates provide financial security for households, the slowdown in consumer spending could stall short-term economic growth. In Q1 2024, real personal consumption expenditures (PCE) grew just 1.3%, down sharply from 3.4% in Q4 2023. This slowdown reflects persistent inflationary pressures.

As discretionary spending contracts, sectors dependent on non-essential purchases, such as luxury goods and travel, face significant challenges. Bain & Company reports that global luxury market growth slowed to 3% in 2024, a stark decline from double-digit growth in previous years.

However, wellness, health products, and essential goods continue to see strong demand, driven by consumer interest in well-being and sustainability.

As consumer caution impacts overall economic activity, particularly in markets reliant on consumption-driven growth, policymakers and brands must adapt. Encouraging spending on wellness and essential goods, while promoting savings, could help stabilize growth. Companies that strategically align with these consumer priorities—through innovation, targeted marketing, and flexible pricing – will be better positioned to thrive despite economic uncertainty.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

In the last year alone, bookings for luxury river cruises by travelers over the age of 65 rose by more than 70%. In Southeast Asia, spa and wellness retreats report that seniors now make up the fastest-growing customer group. And in the United States, recent data shows that older adults are adopting wearable tech at a faster clip than millennials. These aren’t isolated shifts—they’re signals of a broader recalibration underway in global consumption.

For decades, older consumers have been cast in a supporting role: brand loyal, budget conscious, and resistant to change. The stereotype of the frugal retiree—committed to saving, disinterested in trends—has shaped how marketers target, serve, and sometimes overlook the over-65 segment. But the demographic reality has changed, and so have the consumers within it.

Today’s seniors are living longer, staying active, and spending more. In markets like the US and UK, they hold the bulk of wealth and show no hesitation in using it. In Southeast Asia, where aging populations are rising sharply, many seniors are approaching retirement with more education, financial independence, and appetite for indulgence than the generation before them. From travel and wellness to personal tech and home upgrades, older consumers are not only participating—they’re leading demand in categories once reserved for younger buyers.

This isn’t a niche. It’s a market-wide shift. As aging populations expand in both developed and emerging economies, their economic power is no longer confined to healthcare and insurance. It’s influencing the way brands think about experience, design, value, and messaging. Marketers who continue to fixate on youth risk missing one of the most quietly powerful growth segments in the global economy. Because while demographic trends might move slowly, consumer behavior is already changing—and the brands that recognize it early stand to benefit most.

A New Consumer Class with Global Influence

The global demographic landscape is undergoing a significant transformation. By 2030, individuals aged 65 and older are projected to constitute over 20% of the population in most developed countries, marking a substantial increase from previous decades .

In the United States, baby boomers—those born between 1946 and 1964—hold a dominant financial position. They control approximately 70% of the nation’s disposable income, making them a formidable economic force . This wealth accumulation is attributed to factors such as prolonged careers and favorable investment returns .

Regional Spending Patterns

- Japan: With nearly 30% of its population aged 65 or older, Japan faces unique economic challenges and opportunities. The aging demographic has led to increased demand for healthcare services and age-friendly technologies

- Singapore: Retired households in Singapore allocate a significant portion of their expenditures to health and wellness. Studies indicate that these households prioritize recreation and cultural activities, reflecting a desire for active and engaged lifestyles

- United Kingdom: In the UK, seniors are playing a pivotal role in preserving and revitalizing traditional crafts. The resurgence of interest in heritage crafts, such as cask ale brewing, is partly driven by older consumers who value authenticity and tradition .

Emerging Markets

- India: Urban Indian seniors are exhibiting increased consumer confidence. Recent surveys show a rise in sentiment regarding personal finances and investments, suggesting a growing willingness to spend on quality products and services

- Vietnam: Vietnamese seniors are among the most optimistic consumers in Southeast Asia. Their positive outlook translates into active participation in the economy, with increased spending on healthcare, leisure, and technology

The Spending Habits That Are Defying Age Expectations

The conventional image of older adults as cautious spenders is increasingly outdated. Recent data reveals that seniors are actively engaging in various sectors, from travel and wellness to home improvements and technology, often outspending younger demographics.

Travel and Leisure

Seniors are embracing travel experiences that prioritize comfort and enrichment. In the UK, luxury rail journeys are booming—Railbookers added nearly one new high-end booking for every two made the year prior. Similarly, wellness tourism added more than $200 billion in a single year—growing by nearly one-third to reach $868 billion in 2023, indicating a growing preference for health-focused travel among older adults.

Wellness and Beauty

The pursuit of health and longevity is driving seniors to invest in wellness products and services. Thailand’s wellness economy expanded by nearly $9 billion in just one year, reaching $40.5 billion in 2023, with older consumers contributing significantly to this surge . The global skincare supplement market also reflects this trend, valued at $2.81 billion in 2023 and projected to reach $5.86 billion by 2032 .

Home and Lifestyle

Aging in place has become a priority for many seniors, leading to increased spending on home modifications. In the U.S., homeowners spent an average of $13,667 on home improvement projects in 2023, with accessibility and comfort being key motivators . Retailers like Home Depot and Lowe’s have responded by offering products tailored to the needs of older adults, such as ergonomic fixtures and safety enhancements.

Technology Adoption

Contrary to stereotypes, seniors are increasingly adopting smart technologies. AARP reports that nearly 9 in 10 adults over 50 now use smartphones, with two-thirds streaming on smart TVs and one in three engaging with voice assistants at home. This trend underscores the importance of user-friendly technology that caters to the preferences and needs of older consumers.

In category after category, senior preferences are leading—not lagging—market demand. Their choices no longer mirror trends; they initiate them.

Challenging the Utility-Only Narrative

The prevailing notion that older consumers prioritize practicality over pleasure is increasingly being challenged. Increasingly, older consumers are choosing experiences that deliver joy, autonomy, and a sense of identity—not just utility.

Seniors are drawn to luxury not for function alone, but for how it affirms identity. A 2025 study by Bargaoui found that older adults associate luxury consumption with emotional reward and self-worth—a signal that indulgence and aspiration are still core drivers well past middle age.

This shift in consumer behavior necessitates a reevaluation of product positioning strategies. For instance, hearing aids are increasingly marketed not just as medical devices but as lifestyle enhancers that seamlessly integrate with other technologies. Apple’s approach to product design exemplifies this trend. Features like Voice Control and fall detection are incorporated into devices like the iPhone and Apple Watch, offering functionality that appeals to seniors without overtly targeting them as a separate demographic.

The same logic applies outside of tech. In the UK, older travellers are fueling demand for immersive rail experiences built around comfort, not spectacle. In Southeast Asia, seniors are driving bookings at wellness retreats that blend self-care with cultural depth.

Why the Marketing World Still Prioritizes Youth

Despite the growing economic influence of older consumers, advertising strategies continue to disproportionately target younger demographics. This focus persists even as individuals aged 50 and above contribute significantly to consumer spending.

In the United States, consumers over 50 account for more than half of all consumer spending. However, only 5–10% of marketing budgets are allocated to engage this demographic . This disparity is not limited to the U.S.; in the United Kingdom, over-50s represent a third of the population and hold 80% of the nation’s wealth, yet they remain largely invisible in advertising campaigns

Several factors contribute to this imbalance. One is the composition of the advertising industry itself. According to Forbes, only 5% of ad agency employees are over 50, and most do not work in creative departments . This lack of age diversity within agencies can lead to a limited understanding of older consumers’ preferences and needs.

There remains a persistent stereotype that older consumers are less receptive to digital media. Yet data shows adults aged 55 and above now spend over half (54.4%) of their media time online—a shift that challenges the industry’s long-held assumptions.

Neglecting the older demographic not only overlooks a substantial market segment but also poses risks to brand relevance and loyalty. Competitors who recognize and address the needs of older consumers can capture market share and build lasting relationships. The influence of older consumers isn’t coming. It’s already reshaping how value is defined across categories—from beauty to tech to travel. Brands still tethered to a youth-first playbook aren’t just behind the trend—they’re blind to where the momentum has moved.

Meeting Older Consumers Where They Are

A handful of brands are beginning to adjust course—not by singling out older consumers with age-stamped campaigns, but by rethinking product design, messaging, and experience in ways that recognize the influence and expectations of this group.

L’Oréal has expanded its age-inclusive approach beyond token representation. In markets like the UK and Japan, it has invested in research and formulation targeting mature skin, while casting women over 60 in its mainstream campaigns—not in niche “silver” editions. What’s notable is the absence of the patronizing tone that once marked age-focused advertising. The positioning is subtle: aspirational without being age-anxious, confident without being corrective.

In travel, companies like Viking and Belmond have seen a surge in demand from older travelers seeking richer, more immersive journeys over fast-paced itineraries. These brands have responded by retooling the product—not just offering mobility-friendly options, but reshaping the tone of travel itself. Longer stays, expert-led local immersion, and a focus on comfort over spectacle have proven to resonate. It’s not age that defines the appeal, but sensibility.

Tech companies have also begun to shift. Apple, as noted, integrates accessibility features across its product suite, yet never markets them explicitly as “senior” tools. Voice commands, larger interfaces, and health tracking appeal to all users, but are particularly beneficial for older ones. This universality is intentional—and effective. In 2023, adoption of the Apple Watch among consumers aged 60 and above increased by more than 25% year over year, according to Counterpoint Research.

In Southeast Asia, telcos and financial platforms are investing in UX overhauls aimed at improving digital fluency for older users. Singtel’s wellness and lifestyle offerings for seniors, for instance, go beyond low-cost data plans to include curated content, concierge services, and simple app layouts tailored to common needs. The pitch isn’t that seniors are less tech-savvy—it’s that good design should accommodate everyone.

These brands succeed not by targeting older consumers differently—but by removing age as a constraint. Their advantage lies in recognizing behavior, not categorizing it.

For brands looking to operationalize these insights, the following cheat sheet outlines actionable ways to better engage senior consumers across touchpoints—from UX and messaging to service and product design.

How to Appeal to Senior Consumers

| Category | Best Practices |

| Customer Understanding | – Segment by behavior, not just age- Use in-depth interviews and observational research, not just online surveys |

| UX & Product Design | – Font size ≥ 14–16pt, high contrast text- Simple, intuitive navigation- Large touch zones (≥44x44px)- Screen reader–friendly code- Clear, concise copy without jargon- Progress indicators and confirmation messages- Design with accessibility (WCAG) in mind |

| Customer Service | – Maintain responsive phone support- Use empathetic, clear communication- Ensure continuity across channels (phone, in-store, digital)- Offer personalized follow-up (call, mail, or email) |

| Marketing Channels | – Email (well-targeted, not overwhelming)- Google Search (strong SEO and PPC)- Facebook (high usage globally among 60+)- YouTube (growing for how-tos, lifestyle)- Traditional media (TV, print) still valuable in key sectors |

| Messaging & Tone | – Aspirational, not patronizing- Purpose-led (quality, legacy, sustainability)- Emotionally intelligent (family, community, joy) |

| – Feature active, diverse older adults—not stereotypes | |

| Product & Service | – Prioritize ergonomic, easy-to-use design- Offer modular or personalized options- Highlight safety, quality, and customer support- Allow for trials or no-commitment use (especially for tech or wellness) |

Age Is No Longer a Signal of Decline—It’s a Forecast of Opportunity

For decades, brands have treated older consumers as the end point of a lifecycle—an audience to retain, not one to build around. That logic no longer holds. Seniors are not only outliving the systems built to serve them—they are outspending, outpacing, and, increasingly, out-influencing expectations.

They are the early adopters of wellness routines previously marketed to 30-somethings, the repeat buyers of luxury services, and the most consistent upgraders of home technology. Their behavior is not defined by age, but by intent. And if there’s one insight brands should act on now, it’s this: longevity is no longer just a medical issue. It’s a commercial one.

Their economic power is growing, but their motivations remain misunderstood. Too often, research flattens them into averages, surveys them through outdated assumptions, and overlooks the complexity that defines their choices. This is not just a missed opportunity. It’s a strategic blind spot.

To lead in the decade ahead, brands need to stop asking how to market to older consumers and start asking what they are telling us through the choices they make. That shift—from messaging to meaning—is where research proves its value. Not in confirming what we think we know, but in uncovering the complexity we’ve long overlooked.

In a marketplace increasingly driven by flexibility, aspiration, and self-determination, it may be the oldest consumers who are best positioned to show us what the future looks like. But only if we ask better questions—and actually listen.

Looking to better understand the evolving expectations of senior consumers—or any audience segment reshaping your market? At Kadence International, we help brands uncover the insights that drive results. Through in-depth research across key global markets, we go beyond demographics to decode behaviors, motivations, and emerging opportunities. Let’s start working together today.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Boycotts can upend entire markets overnight. In 2019, a diplomatic dispute between South Korea and Japan turned into a full-scale consumer revolt. Sales of Japanese beer in South Korea plummeted by 92%, and Uniqlo shuttered multiple stores as South Korean consumers rejected Japanese brands en masse. What began as a trade conflict quickly became an economic weapon wielded by consumers.

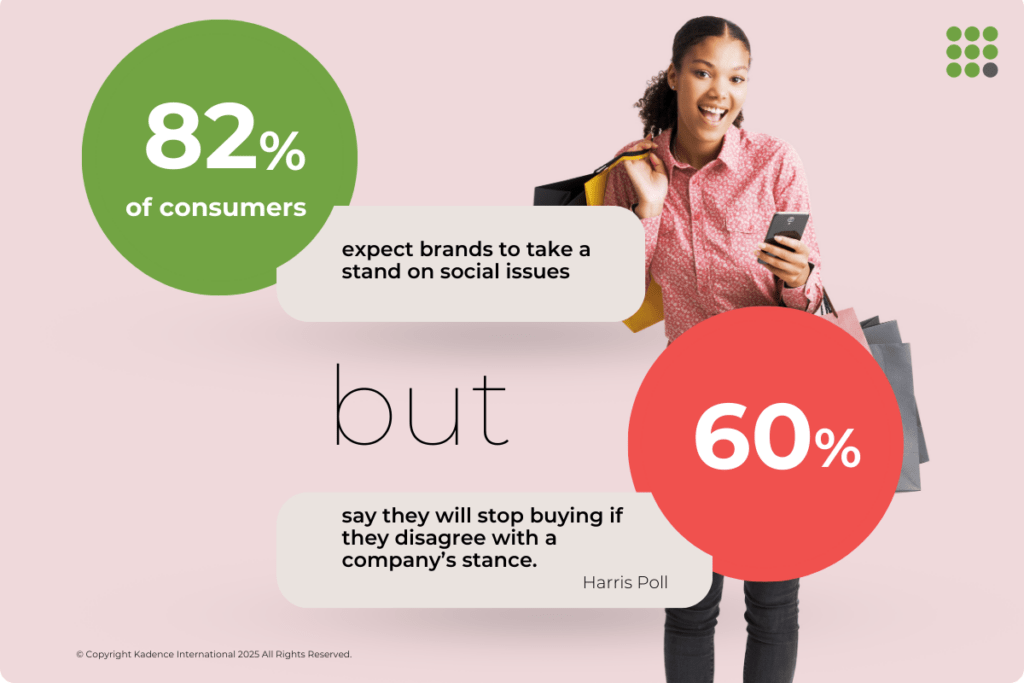

Boycotts are no longer just reactions to political events—they have become economic power plays. Global brands increasingly find themselves at the center of cultural, political, and trade conflicts. Starbucks faced backlash from both conservatives and progressives over its unionization stance, while Disney’s opposition to Florida’s “Don’t Say Gay” bill sparked boycotts from both LGBTQ+ supporters and conservative groups. In today’s market, even neutrality is a decision with consequences.

Brands have become battlegrounds for political, social, and economic conflicts. Silence is no longer a shield. When French President Emmanuel Macron defended the right to publish caricatures of the Prophet Muhammad in 2020, French businesses bore the consequences. Middle Eastern supermarkets pulled French products, and #BoycottFrenchProducts trended across social media. Carrefour scrambled to issue damage control statements. Even companies with no direct political involvement can be caught in ideological crossfire.

Managing consumer activism is no longer optional. Today’s boycotts can move markets and shake billion-dollar companies. In an era where brand loyalty is tied to political and social beliefs, companies caught in the crossfire risk more than just lost sales—trust, once broken, is far harder to rebuild.

Boycotts don’t just make headlines—they leave financial wreckage. In 2012, a territorial dispute between China and Japan ignited a mass boycott, sending Toyota’s sales in China tumbling 44% in a single month. The backlash erased years of market gains, forcing Toyota and Honda into a costly recovery battle.

Even dominant brands can feel the sting of consumer backlash. During the U.S.-China trade war, nationalist sentiment fueled a #BoycottApple campaign, pushing many Chinese consumers toward Huawei. Apple maintained its global standing, but its sales took a hit—proof that even industry giants aren’t immune to geopolitics.

Some boycotts reshape markets permanently. In 2019, a South Korea-Japan dispute led consumers to abandon Japanese beer, cosmetics, and cars—habits that didn’t revert even after tensions cooled. Similarly, a 2006 boycott of Danish products in the Middle East, triggered by controversial cartoons, wiped out $70 million in sales for dairy giant Arla Foods. Even years later, some retailers never restocked Danish brands.

Not all boycotts leave scars. Starbucks has repeatedly faced backlash over labor policies and political stances, yet its dominance remains unshaken. The reason? A fiercely loyal customer base and a brand identity strong enough to weather short-term activism. The difference between a fleeting boycott and lasting damage often comes down to one factor: how replaceable the brand is. Companies with distinct identities bounce back. Those that hesitate, or fail to differentiate, may never recover.

Why Some Boycotts Fade While Others Leave Lasting Damage

For over 40 years, Nestlé has faced recurring boycotts over its infant formula marketing in developing countries. Despite its global dominance, consumer advocacy groups have kept the controversy alive, cementing Nestlé’s reputation as a corporate villain for many.

The oil industry faces a similar challenge. Shell and BP have endured decades of boycotts over environmental concerns. While these campaigns haven’t triggered financial collapse, they’ve permanently tarnished brand perception—especially among younger, climate-conscious consumers.

The real risk isn’t a single high-profile boycott—it’s the slow erosion of trust from repeated controversies. Over time, consumer activism can turn a brand name into shorthand for corporate misconduct, making reputation recovery an uphill battle. A boycott is more than a PR crisis; it’s a moment of truth. Brands can either reinforce loyalty or lose trust from all sides.

Some brands emerge stronger by standing their ground. Patagonia, for example, has made environmental activism central to its identity—even suing the Trump administration over national park protections. Rather than triggering backlash, the move galvanized its core customers.

Not all brands navigate boycotts successfully. When Carrefour’s Middle Eastern stores suffered backlash during the Macron controversy, the company tried to distance itself—but this only bred confusion and distrust. Silence can be as risky as speaking out. Consumers expect companies to take a stance, but a miscalculated move can alienate as many as it attracts. The real challenge isn’t whether to engage, but how to do so without escalating the crisis.

Avoiding controversy doesn’t mean avoiding backlash. In 2022, Disney’s attempt to stay neutral on Florida’s “Don’t Say Gay” bill backfired spectacularly. Employees and LGBTQ+ activists pressured the company to take a stance, while conservatives retaliated once it did. Florida lawmakers stripped Disney of key tax privileges, leaving it alienated from both sides. A 2023 Harris Poll found that 82% of consumers expect brands to take a stand on social issues—yet 60% say they will stop buying if they disagree with the stance. The lesson? Taking a position can build loyalty with one group while permanently alienating another.

The risk isn’t just political—it’s about perception. Brands that fail to define their values risk having their identity shaped by the loudest voices. In today’s landscape, silence isn’t neutral—it’s a statement.

Navigating a boycott isn’t just about damage control—it’s about leadership. The brands that survive aren’t the ones scrambling to react, but those that take control of the narrative. When a boycott gains traction, the worst mistake a company can make is letting others define its response. A clear, well-structured message—consistent across all platforms—determines whether a brand weathers the storm or gets swallowed by it.

The financial hit of a boycott is often inevitable, but well-prepared brands see beyond the short term. Companies that anticipate consumer activism have contingency plans—shifting market focus, reinforcing ties with loyal customers, and ensuring financial resilience in the face of backlash.

A boycott can erupt in minutes, leaving companies no time to craft a careful response. In today’s hyper-connected world, silence is often seen as complicity, while a poorly handled statement can make things worse. The brands that survive aren’t those that avoid controversy—they’re the ones prepared for it.

The difference between a temporary backlash and a full-blown reputational crisis often comes down to preparation. The brands that weather boycotts aren’t scrambling in the heat of the moment—they have a crisis playbook ready long before trouble starts.

At the heart of any crisis playbook is a clear decision-making framework: Who makes the call on how to respond—the CEO, the communications team, or a crisis committee? Without a defined chain of command, brands risk internal chaos, mixed messaging, and costly missteps.

Just as critical is message control. In the social media age, companies no longer have the luxury of waiting days—or even hours—to respond. A delay means losing control of the narrative. The most prepared brands have adaptable, pre-drafted messaging ready to deploy, ensuring their first response is measured rather than reactionary.

Not all boycotts require engagement. The strongest brands assess the market impact first—does the backlash threaten core revenue streams, or is it mostly symbolic? Overcorrecting in response to a boycott from non-customers can backfire, alienating loyal buyers—a mistake that has cost brands billions.

Boycotts don’t just test a brand’s values—they reveal whether a company was ever prepared to defend them. The biggest failures aren’t necessarily from taking the wrong stance, but from appearing unprepared, inconsistent, or defensive. A boycott forces brands to make a critical decision: should they engage directly or let the controversy fade? The wrong choice can amplify the backlash, while the right move can reshape public perception.

Some boycotts are short-lived outrage cycles, driven by social media but lacking real economic impact. Rushing to respond can sometimes prolong the controversy rather than defuse it. Smart brands know when to let public sentiment run its course. But silence isn’t always an option. When a controversy gains enough traction, failing to engage can cause lasting damage. In those cases, brands must take control of the narrative before it’s shaped for them.

When two Black men were arrested at a Philadelphia Starbucks in 2018, the backlash was immediate. Instead of retreating, Starbucks’ CEO issued a direct apology, shut down 8,000 stores for racial bias training, and met with community leaders. By acting quickly, the company prevented long-term brand damage and reinforced its identity as a socially conscious brand.

The High Cost of Getting It Wrong

Contrast this with United Airlines’ 2017 fiasco, when a passenger was violently dragged off a plane. The airline’s initial response—a cold, legalistic defense of policy—only inflamed public outrage. Only after intense backlash did the CEO shift to an apologetic stance, but by then, the damage was done. The lesson? A delayed or tone-deaf response can make a crisis exponentially worse.

Knowing when to engage and when to stay silent isn’t about avoiding controversy—it’s about controlling the story. The strongest brands don’t just react to boycotts; they strategically decide whether to own the moment or let it pass. Brands overly dependent on a single geographic or ideological customer base are more fragile. Companies that diversify—whether through global expansion or appealing to multiple demographics—are far more resilient.

During the 2020 Middle Eastern boycott of French brands, Carrefour and Danone lost significant business over President Macron’s remarks. But both companies quickly refocused on growing consumer bases in Africa and Asia, stabilizing their bottom line. Similarly, global tech brands facing boycotts in China have expanded into India and Southeast Asia to offset losses. Instead of engaging directly in controversy, they pivot their business strategy toward emerging markets, reducing long-term financial exposure.

Consumers today can spot corporate insincerity from a mile away. When brands respond to controversy with empty gestures rather than meaningful action, they risk deepening public distrust rather than repairing it.

Pepsi learned this the hard way in 2017 with its now-infamous ad featuring Kendall Jenner handing a can of Pepsi to a police officer during a protest. Instead of making a genuine statement, the ad came off as exploitative—a hollow attempt to co-opt social justice for marketing. The backlash was immediate. Pepsi pulled the ad within 24 hours, but the damage was already done.

H&M faced a different kind of fallout in 2021 when it tried to navigate allegations of forced labor in Xinjiang, China. The company issued a carefully worded—but vague—statement distancing itself from the controversy. Instead of appeasing consumers, the move backfired: Chinese authorities removed H&M from online platforms entirely. The half-measure pleased no one and led to real financial losses.

Consumers today can spot empty gestures. If a brand takes a stand, it needs to mean it—half-measures and corporate platitudes only make things worse. Brands that emerge from boycotts with their reputations intact are those that meet controversy head-on—with clarity, honesty, and decisive action. Attempts to placate all sides or hide behind corporate jargon only fuel further backlash.

When McDonald’s exited Russia in 2022 following the Ukraine invasion, it didn’t just issue a press release—it explained, in plain terms, the ethical and economic rationale behind its decision. By offering transparency instead of vague corporate messaging, it reinforced its credibility as a company willing to take a stand rather than simply responding to pressure.

Patagonia’s 2022 decision to transfer ownership to an environmental nonprofit wasn’t a publicity stunt—it was a long-planned move. By embedding activism into its business model, Patagonia proved that brand values can be more than just marketing.

Brands that rely on damage control instead of transparency often make things worse. Half-hearted statements, vague acknowledgments, or empty pledges do little to rebuild trust. Consumers today don’t just expect brands to take a stand—they expect them to back it up with real action.

Boycotts aren’t rare disruptions anymore—they’re part of doing business in a politicized world. The brands that navigate them best don’t avoid controversy; they prepare for it, understand their audience, and act with conviction when it matters. Some brands survive by doubling down on their values and reinforcing ties with their core customers. Others try to appease everyone and end up alienating all sides. The difference isn’t the controversy itself—it’s how well a brand understands its identity and whether it has the courage to stand by it.

Consumer activism isn’t an occasional disruption anymore—it’s a permanent force in the global marketplace. Modern boycotts are faster, more coordinated, and more politically charged than ever. For brands, this signals a fundamental shift: accountability isn’t optional, and neutrality is an illusion.

Why Boycotts Are Becoming More Frequent

Several forces have converged to make consumer boycotts more widespread—and more impactful—than ever before.

- The Acceleration of Social Media

What once took months of grassroots organizing now happens in minutes. A single viral post can mobilize millions, turning hashtags like #BoycottApple and #DeleteUber into economic flashpoints overnight. The sheer speed of digital outrage leaves companies scrambling to control the narrative before it spirals.

- The Rise of Economic Nationalism

Boycotts are no longer just ideological protests—they’ve become geopolitical weapons. Trade disputes between the U.S., China, Japan, and South Korea have fueled consumer-driven economic retaliation, proving that governments are no longer the sole enforcers of economic policy.

- Shifting Consumer Expectations

Millennials and Gen Z expect companies to align with their values—not just sell products. According to a 2023 Harris Poll, 71% of Gen Z consumers say they would stop buying from a company that does not reflect their beliefs. Corporate reputation is no longer just about products—it’s about leadership, ethics, and action.

A New Risk: Backlash from Both Sides

Boycotts today aren’t just about what a company does—they’re about how different ideological groups interpret its actions. The result? Backlash from both sides.

- Disney (2022-Present) – After opposing Florida’s Parental Rights in Education bill, Disney became a target for both progressive activists (demanding stronger action) and conservatives (accusing it of corporate activism). The result? Sustained boycotts from competing sides.

- Bud Light (2023) – The brand’s handling of its partnership with Dylan Mulvaney alienated both conservatives (who boycotted over the campaign itself) and progressives (who boycotted after Bud Light failed to stand by its decision). The result? A record sales decline and a leadership shake-up.

- Target (2023-Present) – After backlash over its Pride Month merchandise, Target scaled back displays in conservative regions—only to face boycotts from both the right (for supporting LGBTQ+ issues) and the left (for failing to stand firm).

The Increasing Polarization of Boycotts

Consumer boycotts have long been a form of economic resistance, but today they are something more—a permanent force reshaping how brands interact with the public. They are faster, more politically charged, and more frequent than ever. Companies aren’t just selling products anymore; they are expected to serve as political, cultural, and ethical entities. This shift demands a new kind of leadership—one that treats consumer activism as a reality to be managed, not just a crisis to be feared.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Forever 21 is closing its doors – again. Once the crown jewel of American mall culture, the fast-fashion giant is filing for bankruptcy for the second time in under five years. As shuttered storefronts stretch across the US, its downfall has become more than a brand misstep – a sign that the old fast-fashion model is running out of time.

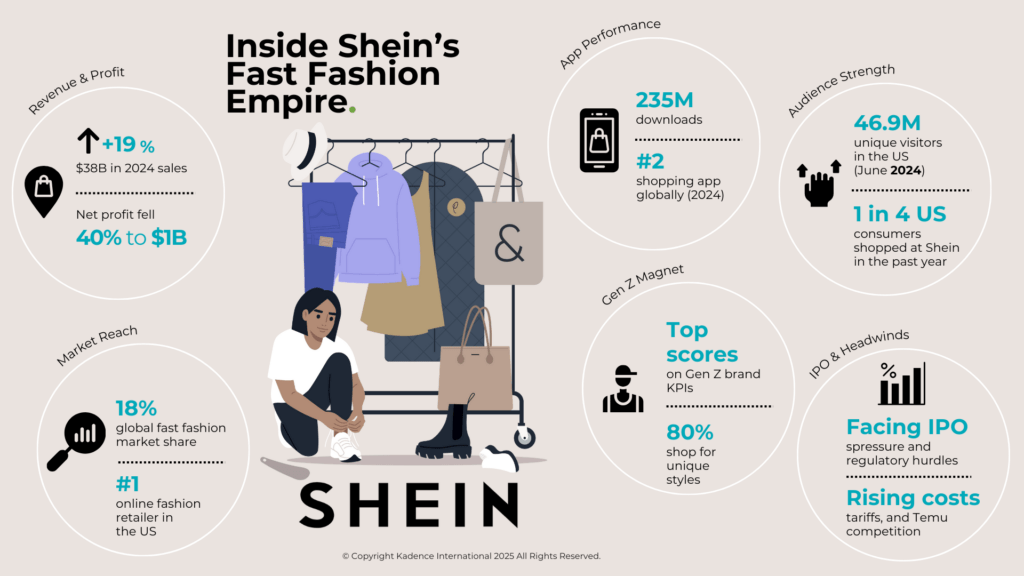

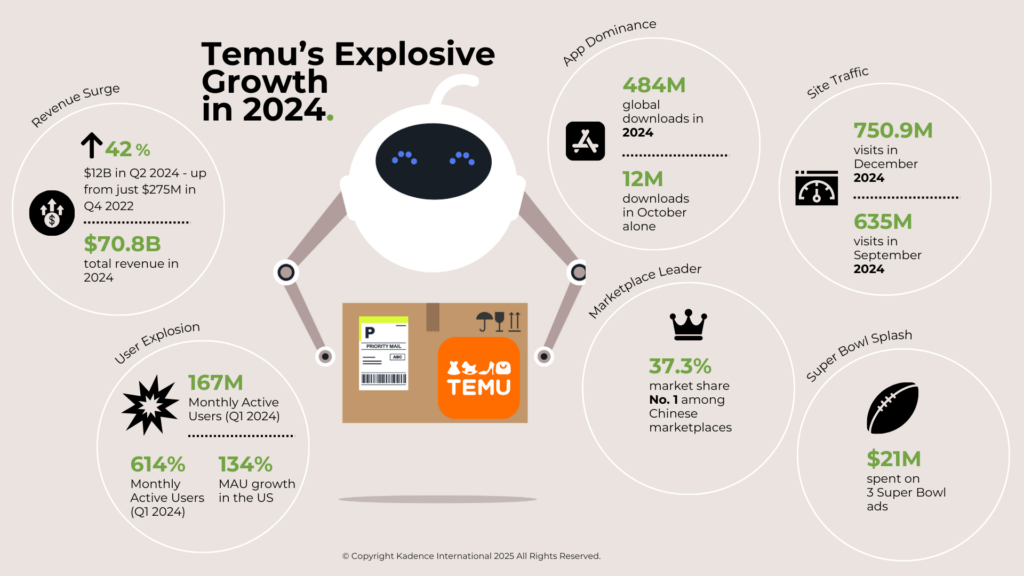

In its place, a new breed of fashion titans is rising. Shein and Temu, two digital-first platforms with Chinese roots, have turned the industry on its head. Their tools? Artificial intelligence, real-time trend scraping, lightning-fast production, and a hyper-personalized consumer journey. These aren’t just cheap alternatives; they’re smart machines designed for a generation that grew up with TikTok, interactive shopping, and constant trends.

Forever 21’s decline isn’t a singular event. It’s part of a deeper market shift – one where legacy playbooks are being rewritten by code, content, and community. As fashion retail becomes more focused on digital channels, brands that do not change may become outdated and irrelevant.

Forever 21’s Fall Signals a Broken Retail Model

Forever 21’s descent didn’t happen overnight. It was a slow unraveling, a brand once emblematic of youth culture now outpaced by the very consumers it once captivated. At its peak, Forever 21 thrived on trend turnover, sprawling mall spaces, and low prices. But the retail landscape changed, and the brand didn’t.

As digital shopping accelerated and consumer expectations shifted, Forever 21 remained tethered to an outdated model – long production cycles, centralized design decisions, and a heavy reliance on brick-and-mortar foot traffic. Its once-successful approach became a liability. While consumers moved toward immediacy and personalization, the company doubled down on bulk inventory, sluggish turnarounds, and static pricing. It failed to keep pace with the velocity of online trend formation – a pace now dictated not by runways or retail calendars but by social feeds refreshed by the second.

The gap widened as Gen Z entered the market. Raised in an era of choice overload, platform-native shoppers sought brands that moved with them – fluid, responsive, and in sync with their aesthetic sensibilities. Forever 21, by contrast, felt stuck. Its collections lagged behind trends. Its online presence was clunky. It couldn’t deliver the frictionless experience digital-native brands were engineering.

Even attempts at reinvention – rebrands, collaborations, and in-store tech integrations – were often too reactive or off-mark. Market research during this period revealed a steady erosion in brand affinity among younger demographics, who increasingly dismissed mall-based fast fashion as outdated, unoriginal, or environmentally negligent. The retail floors, once buzzing with teens became quieter, the racks fuller, and the margins thinner.

The retail model that once made Forever 21 a sensation has become outdated. And in an industry that now rewards adaptability over legacy, the brand’s decline underscores a critical truth: fashion doesn’t wait.

Shein and Temu Built a Smarter System

While legacy players like Forever 21 struggled to pivot, Shein and Temu were busy rewriting the rules of engagement. What distinguishes them isn’t just speed – it’s the system beneath the surface, a high-velocity engine built on data, automation, and platform-native behavior. These brands aren’t retailers in the traditional sense; they’re algorithmic marketplaces fueled by machine learning, social signals, and a relentless feedback loop between consumer demand and product creation.

Shein, in particular, operates more like a tech company than a fashion label. Its infrastructure is designed to detect real-time micro-trends, testing new styles in limited batches and scaling only the best performers. Instead of seasonal collections, it drops thousands of SKUs daily – each one a calculated bet based on keyword spikes, user behavior, and social engagement. What used to take legacy brands months now takes Shein days, with entire production cycles compressed into near real-time manufacturing.

Image Credit: Boffin Coders

Temu is building dominance on a different front. Backed by the e-commerce powerhouse PDD Holdings, its model leans heavily on gamification and bottom-dollar pricing, turning shopping into a behavioral loop. Discounts are dynamic, product discovery is algorithmically engineered, and the platform’s addictive scroll mimics social media architecture. Rather than chasing trends, Temu floods the feed with hyper-targeted inventory based on browsing data, purchase history, and behavioral nudges. Brand storytelling becomes secondary to price, pace, and personalization in this context.

Image Credit: Tech Crunch

Both companies excel at bypassing traditional gatekeepers. Instead of relying on expensive ad campaigns or celebrity endorsements, they tap into the power of peer-to-peer virality. TikTok hauls, influencer codes, and affiliate campaigns do more than drive traffic – they create a cultural moment, making shopping a social performance. The result is a decentralized and infinitely scalable distribution model.

Where traditional fast fashion brands pushed products, Shein and Temu pull consumers into a constantly evolving loop of discovery, validation, and conversion. It’s a model built not on intuition but on information, a data-centric approach that doesn’t just respond to the market but often predicts it.

Speed and Price Now Come with a Cost

But the same mechanisms fueling this meteoric rise are now drawing intensified scrutiny. As Shein and Temu scale at breakneck speed, regulators, watchdogs, and increasingly vocal consumer groups are beginning to question the true cost of their success. Investigations into labor practices, environmental degradation, and product safety are no longer confined to fringe activism; they’re reaching mainstream legislative agendas in the U.S. and Europe.

To soften criticism, Shein recently launched a resale platform in the U.S., positioning it as a circular fashion solution. Branded as a way for consumers to buy and sell secondhand Shein items, the initiative appears, on the surface, to nod toward sustainability. But industry experts and environmental advocates have been quick to call it out. Critics argue that the move lacks substance, pointing out that reselling ultra-low-quality garments does little to counteract the brand’s core business model – one built on volume, disposability, and micro-trend churn. The resale program, some say, is more about optics than impact.

Image Credit: Glossy

This tension highlights a bigger issue in the industry. The European Union has suggested tougher rules for transparency in textile imports, and U.S. lawmakers want more oversight on very cheap goods coming in through de minimis loopholes. These regulatory flashpoints are less about fashion and more about accountability – demanding that platforms operating on mass micro-consumption clarify how and where products are made, under what conditions, and at what environmental cost.

At the same time, cultural sentiment is shifting. What was once dismissed as disposable fashion is becoming a reputational risk. High-visibility criticism from sustainability influencers, investigative journalists, and even former brand collaborators is reshaping the narrative around what it means to shop cheap. For a growing subset of consumers, convenience and cost are no longer blind spots; they’re trade-offs weighed against a rising ethical awareness.

Still, the backlash isn’t yet translating into behavioral change at scale. Most consumers prioritize value and speed, even as they express concerns about sustainability. But the growing friction between convenience and conscience is opening a critical window. For competitors, this is a signal: the future of fast fashion won’t just be about how quickly brands can produce – it will hinge on how transparently they can operate in a world that’s starting to ask harder questions.

Retailers Must Rethink the Entire Playbook

The road ahead demands a fundamental shift in how fashion brands think, operate, and communicate. Survival won’t come from marginal tweaks to legacy systems but from a reengineering of retail itself – beginning with the supply chain.

Brands must move beyond cost efficiency and embrace operational intelligence. That means investing in technologies that enable demand sensing, real-time replenishment, and localized micro-manufacturing. Flexibility is no longer optional; it’s the foundation of relevance.

Equally critical is the evolution of pricing strategy. Competing with Shein and Temu on cost alone is a race few can afford to run. Instead, smart pricing – anchored in perceived value, quality assurance, and ethical sourcing – offers a more sustainable path. Consumers may be price-conscious, but they’re also becoming more aware of what pricing signals. Transparency around why a product costs what it does can strengthen trust and justify margins in a way race-to-the-bottom tactics cannot.

The marketing function must also be rebuilt for the algorithmic age. Traditional seasonal campaigns are losing ground to dynamic, always-on storytelling that responds to cultural shifts and consumer moods in real-time. This is where social commerce becomes critical, not as a trend but as infrastructure. Influencers are not just amplifiers; they’re now co-creators, collaborators, and curators of brand identity. Investing in decentralized content strategies, creator partnerships, and community-led design isn’t a nice to have – it’s how brands remain visible in a crowded, scroll-driven marketplace.

Finally, there’s the matter of trust. Authenticity becomes the ultimate differentiator in an ecosystem flooded with low-cost, high-frequency goods. Brands that can demonstrate their values through verifiable action – whether in ESG commitments, labor transparency, or community impact – will carve out a deeper connection with consumers navigating ethics. It’s not about appealing to everyone; it’s about being clear, consistent, and credible in what you stand for.

The Fast Fashion Reckoning Is Already Here

The fast fashion battleground is no longer about who can flood the market with the most products – it’s about who can navigate a volatile consumer landscape with speed, precision, and purpose. Shein and Temu have exposed the vulnerabilities of legacy brands not just by being faster or cheaper but by building systems attuned to cultural momentum, behavioral data, and the economics of digital attention. But their rise also highlights the limits of optimization when values, trust, and transparency are left out of the equation.

The future belongs to brands that can do both – move at the algorithm’s speed while operating with the discipline of long-term stewardship. Fashion is evolving from a product-based business to a platform-based experience, where relevance is won not once but constantly. For incumbents and challengers alike, this moment is not just a test of resilience. It’s a call to rethink what fashion means in a world where everything can be copied, but not everything can connect.

The rules have changed. What remains is the opportunity for those willing to radically rethink their systems as Shein and Temu have and to act before the next store closes.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

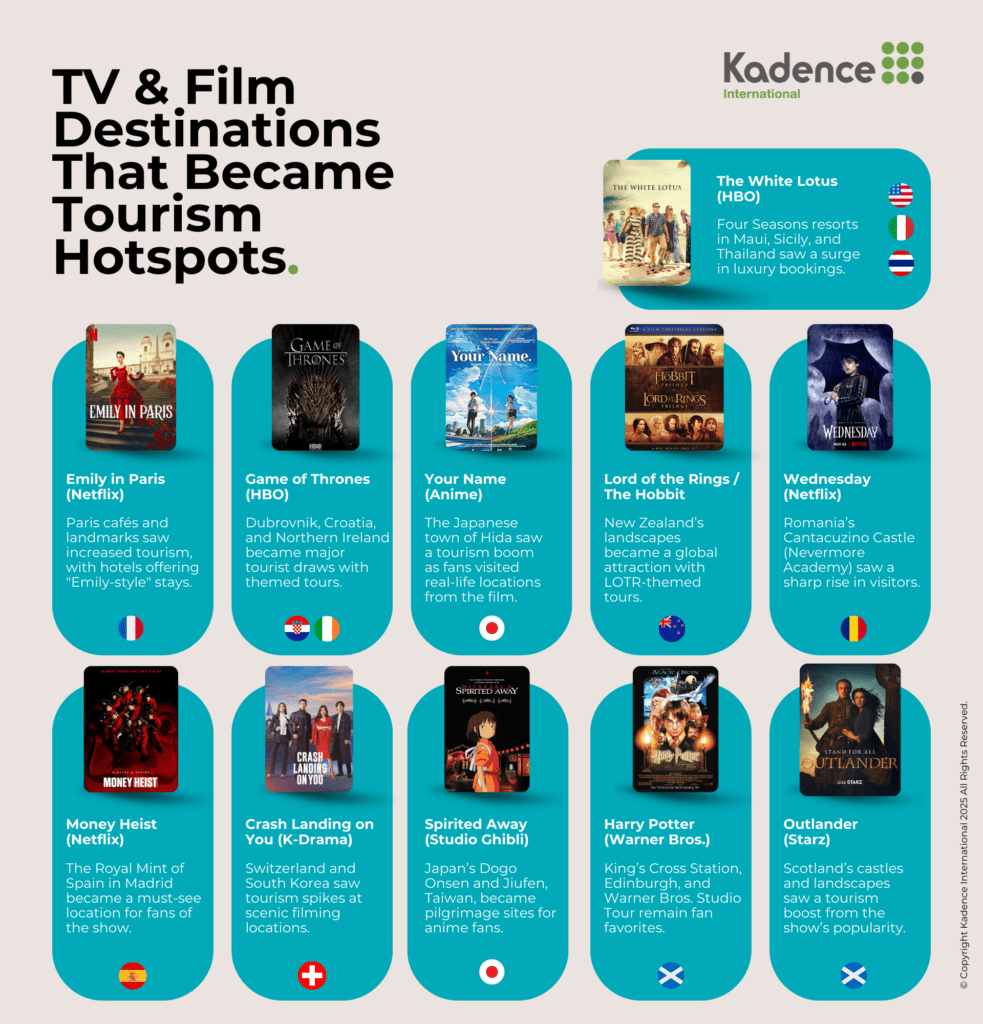

A TV show about dysfunctional elites on vacation has done more for Four Seasons’ bottom line than any ad campaign could. Since The White Lotus aired, bookings at the luxury hotel’s Maui, Sicily, and Thailand properties have surged, with high-end suites seeing record demand. The show didn’t just showcase opulence – it turned its filming locations into must-visit destinations for high-net-worth travelers.

What started as a pandemic-era gamble – letting HBO use Four Seasons resorts as backdrops for satire – has become a masterclass in luxury hospitality marketing. Now, the brand is doubling down, offering private jet tours between its White Lotus resorts and reshaping how luxury travel intersects with pop culture.

This isn’t just a tourism bump. It’s a blueprint for how high-end brands can turn cultural cachet into long-term revenue.

Turning Screen Time into Bookings

The White Lotus didn’t just feature Four Seasons;it made the brand part of the story.

Following the debut of The White Lotus, Four Seasons experienced significant increases in interest and bookings. For instance, after Season 1, the Four Seasons Resort Maui at Wailea saw a 425% year-over-year increase in website visits and a 386% rise in availability checks. Similarly, during Season 2, the Four Seasons Hotel Taormina in Sicily reported a 193% increase in web traffic. With Season 3 set in Thailand, the Four Seasons Resort Koh Samui has already observed a 65% spike in searches shortly after the premiere.

Four Seasons Resort Maui at Wailea became shorthand for tropical indulgence, while Sicily’s San Domenico Palace, once a monastery, emerged as an icon of old-world grandeur. Following Season 2, the Sicilian property saw a 193% increase in web traffic. Now, with Season 3 set in Thailand, the Four Seasons Resort Koh Samui has already recorded a 65% surge in searches from travelers looking to step into the show’s next setting.

Rather than letting the hype fade, the hotel chain quickly capitalized. It introduced private jet itineraries linking its White Lotus resorts, offering an ultra-luxury package for guests looking to replicate the on-screen experience. More than just a tourism boost, the HBO partnership has given Four Seasons a new brand identity – one that sells not just a stay but a story.

TV Tourism Is the New Gold Rush for Hospitality Brands

Four Seasons isn’t the only brand cashing in on TV tourism. After Emily in Paris, hotel bookings in the French capital spiked, with luxury stays marketing their own “Emily-style” experiences. Game of Thrones turned Dubrovnik into a global tourism hotspot, with visitors flooding its medieval streets years after the series ended. The message is clear: travelers don’t just want a destination, they want a cinematic setting.

Hospitality brands are responding fast. Hotels are no longer just offering rooms – they’re curating worlds viewers already feel connected to. With the right media partnership, a resort becomes more than a destination; it becomes a cultural landmark. But to turn a pop culture moment into long-term brand value, it takes more than just letting the cameras roll.

Four Seasons understood this shift. It didn’t just lend its properties to The White Lotus; it leveraged the show’s themes of exclusivity and indulgence to redefine its own brand narrative. Every infinity pool, oceanfront suite, and private excursion wasn’t just a set piece; it became part of the experience the hotel could sell long after the credits rolled.

Experiential and Ultra-Luxury Tourism Is Redefining Travel Marketing

For luxury travelers, a five-star suite alone no longer satisfies. Today’s premium offering is access – an experience so exclusive, it feels scripted. This expectation is driving the rise of “live the show” tourism, where resorts don’t just host guests – they immerse them in a narrative they’ve already bought into.

Four Seasons has capitalized on this demand. In Sicily, guests can book private yacht tours along the same coastline where The White Lotus characters plotted their next move. In Thailand, where the latest season premiered, the chain has been marketing cultural excursions inspired by the series, turning its resorts into real-life extensions of the show’s world.

The strategy is paying off. VIP packages, custom itineraries, and pop culture-branded experiences now command premium rates – some exceeding $10,000 per stay, according to industry reports. Luxury travelers aren’t just buying comfort; they’re buying cultural capital. For hospitality brands, the takeaway is clear: locations don’t sell on their own. Story-driven experiences do.

Is TV the New Luxury Travel Influencer?

Forget glossy travel ads and celebrity endorsements – scripted entertainment is proving to be a more powerful driver of luxury tourism. The White Lotus turned Four Seasons from a high-end hotel chain into a must-visit brand, delivering hours of aspirational storytelling that no traditional campaign could replicate.

Luxury hospitality groups are taking note. The right on-screen exposure doesn’t just showcase a destination; it reshapes traveler demand. Hotels, airlines, and tour operators now see productions as strategic partners rather than passive tenants. From filming incentives to immersive brand collaborations, entertainment is becoming a long-term marketing asset.

For Four Seasons, The White Lotus wasn’t just a tourism bump – it was a repositioning moment. The show’s themes of wealth and indulgence aligned so closely with the brand that its resorts felt like characters in the story. Now, as other luxury brands chase their own White Lotus moment, the real competition isn’t location or amenities – it’s cultural relevance.

Luxury Hospitality Is Turning to Entertainment as a Growth Strategy

Four Seasons didn’t just benefit from The White Lotus; it created a new blueprint for luxury travel marketing. The divide between entertainment and hospitality is disappearing, and brands that fail to adapt risk being left behind.

High-end hotels are now seeking strategic partnerships with streaming platforms, aiming to replicate Four Seasons’ success. Destination collaborations with filmmakers are no longer just background deals; they’re becoming core business strategies designed to position hotels as aspirational travel hubs. The next phase of entertainment-driven tourism isn’t passive product placement; it’s about immersive brand integration, where travelers don’t just visit a location – they step inside a story.

This shift is already happening. Hotels are launching co-created experiences, interactive stays, and even story-driven itineraries modeled on cinematic worlds. The most forward-looking brands are embedding themselves where travel, entertainment, and culture converge – turning pop culture into long-term brand growth.

Cultural Relevance Is the New Currency of Luxury

In luxury hospitality, the meaning of status is shifting. It’s no longer defined solely by five-star service or remote, exclusive locations. Today, status is increasingly measured by how seamlessly a brand lives within the cultural moment.

The White Lotus gave Four Seasons more than exposure – it gave the brand narrative power. Suddenly, staying at the Four Seasons wasn’t just aspirational; it was culturally resonant. In a world where travelers want to mean as much as an indulgence, the ability to connect with the zeitgeist is the ultimate differentiator.

In the attention economy, real luxury is no longer about where you go. It’s about how that place makes you feel – and whether the world is paying attention when you get there.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Once upon a time, toy stores decided what lined the shelves and, in turn, what kids begged their parents for. Not anymore. Social media can turn an obscure plush toy into a global obsession overnight, artificial intelligence is blurring the line between play and companionship, and a new wave of adult collectors is redefining what it means to be a toy brand. The business of play has become an unpredictable, high-stakes competition where the next blockbuster toy could come from anywhere.

Worth over $108 billion, the global toy market isn’t slowing down – it’s evolving. Consumers aren’t just looking for play; they’re looking for connection, creativity, and collectibility. AI-powered toys that respond like real companions, nostalgia-packed reboots, and digital-physical hybrids are shaking up the industry, forcing brands to rethink the blueprint of a best-seller.