As a result of the COVID-19 lockdowns, education institutions across the globe have faced a myriad of challenges, including the move to distance learning and finding new ways to support pupils. Students have also had to adapt with the support of an in-person learning environment

Now that some educational institutions are emerging from the pandemic, it will be important not just to address short term needs but also to identify innovations that can be adopted to improve student learning in the long run.

This piece explores three key challenges to address in the short term but also considers the long-term implications of what these new changes may bring. The 3 themes we’ll be looking at are:

- The role of a “classroom” and going beyond physical spaces

- Rethinking the way we share knowledge

- Addressing current inequalities and what educators can do to ensure the future success of students

Where is the classroom?

Short-term trends

As governments and educational institutions make decisions on when and how to reopen schools, health and safety is naturally front of mind. Some schools have opened with strict checking procedures in place. In Shanghai, for instance, students are required to enter the school building via a thermal scanner and there are multiple posters in place highlighting the measures in place to tackle coronavirus. In other schools, remote learning is still continuing as only limited numbers of pupils return. Schools in New South Wales, Australia, for example, have re-opened but are only allowing students to attend one day a week on a staggered basis. Whatever the approach, the priority continues to be safeguarding people’s wellbeing and schools will observe and learn from countries that are practicing safe re-opening procedures.

Long-term trends

However, the COVID crisis has also demonstrated that classrooms are not the only places where education can take place. The pandemic has highlighted that learning can take place at any time, anywhere and in any way. It’s clear that the opportunities offered by digital capabilities will go well beyond its temporarily use during the crisis.

Technology can enable teachers and students to access massive amounts of digital resources, most of which are free to use. Examples from other countries have also shown that the delivery of information through various means – TV, online, mobile – can work to help engage students. What’s more, AI and digital technology are now able to capture data to measure students’ progress so that learning can be adjusted based on ongoing assessments rather than through high stakes exams.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Rethinking Knowledge Sharing

Short-term trends

Just as students are adjusting to distance learning, most teachers are also new to teaching online and have had to quickly adapt their lessons to an online format that keeps pupils engaged.

But teachers don’t just need the technological tools to facilitate online learning. They need resources to help enhance their teaching practice. A number of initiatives have sprung up around the world to facilitate this. In South Korea, the Education and Research Information Service offers an online platform to facilitate the sharing of materials created by teachers and in the United Arab Emirates, the Ministry of Education invited over 40,000 teachers to take part in a ‘Be an online tutor in 24 hours’ course. Global organizations such as the Khan Academy, TEDed, Google Arts & Culture are also continually providing relevant education resources for students and teachers.

Long-term trends

In the long-term, we may see a new form of teaching emerging. In a world where students can access to knowledge through a few clicks, educators will need to review and potentially redefine their role in the classroom.

The emphasis should be not only on the delivery of content but also on generating engagement. Educators need to learn to create a positive experience within a digital context – one that is more interactive and engaging. One organisation leading the way on this is Singapore’s SIT University, which has created training materials for lecturers to provide online learning. The topics covered how to create narrated slides, how to run effective live streaming classes, how to design alternative assessments, and the use of online proctoring tools for assessments.

Addressing current inequalities and what educators can do to ensure the future success of students

Short-term trends

While technology has helped many students continue their education at home, data from UNESCO has found that in other ways, it has exacerbated the digital divide. Half of all students do not have access to a computer and more than 40% have no internet access at home.

Students living in rural areas, low-income households, students with special needs and those living in less developed areas face issues with a lack of resources including not having the technology needed for remote learning.

Governments, private companies, and educational institutions need to be able to work in partnership to ensure that needs of all students are met. Success stories from around the world can provide inspiration. In France, the University of Strasbourg identified students whose lack of resources jeopardised their ability to continue their education, setting up an Emergency Fund and distributing more than a hundred computers to students in need. China offered mobile data packages, telecom subsidies and repurposed some of the state-run television channel to air lesson plans for K–12 education in remote regions. Italy put together an €85 million Euro package to support distance learning for 8.5 million students and improve connectivity in isolated areas.

Long-term trends

While COVID-19 has fast-tracked the need to acquire digital skills, we also cannot forget the education students will need to prepare them for the workplace of the future.

As a result of the pandemic, the demand for certain jobs and specialities will decline, whilst otherareas come to the fore. Educational institutions need to be flexible enough to adapt their curriculum and resources to meet students’ and workforces’ changing needs.

There will continue to be a need to train people in emerging digital skills but learners will also need “non-automatable” skills. According to the World Economic Forum’s Future of Jobs Survey, “a wide range of occupations will require a higher degree of cognitive abilities — such as creativity, logical reasoning and problem sensitivity — as part of their core skill set.” Institutions who more readily recognise and adapt their curriculum and resources to meet these needs are more likely to thrive moving forwards.

You might also be interested in

The automotive industry has been one of the hardest hit by the pandemic. Cars have lain dormant in driveways for months as a result of lockdowns across the world, and economic shutdowns hit supply chains, with reports of some manufacturers even resorting to flying parts across the world in suitcases.

But as consumers emerge into a ‘new normal’, what does this mean for the automotive industry? What are the trends to watch – both in the short and the long-term?

In this article, our auto experts across the UK, Thailand and Indonesia, Bianca Abulafia, Digo Alanda and Kajornkiat Kiatsunthorn explore 3 key areas:

- Changing purchase patterns

- The future of electric

- The digital path to purchase

Changing purchase patterns

Short term

In the short-term, we expect to see growth in the second hand and luxury end of the market especially.

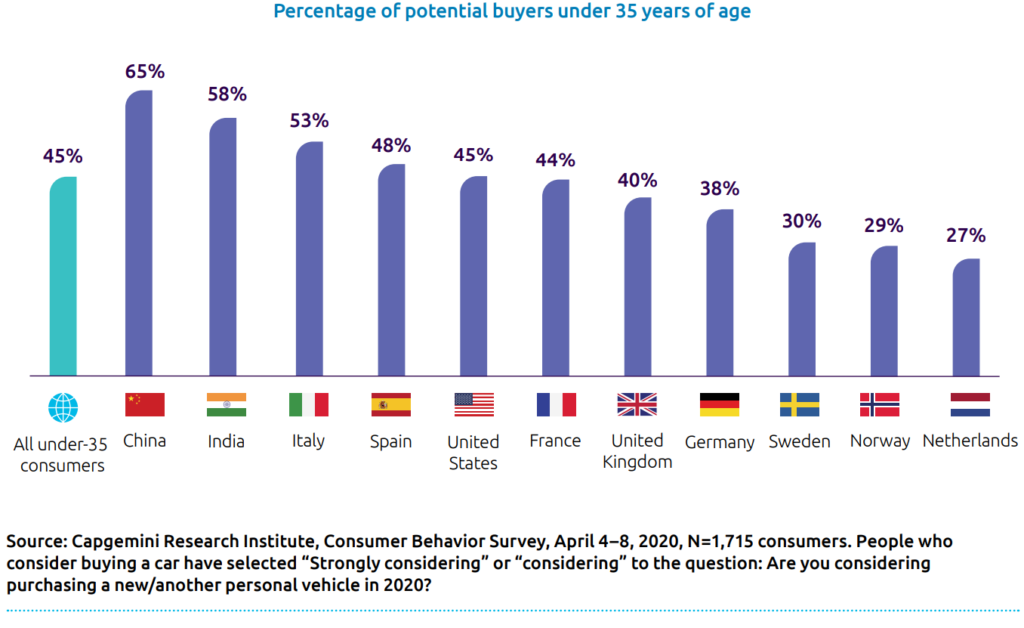

The pandemic has resulted in a renewed focus on the car as hygiene concerns have come to the fore. This has resulted in those that have previously shunned car ownership such as urbanites and young people re-evaluating their stance. In the US, a cars.com study showed that 20% of people who don’t own a car are thinking of buying one, and this figure rises when we hone in on young people. A recent global Capgemini survey of under 35s shows that 45% are considering buying a car and this is highest in countries that have been hardest hit by the pandemic.

We have talked about the emergence of “revenge buying” in other sectors, and we expect this to manifest in the automotive industry within the second-hand market as a more affordable option for younger buyers. “Revenge buying” is also relevant at the luxury end of the market. As a result of being able to save, the budget of some affluent buyers has increased, meaning that they’re now able to trade up. Volvo’s Chief Executive notes this has happened in China, where the company has seen a 20% increase in sales compared to 2019. “People are really tired of sitting at home locked and they really want to go out and buy.” Outside of this, we expect sales to suffer, with existing car owners putting off purchases in the midst of economic instability.

Long-term

Looking at the long-term impact, it will take some time until car sales return to pre-COVID levels. An ING report, looks back to the 2008 financial crisis for indicators, highlighting that it took 11 months for vehicle sales to recover in this instance. But if we consider that this pandemic has brought lifestyle and behavioural changes, in addition to economic instability, it’s much harder to predict.

In the long-term, will we see a permanent shift towards home working that encourages people to move out of urban centres, necessitating the need for a car? Will increased domestic tourism result in a desire to have access to a car for longer trips – ushering in an opportunity for shared ownership of vehicles? The automotive industry doesn’t exist in a vacuum and it will be vital for auto manufacturers to observe the broad trends to understand where they can play a role.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

The digital path to purchase

Short-term

Car manufacturers have had to rapidly adapt to a new sales environment, as they seek to comply with social distancing measures and meet the needs of the more cautious shopper. Capgemini’s COVID-19 and The Automotive Consumer report indicates that 46% of consumers want to minimise visits to dealerships to compare offers, instead preferring to do this online. We’ve seen lots of innovative responses to this. In China, for instance, Volkswagen has trained 70,000 employees to communicate with customers online, even livestreaming from dealerships via TikTok and Kuaishou.

Long-term

In the long-term, we only expect this to continue. The impact of coronavirus has acted as a catalyst for the digital transformation of many industries, sparking changes in consumer behaviour that were thought to take years. Automotive will be no exception as people seek the convenience that they’re experiencing in their interactions with other brands and industries. This will be particularly important in the research phase but we believe it will also extend to online purchase and home delivery, with a recent Think with Google survey finding that 18% of people would buy a vehicle sooner if there was an online purchase option. The desire for convenience could also impact the after sales experience with servicing being carried out at home.

The future of electric

Short-term

In the immediate term, economic instability, plus the appeal of lower oil prices, could dissuade car buyers from making the move to electric. However, we don’t expect this to last long, with any savings from oil prices likely to be temporary, and not significant enough in the long-term to fundamentally influence decisions.

One area to watch is other electric transportation options beyond the car – such as scooters and bikes. As people avoid public transport and seek other routes around the city, governments are having to radically rethink how they can support this. The UK has announced that improvements in cycling infrastructure and trials to allow rented e-scooters on the streets have been fast-tracked, which could encourage people to start exploring electric bikes and scooters as alternative options for commuting. Increased familiarity with electric powered means of transportation could result in a greater adoption of motorbikes or cars.

Long-term

When we look at the long-term view, we don’t expect the shift towards electric to be significantly impacted. From the canals in Venice being clear enough to see the fish to Nasa satellite images showing the dramatic drop into pollution levels in China, the upsides of the lockdown on the environment have been well documented – with many consumers acknowledging benefits of this on their quality of life.

This could influence purchase behaviours in the longer term, with consumers wanting to do their bit for the environment at the point at which economic conditions become more favourable for them to do so. But more significantly, changing consumer sentiment towards the environment is also likely to increase pressure on governments to bolster schemes to incentivise electric car ownership, making them a more financially attractive proposition to car buyers. In fact, this is something that has already happened in China in the wake of the pandemic, with some cities announcing subsidies for new electric vehicles, and others upping their investment in the associated infrastructure.

We also shouldn’t forget the status symbol factor, particularly in the luxury segment. Our research has shown that owning an electric car represents a new way to demonstrate wealth and status, and we don’t see this diminishing any time soon.

You might also be interested in

When we look the impact of COVID-19 on the media industry it’s a mixed picture. Whilst some areas, like video streaming services, have thrived as a result of increased time at home, others have come to a complete standstill, such as OOH advertising and cinema. But which trends in media will persist?

In this article we explore 3 key areas of the media landscape:

- Linear TV

- Streaming services

- Advertising

The role of linear TV

Short-term changes

As people have been forced to spend time at home and routines have been upended, viewing of linear television has enjoyed a resurgence. According to the BBC, viewers were watching 44% more linear channels in May compared to this time last year, rising to 67% for young people. A trend that flies in the face of pre-pandemic viewing behaviour.

The rise of linear television in this period should really come as no surprise. It’s allowing for shared moments at a time when human connection is in short supply. Thinkbox observed a 30% increase in shared viewing in this period.

Content preferences have also shifted, reflecting the pandemic situation, with programmes that allow for nostalgia and escapism proving popular with viewers.

Long-term trends

We expect the rise of linear TV to be short-lived. As a direct response to the lockdown, it’s unlikely that this behaviour will persist as the pandemic subsides. As economies reopen, and consumers given more freedom to socialise, we expect to see linear TV consumption patterns return to pre-pandemic levels, as the long-term trends we’ve seen towards VOD and SVOD continuing.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Streaming

Short-term changes

Streaming providers have been one of few beneficiaries of the COVID-19 crisis. With more time on their hands at home, people are turning to paid online streaming services – and some for the very first time. A survey for the Consumer Technology Association carried out in March found that 26% of US consumers are using video streaming services for the first time. A combination of new users like these, and others that have added to their existing subscriptions are creating big returns for streaming giants. In the first quarter, Netflix more than doubled the number of new subscribers it had expected. Disney Plus is another success story. Just 8 months after launch, it has over 54 million subscribers globally. This puts it in touching distance of its 2024 target, a whole 4 years early.

Medium and long term

In the long-term, it’s difficult to predict exactly how streaming will fare. One school of thought is that as the economic impact of the crisis hits consumers will re-evaluate their discretionary spending, and cut back, which could see subscriber numbers fall, particularly amongst those with multiple subscriptions.

Others argue that as consumers tighten the purse strings, they’ll be scaling back on more significant purchases. This could mean that spend on streaming services will be protected as a worthwhile investment, particularly if the focus on the home remains, with working from home continuing in the long term.

One trend that we expect to remain is the emphasis on shared viewing on demand. We’ve seen streaming providers innovating to meet this need with features like Netflix Party, that allow users in different locations to synchronise playback and communicate via a group chat. Meeting the desire for shared experiences but enabling different audiences in one household to watch what they like, we see this trend being important in future.

Another development to watch out in the medium-term is the future of film. During the pandemic Universal Pictures made some of its film releases available on demand on Comcast, Sky, Apple and Amazon for a one-off fee. With the emphasis on value for money and continued social distancing, will this be an attractive option to consumers in the medium, and a way to offset lost revenues from cinemas?

Advertising

Short term

The drop in advertising spending during the pandemic has been well documented. According to a report from Publicis, Q1 ad spend was down 15% in China and 9% across Europe, as companies sought to cut costs and postpone campaigns. And with this continuing in Q2 and into the second half of the year, the World Federation of Advertisers predicting a 31% decrease in investments across 2020.

In response to the pandemic the tone of ads has changed too, with many brands emphasising their contribution to the relief effort or how they’re supporting customers in this difficult time. In the short-term, we can’t expect an immediate return to pre-pandemic marketing strategies. Our recent research Brands Exposed research, with 4,000 consumers across 10 countries found that levels of worry around the pandemic influence how consumers respond to ads, with overt sales messaging being rejected by those that are most worried, in favour of more reassuring advertising. This indicates that in the short-term, brands will need to make a concerted effort to understand the sentiment of their customer base and position their ads accordingly.

Medium to long-term

Advertising has always had to shift in response to behavioural changes, and this will be no exception. A recent Goldman Sachs report predicts that “the crisis will only accelerate the secular shift in advertising budgets towards digital.”

In the medium and long-term, we expect to see brands funnelling more money into digital advertising, reflecting the increase in time that consumers are spending on digital channels. Social media usage is up 21% globally. It’s likely that advertisers will also look to move ad spend towards ad supported streaming services, at the expense of TV.

In the long-run, we also expect to brands continuing to place a sustained importance on responsibility and honesty, in response to rising consumer expectations, as suggested by our Brands Exposed research.

You might also be interested in

Over the past few months, COVID-19 has had a significant impact on how we think and behave when it comes to food and beverage (F&B). When lockdowns were implemented in countries around the world, non-essential retailers were closed, dining-in was prohibited, and supply chains were tested. As a result, buying behaviours and attitudes have changed and F&B retailers are having to respond rapidly. Those that are able to act quickly will be able to emerge triumphant past the crisis, with many new strategies remaining relevant even after the pandemic.

As countries are opening up, a common question among businesses is ‘what next?’ Governments around the world are trialing different measures to reopen the market, while trying to minimize the likelihood of a second wave of mass infections. Businesses are on one hand rapidly trying to adapt to the latest governmental policies, and on the other, thinking about how they should change to cater to a marketplace that in some ways looks very different. We’ll explore 3 key trends, with our thoughts on what is likely to stay post-COVID when it comes to F&B:

- Consumer behavioural changes

- Business adaptability

- Unfulfilled consumer needs

‘Stay home projects’: behavioural and purchasing patterns arising out of having to eat at home

Short term changes

While purchases of luxury products have largely decreased during the pandemic, there was a sharp rise in everyday products. With the closure of physical stores, and restaurants doing takeaway only, more people embarked on different ‘stay home projects’, experimenting with homemade recipes.

According to social listening data from Circus Social, people in Singapore, Japan, South Korea and Indonesia ended up making more homemade snacks during this period. In China, the sale of egg whisks on online retailer Tmall increased five-fold year on year. In Singapore, essential baking ingredients such as yeast and baking soda were wiped off the shelves in most supermarkets during the first month of the Circuit Breaker, and many consumers looking for alternatives online. This shift has had a huge impact on supermarkets and grocery retailers, forcing them to look for alternative sources of supply and diversifying their supply chain strategy.

The surge in interest in ‘stay home projects’ has also led to a dramatic increase in the viewership of inspiration channels as well as recipe searches, with Instagram-worthy home café recipes trending on social media shortly after they were posted. This presented opportunities for brands to think about showcasing their products through strategic product placements on these channels. This may not be a novel strategy, but it has become highly relevant given the larger share of eyeballs on these channels during this period. In addition, we see F&B brands offering home cooking meal kits, riding on the wave of ‘stay home projects’ and engaging with partners to showcase the ease of using these meal kits online.

Long term trends

We believe that many of these trends will persist even after lockdown. More people, including newbies in the kitchen, have found a love for cooking and baking, while homecooked meals have also brought many families closer together. With the increased appreciation towards ‘home projects’, we are expecting more people to cook at home than in pre-COVID times.

Improving e-commerce channels and offline-to-online services will be also important to meet the needs of consumers in the future. F&B retailers will need to up their e-commerce game. While brick and mortar stores will still remain relevant in the post-pandemic world, this period has shown the importance of having a strong e-commerce presence and robust supply chain. Consumers will become more used to shopping for groceries online, especially for products that they cannot typically find in the brick-and-mortar stores. If F&B brands want to extend their reach to a wider audience through e-commerce, the time to do so is now.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Adaptability: the virus has become the catalyst for tech and sales model evolution for F&B retailers

Short term changes

With every crisis, there is opportunity. COVID-19 has accelerated the evolution of the food retail space, and retailers are adapting in order to realign with the shift in purchasing priorities and new lifestyles.

When bubble tea stores were mandated to close during the Circuit Breaker in Singapore, some partnered other restaurants to continue their sales. Some cafes offered coffee subscription plans for the caffeine-deprived, and others introduced ‘Circuit Breaker meals’ to go along with their drinks. Restaurants that were limited by physical space, or located in less accessible areas, are now able to be on a more level playing field with other restaurants, as long as they have presence online and support home deliveries.

For some brands, the pandemic had a positive impact on their business as they discovered new opportunities online. More consumers got to know some establishments through social media and review sites, meaning that these brands are now able to reach more customers than ever before. However, being able to realise these positive outcomes depended on how fast retailers could adapt to the F&B landscape in lockdown. Whilst some partnered with established food delivery apps such as GrabFood or Deliveroo, others drew on their own staff for deliveries and adopted alternative ways of ordering, such as using SMS/WhatsApp, Instagram messages, or their own websites. During lockdown, consumers were more tolerant of the usability of the platform – instead being able to demonstrate that you were adapting quickly to meet consumer needs was more important.

Long term trends

In the long run, restaurants need to reassess the competitive landscape in order to continue to stand out post-pandemic. Every aspect of the typical sales funnel, such as brand awareness, consideration, and trial, would have shifted due to the purchase behavioral changes during the stay home period. Previously unknown brands may have gained popularity as they reached more consumers’ homes. Consumers will also have different assessment standards for restaurants post-COVID, such as hygiene standards. Retailers therefore need to reconsider their USPs to stand out amongst new competitors in the market.

Unfulfilled need: starving for experiences – an area brands can focus on during and post COVID

Short term changes

As the pandemic subsides, will restaurants still retain their delivery model? Yes and no. Less popular food places, and those restricted by physical location or the space required for social distancing may continue to improve their online platforms to expand their reach through deliveries. But, high-end restaurants and cafes may not. While taste is a critical component of the F&B experience, it has to go in hand with the service, the ambience, and even the company while dining in. Psychological research has also shown that the sense of taste plays only a small role in the whole dining experience. It is a multisensorial experience, which can be best presented in the curated setting of a restaurant, with its choice of plating, lighting, background music, and interior design.

Even though there are do-it-yourself packs for bubble tea or cocktails, for most the ambience of eating or drinking out is unbeatable, so F&B retailers will need to consider how they deliver the experiential aspect, whilst social distancing continues, in order to differentiate from other brands.

Medium to long term trends

Post pandemic, consumers who have been starved of in-restaurant F&B experiences will be hungry for these – and may not mind paying a premium. How can F&B retailers tap into this need while keeping in mind the greater expectations for hygiene standards?

Against, this backdrop, there’s an opportunity for F&B outlets to increase and monitise service personalisation. Having more attentive service, customisable menus and dishes, or even food that can ‘interact’ with the diner – basically things that cannot be recreated at home – can be considered by F&B retailers.

You might also be interested in

If you are anything like me, amidst the coronavirus and the global lockdown (even as some markets like Vietnam and Vienna are slowly returning to ‘normal’), you would be doing one of 3 things:

- Staying at home and minimizing social contact

- Trying to make home-based working happen while balancing all kinds of other personal life commitments

- Try to keep things light-hearted by looking at memes

While we all know that going back in time is not (yet) possible, brands can certainly try to move things forward by thinking about what they CAN do with the rest of the year. Dealing with uncertainty requires strategy and guidance, as detailed by our MD Phil Steggals in his recent article. That said, where do brands find guidance?

We at Kadence are big advocates of brands creating their own futures, rather than try to predict it. Earlier in the year, before the whole pandemic went global, we brought together trend watching experts from across our global boutique to identify four key trends that we believe will define the next 12 months, inspiring innovation across Asia, the US and Europe, that we outlined in this report.

While it may be still early in the year to review our own work (spoiler alert: we’re on the money!), we certainly think our identified trends are definitely relevant to the current times, and can guide brands to think about the rest of the year (and even beyond!)

First things first, a quick recap of the 4 trends:

- The shift towards 360-degree wellness

- The move from brand purpose to purposeful design

- Consumers left craving connection

- Personalisation reaching a new frontier as it moves offline

The shift towards 360-degree wellness: Trend vs. Manifestations

One of our key trends to watch for 2020 was the shift in how consumers are thinking about their wellbeing. We’re seeing consumers moving away from focusing purely on physical health and appearance, to now recognising the importance of their mental health too.

As an article discussing mental health issues in a recently re-opened Wuhan shows, this trend is definitely a strong one: Along with the countless new online fitness platforms that have sprung up over the past 6 weeks, the conversation is increasingly steering towards how people staying at home needs to pay attention to their mental health too. Already there are reports about how anxiety over job losses is impacting the American population, while closer to home, Singapore has decided to keep allied health services, such as psychology and social work, open because they are defined as ‘essential services’. Dealing with a global situation requires both physical and psychological strength, which is what this trend is all about.

What can my brand do with this in the #newnormal?

Regardless the industry you are in or the product/service that you offer, highlighting a mental benefit or creating one (within credible limits) will definitely benefit your brand’s standing with consumers, even after the situation improves – this trend is here to stay.

From brand purpose to purposeful design: Trend vs. Manifestations

Brand purpose is undoubtably one of the big trends of the past few years. We’ve seen ads against toxic masculinity, deforestation and discrimination, as brands have tried to convince consumers that they share their values and have a higher purpose than simply selling products. And with research from Havas Media showing that meaningful brands outperform the stock market by 134%, it’s easy to see why so many brands were quick to adopt this strategy.

But we’re starting to see a shift. As consumers begin calling these campaigns out for being all-talk and no action, companies are realising the need to move beyond surface-level brand purpose and to start embracing what we refer to as purposeful design, creating products and services which allow consumers to make the world a better place.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

There are numerous examples in this space that demonstrate how many big global brands actually ‘get’ it, and have quickly sprung into action in this global crisis: from Louis Vuitton (along with many other high-end luxury brands) producing pertinent medical supplies to Singapore gaming brand Razer pivoting from its core business to produce face masks, these show brands taking action on their beliefs, which can in turn inspire consumers to come forward and do their part as well.

What can my brand do with this in the #newnormal?

We want to believe that it should not take an international calamity for brands to be #woke and realize that ‘purposeful design’ should be at the heart of their operations from here on out. To be more specific, innovation in this space can fall into two categories – products and services which enables people to make a positive impact to the causes they care about and those which enable people to reduce their impact on the world around them. Regardless the product/service, is there a way that your brand can remain relevant in the #newnormal, and satisfy consumers increasing need for being better versions of themselves?

Consumers are left craving connection: Trend vs. Manifestations

This trend we identified focuses on consumers craving connection and a sense of belonging, in an increasingly divided and lonely world. People are now single for longer, meaning that more people are living alone, particularly in urban centres. A Washington Post wrote about how, in Japan, it’s predicted that 40% of households will be single person households by 2040. This trend is echoed in the West – in the US, half of young people aged 18 – 35 say they don’t have a steady romantic partner.

With global lockdowns in place, the way we work and socialize has been forcibly brought into the online world. Zoom meetings are becoming so frequent for work that ‘zoom fatigue’ is a real phenomenon, while social interactions online are a poor compromise because they literally lack the physicality that’s so much of a fundamental human need. These examples show how technological developments, hailed for their power to bring people together, have not always brought positive change, and are essentially stop-gap solutions for quality connections.

That said, though, connections made during this period inevitably become more ‘intimate’ as well (whether intended or not): bedrooms are shown to colleagues as background in work calls, while ‘bring your kid to work’ takes the reverse route because the child is very likely going to pop into the video camera during a conference session anytime. Even ‘live’ shows and music performances take on a ‘closer’ tonality as viewers are now given the chance to peep into a celebrity’s home! All these point to the possibility that consumers will demand not just more, but also better, connections in the post-COVID future.

What can my brand do with this in the #newnormal?

While there are experts who still feel that brands can still meaningfully enhance their customer experience digitally during the crisis, we would propose looking ahead and think about ‘connection’ in the broadest sense of the term, and see how both your brand can put that front and centre. This is not about ‘omnichannel’ or ‘O2O’; this is interrogating what kinds of meaningful connection your offering can provide your customers, as this pandemic leaves us with the realization that effective, rather than efficient, interactions are what they really crave.

Personalisation reaches a new frontier as it moves offline: Trend vs. Manifestations

We predicted that 2020 would see personalisation reach a new frontier as it increasingly starts to occupy offline, as well as online spaces, thanks to the proliferation of new technology.

We already see brands tapping into location and health data from smartphones and wearables to provide personalised products, services and marketing campaigns to consumers on the go. But the rise of facial recognition, and its integration into smart home technology, will take this to another level, making personalisation part of our homes, our shops, our day-to-day offline experiences.

While there aren’t any specific examples of how this trend manifests itself during the COVID situation, we are at least seeing some examples of brands and corporations speeding up the interfacing between offline and online, which may be a good start to push forth this trend. From major Hollywood blockbusters being released for online viewing faster than normal, to tech giants like Google and Facebook quickly updating/launching video chat functionalities to gain competitive edge, it shows brands can make necessary changes, if they want to.

What can my brand do with this in the #newnormal?

This advanced nature of this trend suggests that now’s as good a time as any to think about how your brand is really making sense of all that data to personalize not just messaging and comms, but also offline outreach/products and services that are relevant and pertinent to consumer needs (i.e. see above: Connections, Purposeful Design and 360-degrees Wellness), who may start to have expectations about brands embracing new technologies quicker, once the pandemic ends

We at Kadence are big advocates of brands creating their own futures, rather than try to predict it. Earlier in the year, before the whole pandemic went global, we brought together trend watching experts from across our global boutique to identify four key trends that we believe will define the next 12 months, inspiring innovation across Asia, the US and Europe, that we outlined in this report.

You might also be interested in

Lots of ink has been spilled on various reports and news stories about this pandemic. From its early days in China to its devastating death tolls globally as it spreads to how some markets like Germany and South Korea are slowly opening up their markets to re-establish ‘life as normal’, there has certainly been no lack of opinion, professional or editorial, on the impact of this international viral outbreak.

As the stages of recovery vary across markets, the tonality of different write-ups is gradually shifting towards one that is more forward-facing (and some would even say, hopeful!). Different articles are springing up, pontificating on what kinds of post-pandemic world we want to see. Some question the validity of returning to a ‘normal’ that was anything but in the first place, while others take a more macro-level analysis to arrive at how entire economies and governance should pivot so we’re prepared for the fall-out the best way we can.

We would like to add our voice to this body of work, and share our thoughts on how we think the post-COVID will look like for certain industries, by doing what we do best: analysis through the consumer lens.

Based on our expertise in specific sectors, we went about consolidating and analyzing all current phenomenon that are happening globally, examining the impact of changes that have been observed, thinking about habits that have been formed and questioning what it all means in the long term. Over the next few weeks, we’ll share these – covering everything from retail finance to food and beverage.

What kinds of change can / shoud we expect?

When it comes to the ‘future’, there are various existing theories in the realm of behavioral sciences, that talk about how humans tend not to be ‘future-oriented’ and usually value the ‘now’ more. Within the context of talking about change, that presents a real problem – as the inability to visualize/internalize a version of the future gets in the way of discussing or enacting change. This is a significant point that we need to acknowledge, right off the bat, otherwise any projections or proclamations about post-pandemic change will likely be no more than wishful thinking.

Another common way to put forth any suggestions of change tend to be what is known as the ‘convergent’ approach: for example, Phenomenon A is likely to happen, because Phenomenon B, C and D are observed to be present, and form favorable conditions/climate to facilitate A’s occurrence. While not wrong, and this is at the heart of many techniques of scenario analysis (PESTLE being one of them), it again does not account for the ‘human agency’ element, the clear and pinpointed reason why a change CAN and SHOULD happen.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

To this end, amongst the many change management models out there, we feel there is one that may be particularly useful to help us conceptualize the change that can come about in a post-COVID world. Chip and Dan Heath’s ‘sticky habits’ model talks about how, at the heart of reasonable and sustained changes, are 3 simple elements which explain why/how those changes happened, in spite of supposedly challenging circumstances.

In this model, which can also be used to operationalize change, the authors argue that alignment amongst the rational and emotional sides of a person is crucial in setting about the momentum for change. That process is facilitated further when the route towards change is clear, attainable, and rewarding to the individual aiming to change. The analogy the authors offer is an elephant rider on a path: the ‘rider’ symbolizes the rational mind, while the ‘elephant’ stands for the emotional mind. A determined ‘rider’ cannot make an unwilling ‘elephant’’ go down an intended path, no matter how hard he/she tries, much as how even if the ‘elephant’ is willing, it cannot effectively be on the road without efficient directing from the ‘rider’. Within that analogy, the ‘path’ will also need to be clearly marked and signposted, so it is the actual one the ‘elephant’ and the ‘rider’ wishes to travel on.

We believe in this model, as we feel it helps to guide our examination of change that’s really rooted in consumer needs: what is it about a particular change that we have observed that shows how the rational and the emotional mind have been satisfied, such that even though the path is ‘unclear’, we understand and are confident that it is a feasible change that will stick, once the pandemic is over.

What will stay the same?

“The more things change, the more they seem to stay the same…”

The saying above cannot be truer; in fact, that is the whole premise for a lot of science-fiction based entertainment. The future in a lot of these alternate realities are often only incrementally different to the one that we are living in, because storywriters depicting these worlds realize that no matter how far away this future is, it needs to be rooted in a certain degree of ‘realism’ in order for readers/viewers to appreciate and accept the portrayal, as well as contrast how different/’out of this world’ the changes are.

Another way to understand this contrast between change and non-change, and how acceptance is achieved, is through the MAYA Principle: MAYA stands for ‘most advanced yet acceptable’. This principle provides guidance in the world of product design. As a discipline, product designers are always faced with the challenge of producing something new and exciting for consumers, be it a piece of furniture or an electronic product. Designs that draw too much inspiration from the left field can risk alienating potential users, while sticking too much to the status quo results in a product that does not excite at all. The MAYA principle thus proposes that designers can focus on elements within their work that taps onto the notion of a ‘familiar strange’, where it’s new enough to pique interest, but familiar enough that it does not overwhelm and lead to outright rejection.

Taking on both notions, we thus feel that even as we look forward to propose what’s going to change post COVID-19, we should also take note of consumer mindsets that will likely remain the same, the ‘evergreen’ needs that will not be displaced, even as the world hurtles towards a ‘new normal’.

You might also be interested in

The economic impact of the COVID-19 pandemic in various markets has been undeniable. Some sectors like travel and hospitality have been hard-hit, while physical retail has suffered badly too due to social distancing and lockdown measures. Workers in these industries are affected as well, with their livelihoods threatened by uncertainty and instability. Within this context, money worries are certainly in the minds of many, as they struggle to make ends meet.

Even amongst the fortunate who still have their jobs, it is likely that they would have been impacted as well, albeit at a different level. Without having to worry about the ‘now’, they would be thinking about the ‘next’ and the ‘near future’. Economic downturns are not new, but one caused by a global virus outbreak is a little harder to manage and predict. As such, the more financially-minded consumer will have to start to think about what their investment portfolios should really comprise, how they can be economically-sheltered from the next disaster, and what kinds of financial planning will allow them to not just weather the storm, but also thrive in the long run.

So what should retail banks, financial institutions and fintech entities prioritize, as the pandemic improves? What role do these organizations need to play in their customers’ lives, and on what kinds of principles do their strategies need to be based? We explore 3 key areas: consumer spending patterns, investing and cash, sharing our thoughts by examining what is likely to change in the post-COVID world, and what will remain the same.

Consumer Spending Patterns: Between Saving and Spending

Short term changes

Within Asia, two markets that recently relaxed their lockdown situations were China and South Korea. In both cases, there were instances of what is now an increasing familiar term in post-COVID coverage: ‘revenge spending’. The Hermes flagship store in Guangzhou saw its biggest single-day earning ever, when millions of Yuan were spent by previously cooped-up shoppers on luxury items. While in Thailand, which recently lifted the ban on alcohol sales at retail level, saw unprecedented levels of consumers binge-buying wines, beers, and spirits.

Regardless of the market and product category, one thing is common: perceived scarcity will motivate consumers to spend disproportionately in the short term. This also illustrates how the fundamental principles of behavioral economics and the multitude states of cognitive biases (too many to name here) are once again proven true.

Long term trends

In the longer term though, what are we to make of consumer spending and saving mindsets, in turn motivating actions/behaviors, which will be meaningful for financial entities to action on?

We see two likely scenarios, each combining a certain degree of emotional and rational assessment of how individuals see their ‘now’ and ‘(near) future’:

- Excessive fear and over-reaction to the economic fall-out of the pandemic and feeling the extreme need to be more assured/confident of their financial states, leading to reduced spending/motivation to seek out additional/side income

- Resignation and coming-to-terms with their helplessness when it comes to managing their finances (i.e. surrendering to the insurmountable force of macroeconomic changes), and maintaining the status quo, feeling good about creating/maintaining their sense of ‘normal’

There will certainly be many shades between these two extremes, just as there will also be minorities falling outside of these as well (e.g. increased spending/acquiring material goods to achieve the sense of security), but what’s certain is that financial institutes will have to play the role of showing the path to fruitful savings and meaningful spending, without leaning too far into one side or the other. An established bank that has a reputation for best-in-class credit cards in consumers’ minds may take the opportunity to come up with a savings product that validates a consumer’s side hustle, while a fintech that’s trying to break into the travel space may have to use this chance to re-think what their value-proposition really is to consumers who have to temporarily shelve their wanderlust.

Underlying all these, of course, is the presumption that the entity has a ‘trust bank’ upon which to draw notions of credibility and capability; all the money in the world thrown behind a huge messaging campaign in the post-COVID world will not help, if that trust was not already there in the consumers’ pre-COVID reality.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

Investing: Between Risks and Returns

Short term changes

In the pre-COVID days, any sort of consumer research on investment products/journeys/choice and preference of investment instruments, often boils down to 3 main points:

- How clearly the product information is introduced, and how much of its mechanism is understood

- How well the investor can conceptualize the product for himself/herself, and how he/she imagines it within his/her portfolio

- How he/she feels about it on the overall level

This combination of rational considerations and emotional reassurances will likely not change dramatically in the ‘new normal’, but there is the need to acknowledge the likelihood of investors perceiving the market to be more VUCA (i.e. volatile, uncertain, complex, ambiguous), thus leading them to re-assess whether it’s the ‘right time’ to be investing in the first place.

Based on past economic downturns, alternative investment instruments (e.g. art, whisky, coveted luxury brand handbags, etc.) have also started to become more commonplace and offer investors another way to grow their money. However, the mechanisms of such tools are often not clear, and usually complement a portfolio that’s still predominantly stocks/shares driven. Insurance-based products are also believed to be a likely winner in the world of money management; as consumers become more risk-averse, bonds and capital-guaranteed products are logically seen to be aligned with immediate appetites.

Long term trends

All that said, though, it is still necessary to highlight that very few investors carry out investments purely motivated by fear of losing; the savvy ones are aware of the notion of calculated risks, and the really experienced ones within that small bunch of savvy investors also know that ultimately the global market is very much sentiment-driven (read: emotions, cue behavioral economic principles again). This highlights the importance of ‘confidence’ and decision-making based on knowing all the ‘facts’ available at a specific point in time, which is actually the fundamental strategy applied by many governments around the world which have successfully contained the pandemic in their respective countries.

Therefore, in the post-COVID world, we feel retail entities that will do well with investors are those that understand how to pull the ‘clarity’ lever, showing their workings around how they feel a product/tool will help the investor achieve their wealth goals, while acknowledging the presence of VUCA factors and understanding what kinds of emotions can arise from investing in a global economy that’s still ‘finding its feet’.

Consumer perceptions of cash: is it still “king’?

Short term changes

Even before the onset of the pandemic, it is becoming increasingly clear that many markets globally are moving towards implementing cashless systems, or at least encouraging consumers to rely less on cash. Though not all executions were done well (e.g. India’s sudden and forceful removal of certain currencies from the market create a financial nightmare amongst consumers which took many months of correcting), the movement is at least gaining momentum, and acceptance appears to be higher in markets which are traditionally cash-focused

Covid-19 containment measures have basically forced upon various societies the need to pay for items in a cashless way; the removal of physical retail to adhere to safe distancing measures meant that opportunities to use physical cash have reduced dramatically, while paying for online purchases tends to be electronic in nearly all cases (save for cash-on-delivery options). Not having to handle cash within current context also means reduced chances of infection through virus transference on surfaces, so it appears to have multiple advantages that’s aligned with the ‘sign of the times’

What this means, though, is while the transition is quite smooth for the cashless consumer, the cash-minded one will likely have to think about how that impacts other parts of their financial realities. Money management and tracking, for one, will likely need to take new forms if cash spending is slowly being phased out from their daily lives. Another area which will likely see some change is in digital payment security: with increased volumes of payment, it will be naïve to assume that similar online safety mechanisms will suffice. To prevent any backlash that can potentially happen due to insecure cashless payment systems, it is an area within the financial industry that needs immediate attention, such that consumer confidence in the system may be sustained

Long term trends

However, we must not confuse “accelerated pace of change” with consumers loving the new ‘state of play’ for cashless; we are of the opinion that consumer sentiments towards the ‘meaning’ of cash (e.g. freedom/fluidity, security, options, empowerment, tangibility, etc.) may in fact deepen in the post-pandemic world, due to perceived uncertainties and insecurities (as we have mentioned above). What this then means is that the notion of ‘cashless’ may either need to be strengthened such that it goes beyond attributes like ‘convenience’ and ‘ease’, or relegated to specific consumption scenarios that may not need to be as ‘meaningful’ as cash

This has important implications for the numerous fintech institutions globally that are trying to ride on the wave of new financial attitudes in the ‘new normal’; whatever solutions they’re proposing (e.g. payments, investments, money management, etc.) will likely be based on a cashless model, so on top of proving the validity of their use cases, the fundamental value that going cashless needs to be just as apparent. Only then can it achieve both resonance and acceptance amongst consumers, as they navigate their financial world and arrive at their own conclusions on what they will relegate to the cash ‘world’, and what they will gladly make ‘cashless’.

You might also be interested in

This week marks a change in the focus for many news outlets and governments. From protection to productivity – as leaders grapple with the challenge of getting economies moving again. There is more confidence in some countries’ approach and communication (New Zealand) than in others (UK, US – looking at you!). However, in all situations, there is an agreement that the world we are returning to is not the same as we left.

The workplace is no different. The Straits Times last week carried a story from Singapore’s Minister for Trade and Industry about how ‘working from home will continue to be the norm for the majority even after restrictions are lifted. Forbes has taken this further and stated that “The Covid-19 coronavirus is becoming the accelerator for one of the greatest workplace transformations of our lifetime. How we work, exercise, shop, learn, communicate, and of course, where we work, will be changed forever!”

However, for those of us that have been able to continue our working life from the safety of our home, will the adjustment back to the office be harder than the adjustment to work at home? US Tech website BuiltIn quote a CEO who states that it takes “6 to 12 weeks for a smooth transition from on-site to remote working”. For many, this timeframe has already been met. People are working at home, people are productive, and…are people are starting to realise the benefits: lack of travel, more flexible hours, ability to help with childcare … With many positives to working from home, what does this mean for the future of work?

Certainly, in the short term, offices will be sparse locations. Governments are still advising those who can work from home to work from home. If you do return, social distancing measures will have to be evident. Here in Singapore – if you are do not implement safe management of your workplace, the government can fine you or even shut down operations for errant employers. The Economist offers up an opinion piece on how that distancing may look. A 2m gap between desks could reduce the capacity of workspaces to 30-35% of the pre-Covid lockdown. The piece also details a high-tech solution before the lockdown in UAE, with contactless pathways from door to desk, relying on motion sensors and facial coding to open doors. Having a reduced workforce onsite, or investing in tech are expensive options for most firms – but what about the office itself. What role will it play?

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

At Kadence, we have managed to retain productivity. Completing projects to time, and collaborating using video calls, Slack, online whiteboards, and Google Docs. What we really miss is the unintended interaction with others. Overhearing conversations and adding some extra insights, hearing the chatter of voices and the energy in the room. At Kadence, we also have some onsite resources that are hard to replicate offsite. Focus group viewing facilities, a call center, and workshop facilities will all be utilized in the future. However, the floor space may change. We might be more open to a higher proportion of staff working from offsite at any one time. Rather than whole team meetings and designated desks, perhaps our floor space will have more meeting areas. So that project teams can come together in an environment to bounce off each other, then return home to execute the required tasks. Vice talk of new rituals being formed to bring meaning to home working and The Atlantic talk about dress codes changing in life after COVID.

However, perhaps the most important change will be in HR, not in the physical use of space. If people are going to work from offsite more often, how does team bonding work? How will you help teams to prioritize their workloads? How will you manage line reports? These skills will require even more attuned social skills and people managers.

I would foresee offices being more flexible environments. Bringing people together when it matters, but keeping people apart for safety….and for their own personal preference. As a result, team dynamics will change. Managers will need to juggle a wider array of pastoral matters. The corporate cultures that thrive will be flatter, more candid, and more collaborative.

Perhaps the new normal is still being discovered, but the ‘now normal’ is all about flexibility and creativity.

You might also be interested in

In times gone by (which, despite feeling like years ago, I only mean the start of 2020!) if you were in the UK, and making small talk, you would reference the weather. In Singapore, you would ask “have you taken breakfast?” But there is now a new form of small talk. At the start of any news article, blog, meeting or catch up with family, it is now customary to reference the ‘crazy times’ that we live in – and you have to reference ‘the virus’. It begins with small talk, but make no mistake – what we are living through is the dawn of a ‘new normal’ and the sooner we start thinking about ‘what next’ and not about ‘what used to be’ the better countries, companies and consumers will be.

This is an anthropological examination, the likes of which has never been seen before. The ability to assess how governments and populations deal with the exact same crisis at the exact same time will be discussed for years to come. Hopefully, something is learned from this tragic situation, something to reduce the risk in the future. Writing in the Economist this month Bill Gates feels there must be dramatic innovations in vaccines, home diagnostics and antiviral drugs for us to be able to combat another pandemic. However, Gates also references Winston Churchill, speaking in 1942, as Britain had just won its first land victory “This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.” Gates feels that things must change.

A global crisis is nothing new. Neither is the talk about ‘change’. The last recession in the late 2000s saw the rise of Uber, Airbnb and Pinterest. In fact, looking back through history, we can begin to notice a pattern that extends beyond the startup ecosystem: Apple, Microsoft, General Electric, IBM, General Motors, Burger King, CNN, and Disney were all founded during recessions. But this time, in 2020, all the rules have changed.

Get regular insights

Keep up to date with the latest insights from our research as well as all our company news in our free monthly newsletter.

In the past, even during recessions, there were those that suffered economically and those that prospered. Whilst this is still likely to be the case, the type of suffering that is hitting markets is unique. Retailers are shut. Restaurants are shut. Production lines are shut. Airlines are grounded. Every person has been impacted. And as a result how we think about brands, how we rationalise our purchase habits, how we determine what is now an ‘essential’ spend has perhaps been changed forever. As was stated in a Forbes article – How we work, exercise, shop, learn, communicate, and of course, where we work, will be changed forever!

Whilst the temptation is to throw hands in the air and proclaim that ‘nobody knows what’s happening’ is strong. If you watch, if you listen, if you immerse, brands will be able to pick up important clues as to how to navigate these changes. Social media groups are rallying round small businesses. Facebook groups are being set up to identify the brands that ‘deserve’ your money. Brands with billionaire owners, taking advantage of government support packages are being called out as immoral. Now is the time to look, listen and to plan. Whilst I am of course bias, now is perhaps the most important time to invest in your research and strategy teams. Seeking inspiration, insight and ideas from others is perhaps the best use of your time. There will be brands that get it right, and brands that get it wrong. That has always been the case, but somehow, now the stakes feel higher now. None of us know when the crisis will be over. However, we can be sure that the companies that do survive, will be the ones that grasp what is the ‘new normal’ faster than those that don’t.

Senior Marketing Executive

Senior Marketing Executive Sales & Marketing

Sales & Marketing Vital Strategies

Vital Strategies

Customer Intelligence Director

Customer Intelligence Director